(POET) Upgraded plant will create jobs, 32 million bushels of new corn demand -- POET, the world’s largest producer of biofuels, has announced it will expand POET Bioprocessing – Shelbyville, doubling the facility’s bioethanol production capacity. “This expansion reflects POET’s confidence in the

Sustainable Aviation Fuel Take-up in UK Unlikely to Hit 2025 Target, Data Suggests

by Gwyn Topham (The Guardian) Provisional figures in government mandate’s first year show 20% shortfall in levels of SAF supplied for UK flights -- Production data published by the Department for Transport (DfT) covering most of 2025 shows that sustainable fuels (SAF) only accounted for 1.6% of fuel supplied for UK flights – 20% less fuel in volume than the 2% needed to fulfil the requirement.

The government introduced the mandate in January, which requires suppliers to hit targets for SAF – which the industry has argued is important for cutting its carbon emissions – within the overall UK aviation fuel mix.

The mandatory target rises sharply from 2% in 2025 to 10% in 2030 and then to 22% in 2040, including the use of second-generation fuels that are seen as more sustainable in the long term.

So far, the supply of SAF has been exclusively produced from recycled cooking oil from Asia, predominantly China, the DfT figures showed.

The data shows that a little more than 160m litres (35m gallons) of SAF was used, out of 10bn litres of jet fuel burned in UK flying until early October.

...

Although many scientists and environmental groups remain deeply sceptical that it can be delivered, production and uptake of SAF is seen as the only way for commercial, and particularly long-haul, aviation to reduce its emissions.

...

He (aviation minister, Keir Mather) said that SAF represented the biggest opportunity, and the government’s SAF bill, which is passing through the House of Lords, “will deliver the revenue-certainty mechanism that you called for – a guaranteed price for SAF that reduces risks for investors and raises confidence for producers”. READ MORE

Related articles

Excerpt from ResourceWise: The UK government’s recent call for evidence on crop-derived sustainable aviation fuel (SAF) signals a notable shift in policy. For years, official guidance was clear that only waste-based fuels would qualify for support under the SAF mandate. This position helped the UK distance itself from one of biofuels’ most persistent controversies in the food-versus-fuel debate.

That clarity is now fading. With the Department for Transport acknowledging that waste alone may not be sufficient to meet the UK’s 10% SAF target by 2030, crop-based fuels are back on the table.

On the surface, this looks like a pragmatic move to diversify supply and strengthen energy security. In reality, it reflects a more reactive effort to stabilize a domestic ethanol industry that recent trade decisions have left exposed.

From Waste-Only Ambition to Crop Reality

The UK’s ethanol sector has largely been centered around the Vivergo and Ensus plants. However, these plants have been under severe pressure recently.

A policy decision to allow up to 1.4 billion liters per year of tariff-free US ethanol into the UK market dramatically altered the competitive landscape. Less expensive, subsidised US corn ethanol flooded the market and undercut domestic producers that were already operating on thin margins.

The consequences were swift and severe. UK bio-refineries struggled to compete, and Vivergo has already announced its closure.

Against this backdrop, the government’s openness to crop-derived SAF looks less like a strategic pivot and more like a rescue attempt.

By allowing crops into the SAF mandate, policymakers are effectively creating a new outlet for domestic ethanol via the alcohol-to-jet (ATJ) pathway. The move could offer UK producers a lifeline beyond gasoline blending, a market now dominated by imports.

A Mandate Growing More Complex by the Month

The mechanics of the shift are understandable. If domestic ethanol can be upgraded into jet fuel, it creates a new demand pull from aviation. This offers a highly desirable pathway as aviation remains a sector with far greater long-term growth potential than road fuels.

However, the policy architecture underpinning this transition is becoming increasingly convoluted. The call for evidence suggests a cap on crop-based SAF to limit food-versus-fuel risks.

While caps are not inherently problematic, the UK SAF mandate is already heavily fragmented:

- A cap on HEFA (Hydroprocessed Esters and Fatty Acids), currently the only SAF pathway supplied into the UK

- A proposed cap on crop-based SAF

- A sub-mandate for PtL (Power-to-Liquid) Fuels

For a mandate that is less than a year old, this level of complexity risks creating uncertainty for investors and project developers alike.

