by Jael Holzman (E&E News/Greenwire) With climate change pushing the U.S. toward more rapid adoption of new technologies, many Republicans and Democrats are in rare agreement on one key point: This country needs a lot more mines.

But exactly how much new mining is required for the energy transition isn’t clear.

Electric cars, wind turbines and solar panels are made with a wide variety of minerals — from graphite to tellurium — that currently are only available in a few corners of the globe. Some of these minerals are not mined enough to feed a world powered without fossil fuels — particularly lithium, a metal vital for electric cars and other battery-reliant products.

...

The risk for the U.S. is opening untouched landscapes and culturally sensitive areas for mines, under the auspices of reducing greenhouse gas emissions, only to create new pollution problems from a sector that by its very nature carries the risk of potential environmental hazards. READ MORE

The recent passage of the climate-focused Inflation Reduction Act has juiced up the debate, as the need for domestically produced or processed minerals went from an abstract concept to a concrete requirement.

The law tied a $7,500 tax credit for buying an electric car to the origins of a vehicle’s parts. If an American consumer wants to use the full credit, the EV’s battery would need minerals from the United States or a country with a U.S. free trade agreement. The car also can’t include any parts made from minerals mined or processed in China or Russia.

...

Democrats also put other incentives for more mining in the climate law, saying it would help provide the U.S. with independence from China as the country moves away from oil and gas. Any mining operation digging up rocks desired by green tech manufacturers will get a 10 percent tax break. The Pentagon got more than $500 million in added funding to a wartime account that Biden opened for spending on mining activities.

...

Companies insist that an American mining resurgence would be much cleaner than decades past. But industry progress can’t change the geologic reality that the minerals sought after for making green technologies are located in sensitive parts of the United States, including near delicate ecosystems and Native American communities. In Nevada alone, two large lithium projects have sparked fights over endangered species, water use and Indigenous rights. A broader mining boom could see these conflicts play out on a national scale.

...

In September, mining industry data firm Benchmark Mineral Intelligence came up with an answer to how many mines globally need to open for EVs and energy storage batteries to keep growing. After taking a look at the mines producing metals for the battery market today, their estimate was 336 mines by 2035.

“You are going to need mining in this sort of exponential demand phase of the EV revolution,” said Henry Sanderson, executive editor of Benchmark Mineral Intelligence.

But in its own recent analysis, the International Energy Agency noted changing battery designs could result in the world needing fewer new mines.

The IEA concluded roughly 117 lithium, cobalt and nickel mines would have to open to feed the EV market by 2030. Unlike Benchmark, IEA did not analyze how many more mines are needed to produce graphite, a mineral used in battery anodes.

...

Cobalt, a bluish mineral used in cathodes, has been in high demand because it could protect against batteries overheating. That’s changing because of human rights concerns about cobalt mining in the Democratic Republic of Congo, which has sparked investments in battery research. Now automakers are increasingly swapping cobalt-heavy batteries out for ones that don’t use cobalt or nickel, a metal used in cells to store more energy.

...

Hans Eric Melin, the founder of intelligence firm Circular Energy Storage, makes his living by providing companies and individuals with industry data on the full life cycle of batteries used in electric vehicles and energy grids. He said there simply isn’t enough metal available for recycling to drive the transition away from fossil fuels.

“In terms of recycling, you are only able to recycle what is there,” Melin said.

A big issue is lithium, an element essential for making a battery charge.

...

A recent study published in Resources, Conservation & Recycling estimated that by 2035 only 7 percent to 8 percent of U.S. lithium demand could be met with reused materials. READ MORE

More articles

- Coal to clean energy? DOE launches critical minerals program. -- Critical minerals are needed to manufacture batteries for electric vehicles and renewable energy infrastructure, but the nation currently relies on nondomestic suppliers to fill more than 80 percent of demand. (Politico Pro)

- DOE Funds More Studies of Domestic Supply Chain for Critical Minerals for EVs (NGT News)

- Digging for green minerals a priority for the North, says federal minister (CBC)

- There’s lithium in them thar hills – but fears grow over US ‘white gold’ boom (The Guardian)

- EV supply chains have a human rights problem. Can tech fix it? (Washington Post)

- Green Minerals: Justice and Opportunity in the Renewable Energy Transition (Wilson Center; includes VIDEO)

- Minerals trade restrictions bad for climate progress — IEA -- The International Energy Agency in its annual "World Energy Outlook" cautions against countries just ditching minerals from political adversaries like China. (Politico Pro)

- Lack of graphite could gum up American EV market (E&E News Greenwire)

- How a stalled Minnesota mining project challenges Biden’s clean energy goals (Politico)

- 'Made in America' fight clouds EV gains (Politico's Power Switch)

- Electric Cars Are Taking Off, but When Will Battery Recycling Follow? Many companies and investors are eager to recycle batteries, but it could take a decade or more before enough used lithium-ion batteries become available. (New York Times)

- Renewable Energy and Mining in Latin America (Wilson Center; includes VIDEO)

- South America’s Lithium and the Race to Go Green (Wilson Center; includes AUDIO)

- Critical Minerals: What, How, and Why All the Hype? (EERC Webinar; include VIDEO)

- Today's Critical Mineral Technologies and How to Move Forward (EERC Webinar; includes VIDEO)

- Mining firm: Europe’s largest rare earths deposit found in Sweden -- China currently provides the bulk of the EU’s supply. (Politico)

- Feds offer $700M to lithium project at heart of ESA dispute (E&E News)

- Why the DOE might loan millions to a controversial mine project (Politico Energy Podcast)

