(Kutak Rock) On May 12, the House Ways and Means Committee released a complete copy of its draft tax reform legislation. You can find it here. The Ways and Means Committee will hold a “mark-up” session on May 13, at 2:30 p.m. (ET).

The legislation, entitled “The One, Big, Beautiful Bill,” generally breaks down into three major categories: extensions of the 2017 Tax Cuts and Jobs Act, Presidential campaign priorities, and offsets (many of which are achieved by repealing Inflation Reduction Act energy tax policies).

...

The legislation will be subject to amendment tomorrow (May 13, 2025) during the Ways and Means Committee mark-up session. After passage, it will go to the Budget Committee, likely by week end. We anticipate it then going to the Rules Committee early next week, where it will again be subject to change. While leadership is targeting next week for passage out of Rules, it is possible that ongoing negotiations could delay its passage and delivery to the House Floor. Upon reaching the House Floor, the legislation will be subject to revision yet again. We feel well positioned; however further advocacy and engagement could be required. READ MORE

...

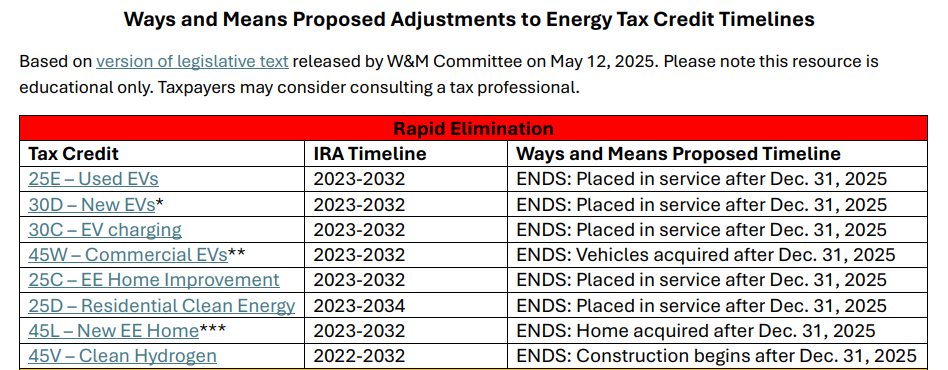

Chart from Clean Energy Business Network

Related articles

- Chart: Ways and Means Proposed Adjustments to Energy Tax Credit Timelines (Clean Energy Business Network)

- The One, Big, Beautiful Bill (United States House Committee on Ways and Means Chairman Jason Smith) Complete legislation

-

Draft ‘big, beautiful bill’ includes 45Z extension, repeal of certain IRA funding for biofuels (Ethanol Producer Magazine)

-

Tax Package Details Released: 45Z Credit Extension Among Provisions in Massive Tax Bill (DTN Progressive Farmer)

-

House panel advances tax portion of Trump agenda bill after marathon meeting (The HIll; includes VIDEO)

-

What will Republican defenders of the IRA do now? (E&E Daily)

-

45Q Carbon Management Incentive Preserved In Latest Budget Proposal (Carbon Herald)

-

House committee advances bill with 45Z extension (Ethanol Producer Magazine)

-

House Ways and Means Extends 45Z in Big, Beautiful Bill (Energy.AgWired.com)

-

Ethanol leaders pleased with 45Z inclusion, but room for improvement (Brownfield Ag News; includes AUDIO)

-

Biofuel Producers Win Big in Draft Reconciliation Bill: Congress is ignoring its predecessors who eliminated ethanol and biodiesel tax credits (Taxpayers for Common Sense)

-

Trump’s big bill advances in rare weekend vote, but conservatives demand more changes (Associated Press)

-

House GOP appears poised to further roll back climate law credits (E&E Daily)

-

House Republicans pass Trump’s big bill of tax breaks and program cuts after all-night session (Associated Press)

-

House GOP wins passage of budget bill that boosts farm programs, extends tax breaks (Agri-Pulse)