The Carbon Debate Returns

The government has continued to stress that any crop-based SAF must still meet greenhouse gas (GHG) reduction thresholds. In theory, converting UK feed wheat into ethanol and then into SAF via ATJ could lower aviation’s overall carbon intensity.

In practice, this is a familiar battleground.

In the US, crop-based ethanol has long faced criticism over whether it delivers meaningful carbon savings compared to fossil fuels. That same debate now looks set to re-emerge in the UK, as stakeholders scrutinize the environmental credentials of crop-derived SAF.

Lower Costs, Higher Adoption

What is far harder to dispute is the cost impact of introducing crop-based SAF.

Alcohol-to-jet is widely seen as one of the most promising pathways for lower-cost SAF production. But its economics are heavily influenced by feedstock prices. Restricting ATJ to waste-based ethanol has undermined its competitiveness because waste ethanol is both higher-value and limited in supply.

Opening the pathway to crop-based ethanol changes that equation dramatically.

ATJ SAF prices can vary widely depending on feedstock and geography. Subsidized US corn ethanol sits at the lower end of the cost curve, enabling SAF prices below $1,500 per ton. By contrast, waste-based, cellulosic ethanol can push SAF prices above $2,500 per ton.

Introducing crop-based ethanol into the mix gives ATJ a clear role as a cost-competitive option for meeting SAF mandates. This could significantly reduce the overall cost burden on airlines.

A Policy Irony Hard to Ignore

There is an undeniable irony at the heart of the UK’s evolving SAF policy. After years spent trying to move away from crop-based biofuels, the government now finds itself embracing them to protect industrial and agricultural jobs in the north of England.

While the official narrative frames this as a necessary broadening of the fuel mix, the underlying driver is clear. The UK must stabilize a domestic industry that previous policy decisions helped to destabilize.

The waste-only vision may have been politically convenient. But the realities of supply, cost, and industrial resilience have forced a rethink. Crop-based SAF is back, and it’s not because it was the preferred option. Instead, it’s because it may now be the only viable option for the UK moving forward. READ MORE

QUOTE OF THE WEEK -- Allen Schaeffer

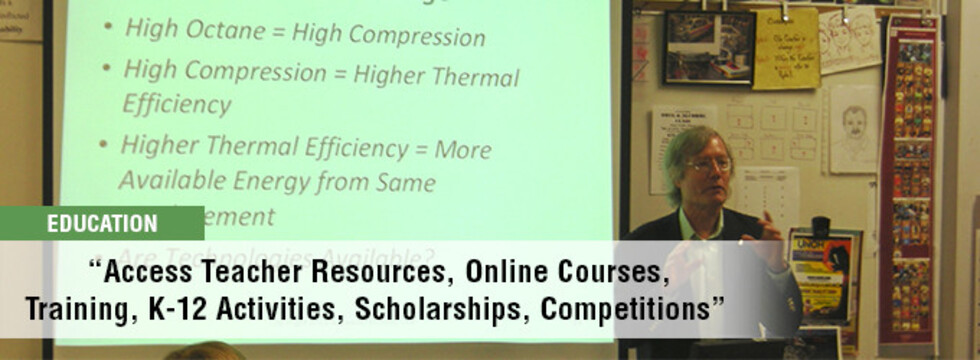

The undeniable and tremendous improvements in air quality we enjoy today are thanks in part to new engines, clean air technology, and cleaner fuels. ... Access to a growing supply of renewable fuels is a key aspect of sustainability for users and for engine technology. Engines work well using a diversity of renewable fuels; more please! -- Allen Schaeffer, Executive Director of Energy Technology Forum READ MORE

Davids, Colleagues Introduce Bipartisan Bill to Boost Sustainable Aviation, Support Farmers, Grow American Jobs

(Office of U.S. Representative Sharice Davids (D-KS-03)) U.S. Representative Sharice Davids (D-KS-03) — alongside Representatives Mike Flood (R-NE-01), Troy Carter (D-LA-02), and Tracey Mann (R-KS-01) — introduced the Securing America’s Fuels (SAF) Act, bipartisan legislation designed to strengthen the sustainable aviation fuel (SAF) industry, create economic opportunities for farmers, and reduce emissions in the transportation sector.

