By Michael Eggleston* (Advanced Biofuels USA) Flying in Formation: Since the first test flight almost 10 years ago, there have been over 40,000 commercial flights supported by four international airports supplying SAFs. Michael Gill, Executive Director of the cross-industry Air Transport Action Group (ATAG) says that analysis has shown that up to 100% of the fuel in 2050 could be from sustainable sources with the right policy measures in place. He comments that it is vital that governments and industry stakeholders alike show their support behind these new sources of fuel for aviation as it will be a key component of the industry’s climate action plan.

Earlier this month, over 300 delegates met in Geneva for the Ninth Global Sustainable Aviation Summit, organized by ATAG to discuss such plans. The Summit brought together sustainability experts from industry and governments alike to review the role air transport plays in supporting today’s economic growth while mitigating the risk of environmental impact. This year’s summit re-visited some vital areas of action around climate change, whilst exploring new areas of focus such as implementing the UN’s sustainable development goals (SDGs) as a business framework.

According to the Business and Sustainable Development Commission’s Director, Gail Klintworth, the SDGs will drive economic growth, reduce cost, risk, and will inspire many stakeholders to feel fulfilled at the workplace. Listen:

Recently, the second Conference on Aviation and Alternative Fuels took place in Mexico City, where the International Civil Aviation Organization’s (ICAO) vision was further discussed with delegates from the industry.

Despite biofuels' mitigating climate change, the ICAO has a more urgent challenge to deal with as nearly 100 environmental and poverty groups released a letter that week slamming the proposal due to the fear that palm oil expansion for the purpose of bio-jetfuel production would further drive deforestation.

Biofuels for Aviation

Global aviation generates approximately 2 percent of global GHG emissions and is forecast to grow to 5 percent by 2050. While most industries have a range of cost-effective options available to reduce carbon emissions, aviation does not. For the foreseeable future, there is no alternative to liquid fuels for jet aircraft. The single largest opportunity to decarbonize air travel is to replace conventional, fossil-based jetfuel with sustainable aviation fuel (SAF) also commonly referred to as bio-jet or bio-kerosene.

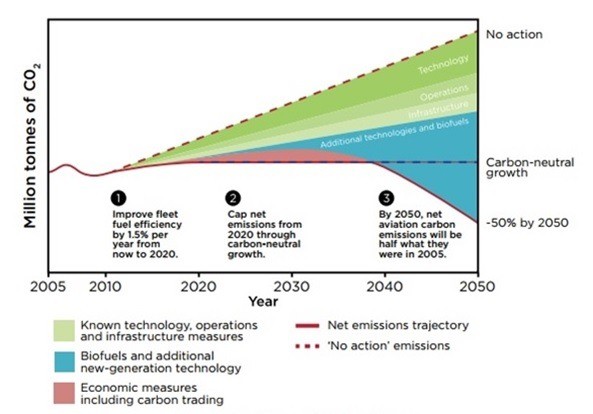

Figure 2: Emissions from aviation in the absence of any action, and emissions-reduction goals set by the industry

Figure 2: Emissions from aviation in the absence of any action, and emissions-reduction goals set by the industry

SAF’s are almost chemically identical to traditional jetfuel, but are synthesized from other, more sustainable ‘feedstocks’. These feedstocks can take the form of plant matter, municipal waste or even used cooking oil. To qualify as truly ‘sustainable’ alternative fuels, the feedstock must fulfill certain criteria, meaning, in part, that the feedstock used should not compete with food crops or other agriculturally sensitive produce. This is why many recent innovative alternative fuels have been produced using sources such as waste, microalgae, or saltwater tolerant plants that grow where the food crops cannot.

However, the emissions-reduction potential of different feedstocks may differ significantly with values ranging from 50 to 90 percent of the claimed potential reduction when compared with fossil jetfuel.

The vast majority of SAF available now is derived from oleochemical feedstocks such as vegetable oil, animal fats, and used cooking oil (UCO). However, costs for these feedstocks, as well as supply and sustainability concerns, make it impossible to quickly scale up production in order to meet demand in the near-term.

The oleochemicals-to-bio-jetfuel pathway will not supply all future needs, but is currently the foundation technology used to establish initial supply chains. According to the Rocky Mountain Institute's (RMI) report, Innovative Funding for Sustainable Aviation Fuel at U.S. Airports, advanced technologies have the potential to meet long-term goals, but are at least five to 10 years away from commercial maturity. These technologies use other feedstocks, such as forest or agricultural matter or other lignocellulosic biomass, waste streams, and algae.