-

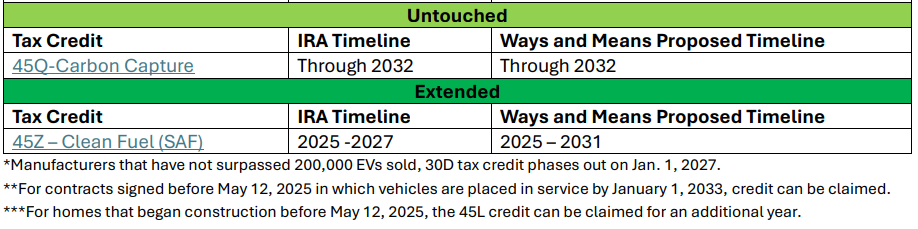

Updated: May 22, 2025 -- House GOP One, Big, Beautiful, Bill Adjustments to Energy Tax Credits (Clean Energy Business Network)

-

One Big Beautiful Bill Includes Ethanol and Farm Provisions (Energy.AgWired.com)

-

American Energy Needs the America First Approach (Real Clear Policy)

-

Conservation programs to get baseline boost under House reconciliation bill: Unspent IRA funds would be repealed (Agri-Pulse)

Excerpt from Ethanol Producer Magazine: The House Ways and Means Committee and House Committee on Energy and Commerce on May 12 released draft proposals for their respective portions of a reconciliation budget package, referred to by President Donald Trump as the “big, beautiful bill.”

Language related to the 45Z credit is included in the proposal released by the House Ways and Means Committee. Provisions included in the draft bill would limit eligibility for the credit to fuels made using feedstocks produced or grown in the U.S., Mexico and Canada.

The bill would also change how lifecycle greenhouse gas (GHG) emissions are calculated for purposes of the 45Z credit by excluding any emissions associated with indirect land use change.

In addition, the draft bill would extend the 45Z credit through the end of 2031. The credit is currently scheduled to expire on Dec. 31, 2027.

"As the budget reconciliation process moves along, we are encouraged to see the inclusion of important tax provisions in the House Ways and Means Committee text released today,” said Geoff Cooper, president and CEO of the RFA. “The draft language would extend the 45Z clean fuel production credit by four years, while also reinstating crucial tax benefits related to research and experimentation. These tax policies can help support expanded production of American energy, accelerate technology innovation, and boost rural economies by creating manufacturing jobs and opening new markets for America's farmers." READ MORE

Excerpt from DTN Progressive Farmer: Multiple House committees this week are scheduled to mark up and vote on a budget-reconciliation bill that would primarily extend President Donald Trump's tax-cut package from his first term. The legislation is expected to cut spending in several areas, such as rolling back large pieces of the 2022 Inflation Reduction Act passed by Democrats.

...

The House Energy and Commerce Committee on Tuesday will vote to rescind several provisions of the Inflation Reduction Act meant to spur renewable energy or reduce greenhouse gas emissions. As part of that package, Energy and Commerce also will vote to repeal higher fuel-efficiency standards for semi-trucks, pickups and passenger cars set by the Biden administration. That committee will also detail ways to cut Medicaid costs....

...

Key provisions in the tax bill that would affect farmers include:

45Z EXTENSION

Biofuel producers haven't had much of a chance to take advantage of the Clean Fuels Production Credit known as 45Z. Under the bill, the tax credit would be extended until the end of 2031. The bill also modifies the 45Z to prevent the use of certain foreign feedstocks, such as used cooking oil from China. Fuels for the tax credit under the bill would be limited to feedstocks produced or grown in the United States, Canada or Mexico. The bill would also limit federal agencies from attributing any greenhouse gas emissions to "indirect land use change." There is also a special provision that opens up the 45Z tax credit to transportation fuels derived from animal manure.

TAX RATES

...

STATE AND LOCAL TAXES (SALT) DEDUCTION READ MORE

Excerpt from E&E Daily: The plan would get rid of tax credits for electric vehicles buyers and hydrogen producers by the end of the year. It would phase out incentives for advanced manufacturing and nuclear power production. And it would end the practice known as “transferability,” which allows project sponsors to transfer the credit to a third party and is often used in finance agreements.

Spared from the knife were incentives for biofuels and sustainable aviation fuels; in fact, they were extended by four years with lower emission qualifications.

The legislation also includes new domestic sourcing requirements intended to disqualify companies tied to China and other foreign adversaries from accessing the incentives.

...

Most environmental groups were aghast at the proposals. Ben Jealous, CEO of the Sierra Club, pointed to a provision that would strip organizations of their tax-exempt status if the administration determined they supported terrorist organizations.