“Investing in sustainable aviation fuel isn’t just good for the environment — it’s good for Kansas farmers, our communities, and our economy,” said Davids. “The SAF Act ensures that clean fuel production incentives are strong and long-term so businesses, farmers, and innovators can plan for the future with confidence. The bipartisan support shows the incredible potential we have to build a healthier, stronger, and more prosperous future for generations to come.”

“America is on the cusp of the next great biofuels revolution,” said Representative Mike Flood (R-NE-01). “The Securing America’s Fuels Act is yet another way Congress can grow our bio economy and encourage innovation that creates great jobs across rural America. Sustainable aviation fuel will help lower emissions while expanding domestic markets for our nation’s farmers, ensuring that our ag economy thrives for generations to come. I want to thank Congresswoman Davids for introducing this much-needed bill and look forward to working together to advance this commonsense, bipartisan bill through Congress.”

The sustainable aviation fuel (SAF) industry currently relies on the 45Z Clean Fuel Production Tax Credit to make production economically viable. While recent legislation extended the credit for all clean fuels, it eliminated the SAF-specific bonus. To address this challenge, the SAF Act would:

- Reinstate the SAF bonus credit eliminated under the recent federal budget, allowing qualifying SAF producers to receive up to $0.35 or $1.75 per gallon.

- Extend the 45Z Clean Fuel Production Tax Credit for all clean fuels through 2033, providing long-term stability for the growing clean fuels industry.

SAF is a game-changer for local communities, agriculture, and the transportation industry. Scaling SAF to meet U.S. goals could generate 33,000 construction jobs over five years, sustain 4,500 permanent operations jobs, and support 60,000 jobs in agriculture and logistics by 2030. SAF can also reduce lifecycle greenhouse gas emissions by up to 80 percent, delivering major environmental benefits while using existing aviation infrastructure.

"Without coordinated action between government and industry, greenhouse gas emissions will continue to increase as more people and goods fly through our skies,” said Representative Troy Carter (D-LA-02). “Sustainable aviation fuel is an exciting, new green fuel that’s creating jobs in Louisiana and driving demand for American agricultural products. I’m proud to introduce this bipartisan legislation to ensure America is on track to meet the growing demand for cleaner transportation and healthier communities.”

“Sustainable aviation fuel is a worthwhile investment for American agriculture and for American energy dominance,” said Representative Tracey Mann (R-KS-01). “The Securing America’s Fuels Act gives Kansas farmers the certainty they need to plan, invest, and keep supplying fuel to the country and our aviation sector. I will always support legislation that supports rural communities and helps the United States continue to lead the world in producing the fuels of tomorrow.”

Davids co-chairs the Congressional Sustainable Aviation Caucus (CSAC), which works to reduce the aviation industry’s environmental impact and maximize its financial sustainability. By leveraging federal policy, holding forums, and bringing together public and private partners, the caucus plays a key role in the integration of new technologies into the nation’s aviation network.

The bipartisan legislation is endorsed by major industry and agricultural groups, including National Corn Growers Association, SAF Coalition, Airlines for America, Kansas Farm Bureau, Renew Kansas, Kansas Corn, Kansas Soybean Association, Greater New Orleans Inc., Nebraska Corn Growers Association, Nebraska Soybean Association, Nebraska Farm Bureau, Twelve, Darling Ingredients, Louisiana Farm Bureau Foundation, Advanced Biofuels Association, Global Business Travel Association, and American Sugarcane League.

“The SAF Coalition applauds Reps. Sharice Davids and Mike Flood for their leadership in introducing The Securing America’s Fuels Act,” said Alison Graab, Executive Director, Sustainable Aviation Fuel (SAF) Coalition. “This legislation continues the broad, bipartisan support for SAF in Congress and recognizes SAF’s unique ability to fuel America’s energy dominance while supporting American farmers. The SAF Coalition urges Congress to pass this legislation so we can grow America’s rural economies, create new markets for our farmers and secure a stronger energy future for our nation.”

