by Jefferson dos Santos Estevo* (Advanced Biofuels USA) The production of Sustainable Aviation Fuel (SAF) continues to expand worldwide. Data from the International Civil Aviation Organization (ICAO), as of the end of August, indicate that if all 472 announced production plants are effectively implemented, global SAF production would total 53.9 billion liters (bn L). Currently, 172 airports worldwide are supplied with SAF, with 70 routes batch deliveries and 102 routes continuous supply systems. In 2016, there were only 8 production announcements, compared with 109 in 2024 and 58 by the end of August 2025, demonstrating significant progress (ICAO, 2025).

However, SAF’s share in mitigating emissions from the aviation sector remains minimal and is expected to represent only 0.7% of total airline fuel consumption by the end of 2025, equivalent to cerca 2.5 bn L. The main obstacle is the high cost of SAF, which limits its large-scale adoption and keeps production concentrated in a few countries such as the United States, the United Kingdom, and certain European Union member states. These regions have implemented policies with SAF targets or mandates and relevant economic measures to grant SAF production and use competitive advantages (IATA, 2025).

In Brazil, regulatory progress related to SAF has been substantial in recent years. The National Program for Sustainable Aviation Fuel (ProBioQAV), established in 2023, provides a framework for the development of mandates, incentives, and policies for SAF implementation. The aviation sector accounted for approximately 0.67% of Brazil’s total emissions in 2023 (SEEG, 2024; ANAC, 2025). The key legal instrument is Law No. 14,993, enacted in October 2024, known as the “Future Fuel Law” (CF). This law established a robust regulatory framework, with an initial target of 1% emissions reduction by 2027, increasing progressively from 2029 onwards to reach 10% by 2037, with a growing share of SAF in the aviation fuel mix (Brazil, 2024).

Beyond the targets established under the Future Fuel Law, Brazil must also meet its commitments under CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation), starting in 2027, when all participating countries are required to apply emissions reductions. Under CORSIA, emissions from Brazilian airlines must be monitored and compared with the 2019–2020 baseline average. If an operator’s emissions exceed this reference value, the difference must be offset through the purchase of carbon credits or CORSIA-eligible SAF in order to compensate for and reduce emissions from international flights the purchase of carbon credits or CORSIA-eligible SAF, thus compensating and reducing emissions from international flights. CORSIA aims to stabilize emissions at 2020 levels, ensuring carbon-neutral growth for international aviation, although it does not impose SAF-specific mandates .

Therefore, in Brazil, both domestic flights (via the CF Law) and international flights (under CORSIA) are governed by emissions reduction requirements rather than mandatory SAF blending targets. In contrast, the European Union and the United Kingdom have set mandatory SAF use targets of 2% starting in 2025, with a gradual increase until 2050, while the United States targets annual production of 3 billion gallons (11.3 bn L) by 2030. Consequently, it is crucial to determine which SAF production pathways will be used and the corresponding emissions reduction potential. In Brazil, feedstock selection and production pathway are decisive for performance under both CF and CORSIA.