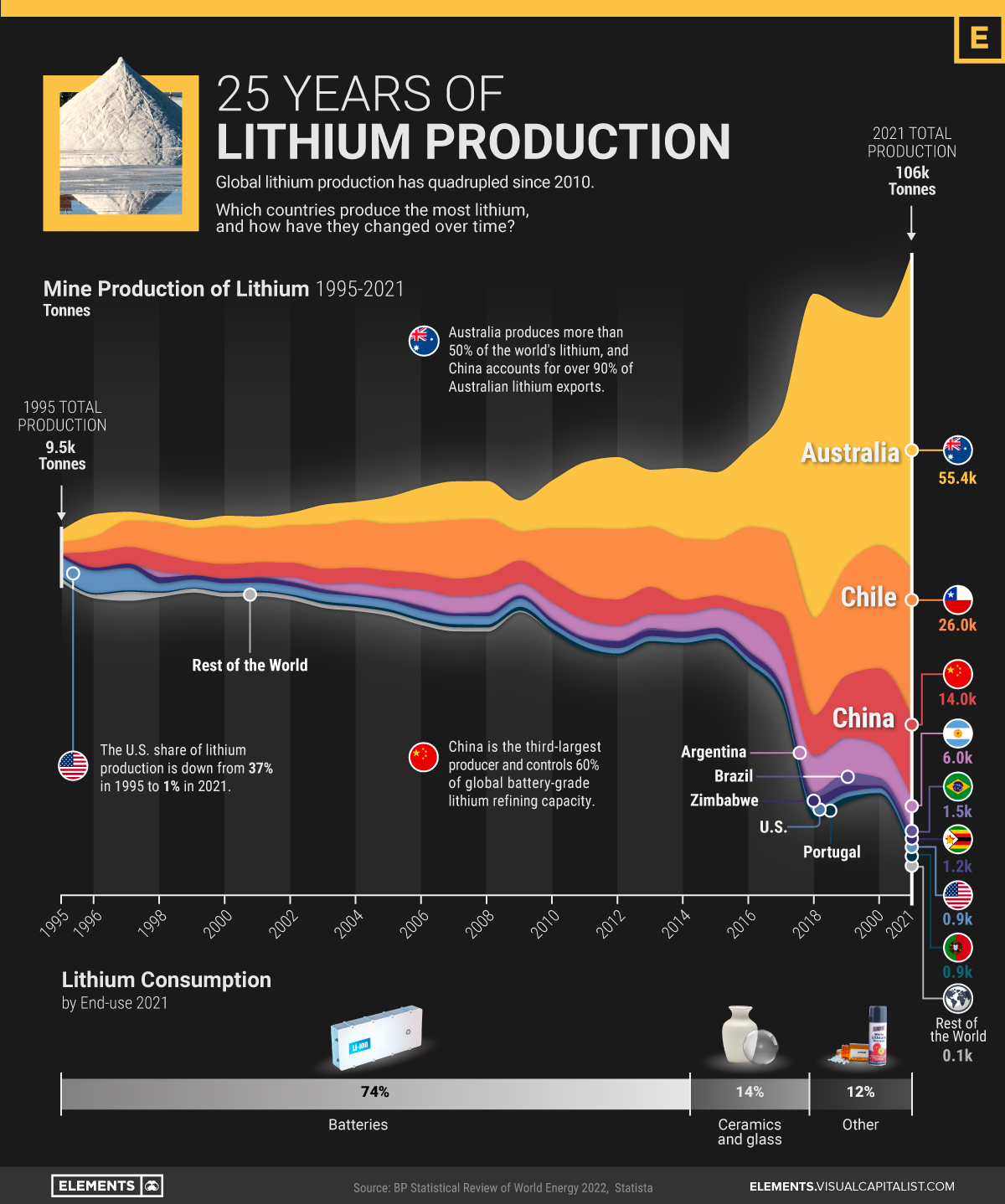

- Lithium Production by Country (1995-2021) (Transport Energy Solutions/Visual Capitalist)

- States see lithium rush for EVs as environmentalists urge caution (The Hill)

- Lithium company Ioneer scores $700 million conditional loan from Energy Department for Nevada plant (CNBC)

- Feds offer $700M to lithium project at heart of ESA dispute (E&E News)

- DOE offers contentious Nevada lithium mine $700 million loan: If finalized, Rhyolite Ridge project could potentially support production of lithium for about 370,000 electric vehicles each year (Idah0 Capital Sun)

- LPO Announces Conditional Commitment to Ioneer Rhyolite Ridge to Advance Domestic Production of Lithium and Boron, Boost U.S. Battery Supply Chain (U.S. Department of Energy)

- Nevada lithium mine gets conditional $700M government loan: The U.S. Department of Energy says it plans to loan $700 million to an Australian mining company to pursue a proposed lithium project in Nevada (ABC News)

- Inside the only lithium producer in the U.S., which provides the critical mineral used in batteries by Tesla, EV makers (CNBC)

- A Rare Plant Got Endangered Species Protection This Week, but Already Faces Threats to Its Habitat -- Lithium led Tiehm’s buckwheat to evolve on a 10-acre plot in Nevada. Now the flower is threatened both by a mine for the metal that’s critical for the energy transition and grazing cattle. (Inside Climate News)

- U.S. strikes at China with EV battery deal (E&E News)

- Revealed: how US transition to electric cars threatens environmental havoc (The Guardian)

- Transition to EVs could cause lithium shortages — report -- Converting the existing U.S. car fleet to battery-powered electric vehicles would require three times more lithium than the world currently produces. (Politico Pro)

- US moves to protect Minnesota wilderness from planned mine (Star Tribune)

- Will Biden’s Mining Ban in Minnesota’s Boundary Waters Hurt the Clean Energy Transition? (Inside Climate News)

- Biden protects vast wilderness area in Minnesota from mining -- The move comes as the administration faces a string of tough decisions on federal conservation for spots in Alaska and Nevada (Washington Post)

- Biden blocks Pebble, but Bristol Bay fights could continue (E&E News)

- GM to invest $650M in Nevada lithium mine for EV push (Politico Pro)

- Minerals are crucial for electric cars, wind turbines, and solar panels. Some worry whether the future supply can meet the rising demand. (Washington Post)

- Study: Enough rare earth minerals to fuel green energy shift (Associated Press)

- Future demand for electricity generation materials under different climate mitigation scenarios (Joule)

- Energy in the New Cold War: Critical Minerals (Energy Minute/Transport Energy Strategies)

- U.S. Geological Survey, Mineral Commodity Summaries, January 2022--Lithium (U.S. Geological Survey)

- The Climate Crusaders Are Coming for Electric Cars Too -- A new report makes clear the ultimate goal: tiny, uncomfortable apartments and bicycles for all. (Wall Street Journal)

- Electric vehicles need lithium. See how they get it. (Washington Post; includes VIDEO)

- Biden turns to Africa to counter China (Power Switch)

- U.S. strikes at China with EV battery deal (E&E Energy Wire)

- Bleak photos show the reality of the cobalt mining industry responsible for the batteries in your phone, computer, and car (Business Insider India)

- A lithium CEO on how the world will change (Semafor)

- 'Silicon Valley of lithium': Nevada mine breaks ground -- With the nation's second lithium mine starting construction this week, Nevada is moving toward creating a full-fledged lithium industry. (Politico)

- Europe’s green dilemma: Mining key minerals without destroying nature -- Conservationists are spooked by Brussels’ plans to ramp up mining of critical raw materials, but advocates say it’s needed to hit the bloc’s green goals. (Politico)

- Pan American Energy to Collaborate with Integrity Mining and Industrial to Pilot Sustainable Chemistry for Lithium Extraction in North America (Pan American Energy Group/Yahoo!)

- U.S. and Japan Strike Deal on Minerals Used in Batteries for Electric Cars: Move aims at China’s supply-chain dominance and Japan meeting requirements on EV subsidies in the U.S. (Wall Street Journal)

- Biden’s EV push sparks lobbying surge (E&E News Greenwire)

- Biden’s EV bet is a gamble on critical minerals (E&E News Greenwire)

- ‘Net Zero’ Will Mean a Mining Boom -- But political instability will make it difficult to obtain all the minerals electric cars will need. (Wall Street Journal)

- Apple Commits to 100% Recycled Cobalt in Batteries by 2025 (Environment + Energy Leader)

- Latin America’s Lithium: Critical Minerals and the Global Energy Transition (Wilson Center)

- The underbelly of electric vehicles: What goes into making EVs, where it comes from and at what human cost (Washington Post)

- On frontier of new ‘gold rush,’ quest for coveted EV metals yields misery: Soaring demand for electric vehicles is fueling dramatic changes in Guinea, home to the world’s largest bauxite reserves (Washington Post)

- The U.S. Wants a Rare-Earths Supply Chain. Here’s Why It Won’t Come Easily. -- New tax credit bill seeks to challenge China’s dominance in the processing of critical minerals (Wall Street Journal)

- How Lithium Gets from the Earth to Your Electric Car (Washington Post)

- U.S. to partner with Philippines on green tech minerals: The move is intended to help both countries meet their climate goals, as well as serve as a check on China's dominance of the market. (E&E News Climatewire)

- To meet EV demand, industry turns to technology long deemed hazardous -- Indonesia is richly endowed with nickel, but refining this crucial mineral poses a daunting environmental challenge (Washington Post)

- Factbox: Ford strikes multiple lithium deals to ramp up EV production (Reuters)

- The U.S. Needs Minerals for Electric Cars. Everyone Else Wants Them Too.The United States is entering an array of agreements to secure the critical minerals necessary for the energy transition, but it’s not clear which of the arrangements can succeed. (New York Times)

- ExxonMobil Dips Its Oily Toe Into Lithium: The fossil fuel giant is joining the race to mine lithium for the clean energy revolution. (Gizmodo)

- Biden admin delays decision on Alaska mining road: The 211-mile-long Ambler Road would cut through remote areas of Alaska to reach the Ambler Mining District. (Politico Pro/E&E News Greenwire)

- 'Land rush': Ford, automakers forge mineral deals amid EV boom: In just one of the agreements announced this week, Ford said it has committed to buy lithium hydroxide produced near the Salton Sea in California. (E&E News Greenwire)

- 'Lithium Valley' may provide California with its next gold rush (CBS News)

- Big Oil Is Getting Serious About Lithium: The world’s heavyweights finally are seeing upside to extracting a mineral that has long been associated with oil and gas. (Bloomberg)

- The world’s moving closer to deep-sea mining. There are no rules. (E&E News Greenwire)

- This national park is so wild, it has no roads. Now some want to mine outside its gates. -- A proposed copper mine near two national parks is turning into a test of values --- how to protect wilderness while supplying minerals (Washington Post)