“Agriculture and aviation are crucial to Kansas’ economy and Kansas Farm Bureau appreciates Rep. Sharice Davids’ leadership in introducing the Securing America’s Fuels Act alongside Rep. Tracey Mann. Incentivizing the use of domestic crops to produce sustainable fuels creates a new market for Kansas farmers while lowering the carbon emissions of the aviation industry,” said Joe Newland, President, Kansas Farm Bureau.

"The development of Sustainable Aviation Fuel (SAF) holds great promise for Nebraska biofuels producers as well as Nebraska's farmers and ranchers,” said Mark McHargue, President, Nebraska Farm Bureau Federation. “We appreciate the leadership of Nebraska Congressman Mike Flood in offering this legislation that provides incentives that will help get this emerging industry off the ground. Nebraska Farm Bureau stands ready to work to get this legislation approved and help Nebraska become the SAF epicenter of the country."

“It is crucial that Congress finds ways to support farmers with good domestic policy, at this time when international trade negotiations have left farmers in difficult market conditions,” said Richard Fotenot, President, Louisiana Farm Bureau. “Congressional policy changes can also provide relief to American consumers. The SAF Act does both. It creates consistency in domestic aviation fuel markets in a sustainable manner important to consumers. We are grateful to Congressman Carter and his colleagues for continuing to find ways to support these efforts through ideas like the SAF Act.”

“SAF may offer a great opportunity for sugarcane farmers,” said Jack Pettus, VP of Government Relations, American Sugar Cane League. “Our mills use bagasse, the fibrous byproduct of recovering sugar from the sugarcane plant, to power their operations during harvest season. Our farmers have been growing and delivering this renewable fuel for over a century and we are anxious to find new uses for the excess biofuel (bagasse) that we currently produce. The American Sugar Cane League appreciates this bipartisan effort to identify and encourage demand for domestic renewable energy feedstocks in markets like aviation fuels.”

“The Advanced Biofuels Association strongly supports this bipartisan effort to strengthen sustainable aviation fuel (SAF) producers and improve the overall availability of renewable fuels for America’s airline industry,” said Michael McAdams, President, Advanced Biofuels Association. “This type of legislation is essential in the United States’ effort to achieve its energy dominance policy agenda.”

“Delta applauds Reps. Flood, Davids, Mann, and Carter for their leadership in introducing the Securing America's Fuels Act, which will ensure 45Z reaches its full potential and provides the critical investment certainty necessary to bring additional SAF production facilities online to meet our industry's unprecedented demand for cost-competitive, homegrown fuels," said Cherie Wilson, Vice President, Government Affairs - Sustainability, Delta Air Lines.

“U.S. airlines are grateful to Representatives Flood, Davids, Carter, and Mann for introducing legislation that would restore and extend the full 45Z tax credit,” said Airlines for America. “This will stimulate private sector investment in SAF while also bolstering American energy dominance. This credit is a win-win for both the aviation and agriculture industries, supporting U.S. job growth across the country.”

“The Clean Fuel Production Credit is an extremely valuable economic support policy for the rural economy, and we are pleased to see Kansas taking the lead in extending and expanding it,” said Kaleb Little, Kansas Soybean Association CEO. “We thank Representative Davids and Representative Mann for co-sponsoring this bi-partisan legislation. Biomass-based diesel production supports approximately 10 percent of the value of every bushel of soybeans grown in the United States, or an additional $149 million for Kansas farmers in 2024. Farmers and fuel producers have made tremendous investments to build a biodiesel, renewable diesel and sustainable aviation fuel industry that can help meet America’s energy needs.” READ MORE

Related articles

- NATA Welcomes Legislation to Restore SAF Tax Credit Value (National Air Transportation Association)

- U.S. SAF tax credit gets new life in bipartisan House legislation (The Air Current)

- GBTA Urges Support for “Securing America’s Fuels (SAF) Act” Among U.S. Policymakers (Global Business Travel Association)

- SAF Coalition Applauds the Introduction of Securing America’s Fuels (SAF) Act in U.S. House of Representatives (SAF Coalition)

- NBAA Welcomes Bipartisan Bill to Restore and Extend SAF Tax Credit (National Business Aviation Association)

- SAF Act aims to extend 45Z credit, reinstate SAF premium (Ethanol Producer Magazine)

Excerpt from Global Business Travel Association: GBTA applauds today’s introduction of the “Securing America’s Fuels (SAF) Act” in the U.S. House of Representatives which would restore the full value of the credit for Sustainable Aviation Fuel and extends related 45Z tax credits through 2033.