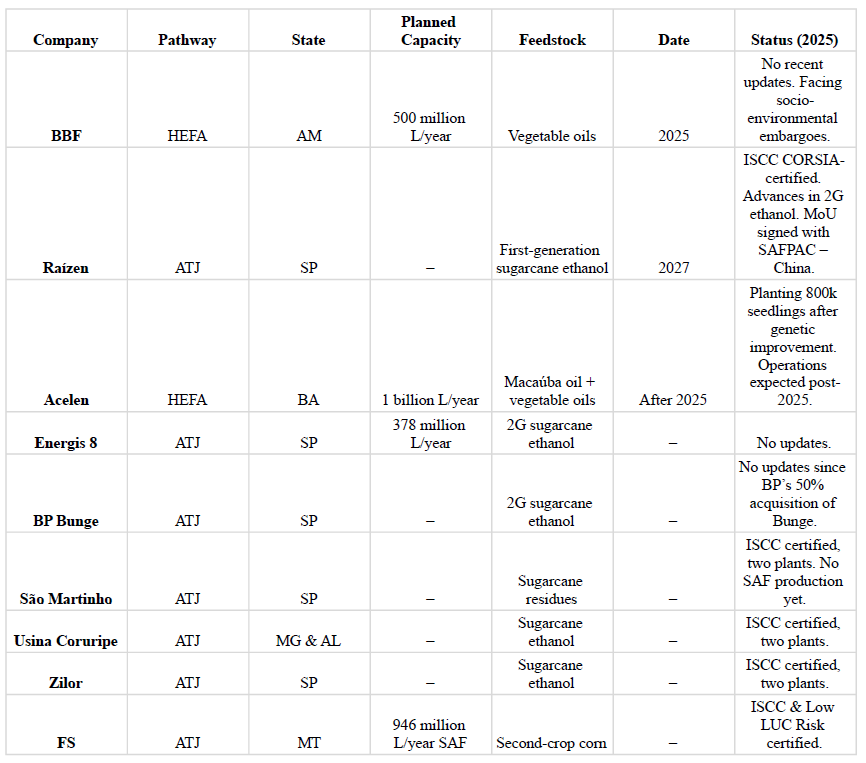

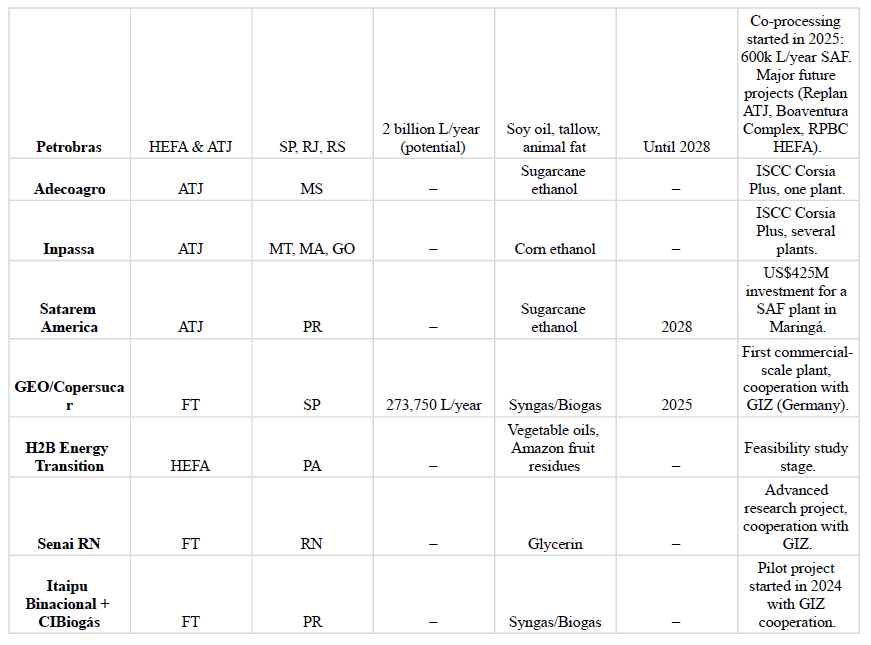

Given Brazil’s potential as the world’s second-largest biofuel producer, the country can develop multiple SAF production pathways. Recent announcements include the HEFA and ATJ pathways, using different feedstocks and leading to distinct life-cycle emissions reduction values. The table below presents the main SAF projects in Brazil as of early 2025.

Table – Main SAF Players and Projects in Brazil (2025)

Regarding BBF’s project, there have been no recent updates; it is expected to start next year in a reforestation area using palm oil as feedstock. However, the company faces difficulties due to financial embargoes imposed as a result of production irregularities in the region ( InfoAmazon, 2025).

For Raízen’s project, a key milestone was the ISCC CORSIA Plus certification for ethanol produced in Piracicaba (SP), meeting international sustainability criteria for aviation fuel (Raízen, 2023). Production is expected to begin only in 2027 due to technological challenges still present in Brazil. At the same time, the company is advancing its plans to produce SAF from second-generation ethanol using sugarcane bagasse, having recently secured BRL 1 billion in financing from BNDES to build a plant in Andradina, São Paulo (BNDES, 2025). Additionally, during a recent Brazilian government mission to China, the company signed a memorandum of understanding with SAFPAC Ltd., based in Hong Kong, for a US$1 billion investment in SAF production, also through second-generation ethanol (Brazil, 2025).

Acelen’s project is located in São Francisco do Conde, Bahia, and involves BRL 12 billion in investments for macaúba cultivation and the construction of a biorefinery with a production capacity of 1 billion liters per year of SAF and HVO, scheduled to begin operations in 2027 . Due to the innovative nature of macaúba cultivation, the project includes partnerships with institutions such as ESALQ/USP for genetic improvement and productivity enhancement. Planting began in 2025, with approximately 200 hectares of macaúba palms already established and plans to expand to 1,500 hectares in the region, with over 800,000 seedlings to supply the nearby biorefinery (Acelen, 2025).

Regarding Energis 8, there is no current information beyond 2024, when the company expressed interest in building a SAF plant in Paulínia, São Paulo, using the ATJ pathway with second-generation ethanol, although there are no signs of construction having started (CNN, 2024).