- Lithium industry needs US$116 billion to achieve 5.7x ramp-up for 2030 goals (Energy Storage News)

- Lithium industry needs over $116 billion to meet automaker and policy targets by 2030 (Benchmark Source)

- Report: Climate law puts U.S. at risk of critical mineral shortage -- "Everything is more difficult and more complicated than it may look," said Daniel Yergin, the vice chairman of S&P Global. (Politico Pro)

- Biden’s overseas mineral strategy faces early test (E&E News Greenwire)

- $67 Billion of Rare Minerals Is Buried Under One of the World’s Biggest Carbon Sinks -- A fight is brewing in Canada about how, or whether, to dig out materials essential for EV batteries that lie deep beneath vast peat bogs (Wall Street Journal)

- Exxon unveils plan to drill for lithium to feed EV supply chains: The company is one of several oil and gas majors that have been eyeing lithium production. (Politico Pro)

- Dirty Water and Dead Rice: The Cost of the Clean Energy Transition in Rural Minnesota -- Mining the critical minerals needed for electric vehicle batteries could threaten local water supply and Indigenous culture. (Inside Climate News)

- Mucus-Covered Jellyfish Hint at Dangers of Deep-Sea Mining -- Shipboard experiments suggested that sediment from the exploitation of metals in the ocean could be harmful to marine life. (New York Times)

- Aridity Could Dry Up Southwestern Mine Proposals -- Critical minerals for the clean energy transition are abundant in the Southwest, but the dozens of mines proposed to access them will require vast sums of water, something in short supply in the desert. (Inside Climate News)

- Washington Wants to Revive a Critical Minerals Mega-Railway Through Africa -- The move comes straight out of China’s Belt-and-Road playbook. (Foreign Policy)

- Biden Jump-Starts Electric-Vehicle Push With Massive Lithium Loan: Lithium Americas to get a $2.26 billion loan for its Thacker Pass mine (Wall Street Journal)

- EU Policy. Critical materials mining approved despite green fears (euronews.green)

- Mining Companies Say They Have a Better Way to Get Underground Lithium, but Skepticism Remains -- Direct lithium extraction has been touted as a more environmentally friendly way to mine the resource needed for EV batteries. But the technology is largely untested and could impact already limited water supplies in the Southwest. (Inside Climate News)

- The Global Mining Boom Puts African Great Apes at Greater Risk Than Previously Known -- New research reveals that one-third of great apes on the African continent are threatened by mining concessions, while inadequate protective measures are in place. (Inside Climate News)

- The role of copper in the energy transition (DNV)

- Cobre Panama: How a $10 billion copper mine is now sitting idle in the jungle (Mining.com)

- Lithium Companies Fight Over Water in the Arid Great Basin: In the Nevada valley that is one of the most significant domestic sources of a key element for the energy transition, one company controls the groundwater needed to mine it, another is fighting for a share of it and others are lining up at the tap. (Inside Climate News)

- Researchers say a copper shortage could imperil Michigan’s EV future (Bridge Michigan)

- Copper Mining and Vehicle Electrification (International Energy Forum)

- Copper Crunch: Looming Shortage Threatens Electric Future (Crux Investor)

- Electrification Goals Hampered by Copper Shortage, Study Finds (Space Daily)

- IEF: EV transition targets out of reach without more copper mines (Green Car Congress)

- Why the World Needs More Copper — a Lot More Copper (Bloomberg)

- Copper Hits Record Above $11,000 on Bets That Shortage Looms: Investors have piled up bets as metal faces supply shortfalls; Price on London Metal Exchange is up more than 25% this year (Bloomberg)

- Copper can’t be mined fast enough to electrify the US (University of Michigan)

- The world faces a shortage of minerals needed for the energy transition (CNN)

- Global Critical Minerals Outlook 2024 (IEA)

- A Proposed Nevada Lithium Mine Could Destroy Critical Habitat for an Endangered Wildflower Found Nowhere Else in the World (Inside Climate News)

- Pennsylvania’s Fracking Wastewater Contains a ‘Shocking’ Amount of the Critical Clean Energy Mineral Lithium: A new study estimated there is enough lithium in the state’s wastewater to meet up to 40 percent of domestic needs. But experts are concerned the discovery will be used to justify more fracking. (Inside Climte News)

- In race to regain rare earth glory, Europe falls short on mineral goals (Mining.com)

- The Hawaii seabed mining ban doesn’t spell the end of EV batteries -- A growing U.S. recycling marketplace is taking its place. (Green Biz)

- Deep Sea Mining Is An $8 Trillion Opportunity (OilPrice.com)

- Is deep-sea mining a sound investment? New guidance from UNEP-FI warns investors about the risks of sinking funds into ocean mining activities (Economist Impact)

- Biden admin sees the US becoming a big lithium exporter. Is that possible? Lithium — a critical ingredient in rechargeable EV batteries — is mostly exported by Australia, Chile and China. (E&E News Greenwire)

- Indonesia’s massive metals build-out is felling the forest for batteries (Associated Press)

- Lithium Critical to the Energy Transition Is Coming at the Expense of Water -- A new study finds that the mining and processing of the metal critical to EV batteries and renewable energy storage projects depletes and contaminates surface water, often in already vulnerable communities. (Inside Climate News)

- As a Nevada Community Fights a Lithium Mine, a Rare Fish and Its Haven Could Be an Ace in the Hole -- The Ash Meadows Wildlife Refuge has been called the “Galapagos of the Mojave Desert,” but nearby residents fear a proposed lithium mine’s impacts on the region’s water will hurt both the wildlife and their town. (Inside Climate News)

- Nickel mining for EVs linked to higher emissions — report: Indonesia is clearing forests for mining operations and using coal to power processing facilities. (Politico Pro)

- The future of deep sea mining hinges on a contentious election -- Leticia Carvalho, a Brazilian ocean scientist, says Kiribati’s ambassador tried to bribe her to drop out of the race to run the International Seabed Authority (Mining.com)

- Deep-sea mining may be inevitable, says UN regulator (Mining.com)

- Nations gather to negotiate deep sea mining code as opposition mounts (Reuters)

- ISA hosts the first in-person meeting of international experts selected to develop environmental threshold values for deep-seabed mining (International Seabed Authority)

- Deep-Sea Mining Regulations Remain Far From Complete -- Dozens of outstanding issues expose threats to ocean life, new study finds (Pew Trusts)

- Billions in US funding boosts lithium mining, stressing water supplies: The energy transition is driving demand for batteries; funding from the Inflation Reduction Act and other federal programs is helping to fill it. (Floodlight)

- Tribe sues Interior to halt lithium exploration near Arizona spring: The lawsuit is part of a larger battle over the rush to explore for and mine lithium, a key component of EV batteries. (Politico Pro Greenwire)

- A Nevada Lithium Mine Nears Approval, Despite Threatening the Only Habitat of an Endangered Wildflower (Inside Climate News)

- Norway’s Plan for Seabed Mining Threatens Arctic Marine Life, Greenpeace Says: The search for rare minerals amid the deep ocean floor could have a devastating effect on whales, other marine mammals and numerous forms of aquatic life, according to the report. (Inside Climate News)

-

U.S. targeted ‘corrupt’ mines to help workers — but instead plunged them into economic crisis (Washington Post)

-

How a tiny town hit by Helene could upend the global semiconductor chip industry (CNBC)

-

Key wind industry metals facing supply deficits this year — BloombergNEF (Wind Power Monthly)

-

Unlocking Arkansas' Hidden Treasure: USGS Uses Machine Learning to Show Large Lithium Potential in the Smackover Formation (US Geological Survey)

-

Mining sector struggles to meet the green moment: The Biden administration is banking on a southeast Arizona mine to scrub the industry’s image amid a rush for EV battery metals. (Politico Pro Greenwire)

-

Norway stops deep-sea mining, for now (Reuters)

-

Renewables and EVs Are Driving Copper Shortages Faster Than Expected -- Experts warn immediate action is critical to secure future supplies. (Manufacturing.net)

-

Electric dreams turn into a nightmare for battery metals (Reuters)

-

A Nickel Rush Threatens Indonesia’s Last Nomadic Tribes and Its Forests, Fishermen and Farmers (Inside Climate News)

Excerpt from CBC: N.W.T. MLA says sentiment amounts to call for deregulation of mining -- ... One of the federal government's priorities as it moves to a net-zero economy is to make it easier to step up critical mineral mines like this one, which extracts rare earths. ...