GBTA, as well as the SAF Coalition, sent letters to key U.S. policymakers urging swift, bipartisan passage of the bill which will improve economic growth, provide business certainty for SAF producers and airlines, and lower costs for consumers and businesses travelers over time.

In brief, the 45Z Clean Fuel Production Tax Credit currently allows SAF bonus credits of up to $1.75 per gallon if prevailing standards are met. However, in July 2025 the SAF bonus credit was eliminated beginning in 2026, reducing the maximum incentive and undermining the economics of new SAF projects.

“Reliable, affordable, and sustainable air travel is essential to our members’ operations, and the future growth of the U.S. economy. GBTA strongly supports the passage of the SAF Act and encourages the House to include complementary measures that streamline SAF certification, improve supply chain logistics, advance research and demonstration programs that lower costs, and accelerate deployment at airports nationwide,” said GBTA CEO Suzanne Neufang.

Read the full GBTA letter here. READ MORE

Excerpt from National Business Aviation Association: “NBAA thanks Reps. Flood and Davids for introducing this measure and understanding SAF’s economic and sustainability benefits,” said NBAA President and CEO Ed Bolen. “Restoring the full credit provides the clarity and stability needed to unlock investment, expand supply and accelerate progress toward our industry’s long-term environmental commitments.”

SAF is a drop-in jet fuel produced from bio-based feedstocks and can reduce lifecycle greenhouse gas emissions by up to 80% over legacy fuels. The fuel is central to business aviation’s commitment to achieve net-zero carbon emissions by 2050. READ MORE

Excerpt from Ethanol Producer Magazine: The original 45Z tax credit, as established by the Inflation Reduction Act of 2022, provided a tax credit for the production and sale of low-emission transformation fuels. The credit started at 20 cents per gallon for non-aviation fuels and 35 cents per gallon for sustainable aviation fuel (SAF). For facilities that satisfy the prevailing wage and apprenticeship requirements, the value of the tax credit was up to $1 per gallon for non-aviation fuels and $1.75 per gallon for SAF. Under the IRA, the 45Z credit was available for 2025, 2026 and 2027.

President Trump on July 4 signed the One Big Beautiful Bill Act, a budget reconciliation package that extended the 45Z credit through the end of 2029, altered the credit by limiting eligibility to fuels derived from feedstocks produced or grown in the U.S., Canada or Mexico, and eliminated the “special rate” for SAF. The elimination of the “special rate” effectively caps the value of the SAF credit at $1 per gallon starting in 2026.

...

The SAF Act is not the only legislation introduced in recent months to reinstate 45Z's special rate for SAF. In October, Rep. Mike Thompson, D-Calif., introduced a bill that aims to reinstate many of the renewable energy tax credits eliminated by the OBBBA. One provision of that bill aims to reinstate the 45Z credit premium for SAF. READ MORE

SAF 101: The Fundamentals

Daniel Bloch of LanzaJet, will break down the fundamentals of SAF: what it is, how it’s produced, and why it matters for aviation’s climate goals. This exceptional program offers the basics needed to understand the feedstocks and certified pathways at

January 08, 2026 Read Full Article

Biofuels 2026: Policy, Progress, and the Road Ahead --- February 4, 2026 --- ONLINE

As we move into a new year, the landscape for biofuels continues to evolve at both the state and federal level. What lessons can we take from recent policy victories and challenges? More importantly, what’s on the horizon for 2026? Please

January 08, 2026 Read Full Article

China Gas Holdings Limited Officially Launched Its B100 Biodiesel Fuel Supply Service in Hong Kong