“Allowing any administration to label an American organization it disagrees with or simply does not like as ‘terrorists’ is not just wrong, it is unamerican,” Jealous said in a statement.

Some renewable energy advocates invoked Republican rhetoric in criticizing the legislation. “The Ways and Means bill is at odds with American energy dominance,” said Jason Grumet, CEO of the American Clean Power Association.

...

Sen. Ed Markey (D-Mass.) was not as quiet. He chided Republicans, saying they were ceding the clean energy economy to China. READ MORE

Excerpt from E&E Daily: The American Petroleum Institute and dozens of trade groups and hydrogen companies urged congressional leaders to keep the hydrogen production tax credits, or 45V.

“Retaining the 45V incentive without new limitations will drive domestic innovation, manufacturing, and infrastructure development — ensuring America leads in the clean hydrogen economy, rather than ceding ground to strategic competitors,” the letter reads. READ MORE

Excerpt from Carbon Herald: Several changes did make their way into the draft. The first is aimed at limiting those claiming both 45Q and 45V credits from the same facility, while the other prevents the transferability of credits to any “foreign-influenced entity”.

...

Sustainable aviation fuel also received a boost with the 45Z credit largely preserved but needing to adapt to stricter IRS rules on emission thresholds and reporting.

...

The release of the draft will be seen as a positive sign for both carbon capture and removal in the U.S. With the support of the Inflation Reduction Act (IRA) both approaches have seen substantial growth in the last several years, usually enjoying broad bipartisan support but also seeing unlikely alliances form against them.

In March, Representative Scott Perry, a Republican from Pennsylvania, teamed up with Democrat Ro Khanna of California to introduce the 45Q Repeal Act, with the goal of removing support to carbon capture, utilization, and storage (CCUS).

Despite opposition the industry’s growth has provided a foundation for thinking big, attracting capital and commiting to investments in the 2022-24 period but enthusiasm was dampened in 2025 with concerns about the level of support (or lack thereof) under the Trump administration.

The presence of an almost entirely intact 45Q in this draft does hint at the strength of its supporters. Similar to many of the renewable energy projects supported by the IRA, most of the funds directed towards carbon management have landed in red states. Texas, Louisiana and Wyoming are leading the charge with the latter’s governor placing carbon management at the forefront of his agenda. READ MORE

Excerpt from Ethanol Producer Magazine: While the draft bill updates and extends the 45Z tax credit and leaves the 45Q credit mostly unchanged, it also aims to repeal and scale back numerous other clean energy tax credits, including the clean hydrogen tax credit and the alternative fuel vehicle refueling property credit.

The alternative fuel vehicle refueling property credit allows taxpayers to claim a tax credit for advanced refueling property placed in service during a give tax year, including property used to dispense E85, biodiesel blends of B20 or greater, natural gas, hydrogen, propane, and electricity. The credit value is 30% of the cost of the property, up to $100,000. The credit is currently scheduled to retire on Dec. 31, 2032. The draft bill would accelerate the sunset date of the credit to Dec. 31, 2025. READ MORE

Excerpt from Brownfield Ag News: Brian Jennings with the American Coalition for Ethanol tells Brownfield the prevailing wage and apprenticeship requirements that were tied to most of the Biden era tax credits including 45Z are not feasible. “Potentially, include either an improvement to that prevailing wage and apprenticeship language or eliminating that requirement alltogether. That’s a conversation we’ll be having with the House and with the Senate.”

Geoff Cooper with the Renewable Fuels Association agrees and says he would also like to see the transferability of the credit go beyond 2027 to help smaller producers. He says the bill also doesn’t allow ethanol producers to benefit from conservation practices on the farm as part of the carbon intensity scoring. “And therefore, there’s really no way for ethanol producers to reward farmers for those practices through the existing structure of this tax credit.”

Cooper is hoping these issues can be addressed in the House Budget Committee or in the Senate before the bill is finalized.

Jennings says if the 45Z tax credits are available, ethanol companies are ready to innovate and take advantage of them, but he wonders if the value of the credit will be enough to get sustainable aviation fuel production off the ground because of the extra refinement needed.