Speeding up the regulatory process for critical mineral mines in the North is a goal of the federal government, according to Canada's natural resources minister.

"Critical minerals are essential for us to be able to successfully execute an energy transition," said Jonathan Wilkinson. If Canada doesn't mine more critical minerals, he said, it can't make batteries for electric vehicles needed to reduce emissions from transportation.

Rare earths, for example, are a critical mineral said to be crucial in technology like computers, LED displays, wind turbines and electric vehicles. Canada's first rare earth operation is the Nechalacho mining project in the N.W.T.

Of the 31 minerals deemed critical by the federal government, 23 can be found in the N.W.T. and 25 are in the Yukon.

"We have to find ways to expedite [these projects] in a manner that's consistent with environmental sustainability," said Wilkinson. He also said getting such projects down to zero emissions or close to zero emissions is important, and suggested biomass, biofuels or synthetic fuels as an option for mines that can't connect to hydroelectric power.

But Kevin O'Reilly, the MLA for Frame Lake in the N.W.T., believes the federal government is suggesting to deregulate critical mineral mines. He said it's not environmental regulations that keep mines from opening.

...

O'Reilly said if the federal and territorial governments want to speed up the review process, it should settle outstanding Indigenous land claims of the Dehcho and Akaitcho regions. READ MORE

Excerpt from Washington Post: The difficulty electric carmakers face building supply chains free of human rights and environmental violations came into focus earlier this year, when U.S. investigators completed their probe of a massive mining tragedy in Brazil.

Before 270 people were killed in a collapse of a dam holding iron ore mining waste — most of them buried alive in a deluge of toxic sludge — the metals company Vale provided audits and certifications to assure clients and investors of its commitment to safety and environmental stewardship. The lawsuit the Securities and Exchange Commission filed in April charges that the paper record was fraudulent, with Vale manipulating audit reports and suppressing crucial safety findings ahead of the 2019 catastrophe.

The SEC’s federal lawsuit was a wake-up call for an auto industry straining to source massive amounts of new metals in a manner consistent with the green branding of electric vehicles.

...

“People care where these things are coming from,” said Aimee Boulanger, executive director of the Initiative for Responsible Mining Assurance, a nonprofit that tracks the sustainability of extraction operations around the world. “It is hypocritical to say we are here with these electric vehicles to solve our climate problems if, in making them, we contaminate a community’s drinking water or dry up the irrigation wells they rely on.” READ MORE

Excerpt from E&E News Greenwire: A key ingredient in the modern EV battery, graphite is used in making rechargeable cells. But it hasn’t been mined in this country for decades. There’s also synthetic graphite — often made with coking coal — but little production exists today in the United States.

Like with so many parts of the battery supply chain, China dominates in production of both kinds of graphite — a source Biden and a bipartisan contingent of lawmakers in Congress have stridently turned against.

...

To get around this, the Biden administration may now have to help prop up a domestic graphite mining and refining industry in the United States, while fostering the sector’s growth abroad.

China’s control of the graphite market has started to weigh on the minds of people like John DeMaio, CEO of Graphex Technologies, a company building a graphite anode manufacturing plant in Michigan.

“What would happen if the Chinese supply was cut off?” DeMaio said. “There will be less risky places … but you’re not going to transition the entire graphite supply chain overnight.”

Only two places in the United States hold any potential in the near-term for new graphite mining, according to federal data: a river ecosystem in Alabama rich with rare species, and an untouched swath of tundra off the coast of central Alaska. Other countries have plenty of graphite in the ground — like Canada — but they’re not digging anywhere enough of it yet to fully supply the rapidly growing EV market.

To address the problem, Biden has used the Defense Production Act to liberate millions of dollars for potential exploration for graphite and other minerals critical to the energy transition (Climatewire, April 19). The bipartisan infrastructure law provided funds for building mineral refineries and manufacturing plants, a pot of money he used last month to fund the construction of two synthetic graphite plants in the United States, as well as the expansion of a graphite refinery in Louisiana (Energywire, Oct. 20). READ MORE

Excerpt from Politico: Beneath the northeastern Minnesota woods lie massive deposits of copper, nickel and cobalt that the Twin Metals company wants to mine. Mining those critical minerals would help the clean energy industry grow to meet the Biden administration’s climate change goals. But the administration has rejected plans to build the mine because of risks to the environmentally sensitive site – a decision that has drawn charges of hypocrisy from Republicans. POLITICO’s Catherine Morehouse breaks down the politics behind the stalled Minnesota mining project. Plus, the Biden administration has approved an oil export terminal in the Gulf of Mexico over some local environmental and public health concerns.

Josh Siegel is an energy reporter for POLITICO.

Catherine Morehouse is an energy reporter for POLITICO.

Nirmal Mulaikal is a POLITICO audio host-producer.

Raghu Manavalan is a senior editor for POLITICO audio.

Jenny Ament is the executive producer of POLITICO’s audio department. LISTEN

Excerpt from Politico's Power Switch: In 2021, the country imported more than 25 percent of its lithium, 48 percent of its nickel, 76 percent of its cobalt, and all its graphite and manganese, Atlas Public Policy found.

Sourcing these minerals inside the country also comes with a host of environmental justice concerns. Deposits of the vast majority of all five critical minerals are located within 35 miles of Indigenous reservations.

While mining safety requirements have improved in recent decades, mining can still cause environmental degradation and disruption to cultural sites. READ MORE

Excerpt from Politico: According to the European Commission, demand for these elements is expected to increase more than fivefold by 2030, as they are needed for building digital and green technologies.

Given current permitting processes, it could take between 10 and 15 years for operations begin at the Kiruna mine, where the deposits were found, said Moström.

He called on Brussels to speed up and streamline those processes as part of its Critical Raw Materials Act, which is slated to be announced on March 14. READ MORE

Excerpt from E&E News: The Biden administration on Friday offered its first loan commitment for a lithium processing plant, backing a facility in southwest Nevada that would provide the highly sought mineral needed for EV batteries but that some environmentalists contend will further threaten an endangered flower.

The Department of Energy revealed in a release that the agency’s Loan Programs Office has offered a conditional commitment of up to $700 million for a proposed lithium carbonate processing plant that has just started undergoing a federal environmental review. If built, the proposed plant and associated mine at the site would provide enough lithium for almost 400,000 electric vehicles each year.

The administration’s financial backing of the project is part of its larger push to boost domestic supply chains for battery minerals and electric vehicles, with federal agencies looking at the steps needed to ramp up electrification and slash emissions from the nation’s transportation sector. According to DOE, lithium demand is expected to surpass global production by 2023.

...

A major point of contention is Ioneer Rhyolite Ridge LLC’s plan to build the project close to only known habitat for the Tiehm’s buckwheat, a yellow-tinged wildflower that the Fish and Wildlife Service recently listed as endangered (Greenwire, Dec. 14, 2022). The agency’s decision means the low-growing perennial herb will be protected under the Endangered Species Act and surrounded by a designated critical habitat of 910 acres.

...

Once the lithium is developed, Rhyolite Ridge has executed offtake agreements with Ford; Prime Planet Energy & Solutions, a joint venture battery company between Toyota Motor Corp. and Panasonic Corp.; and EcoPro Innovation, a major cathode supplier for global battery manufacturers. Those contracts range from three to five years. READ MORE

Excerpt from Transport Energy Solutions/Visual Capitalist: Lithium is often dubbed as “white gold” for electric vehicles.

The lightweight metal plays a key role in the cathodes of all types of lithium-ion batteries that power EVs. Accordingly, the recent rise in EV adoption has sent lithium production to new highs.

The above infographic charts more than 25 years of lithium production by country from 1995 to 2021, based on data from BP’s Statistical Review of World Energy.

...