As of May 2016, the American Society for Testing and Materials (ASTM) has certified five different technology pathways to produce SAFs. ASTM certification is required before commercial airlines can use a fuel for an international flight. The 5 pathways are:

Table 1: ASTM Pathways to produce SAFs

| Pathway | Feedstock | Blending | Aromatics Content | Technology Developer | ASTM Cert. |

| Fischer-Tropsch Synthetic Paraffinic Kerosene

(FT-SPK) |

Municipal solid waste (MSW) or woody biomass | 50% | Low | Sasol, Shell, Syntroleum | 2009 |

| Hydroprocessed Esters and Fatty Acid fuels

(HEFA-SPK) |

Oleochemicals such as oil and fats | 50% | Low | Honeywell UOP, Neste Oil, Synamic Fuels, EERC | 2011 |

| Hydroprocessed Fermented Sugars to Synthetic Isoparaffins

(HFS-SIP) |

Fermentation of bio-sugars via microbial intervention | 10% | Low | Amyris, Total | 2014 |

| FT-SPK with aromatics

(FT-SKA) |

Municipal solid waste (MSW) or woody biomass | 50% | High | Sasol | 2015 |

| Alcohol-to-jet fuels(ATJ) | Fermentation of bio-sugars via microbial intervention | 30% | Low | Gevo, Cobalt, Honeywell UOP, Lanzatech, Swedish Biofuels, Byogy | 2016 |

Today’s Challenges

Achieving the GHG emissions reduction targets proposed by the aviation industry and by the ICAO will require a significant increase in SAF production and consumption. RMI notes the exact volumes required to achieve specific goals are not clear because of factors such as the aviation sector’s future fuel consumption, the extent of emissions reductions achieved through offsets, and the specific emissions-reduction potential of various options for making bio-jetfuels, which were mentioned in Table 1.

Despite the keen interest in SAFs, wide-scale deployment of these fuels into the jetfuel market has significant barriers to overcome including:

- Drop-in fuel compliance; Aircraft and airport fuel storage and delivery systems are designed to last for decades; new fuels must be compatible with existing systems.

- Chemical flexibility - cannot freeze, boil, or absorb water; A plane may take off from a scorching Arizona desert, climb to a freezing 30,000 feet, and land in a humid Louisiana swamp.

- Raw material competition; SAF producers will need to compete with biodiesel and ethanol producers and SAF purchasers must pay a sufficiently high price to keep SAFs from being sold into distillate fuel markets.

- Tax incentive acquisition; Many of the tax and other incentive programs for blending of biofuels into highway fuels have traditionally not been available for SAFs.

Discussing these challenges at the conference was a panel lead by Julie Felgar, the Senior Advisor at CollaborateUp; a conversation from which much can be learned as commercialization of SAFs lags behind about a decade from biofuels that have been taken up by the automotive industry.

According to Jonathon Counsell, the Group Head of Sustainability at the International Airlines Group, the competitive cost of petroleum-based jetfuel is the biggest challenge for the development of SAFs. Listen:

Financing SAFs is a problem familiar to Honeywell UOP. James M. Andersen the Business Director of Green Fuels and Chemicals discussed the importance of restructuring California’s Low Carbon Fuel Standard (LCSF) to include premium credits for SAFs. Listen:

For European Airports such as Genève Aéroport, SAF uptake has been made mandatory up to 1 percent of the total fuel consumption in order to facilitate the transparency of financing to airlines said André Schneider, the CEO of the airport. Listen:

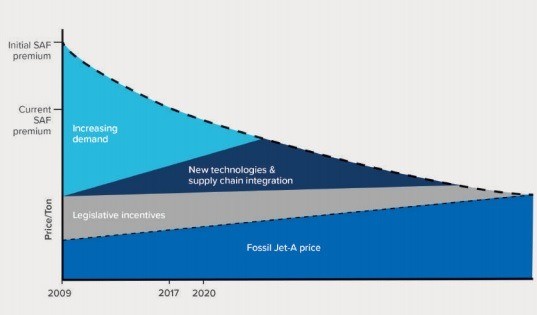

High SAF prices are the primary reason for the slow uptake and the related absence of large-scale production capacity. Despite government incentives, the price premium for SAF is still significant. Airlines operate on low profit margins with fuel as the largest expense; thus, there is limited ability to absorb these additional costs. The challenge for this industry now is to produce these fuels in a sufficient quantity at a competitive price, making them commercially viable.

Due to scaling growth, the development of dedicated production capacity and increasingly efficient supply chains, the price difference between SAFs and petroleum-based aviation fuel has fallen dramatically to roughly three times the price of conventional fuel. The actual cost of SAF and its cost difference relative to fossil-based jetfuel differ significantly across regions, driven by feedstock price, conversion technology/capital investment for a production facility, the policy environment, supply chain logistics, and other factors.