In the case of BP Bunge, there are also no new updates beyond BP’s 50% acquisition of Bunge in 2024, a major ethanol producer in Brazil with ATJ SAF production potential (Reuters, 2024). Ouroeste mill already holds ISCC CORSIA Plus certification (UOL, 2023). However, reports indicate that BP is reassessing its renewable energy strategy and redirecting investments toward fossil fuel products (Reuters, 2025).

São Martinho holds ISCC CORSIA Plus certification for two plants, in Pradópolis (São Martinho) and Américo Brasiliense (Santa Cruz), both in São Paulo. Despite its strong ethanol production capacity and certification, there are no announcements regarding SAF production (Eixos, 2024).

Similarly, Zilor, which also holds ISCC CORSIA Plus certification for its plants in Macatuba and Lençóis Paulista, has no active or planned SAF projects (Zilor, 2025).

Another certified company is Usina Coruripe, with two units in Minas Gerais (Iturama and Limeira do Oeste).

A company not included in the table or the SAC Report is Adecoagro, with its Angélica plant in Mato Grosso do Sul (DATAGRO, 2024). FS Bioenergia stands out as a differentiated case, as it specializes in corn ethanol production and holds both ISCC and Low LUC Risk certifications, highlighting its use of feedstocks that minimize indirect land-use change emissions (Nova Cana, 2024). Despite all these certifications and technological potential, none of these three companies currently have concrete SAF production in operation.

Beyond Adecoagro, new SAF-related actions are emerging in Brazil that were not covered in the SAC Report. For example, Inpassa, Brazil’s largest corn ethanol producer, has obtained ISCC certification for all its plants in Mato Grosso, Maranhão, and Goiás (Inpassa, 2025). Although production or concrete plans have not yet been disclosed, its potential to produce SAF is substantial given the company’s ethanol output.

Another noteworthy initiative is by Satarem America Inc., a U.S.-based company, which announced a US$425 million investment to build a SAF plant in Maringá, Paraná. Operations are scheduled to begin in December 2028, with ethanol as the initial feedstock. The facility is strategically located on the border between Maringá and Sarandi, an area with a strong concentration of ethanol mills. Part of the production will be exported, including to airlines such as Ethiopian Airlines, while another share will meet domestic demand (Eixos, 2025).

Two additional projects are still under study. The first is a partnership between GEO and Copersucar, supported by GIZ (German Cooperation for Sustainable Development), to develop the first commercial-scale plant in Brazil for SAF production from biogas, with operations expected to begin in 2025 and a projected output of 750 liters/day. The project involves investments of €7.8 million, including €1.5 million from Germany’s Federal Ministry for Economic Cooperation and Development (GEO, 2024).

The second initiative, still in its initial stage, is being led by the Federal University of Pará (UFPA) and the Guamá Science and Technology Park (PCT-Guamá), which are conducting a feasibility study for SAF production using Amazon residues such as macaúba oil, açaí seeds, and cocoa husks. The project, in collaboration with H2B Energy Transition, aims to assess the technical and economic viability of using these regional feedstocks for SAF production (Bacarena, 2025).

GIZ is also involved in two more advanced SAF projects. The first is with the SENAI Institute, which inaugurated the Hydrogen and Advanced Fuels Laboratory (H2CA) at the Innovation and Technology Hub (HIT) in Natal, Rio Grande do Norte. This pilot plant uses glycerin, a by-product of the biodiesel industry, to produce SAF via the Fischer–Tropsch pathway, with an investment of €1.4 million (GIZ, 2023).

The second is located in Foz do Iguaçu, Paraná, in collaboration with Itaipu Binacional and the International Center for Renewable Energy (CIBiogás), where the first national pilot plant for producing synthetic oil from biogas was inaugurated, with the aim of producing SAF through Fischer–Tropsch technology. The project received €1.8 million in investment ( Martins, 2025).

In terms of the country’s most advanced SAF production, Petrobras stands out as the leading player. Through co-processing, the company has started producing SAF with up to 1.2% corn oil blended into conventional jet fuel (QAV) at its Reduc (Duque de Caxias), Regap (Betim), and Replan (Paulínia) refineries, with a capacity of up to 600,000 L/year.

In addition, Petrobras plans to expand this production to the Revap refinery (São José dos Campos) in the coming months. According to the most recent information, Reduc will be able to supply SAF via co-processing in the coming months, ahead of initial plans, using a blend of jet fuel with 1.2% corn oil (Petrobras, 2025; MME, 2025).

In parallel, the company is investing in dedicated renewable SAF production units, separate from co-processing. A project under development at the Paulínia refinery (Replan) aims to produce SAF from ethanol using Alcohol-to-Jet (ATJ) technology. This plant is designed for a production capacity of 572,400 L/year, with operations scheduled to start after 2029.