As the world produces more batteries and EVs, the demand for lithium is projected to reach 1.5 million tonnes of lithium carbonate equivalent (LCE) by 2025 and over 3 million tonnes by 2030.

For context, the world produced 540,000 tonnes of LCE in 2021. Based on the above demand projections, production needs to triple by 2025 and increase nearly six-fold by 2030.

Although supply has been on an exponential growth trajectory, it can take anywhere from six to more than 15 years for new lithium projects to come online. As a result, the lithium market is projected to be in a deficit for the next few years. READ MORE

Excerpt from The Guardian: By 2050 electric vehicles could require huge amounts of lithium for their batteries, causing damaging expansions of mining -- The US’s transition to electric vehicles could require three times as much lithium as is currently produced for the entire global market, causing needless water shortages, Indigenous land grabs, and ecosystem destruction inside and outside its borders, new research finds.

It warns that unless the US’s dependence on cars in towns and cities falls drastically, the transition to lithium battery-powered electric vehicles by 2050 will deepen global environmental and social inequalities linked to mining – and may even jeopardize the 1.5C global heating target.

But ambitious policies investing in mass transit, walkable towns and cities, and robust battery recycling in the US would slash the amount of extra lithium required in 2050 by more than 90%. READ MORE

Excerpt from Star Tribune: The Biden administration moved Thursday to protect northeastern Minnesota's pristine Boundary Waters Canoe Area Wilderness from future mining, dealing a potentially fatal blow to a copper-nickel project.

Interior Secretary Deb Haaland signed an order closing over 350 square miles (900 square kilometers) of the Superior National Forest, in the Rainy River Watershed around the town of Ely, to mineral and geothermal leasing for 20 years, the longest period the department can sequester the land without congressional approval.

The order is "subject to existing valid rights," but the Biden administration contends that Twin Metals Minnesota lost its rights last year, when the department rescinded a Trump administration decision to reinstate federal mineral rights leases that were critical to the project. Twin Metals, which is owned by the Chilean mining giant Antofagasta, filed suit in August to try to reclaim those rights. READ MORE

Excerpt from Washington Post: According to the International Energy Agency, the average electric car requires six times the mineral inputs of a conventional gas-powered car; an offshore wind-turbine, meanwhile, requires nine times the mineral inputs of a typical gas-fired power plant.

So, will we run out?

There is no doubt that clean energy — that is, solar, wind, geothermal, nuclear and other sources that do not produce greenhouse gas emissions — requires more mineral inputs than power plants run on fossil fuels. The IEA estimates that if the world builds enough renewable energy to meet the goals established in the 2015 Paris Agreement, mineral demand will double or quadruple in the next 20 years. Countries will need copper for power and transmission lines, lithium for batteries, silicon for solar panels and zinc for wind turbines.

...

Abigail Wulf, vice president of critical minerals for Securing America’s Future Energy (SAFE), a D.C.-based energy think tank, says that when minerals become valuable enough, people get motivated.

“It all has to do with economics,” she said. “If people get super desperate for these minerals, they will find very creative ways to find them.”

...

According to the study (released recently by scientists at the University of California at Irvine and MIT), the materials required for the transition to low-carbon electricity would take up somewhere between 1 and 9 percent of the remaining carbon budget: a significant amount but one that wouldn’t undercutoverall climate goals.

...

The larger problem may be not whether the world as a whole has enough critical minerals — but whether they are available quickly enough and in the right places. Minerals are not distributed equally around the globe — for example, much of the cobalt mined right now is from the Democratic Republic of Congo, most of the rare earths are mined in China, and much of the lithium is mined in Australia. China also dominates the world’s processing of critical minerals: 80 percent of rare earth metals, over 60 percent of cobalt and over 50 percent of lithium are processed there.According to a recent analysis by the USGS, the United States relies on imports for almost 50 percent of the minerals it consumes. READ MORE

Excerpt from Energy Minute/Transport Energy Strategies: Critical minerals play a vital role in maintaining a country’s economic and national security. It is important for nations to secure access to these resources while also considering the environmental and social impacts of mining and extraction.

Background: Critical minerals are a group of minerals that are essential for the production of high-tech products, such as smartphones, wind turbines, electric vehicles, and defense equipment. These minerals include rare earth elements, cobalt, lithium, and others.

In today’s world, where geopolitical tensions are on the rise, the importance of critical minerals has become more evident than ever. These minerals play a crucial role in maintaining a country’s economic and national security. For example, rare earth elements are used in the production of high-tech weapons systems, such as guided missiles and radar systems. Similarly, lithium is used in the production of batteries for electric vehicles and other energy storage systems.

The dependence on critical minerals has led to an increased competition among nations to secure access to these resources. Some countries, such as China, have a near-monopoly on the production of certain critical minerals, which has led to concerns about supply chain disruptions and increased prices. This has prompted many countries to invest in their own domestic production of critical minerals, as well as to diversify their sources of supply.

In addition to ensuring access to critical minerals, it is also important to consider the environmental and social impacts of mining and extracting these resources. Many critical minerals are mined in countries with weak regulatory frameworks, which can lead to negative impacts on local communities and the environment. READ MORE

Excerpt from Wall Street Journal: Replacing all gasoline-powered cars with electric vehicles won’t be enough to prevent the world from overheating. So people will have to give up their cars. That’s the alarming conclusion of a new report from the University of California, Davis and “a network of academics and policy experts” called the Climate and Community Project.

...

Problem No. 1: Electric-vehicle batteries require loads of minerals such as lithium, cobalt and nickel, which must be extracted from the ground like fossil fuels. “If today’s demand for EVs is projected to 2050, the lithium requirements of the US EV market alone would require triple the amount of lithium currently produced for the entire global market,” the report notes.

Unlike fossil fuels, these minerals are mostly found in undeveloped areas that have abundant natural fauna and are often inhabited by indigenous people. “Large-scale mining entails social and environmental harm, in many cases irreversibly damaging landscapes without the consent of affected communities,” the report says. Mining can be done safely, but in poor countries it often isn’t.

Problem No. 2: Mining requires huge amounts of energy and water, and the process of refining minerals requires even more. According to the report, mining accounts for 4% to 7% of global greenhouse-gas emissions. Auto makers have made a priority of manufacturing electric pick-up trucks and SUVs because drivers like them, but they require much bigger batteries and more minerals.

More mining to make more EVs will increase CO2 emissions. It will also destroy tropical forests and deserts that currently suck CO2 out of the atmosphere, the report says. READ MORE

Excerpt from Business Insider India: Cobalt is the new blood diamond.

It's highly valuable and dangerous to extract. The Democratic Republic of Congo is responsible for about 70% of the world's supply of Cobalt.

As the world transitions to renewable energies to fight climate change, the demand — and the price — for cobalt, a crucial ingredient used to make lithium batteries, has skyrocketed.

But even as the cost increases, the working conditions of the people mining it can be brutal, and the pay is almost nothing — The Guardian found in an investigation that workers were getting paid about 35 cents an hour.

Here's the reality of where cobalt comes from and how it is mined. READ MORE

Excerpt from E&E News: The Biden administration’s climate change agenda has spurred an unprecedented lobbying boom driven by mineral and battery companies in search of incentives for expanding North American operations.

More than 30 of those companies retained lobbying firms for the first time since President Joe Biden took office in 2021, an E&E News analysis of disclosure records found, while many others boosted their lobbying might or greatly increased spending.

The National Mining Association, which had reduced its spending amid the coal downturn, more than doubled its federal lobbying expenditures from 2020 to 2022, when it reached $2.2 million.

...

Critical minerals, battery and other clean-tech companies have already scored major policy wins during the Biden administration and are now working to secure their vision of how the infrastructure law, the Inflation Reduction Act and other initiatives are implemented.

The Inflation Reduction Act, passed by Democrats under budget reconciliation, includes tax incentives for electric vehicles, but with certain sourcing mandates championed by Senate Energy and Natural Resources Chair Joe Manchin (D-W.Va.) to increase domestic production of minerals and other components.

The Treasury Department last month released long-awaited guidance on how to implement those requirements. It’s a document lawmakers, automakers and miners have been eager to shape.

