by Cácia Pimentel* (Advanced Biofuels USA) On February 15th the Center on Global Energy Policy (CGEP) Carbon Management Research Initiative and the Women in Energy program hosted a panel of experts to discuss carbon capture policies and technologies, especially Carbon Capture, Utilization and Storage (CCUS). CCUS are methods and technologies to remove CO2 from the atmosphere and recycle it for further utilization in industrial processes or for permanent storage.

Speakers included Judi Greenwald, a Fellow at Princeton University’s Andlinger Center for Energy and the Environment. She is also the Principal of Greenwald Consulting LLC, providing energy and environmental expert advice. Romany Webb is a Senior Fellow with the Columbia University Sabin Center for Climate Changer Law. Shannon Angielski is the Principal for Governmental Issues and advises on energy policy issues at Van Ness Feldman LLP. She is also the Executive Director of the Carbon Utilization Research Council (CURC). Julio Friedmann, a senior Research Scholar at CGEP, served as the moderator.

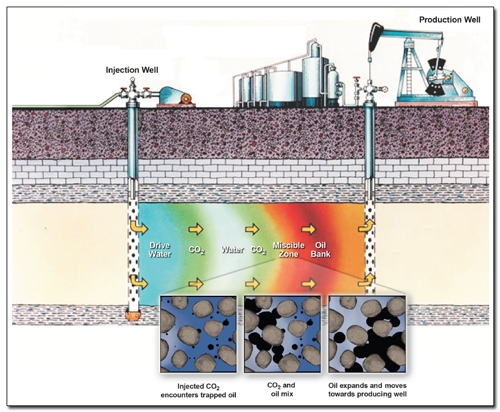

Source: US Department of Energy www.energy.gov/fe/science-innovation/oil-gas-research/enhanced-oil-recovery

Source: US Department of Energy www.energy.gov/fe/science-innovation/oil-gas-research/enhanced-oil-recovery

WHAT'S IT ALL ABOUT?

Carbon capture is an emission reduction technology that can be applied across the fossil energy value chain.

For example, companies can increase oil production out of existing wells using carbon dioxide and companies are paying for CO2 to do this.

One way to obtain CO2 is by drilling for CO2 that naturally occurs underground, bringing it up and reinjecting it into the oil wells.

Meanwhile, energy consumers are producing CO2 as waste and emitting it into the atmosphere. This means that there is a shortage of CO2 supply for companies and at the same time a tremendous release of CO2 into the atmosphere.

This carbon capture technology started back in 1972 led by the United States, and now there are approximately 4500 miles of pipelines. The CO2 is stored underground where the oil used to be before it was extracted. There are around 20 operating plants around the world, most of them in the United States. There is about two decades of carbon dioxide already in storage and the capacity to store centuries worth of CO2 emissions. The challenge now is to build up the pipeline network from sources to sinks.

A drawback of this Enhanced Oil Recovery (EOR) type of CCUS technology is that it is mainly used to enhance oil fields productive life, adding decades of drilling and many million barrels of oil that otherwise would not be drilled. Thus, this technology increases the presence of fossil fuel in the energy matrix.

Scientists learned how to capture the carbon dioxide that would bring hope for the environment if it were applied to meet the UN 2030 Sustainable Development Goals (SDG) level of 350 Mt CO2 captured per year.

Scientists learned how to capture the carbon dioxide that would bring hope for the environment if it were applied to meet the UN 2030 Sustainable Development Goals (SDG) level of 350 Mt CO2 captured per year.

CCUS can achieve deep decarbonization mostly for two reasons. First, 40% of global emissions come from industrial processes and their CO2 emission can be reduced by carbon capture. Second, public and private agents have been too slow to reduce greenhouse gas emissions enough to achieve climate change mitigation goals and therefore, countries will have to achieve negative emissions. This means, direct capture of emissions already in the atmosphere. To do so, CCUS is required.

Despite scientific recognition that carbon capture should be a relevant emissions mitigation technology, its deployment to protect the environment is not on the radar, according to the International Energy Agency (IEA).