However, as the hype for hybrid-electricity increases as this technology becomes more affordable to the consumer, SAFs still provide the most promising alternative in meeting the aviation sector’s immediate emission reduction targets since they can be implemented immediately as a drop-in-fuel. Hybrid-electricity on the other hand could prove to be a solution for the long term as Counsell mentions. Listen:

The Commercial Aviation Alternative Fuels Initiative (CAAFI) R&D Team has developed a series of white papers addressing these key challenges related to alternative jet fuel development.

Leading by Example

Despite these challenges, SAF technology and deployment are progressing.

Alaska Airlines, KLM, and United Airlines have all deployed bio-jetfuel on commercial flights in 2011 to demonstrate how the fuels could be integrated in regular service.

Furthermore, in 2012, the first airline purchase agreement for regular supply was linked with a prospective SAF producer.

Then in 2014, the first volumes of SAF from a commercial SAF plant in Brazil were used in commercial service that year.

Later during the conference, during a workshop held covering the theme of innovation solutions to address climate change, Shamsul Leman, Head of Occupational Safety, Health and Environment at Singapore Airlines (SIA) illustrated how their effort to reduce international aviation emissions in partnership with the Civil Aviation Authority of Singapore (CAAS) has resulted in a series of 12 ‘green package’ flights over a three-month period along a non-stop San Francisco-Singapore route. The ‘green package’ flights are the first in the world to combine the use of biofuels, fuel-efficient aircraft and optimized flight operations which provide the industry with valuable insight into the economics, logistical requirements and performance of these SAFs.

Leman says that in order for the ‘green package’ to succeed that it needs support from governments and industries alike. Listen:

Gaining Support

The beginning of 2016 saw a landmark event to normalize the use of SAFs with Oslo Airport becoming the first international hub in the world to offer the fuel to all airlines serving the airport. This is also a particularly significant step, so far as the supply method is concerned, with the fuel being incorporated into the airport’s hydrant system, which means that airlines do not need to alter their normal re-fueling process.

Original equipment manufacturers (OEMs) have been instrumental in the development of SAFs, with two leading manufacturers, Airbus and Boeing, making significant contributions.

Airbus has developed programs in Australia, Brazil, Qatar, Romania and Spain, and has partnered with China’s Tsinghua University and the China Petroleum and Chemical Corporation (Sinopec) to explore bio-jet development in China. Airbus has also carried out numerous test flights using bio-jetfuels.

In order for the sector’s goals to be met, OEMs need to increasing their capacity to certify more than one SAF per year says Andersen. Listen:

Preparing for Take-Off: Countdown to CORSIA

Panel members emphasized that policy support is widely recognized as essential if SAF deployment is to be successful.

The Indonesian government’s announcement of a mandate for SAF is one example of public-policy support that could have a significant impact on bio-jet development. However on a global basis there have been very limited government efforts to develop and implement the types of policies that have been successful in promoting road-transport biofuels. These include mandates, tax incentives and subsidies. This low level of government policy support is one of the main reasons why there has been limited development and deployment of SAF.

The lack of direct government involvement might be partially due to the international nature of aviation and the legal role of ICAO.

At the international level, the ICAO plays a major role in global development of the aviation sector. It works with 191 member states and global aviation organizations to develop international standards and recommended practices. The member states are obliged to reference those standards when developing their own legally enforceable national civil-aviation regulations.

In 2016, after many years of debate and planning, the ICAO has agreed on a new global market based measure (GMBM), with the goal of implementing these measures by the end of 2020. Such market based mechanisms would provide the basis to set a price on emissions, seen as the primary means for emission reduction at the national and regional levels. GMBMs have been proposed as a way to bridge the time gap, by limiting carbon emissions while bio-jetfuels and other technologies are developed.

After 2020, technological, infrastructure and operational efficiency measures will be complemented by the ICAO Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

Under CORSIA, aircraft operators will be required to purchase offsets, or ‘emission units’, for the growth in CO2 emissions covered by the scheme. CORSIA aims to address any annual increase in total CO2 emissions from international civil aviation above 2020 levels. In order to address the concerns of developing states and to take into account the special circumstances and respective capabilities of states, CORSIA will be implemented in phases.

The adoption of CORSIA by governments meeting at ICAO is the first climate measure of its type for any global industry and is a solution which will help airlines avoid a complex patchwork of different schemes and achieve carbon-neutral growth in a cost effective way.

The industry has already pushed to get CORSIA implemented for more than six years, but as of September 2017, only 72 member states out of 191 have volunteered to be part of its first phases. This represents close to 88 percent of international aviation activity and 80 percent of emissions growth above 2020 levels.