Biden has also invoked a Cold War-era law to boost critical minerals. The Inflation Reduction Act, or IRA, appropriates up to $500 million under the Defense Production Act to help U.S. and Canadian companies strengthen mineral supply chains.

...

Critical mineral and battery companies have long been lobbying the federal government and were keen on former President Donald Trump’s support for mining.

...

Among the companies that have retained lobbyists since 2021 are Piedmont Lithium Inc., which is hoping to mine lithium in North Carolina. It retained Venn Strategies in 2021 to lobby on matters surrounding mining, processing and manufacturing of lithium, and has paid $360,000.

“Venn Strategies has been very helpful as we develop our projects, given their strategic importance in boosting the domestic production of critical battery materials, and as we move through the grant selection and loan application processes with the U.S. Department of Energy,” said Malissa Gordon, Piedmont’s vice president of government relations.

...

ElementUS Minerals retained the firm Brownstein Hyatt Farber Schreck last year and has paid it $80,000. The company plans to extract and recycle minerals like rare earths, iron and titanium.

Graphite One, a Vancouver, Canada-based company exploring a graphite mining and processing site in Alaska, retained Capitol Hill Consulting Group’s Kristina Wilcox, a former Capitol Hill aide, in 2021 and has paid the firm $210,000.

US Strategic Metals, formerly Missouri Cobalt, hired Akin Gump Strauss Hauer & Feld last year, and former Rep. Filemon Vela (D-Texas) is part of the team representing the company. US Strategic Metals has paid the firm $120,000.

The lobbying effort is reaching beyond the United States, to include controversial efforts to mine the ocean floor for mineral-rich nodules. Vancouver-based Metals Co., which is hoping to secure permission to mine a swath of the Pacific Ocean seabed, hired Bracewell LLP.

Scott Segal, a partner at Bracewell, said there’s no question that the critical mineral supply chains are turnkey for the clean energy transition and EV battery production will stall without the necessary minerals.

Environmentalists, who oppose deep-sea mining, have expressed alarm with the rush to mine for clean tech and have called for new rules to protect the environment, secure community consent and make sure taxpayers get their due. But the prospects of mining reform in Congress are dim, with Republicans controlling the House and many Democrats on board with more domestic production. READ MORE

Excerpt from Wall Street Journal: California made a stunning decision last year—that by 2035 all new cars sold in the state must have at least 2½ times as much copper as conventional cars today. That’s not literally what the mandate said, of course, but it’s the practical effect of ordering all cars to be electric in the next 12 years. “Big Shovel” will compete with “Big Oil” as mining ramps up to supply the vast increase in a wide range of minerals that energy transition requires. But getting everything that will be needed will be tough.

The drive toward energy transition will increase demand for lithium, cobalt and other minerals many times over. An offshore wind project uses nine times the minerals of a natural-gas-fired power plant of the same generating capacity. READ MORE

The energy companies aren’t talking about mining in the traditional sense, though. Oil brine requires a different set of tools — specifically, a type of early-stage technology that has yet to be used at commercial scale called direct lithium extraction, or DLE. It’s a process that dozens of upstart miners are rushing to develop in an effort to disrupt the industry.

Several oil companies are putting their weight behind these efforts. Occidental Petroleum Corp. has said it’s exploring brine-based lithium extraction, and Imperial Oil Ltd. has a 5% stake in Canadian miner E3 Lithium Ltd., which is testing DLE technology in Canada’s oil patch.

It ultimately may be a while before any fossil-fuel company starts advancing lithium production at commercial scale. First, they’ll have to convince shareholders it’s a worthy investment. E3 Lithium CEO Chris Doornbos said he expects the oil majors to keep any development work outsourced to junior firms until one of them figures out a successful model.

“You’ll see more oil and gas companies in lithium, but they’re waiting for guys like us to prove the technology,” Doornbos said. READ MORE

Excerpt from E&E News Greenwire: The Biden administration wants minerals needed to build out electric vehicles and green the grid. Mineral-rich African countries could be where it finds them.

White House officials hope to put down payments on projects that help shore up lagging supply chains in the United States, while at the same time showing that this country is serious about supporting a continent that holds a third of the world’s critical minerals and has for a decade been the recipient of Chinese investment.

That effort will test the Biden administration’s commitment to meaningful investments that don’t just benefit governments and private industry. Top Biden officials often downplay the idea of taking aim at China, which dominates global mineral supply chains that often start in mines in African countries such as the Democratic Republic of Congo. And yet any U.S. investment will compete with China’s Belt and Road Initiative, which has built out infrastructure in Africa and other developing regions.

Instead, officials say, the goal is to secure, open up and diversify markets crucial to U.S. and global climate goals while forging deals that enrich African countries — all while meeting high labor and environmental standards that critics have long complained are absent from Chinese deals.

“That is what the United States is offering our African partners,” said Amos Hochstein, President Joe Biden’s coordinator for global infrastructure and energy security. “A partnership that invests not only in African critical minerals, but invests in African communities.”

Right now, the administration is mulling key investments, such as helping build a railroad that will cross the continent and showing political support for a nickel processing plant in Tanzania. This is part of a larger diplomatic strategy that’s generated scores of new deals worth upward of $6 billion focused on energy, food security, infrastructure and digital connectivity as Africa faces the brunt of climate change.

International experts say both climate and national security concerns are fueling the U.S. focus on Africa. China’s long-standing presence there is also obviously front of mind, they argue.

Africa has “climbed up on Washington’s foreign policy priority list after what must be seen as a decadelong period of utter neglect,” due to both climate and security considerations, said Tim Zajontz, a research fellow in the Centre for International and Comparative Politics at Stellenbosch University in South Africa.

“Besides more traditional security concerns over growing Chinese and Russian influence on the continent, Washington and other Western governments have become increasingly concerned about Chinese dominance of so-called critical value chains, of which some originate in African mines,” said Zajontz, who also lectures in global political economy at Technische Universität Dresden.

What’s more, the administration faces challenges both at home and abroad.

Republicans have repeatedly criticized the administration for not focusing enough on domestic mining as they look for the minerals necessary for the energy transition, and have called for more details around deals the White House is pursuing abroad.

At the same time, the government is pushing for deals in countries where mining has historically been associated with environmental and labor abuses instead of driving prosperity. Adding another layer of difficulty is that China has invested heavily in specific African countries, with Chinese financiers signing more than $150 billion worth of loans with African governments and state-owned enterprises, according to the Boston University Global Development Policy Center, much of it in power infrastructure, mining, roads, ports and railways.

...

Lifezone, a metals supply chain, development and technology company that has the backing of mining giant BHP, has entered into a partnership with the Tanzanian government to build a nickel processing plant and produce battery-grade nickel for electric vehicles in the United States and around the world as soon as 2026.

Those developments are landing within months of the State Department’s inking a memorandum of understanding (MOU) to help build up an EV battery supply chain in Congo and Zambia. And the Energy Department last year announced a conditional loan guarantee for a Louisiana graphite processing plant that will rely on metal mined in a region of southeastern Africa that’s been plagued by violence from an Islamist insurgency.

But Eric Olander, editor-in-chief and cofounder of the China Global South Project, said the United States needs to turn ambitious plans into concrete developments.

“What we need are wins on the board,” Olander said during a recent panel discussion in Washington hosted by the U.S. Institute of Peace. “The proof points are what people are going to judge us on, and if we only have aspirations, if the MOU doesn’t come through, or PGII doesn’t follow through, which has been our past 20, 30 years now in Africa, then no one’s going to believe us.”

...

China looms large in the global EV supply chains, processing and refining about 70 percent of the world’s cobalt, the majority of it from the Democratic Republic of Congo. China also processes about 35 percent of the world’s nickel, up to 70 percent of lithium, and nearly 90 percent of rare earth elements used around the world, according to the International Energy Agency.

China is also poised to dominate Africa’s growing lithium market, according to U.K. mining data firm Benchmark Mineral Intelligence, even as countries like Namibia and Zimbabwe move to ban exports of raw metal.

Experts caution that China’s presence in Africa is not straightforward or monolithic, but instead is concentrated in certain areas through complex arrangements. The United States needs more expertise, a nuanced approach and the resources to prove it can be a good alternative partner, they said.