Section 45Q is a U.S. tax credit that encourages the development of projects and processes that trap carbon dioxide from power plants and industrial facilities, depositing it in safe reservoirs. Panelists highlighted the potential of 45Q as an incentive to the market. Internal Revenue Service (IRS) is still developing guidance for the updated credits, creating uncertainty and potentially delaying projects. A Congress Coalition is urging the IRS to speed those guidance rules to help companies take advantage of the carbon tax credit statute. Unfortunately, two years has passed since the issue of 45Q without additional regulation of how companies can achieve the credits.

THE ROLE OF BIOFUELS

Companies can capture carbon with biofuels production. For instance, under the California Low Carbon Fuel Standard, it is possible to get tax credit if a biofuel company proves to capture carbon in its process and store it. Not only the growing plants absorb CO2, but the biofuel plant may produce energy by capturing and storing any resulting greenhouse gas emission from the energy production process.

NOTHING IS EASY, BUT EVERYTHING IS POSSIBLE

Although the CO2 market today is mostly comprised of fossil fuel companies, the potential to help a net-zero CO2 emission economy growth is huge. The IEA states that “early opportunities could be developed, especially those related to building materials. Public procurement of low-carbon products can help to create an early market for CO2-derived products and assist in the development of technical standards. In the long term, CO2 sourced from biomass or the air could play a key role in a net-zero CO2 emission economy, including as a carbon source for aviation fuels and chemicals”.

The US desperately needs comprehensive national policies on climate, states Greenwald. She affirms that different climate solutions working together can reinforce good results and reach the finish line together. Indeed, 45Q can strongly help develop new pathways to use CO2 as energy, different technologies can be incentivized to capture released carbon and therefore help the world achieve climate goals. But for that, experts are unanimous: legal reform is urgent!

*Brazilian attorney, Cacia Pimentel is a Visiting Scholar at Columbia University and a PhD candidate in Political and Economic Law at Mackenzie Presbyterian University, Sao Paulo. She holds a Master of Laws from Cornell University, New York.

Chevron invests in carbon capture technology company (Houston Chronicle)

CarbonShot: Federal Policy Options for Carbon Removal in the United States (World Resources Institute)

HOEVEN: RED TRAIL ENERGY TO BEGIN DRILLING A STRATIGRAPHIC WELL FOR CARBON SEQUESTRATION, WILL ENABLE ETHANOL EXPORTS TO STATES LIKE CALIFORNIA: Senator Secured North Dakota’s Regulatory Primacy over Class VI Wells, Supporting PCOR, CarbonSAFE & 45Q Tax Credit to Advance Development of Commercially-Viable CCUS (Office of Senator John Hoven (R-ND))

Going Deep on Carbon Capture, Utilization, and Storage (CCUS), with Julio Friedmann (Resoureces Magazine; includes AUDIO)

SENATORS WANT MNUCHIN TO GRANT CARBON CAPTURE TAX EXTENSIONS: (Politico's Morning Energy)

Excerpt from Politico's Morning Energy: SENATORS WANT MNUCHIN TO GRANT CARBON CAPTURE TAX EXTENSIONS:If Treasury is giving the wind industry an extension on its tax credits, then carbon capture projects should get one too, a bipartisan group of seven senators said in a letter to Treasury Secretary Steven Mnuchin on Monday. The senators, led by Sens. Kevin Cramer (R-N.D.) and Sheldon Whitehouse (D-R.I.), highlight a separate letter first reported in POLITICO earlier this month in which Treasury said it would grant wind and solar projects begun in 2016 an extra year to complete work in order to claim the full value of their tax credits.

But carbon capture projects had to wait years for IRS to write key rules to access the credit, and now social distancing measures prompted by pandemic response have slowed projects further. "In light of the wide-ranging impacts COVID-19 continues to have on the American economy, combined with the over two-year delay in final 45Q guidance, it makes sense to provide as much administrative flexibility as possible," the senators said their letter. "The reported action Treasury is taking on behalf of wind and solar projects should be replicated for carbon sequestration projects seeking to utilize the 45Q credit."

Cramer will likely press Mnuchin on this point today when he testifies before the Senate Banking Committee on the first quarterly report to Congress on the CARES Act. READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- El Salvador

- Equatorial Guinea

- Eqypt

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.