Moreover, Petrobras is planning the construction of a unit at the Boaventura Energy Complex in Itaboraí (RJ), with a capacity of up to 1.087 billion L/year of SAF and renewable diesel, using vegetable oils and animal fats as feedstocks.

Additionally, at the Presidente Bernardes Refinery (RPBC) in Cubatão, São Paulo, the company is developing a project under its BioRefining Program to process approximately 950,000 tons of vegetable oils and animal fats annually, with the capacity to produce up to 915,800 L/year of renewable biofuels. The unit will employ Honeywell UOP-licensed HEFA technology, enabling the conversion of vegetable oils and tallow into SAF and renewable diesel (Petrobras, 2025; MME, 2025; Tolmasquim, 2025).

Within a few years, once all these projects are operational, Petrobras’ SAF and renewable diesel production could reach approximately 2.58 billion L/year, in addition to the current 600,000 L/year from co-processing. This positions Petrobras as the national company with the most advanced initiatives and highest SAF production, significantly contributing to Brazil’s emissions reduction targets.

From a practical standpoint, co-processing offers a key advantage for meeting near-term targets, as it allows for rapid implementation by leveraging existing infrastructure. However, due to the relatively low blending rates (5%–10%), it delivers moderate emission reductions. Given that most major projects are still in the early stages or at the projection phase, Petrobras’ co-processing strategy may represent the most feasible alternative for achieving Brazil’s national targets in the short term.

* Jefferson dos Santos Estevo is a researcher in International Relations and Energy Transition at the Center of Excellence in Hydrogen and Sustainable Energy Technologies (CEHTES) at the Federal University of Goiás. FAPEG Research Fellow. He holds a doctorate in Social Sciences from the University of Campinas.

Related articles

- Petrobras launches coprocessed SAF in Brazil (Petrobras/Biobased Diesel Daily)

- Petrobras delivers first coprocessed SAF volumes, advances 2026-30 clean fuels strategy (S&P Global)

Excerpt from Petrobras/Biobased Diesel Daily: The first deliveries of sustainable aviation fuel (SAF) were announced by Petrobras Dec. 5 in Rio de Janeiro, Brazil.

The company is the first to produce, entirely in Brazil, the fuel that receives sustainability certification according to International Civil Aviation Organization rules.

The volume of 3,000 cubic meters (792,516 gallons) was sold to aviation fuel distributors operating at Tom Jobim International Airport in Galeão.

This volume corresponds to approximately one day of consumption at airports in the state of Rio de Janeiro.

SAF can replace conventional aviation kerosene without requiring modifications to aircraft or refueling infrastructure.

This makes it a practical and quick solution for reducing emissions in the aviation sector.

“SAF, produced through coprocessing at Petrobras’ refining park, is a solution that contributes to meeting the decarbonization goals of the aviation sector,” said Petrobras President Magda Chambriard. “It is a competitive product that meets rigorous international aviation standards. We are offering the national market the possibility of meeting global demands, anticipating compliance with CORSIA, which is an international program for reducing emissions from international flights.”

The anticipation of SAF production in relation to current legislation is fundamental for the aviation market, considering the sector’s future demands.

From 2027 onwards, airlines in Brazil will have to start using this type of fuel on international flights, following the rules of the ICAO’s Carbon Offsetting and Reduction Scheme for International Aviation program, and on domestic flights, based on the Future Fuel Law.

Petrobras SAF has CORSIA certification from the International Sustainability and Carbon Certification System GmbH.

It is a fuel with lower carbon intensity because it uses a percentage of raw material of vegetable origin, which is processed together with mineral aviation kerosene.

Currently, Petrobras is certified to use technical corn oil (TCO), a residual raw material, or soybean oil, with a projected reduction in net CO2 emissions of up to 87 percent in the renewable portion.

The resulting product is chemically identical to mineral fuel, but with a portion derived from sustainable raw materials.

The fuel for the first deliveries was produced at the Duque de Caxias Refinery (Reduc) in Rio de Janeiro, which is certified to produce and market SAF.

Reduc is authorized by Brazil’s National Agency of Petroleum, Natural Gas and Biofuels (ANP) to incorporate up to 1.2 percent of renewable raw material in the production of SAF via this route.

The Henrique Lage Refinery (Revap) in São José dos Campos in the Brazilian state of São Paulo has already conducted tests for the production of SAF using the coprocessing route of vegetable oil with traditional petroleum streams.

It is expected that, also in 2026, the Paulínia Refinery (Replan) in the state of São Paulo, and the Gabriel Passos Refinery (Regap) in Minas Gerais will also begin producing and marketing the fuel. READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Canary Islands

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia/Slovak Republic

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea (Republic of Korea)

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler/Ship

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.