Olander said China is invested heavily in countries like Guinea, Zambia and South Africa, a central hub for mining, along with Zimbabwe, which is emerging as a major player in lithium, and cobalt-rich Congo. But he said discussions and coverage of China’s role — especially on Capitol Hill — are often “distorted, borderline bad, and oftentimes just wrong.”

...

A dozen environmental groups, including Oxfam and Friends of the Earth, for example, are pushing the International Development Finance Corp. to adopt stronger environmental and social policies to protect marginalized communities, Indigenous communities and land rights holders before doling out money. The Biden administration, they say, must uphold the right of free, prior and informed consent, require more extensive financial disclosures and ensure that African communities benefit from any project receiving U.S. support.

Maria Ramos, associate director for extractive industries at Oxfam America, said the concern is that federal agencies flush with money from the Inflation Reduction Act approved last year and 2021's bipartisan infrastructure law don’t have the safeguards in place when they review project proposals and see impacts across the entire value chain.

“Our main concern is that all of this is happening in a fast-tracked and uncoordinated way,” said Ramos. “There's this urgency because it's under the banner of the climate crisis, but without necessarily having the safeguards in place.”

Pooja Jhunjhunwala, a spokesperson for the International Development Finance Corp. (DFC), said any project that receives support must meet the agency's eligibility criteria, and is evaluated to identify and mitigate possible social, environmental and economic risks using studies, a sponsor's track record, proof of equity, local support and offtake and supply contracts.

"DFC monitors all active projects for environmental and social policy compliance and development impact results and manages its credit portfolio, from the first transfer of funds after origination through disbursement until maturity," said Jhunjhunwala.

Those protections are critical in Africa.

The Business & Human Rights Resource Centre recently found scores of alleged human rights abuses in countries like Zambia and Congo directly tied to the mining sector, and recommended ways to avoid those outcomes.

Joseph Kibugu, a Nairobi-based researcher and representative for the group, said that while the continent is flush with critical minerals, many people live without basics like electricity and are not benefiting from mining projects in their own backyards.

“How do we make sure this transition does not happen on the backs of communities?” said Kibugu. “As we scale up on the continent and elsewhere, how do we make sure the transition is not just fast, but also just?”

...

Olander with the China Global South Project said it’s the “dream of the United States to make” the Lobito port in Angola the next major hub for global goods and replace the Port of Durban in South Africa, which has been shut down three times in the last year because of natural disasters and political unrest.

“Right now, there are basically three ports of exit for most of the cobalt that’s coming out, and this is going to be the focus for the U.S. government, is now to build new supply chains that get away from the port of Durban,” said Olander.

The railway would link the deepwater port of Lobito with resource-rich Zambia and southern Congo, said Zajontz with Stellenbosch University. Mining firms, he said, have long eyed the corridor as an alternative route, but the line continues to face capacity constraints and gaps between the existing railway corridor and some mines in Zambia.

The U.S. government, said Zajontz, evidently considers the planned investment as a way to secure and improve open access to one of the world’s most important mining regions. He noted that the railway, along with reaching Congo and its cobalt, would also access the central African Copper Belt, which has huge copper reserves. While trade in minerals is global, Zajontz said the push among Western countries to home-shore and de-risk supply chains could pull those materials to Europe and the United States.

But Zajontz also noted that the investment of $250 million is nowhere near enough money to finish the Lobito rail line and close remaining gaps in the system, the cost of which could surpass $1 billion. Instead, the funding can be seen as “knock-on financing” intended to lure in private investment along the corridor and improve access to important mining areas. READ MORE

Excerpt from Wall Street Journal: Located underneath a distant, swampy expanse of spruce forests and meandering rivers in Northern Ontario that is cut off from major roads, the Ring of Fire is seen by industry and government officials as one of the world’s most important untapped sources of nickel, copper and cobalt—metals essential for making the batteries that power electric vehicles.

But the precious commodities are buried under a vast ecosystem of peat bogs, known by local groups as “the breathing lands,” that hold more carbon per square foot than even the Amazon rainforest. Digging them up could trigger the release of more greenhouse gas than Canada emits in one year, turning one of the earth’s biggest carbon sinks into a major source of emissions, say climate advocates.

A debate over how, or whether, to tap in to this mother lode, located more than 700 miles Northwest of Toronto, has touched off a fight between mining companies, climate advocates, and indigenous groups as demand for cleaner energy and electric vehicles has surged worldwide.

“If I have to hop on a bulldozer myself, we’re going to start building roads to the Ring of Fire,” said Doug Ford, the leader of the province of Ontario, which recently signed deals with automakers Volkswagen and Stellantis to build battery-making factories in the province.

Opponents warn that disturbing the area could have far-reaching consequences.

...

Projects like the Ring of Fire represent a new era for the mining industry. Long considered a dirty and often unfortunate legacy of the industrial economy, mining has taken on a green sheen. Extraction is an essential component of the global movement toward electrification, analysts say.

The U.S. military is encouraging Wyloo’s Canadian subsidiary to apply for a grant program that supports a U.S. effort to build a supply chain for the materials needed to make batteries and military equipment, and loosen China’s grip on the market, according to people familiar with the discussions. The U.S. military is trying to build up a domestic supply of critical minerals to ensure the U.S. isn’t beholden to geopolitical rivals such as China and Russia. READ MORE

Excerpt from Foreign Policy: In one of the most ambitious U.S. infrastructure bids in Africa yet, the Biden administration has pledged to lend hundreds of millions of dollars toward reviving the Lobito Corridor, a 1,200 mile-long railway that would transport critical minerals from the Democratic Republic of the Congo and Zambia to the Angolan coast. The DRC is home to the world’s biggest cobalt reserves, while Zambia is rich in copper.

“The Lobito Corridor is really a play out of Beijing’s own playbook,” said Cameron Hudson, an analyst at the Center for Strategic and International Studies. “It’s a chapter in the Belt and Road Initiative that Washington has, I think, finally gotten smart to the benefits of.”

Building upon previous investments with the Belt and Road Initiative, Chinese President Xi Jinping’s flagship foreign-policy initiative, China has spent the past two decades pouring at least $170 billion dollars into building ports, railroads, and other massive infrastructure projects across Africa. Even as those investments have come under scrutiny, they have also allowed Beijing and Chinese companies to develop long-standing partnerships over critical minerals—the same resources that have, in the years since, emerged as a central geopolitical flash point.

...

“Washington has really played up this investment project, but it has yet to lay one inch of railway,” Hudson said. “We should all expect there to be a serious learning curve.”

...

“All of those initiatives are part of the U.S. strategy to build its own China-free critical minerals supply chain,” said C. Géraud Neema Byamungu, an expert in China-Africa relations at the China Global South Project.

The 122-year-old Lobito Corridor is one of the newest pillars in that strategy. While Belgium and Portugal originally built the railway more than a century ago, the infrastructure was decimated during the Angolan civil war, and in 2004, Chinese firms poured at least $2 billion into revamping the corridor. But in 2022, a U.S.-backed consortium won the rights to develop the railway, beating out Beijing’s bid.

...

Eager to ensure the project’s success, top U.S. officials have intensified their diplomacy in the region, including by signing a memorandum of understanding with Angola, the DRC, Zambia, and the European Union. Biden hosted Angolan President João Lourenço last November, while U.S. Secretary of State Antony Blinken made Angola a key stop in his Africa tour in January. And earlier this month, Amos Hochstein, Biden’s special presidential coordinator for global infrastructure and energy security, also met with Zambian President Hakainde Hichilema and Samaila Zubairu, the president and CEO of the Africa Finance Corporation, to discuss the Lobito Corridor.

...

Just one day before Hochstein hosted Hichilema and Zubairu, Beijing unveiled a proposal to invest more than $1 billion into the Tazara railway, which links Zambia and Tanzania.

The intensifying competition and entry of new players could offer African governments greater leverage in striking future deals and partnerships. Angola, for example, has been “more welcoming to U.S. and European investors in that space, wanting to balance the risk toward too much exposure to China,” said Byamungu of the China Global South Project.

But as the demand for these minerals takes off, many African nations are also eager to build out their own industries and claim a bigger stake in the global market.