Still, in order for CORSIA to be successful the participation of all member states is needed for it to be fully effective, said UNFCCC Deputy Executive Secretary Ovais Sarmad during the Summit’s keynote address.

According to Counsell, it has been more difficult to make progress on governmental policy than it has on restructuring business plans, but incorporating SAFs could be attractive to governments as it reduces waste, creates jobs and decreases foreign oil dependence. Listen:

How will airlines commit to keeping this promise over the years to meet their climate goals?

Leading the cause for intergovernmental framework to limit emissions, the EU decided to add aviation to its Emissions Trading System (ETS). In 2012, the new directive made it a legal requirement that the aviation sector joins the ETS making clear that the EU will focus its compliance activities on all flights within and flying into and out of the EU.

Besides pushing for mandates, helping investors past the “valley of death” stage of commercializing the technology will be needed, as financing for these types of pioneering projects has proven difficult to obtain, particularly at a time of low oil prices.

Industry and customers can also play their part in helping expand the production and use of SAFs. For example, KLM’s corporate program and the Fly Green Fund are some of the corporate programmes that encourage customers to cover the price premium of using SAF.

Voicing change is fundamental to facilitating the development of SAFs as airlines must adhere to the interest of their investors who make their decisions based off of their customer’s interests, said Counsell. Listen:

Taking Flight

Increased use of SAF is essential for the aviation industry to meet its carbon emissions-reduction goals.

Currently the vast majority of SAF is derived from oleochemical feedstocks and uses the HEFA pathway which has a mixed reception to being carbon ‘neutral’. However, this will likely remain the main conversion route over the next five to 10 years, as methods using biomass, lignocellulosic and algal sources, and other advanced bio-jet technologies, are still maturing.

Thermochemical technologies are the most likely to provide the large volumes of advanced SAF required, partly because the co-products produced by biochemical routes to bio-jet are valuable in the chemical, lubricant and cosmetic markets.

Although a number of commercial facilities in operation worldwide can produce HEFA-SPK, they were primarily established to make renewable diesel. Only one facility, AltAir Fuels, is primarily dedicated to SAF production.

Without specific interventions and incentives directed towards SAF production and use, current policies in jurisdictions such as the U.S. will favor the production of renewable diesel over SAF.

Airports must take leadership in pioneering the adoption of SAFs avoiding competitive distortion by fueling all airlines with mandatory blend ratios and by effectively communicating their sustainable development goals to their stakeholders to inspire a chain reaction of support and to facilitate action from governments to incentivize the uptake of these fuels.

References

Aviation Beyond Borders. Geneva, Air Transport Action Group, 2016, pp. 30-31, https://aviationbenefits.org/media/149668/abbb2016_full_a4_web.pdf

Biofuels for Aviation: Technology Brief. Abu Dhabi, International Renewable Energy Agency, 2017, pp. 2-45, https://www.irena.org/DocumentDownloads/Publications/IRENA_Biofuels_for_Aviation_2017.pdf

Directive (EU) 2015/1513 of the European Parliament and of the Council. Office Journal of the European Union, 2015, eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32015L1513&from=EN

General Biomass, edited by Daniel Gibbs, General Biomass Company, 2013, www.generalbiomass.com/renewablejetfuel1.htm

IATA Sustainable Aviation Fuel Roadmap. First ed., Geneva, International Air Transport Association, 2015, p. vii, https://www.iata.org/whatwedo/environment/Documents/safr-1-2015.pdf

Innovative Funding for Sustainable Aviation Fuel at U.S. Airports: Explored at Seattle-Tacoma International. Rocky Mountain Institute, SkyNRG, July 2017, pp.3-9 https://www.rmi.org/insights/reports/innovative-funding-sea-tac-2017

The Flight Paths for Biojet Fuel. Washington D.C., U.S. Energy Information Administration, 2015, pp.1-7, https://www.eia.gov/workingpapers/pdf/flightpaths_biojetffuel.pdf

* Michael Eggleston is a chemical engineering student specializing in the process control & risk management of sustainable development with the University of Rhode Island's International Engineering Program and spending a semester abroad at the Technische Universität Darmstadt: Darmstadt, Germany. He will be reporting on and representing Advanced Biofuels USA at international conferences.

Opinion: Biofuels Sustainable, Essential To Aviation’s Future (Aviation Week & Space Technology)

ICAO Conference on sustainable alternative fuels agrees on new 2050 Vision to guide future development and deployment (International Civil Aviation Organization (ICAO))

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- El Salvador

- Equatorial Guinea

- Eqypt

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

0 COMMENTS

Leave A Comment

Your Email Address wiil not be Published. Required Field Are marked*