by Stefaniya Becking* (Advanced Biofuels USA) The “Waste to Biogas and Clean Fuels Finance and Investment” summit provided a myriad of opportunities to get the latest intelligence on biogas and the clean fuel industry as well as on the financing options for projects in those niche industries. Organized by Infocast, the event took place on March 3-4, 2015, in Santa Clara, California. About 80 people attended this well-organized, discussion-focused event from different parts of the US and Canada.

A panel discussion at the Waste to Biogas and Clean Fuels Finance and Investment Summit (March 4, 2015, Santa Clara, California). From left to right: Steffi Becking (Advanced Biofuels USA), Chris Standlee (VP of Global Affairs at Abengoa Bionenergy), Nick Lumpkin (Director of BD at Clean Energy Renewable Fuels), Eric Bowen (VP of BD and Legal Affairs at Renewable Energy Group).

A panel discussion at the Waste to Biogas and Clean Fuels Finance and Investment Summit (March 4, 2015, Santa Clara, California). From left to right: Steffi Becking (Advanced Biofuels USA), Chris Standlee (VP of Global Affairs at Abengoa Bionenergy), Nick Lumpkin (Director of BD at Clean Energy Renewable Fuels), Eric Bowen (VP of BD and Legal Affairs at Renewable Energy Group).

The conference highlighted the fact that government programs such as the Renewable Fuel Standard (RFS) at the federal level and the Low Carbon Fuel Standard (LCFS) in the state of California remain significant drivers for attracting investment in the renewable fuel industry. As noted in a number of discussions, the instability of those programs has been detrimental for growth of the clean fuel industry. The instability is created by the delays in setting annual minimum volumes of renewable fuels to be used in the supply chain of transportation fuels in the US. As of March 2015, the Environmental Protection Agency (EPA) has not set RFS volumes for 2015 or for 2014. The lack of clarity on the RFS volumes coupled with legal challenges of LCFS shakes the foundation of the renewable fuel market, which was propelled by those policies in the first place.

For some companies in the renewable fuel industry, capturing credits offered through the RFS and LCFS programs remains a vital income source. As Kelly Sarber, CEO of Strategic Management Group, noted: “The income from RFS and LCFS programs is critical for attracting long-term financing for capital intensive projects.” Yet, some of these companies adapt by exploring ways to diversify their portfolio of products and by finding ways to use existing infrastructure to create products from renewable feedstocks.

Diversifying products as a growth strategy and as a strategy to mitigate risks associated with regulatory instability with biodiesel tax credits was illustrated by Eric Bowen, Vice President of Business Development and Legal Affairs at Renewable Energy Group (REG). REG is the largest biodiesel producer in the US, with the production capacity of 257 million gallons of biodiesel per year, which accounts for 10% of total biodiesel production capacity in the US [1]. In 2014, REG acquired LS9, a company that specialized in using microbial pathways to produce chemicals and fuels from renewable feedstocks. With the acquisition of LS9, REG also acquired a new operational by-product – biosolids composed of microbial cells. Noting new opportunities, Bowen said: “We are interested in diversifying our products as we face the instability of the biodiesel tax credit. We are evaluating economics of using biosolids to produce biogas or compost.”

For a global company like Abengoa Bioenergy, the established diversity of products and services provides a springboard for venturing into an emerging market such as the cellulosic ethanol business. Highlighting the wide range of services Abengoa Bioenergy offers, Chris Standlee, Vice President of Global Affairs at Abengoa Bioenergy, noted, “We are in transportation fuels, water treatment, electricity production, just to name a few markets… Our construction business is the most profitable.” With the opening of the cellulosic ethanol plant in the state of Kansas in September 2014, Abengoa Bionenergy has the capacity to produce 25 million gallons of cellulosic ethanol per year [2].

This is a significant milestone for Abengoa Bioenergy and for the cellulosic ethanol industry as a whole as the newly opened facility is only the second bio-refinery in the US that is capable of turning corn stover residues into ethanol at commercial scale. Responding to questions on the business viability of cellulosic ethanol, Standlee commented that "the cellulosic ethanol industry is still emerging, and economics in the fuel business, which is based on commodities such as gasoline and corn, can change overnight.” Standlee also noted that “we [Abengoa Bioenergy] are improving efficiencies and dramatically lowering costs very quickly."

An established business such as a traditional petroleum refinery may consider diversifying feedstock beyond crude oil, when they learn it is possible to use a renewable cellulosic feedstock to produce gasoline and diesel that meet specifications without negatively impacting production lines. Dr. Robert Graham, Chairman and CEO of Ensyn, shared his experience working with the refineries to establish their capability of co-processing Esyn’s renewable feedstock using refineries’ Fluid Catalytic Cracker (FCC) units.