“They want to be able to add value to their minerals and metals before export,” said Zainab Usman, the director of the Africa program at the Carnegie Endowment for International Peace.“They don’t want to just export unprocessed minerals and metals and replicate patterns of extraction.” READ MORE

Excerpt from Bridge Michigan: Michigan automakers transitioning to EV production need more copper than mining companies are currently producing; Deeper underground mining and advanced leaching technologies provide a possible solution; Increased mining raises environmental concerns about pollution that could affect the Great Lakes ecosystem

...

A new International Energy Forum report, co-led by a University of Michigan researcher, found that a swift transition to EVs will require “unprecedented rates of mine production.”

The world’s active copper mines, the authors concluded, can’t deliver.

The report’s findings have big implications for Michigan, the epicenter of the U.S. automotive sector and a state with a long, fraught copper-mining history.

...

But the researchers concluded that under the current policy landscape, in which it takes years, if not decades, to get a new mine approved, “it is highly unlikely that there will be sufficient additional new mines to achieve 100% EV by 2035."

...

EVs require three to five times more of the highly-conductive metal than internal-combustion vehicles.

Copper is used in EV batteries, wiring and charging stations. It helps store energy and transfer it from lithium-ion or lead-acid batteries to the electric motors. It’s on the federal list of critical minerals needed to support the EV transition.

“Without copper,” Simon (Adam Simon, a professor of earth and environment sciences at the University of Michigan and lead researcher on the report) said, “you don’t have an EV.”

Still more of the element is needed to update the electrical grid for EV charging. That means as the industry shifts to EVs, automakers will need far more of the metal.

...

Global copper demand is already rising to electrify the developing world. That alone, researchers concluded, is expected to require more copper in the next 30 years than has been mined in all of human history.

To meet that demand, annual copper mine output needs to increase 82% by 2050, from 20.4 million to 37.1 million tons per year, Simon and his co-author, Lawrence Cathles of Cornell University, concluded.

Mining companies today “will barely be able to produce enough,” Simon said.

It’s not possible to add EVs on top of that without opening new mines, which helps explain why Michigan, Minnesota and other copper-rich regions are seeing a resurgence in mining exploration.

...

Achieving a full net-zero economy could require as many as six new mines per year.

“And I can tell you, that’s not going to happen,” said Simon.

One problem is that copper deposits have to be found before companies can start mining, and discovery is increasingly difficult.

It requires land access for exploration, followed by drilling, assessment of the mineral and an economic evaluation for a company to decide whether the site is a worthy investment.

The success rate of copper mining exploration has dipped to just 1-in-5,000 today from 1-in-2,500 before 2010, the report found. And only a tiny fraction of those discoveries have the potential to become profitable mines.

After that, it takes an average of two decades for a mining company to receive a permit and start digging.

...

Look no further than Michigan’s western Upper Peninsula, where 23 million metric tons of mining wastes left behind by the Mohawk Mining Co. are smothering fish spawning grounds and tainting Lake Superior with copper and arsenic.

Now, environmental concerns are brewing over a planned new copper mine near the Porcupine Mountains.

...

Simon said there are ways to ease the pressure to open more mines.

First, he said, society needs to get better at recycling copper.

Another possible solution is mining from deeper underground. Today’s mines typically don’t go deeper than 500 meters below the surface, but Simon said mining deeper is possible, and could yield more copper output.

Advancements in technology are also making it increasingly possible to extract more copper from already-mined stockpiles that were previously treated as waste.

But even if all of those things happen, Simon said, new mines will likely still need to open. And without more government support and changing public attitudes, that probably can’t happen fast enough to meet current EV transition timelines.

That led the research team to a conclusion that may not sit well with proponents of swift EV adoption:

“Policymakers might consider changing the vehicle electrification goal from 100% EV to 100% hybrid manufacture by 2035,” they wrote. READ MORE

Excerpt from US Geological Survey: Using a combination of water testing and machine learning, a U.S. Geological Survey-led study estimated between 5 and 19 million tons of lithium reserves are located beneath southwestern Arkansas. If commercially recoverable, the amount of lithium present would meet projected 2030 world demand for lithium in car batteries nine times over.

The study’s novel methodology, carried out collaboratively by the USGS and the Arkansas Department of Energy and Environment’s Office of the State Geologist, made it possible to quantify the amount of lithium present in brines located in a geological unit known as the Smackover Formation. Extracting lithium from brines co-produced during oil and gas operations provides an opportunity to extract a valuable commodity from what would otherwise be considered a waste stream.

...

The USGS estimates there is enough lithium brought to the surface in the oil and brine waste streams in southern Arkansas to cover current estimated U.S. lithium consumption. READ MORE

Excerpt from Politico Pro: The Bureau of Land Management on Thursday approved the Rhyolite Ridge mining project in Nevada, potentially unlocking a major domestic source of lithium and boron over the objections of environmentalists concerned about its impact on an endangered flower.

The Australian mining company Ioneer says the project could quadruple the current U.S. supply of lithium and provide a secure source of boron, a mineral with key defense and industrial applications.

Ioneer last year secured a $700 million conditional loan for the project from the Energy Department. But the project has challenged the Biden administration’s efforts to strike a balance between advancing the clean energy transition and protecting biodiversity, as the region is the only place in the world where Tiehm’s buckwheat, a desert wildflower, is known to grow.

Within an hour of the decision being posted Thursday, the Center for Biological Diversity filed a notice of intent to sue under the Endangered Species Act. READ MORE

Excerpt from Reuters:

Prices of lithium, nickel and cobalt collapsed in 2023 and have continued grinding steadily lower over the course of 2024.

A sector that was once racing to build new supply has been closing mines and deferring projects as low prices bite into the cost curve.

The road to an electric future has turned out to be much bumpier than expected with demand from the all-important electric vehicle (EV) sector not living up to expectations.

...

But the positive headlines mask two unwelcome truths for the battery metals sector.

China is still the main driver of the EV revolution with Western markets struggling to build momentum.

While Chinese sales set a new monthly record in November, those in the United States and Canada were up by just 10% year-on-year in November and those in Europe were actually lower.

Western consumers still need an incentive to make the switch from internal combustion engine to electric motor. German new-energy vehicle sales have slumped this year after subsidies were abruptly removed at the end of 2023.

...

U.S. subsidies could go next year if Donald Trump makes good on his threat to roll back the Biden administration's EV policy.

The second reality check is that many EV buyers, particularly those in the critical Chinese market, are opting for hybrids or plug-in-hybrids over battery electric vehicles.

...

Lower-than-expected demand from the EV sector, particularly outside of China, has coincided with supply surges across the battery metals spectrum.

...

Such is the scale of oversupply in the cobalt market that Chinese stockpile managers have been able to scoop up significant tonnages without any obvious market impact.

Chinese lithium producers are also resisting production cuts. Many are vertically integrated, meaning losses in the ground can be offset against gains further down the processing chain.

Even allowing for the many price casualties among Western operators, lithium supply is still expected to exceed demand for the third year running in 2025, according to consultancy Benchmark Mineral Intelligence.

These have batteries about a third of the size of those used in pure battery models, meaning a similar-sized reduction in all the metallic cathode inputs.

...

Some offset for lithium demand comes from the rising market share of lithium-iron-phosphate (LFP) batteries, which accounted for two-thirds of all EV sales in China last year, according to the International Energy Agency.

LFP batteries are cheaper than nickel-rich chemistries and Chinese battery-makers have improved their performance to the point that CATL's latest Shenxing Plus model boasts a single-charge driving range of over 1,000 kilometers.

They are, however, bad news for nickel, cobalt and manganese markets.

...

The final report of the Critical Minerals Policy Group, part of a Select Committee on U.S.-Chinese relations, accused Chinese lithium producers of driving prices lower "through a mix of dumping and overproduction".

...

Joe Biden and Donald Trump may disagree on electric vehicles but there is remarkable bipartisan agreement on the need to build domestic battery metal capacity and loosen China's grip on the global supply chain.

Trump 2.0 is likely to crank up the Biden administration's combination of federal spending and tariffs on Chinese metals. READ MORE

.jpg)

Comments are closed.