The 45Z Clean Fuel Production Credit is one of the few tax policies House Republicans kept from the Biden-era Inflation Reduction Act. As written, the credit would extend to 2031. READ MORE; includes AUDIO

Excerpt from Associated Press: House Republicans narrowly advanced President Donald Trump’s big tax cuts package out of a key committee during a rare Sunday night vote, but just barely, as conservative holdouts are demanding quicker cuts to Medicaid and green energy programs before giving their full support.

Speaker Mike Johnson met with Republican lawmakers shortly before the meeting and acknowledged to reporters that there are still details to “iron out.” He said some changes were being made, but declined to provide details.

It’s all setting up a difficult week ahead for the GOP leadership racing toward a Memorial Day deadline, a week away, to pass the package from the House. The Budget Committee, which just days ago failed to advance the package when four conservative Republicans objected, was able to do so Sunday on a vote of 17-16, with the four hold-outs voting “present” to allow it to move ahead, as talks continue. READ MORE

Excerpt from Agri-Pulse: However, the 45Z credit for clean fuel producers would not only be preserved but also extended in the bill. Biofuel producers and farm groups have argued that the credit needed to be longer to give the market and industry more certainty. The bill also includes restrictions on where feedstocks can be sourced from and makes other adjustments to the credit as sought by biofuel groups. READ MORE

Excerpt from Clean Energy Business Network: The summary below covers the “One, Big, Beautiful, Bill Act,” which passed the House on May 22, 2025. In addition to the timeline adjustments below, this legislation implements stringent restrictions on “foreign entities of concern” that introduce extreme compliance risk and are administratively burdensome. The final House bill shifts these requirements up one year to 2026 from the Ways and Means version. This bill also reinstalls transferability for the duration of all tax credits while the Ways and Means bill eliminated this provision after 2027. Please note, this resource is educational only. Taxpayers may consider consulting a tax professional.

1 Manufacturers that have not surpassed 200,000 EVs sold, 30D tax credit phases out on Jan. 1, 2027. 2 For contracts signed before May 12, 2025 in which vehicles are placed in service by January 1, 2033, credit can be claimed. 3 Eliminates eligibility when homeowner rents or leases property to third party that is also eligible. 4 For homes that began construction before May 12, 2025, the 45L credit can be claimed for an additional year. READ MORE

Excerpt from Energy.AgWired.com: President Donald Trump’s “One Big, Beautiful Bill” passed in the U.S. House of Representatives Thursday morning on a vote of 215-214, with all Democrats and two Republicans voting against. The bill includes several provisions important to America’s ethanol producers and farmers.

“In addition to extending the 45Z clean fuel production credit by four years, the bill also reinstates crucial tax benefits that will stimulate research, experimentation, and innovation across the ethanol supply chain,” said Renewable Fuels Association President and CEO Geoff Cooper. “As the bill now moves to the Senate, we hope additional improvements can be made to ensure these tax policies truly drive demand growth for American-made renewable fuels.”

Sustainable Aviation Fuel (SAF) Coalition’s Executive Director, Alison Graab, says the bill extends the Clean Fuel Production Credit (45Z) through 2031. “This legislation provides the long-term certainty SAF producers need to scale operations, drive private sector investment, and benefits American farmers and rural economies. Sustainable aviation fuel is a vital solution for advancing U.S. energy dominance, driving rural economic growth, and establishing the United States as a global frontrunner in SAF production.”

American Farm Bureau Federation President Zippy Duvall says the bill “modernizes farm bill programs and extends and improves critical tax provisions that benefit America’s small farmers and ranchers. Updated reference prices will provide more certainty for farmers struggling through tough economic times. Making business tax deductions permanent and continuing current estate tax exemptions will ensure thousands of families will be able to pass their farms to the next generation.”

The bill includes an increase to the estate and gift tax exemption amounts to $15 million per individual and $30 million per couple, adjusted for inflation annually and makes this exemption permanent. Other provisions include a permanent increase to the Section 199A Small Business deduction from 20% to 23%, expanding the limitation on Section 179 from $1 million to $2.5 million, reinstating the 100% bonus depreciation for five years and extending the Federal Disaster Tax Relief Act of 2023. READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Canary Islands

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia/Slovak Republic

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea (Republic of Korea)

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler/Ship

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.