Graham commented that “when an idea of co-processing renewable fuels is introduced, refineries above all are worrying about the ability to continue 24/7 operations without 'gumming up' the production line.” To alleviate concerns about possible production disruptions, Ensyn provides convincing operational data on co-processing its proprietary renewable feedstock and performance studies conducted in partnership with UOP, a Honeywell company.

“Ensyn’s advanced cellulosic feedstock can be directly substituted for petroleum feedstocks in oil refineries. With the direct substitution of up to 5% in a FCC unit, the FCC performs as well as when straight petroleum feedstocks are used,” notes Graham. The large scale of the petroleum refineries in the US, on average processing 2 billion gallons of crude oil per year, provides great opportunities to use existing infrastructure [3]. Given this scale, co-processing renewable feedstocks even at only 5% with petroleum feedstocks will result in significant capacity to produce renewable gasoline and diesel.

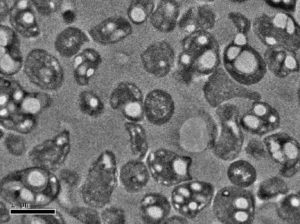

The image is depicting bacteria that use methane gas as a food source and that synthesize PHB polymer inside their cells. PHB polymers are the white globules inside the cells. The image (courtesy of Mango Materials) is obtained using transmission electron microscopy.

The image is depicting bacteria that use methane gas as a food source and that synthesize PHB polymer inside their cells. PHB polymers are the white globules inside the cells. The image (courtesy of Mango Materials) is obtained using transmission electron microscopy.

Yet another way to diversify products through partnerships within an established industry was illustrated by Mango Materials, a start-up company based in San Francisco that specializes in producing biodegradable and bio-based plastics. Mango Materials is commercializing a technology that produces polyhydroxybutyrate (PHB) biopolymer. Non-genetically modified bacteria that use methane as a feedstock to manufacture PHB biopolymer inside their cells are at the heart of the technology. “While the type of plastic produced by Mango Materials has been around for a while, Mango Materials is poised to produce biodegradable PHB cost competitively to polypropylene plastic,” said Anne Schauer-Gimenez, Vice President of Marketing at Mango Materials.

Partnering with wastewater facilities is a natural fit for Mango Materials. In wastewater facilities with anaerobic digesters, bacteria in digesters use biosolids separated from the wastewater as a food source. As bacteria digest biosolids, they produce biogas, primarily consisting of methane and carbon dioxide. Mango Materials has partnered with a large wastewater treatment facility that provides the necessary feedstock from the digesters – methane gas, which in turn can be fed to the biopolymer-producing bacteria. The company is in the process of establishing more partnerships on their path to commercialization.

Diversifying products creates new business opportunities for entrepreneurs and also provides options for consumers. On the consumer side, a number of speakers at the conference expressed appreciation for the diversity of options. In the transportation fuel industry, for instance, the diversity of options provides flexibility to fleet managers who can select a solution based on constraints for a particular application. As David Worthington, Fleet Manager at County of Sonoma, pointed out: “We need all kinds of fuels – compressed natural gas, liquefied natural gas, hydrogen, renewable diesel, ethanol blended with gasoline, electrical… – to meet the needs for a particular location and operation.” Thus, this demand will continue to fuel the diversified supply of options.

Reference(s)

[1] Biodiesel Magazine. “USA Plants.” http://www.biodieselmagazine.com/plants/listplants/USA/. Web. 10 Mar. 2015.

[2] Abengoa Bioenergy. “2G Hugoton Project.” http://www.abengoabioenergy.com/web/en/2g_hugoton_project/. Web. 11 Mar. 2015.

[3] U.S. Energy Information Administration (US EIA). “Number and Capacity of Petroleum Refineries.” http://www.eia.gov/dnav/pet/pet_pnp_cap1_dcu_nus_a.htm. Web. 10 Mar. 2015

The annual refinery capacity to process crude oil in the US in 2014: 17,730,200 barrel/day * 365 day * 42 gal/barrel = 272B gal/yr. The average capacity to process crude oil per refinery in the US in 2014: 272B gal/yr / 139 operating refineries = 2.0B gal/yr.

The annual capacity is based on the “atmospheric crude oil distillation capacity for operating refineries” value for year 2014 in the US EIA data set. The number of refineries in the US is based on the “total number of operable refineries, operating” for the year 2014 in the US EIA data set.

*Stefaniya Becking is a professional with 10+ years of experience in environmental engineering field and information technology applied to creating more sustainable communities. She volunteers for Advanced Biofuels USA by writing articles that cover conference events around the world related to biomass economy. More info is available on her LinkedIn profile: www.linkedin.com/in/stefaniya

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Canary Islands

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia/Slovak Republic

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea (Republic of Korea)

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler/Ship

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.