(Chimbusco Pan Nation) The fuel oil barge "Guosi" has been technically upgraded to become Hong Kong's first Category II certified fuel oil barge specifically for providing B100 biodiesel. China Gas Holdings Limited today announced the official launch of its B100 biodiesel fuel service in

January 08, 2026 Read Full Article

The Digest’s 2026 Multi-Slide Guide to Ukrainian Regenerative Bioeconomy Ecosystem

by Jim Lane (Biofuels Digest) The Ukrainian Regenerative Bioeconomy Ecosystem (URBE) framework addresses the $100 billion in losses and 7.5 million hectares of damaged land in Ukraine. Leveraging Ukraine’s 40% share of Europe’s fertile soils, the initiative integrates science and finance

January 08, 2026 Read Full Article

China Launches Committee to Steer Green Shipping Shift

by Jim Kendrick (Biofuels Digest) In China, Xinde Marine News reports China’s top shipowners and policymakers gathered on January 5 to launch the New Energy and Environment Committee, a high-level alliance set to orchestrate the country’s push for low-carbon shipping. With

January 08, 2026 Read Full Article

MFM Requirement Takes Effect in Rotterdam and Antwerp-Burges

(Manifold Times) Use of a Mass Flow Meter system on board bunker vessels became mandatory for the delivery of residual distillates and biofuels in the ports of Rotterdam and Antwerp-Bruges, from 1 January 2026. -- The use of a Mass Flow Meter

January 08, 2026 Read Full Article

PetroChina Fuel Oil Subsidiary Secures Zhoushan’s First Methanol Bunkering Licence

(Manifold Times) Zhejiang Free Trade Zone PetroChina Fuel Oil is currently in talks with shipping and shipbuilding companies to secure its first methanol bunkering operation. The Zhoushan area of China (Zhejiang) Pilot Free Trade Zone has granted its first license for methanol

January 08, 2026 Read Full Article

The Korea Materials Research Institute Has Developed Korea's First Highly Corrosion- and Wear-Resistant Carbon Coating Technology for Ammonia-Powered Vessels.

(The Korea Institute of Materials Science (KIMS) Google translation) Overcoming the limitations of rapid corrosion and wear of metal! --Overcoming the fatal limitation of ammonia that causes rapid corrosion and wear of metals Development of next-generation, highly corrosion- and wear-resistant carbon coating

January 08, 2026 Read Full Article

Texan Facility Produces Its First Ammonia

by Nadja Skopljak (Offshore Energy) The Beaumont New Ammonia (BNA) facility, located in southeast Texas, U.S., has produced its first ammonia following the completion of systems testing, representing the first phase of operations commissioning of the facility. Commercial production is expected to

January 08, 2026 Read Full Article

Clean Fuels Asks EPA to Maintain RFS Compliance Deadline

(Cl;ean Fuels Alliance America) Today, Clean Fuels Alliance America sent a letter to EPA Administrator Lee Zeldin, asking the agency to maintain the 2025 Renewable Fuel Standard compliance deadline on March 31, 2026, to mitigate the impacts of rulemaking delays. Under

January 08, 2026 Read Full Article

Green Groups Slam Trump’s ‘Retrograde’ Fuel-Economy Plan for Cars

by Mike Lee (Politico Pro Climatewire) The criticism comes as the administration moves toward finalizing CAFE standards that would make vehicles less efficient in 2031 than they are today. -- Environmentalists took aim at one of the Trump administration’s central arguments for

January 08, 2026 Read Full Article

India Energy Week 2026 --- January 27-30, 2026 --- Ongc Ati, Goa, India

Now in its 4th edition, India Energy Week will take place from 27 – 30 January 2026 in Goa, under the patronage of India’s Ministry of Petroleum and Natural Gas, and jointly organised by the Federation of Indian Petroleum Industry

January 08, 2026 Read Full Article

Toyota’s Next Engine Could Make Tuners Forget about The Legendary 2JZ

by Chris Chilton (Car Scoops) ... While Toyota has kept many of the tech details of its new ICE powertrains to itself till now, it has confirmed that they’ll be compatible with carbon-neutral fuels, meaning they could live on even after countries or

January 08, 2026 Read Full Article

Austria’s Fuel Stations Diversify as EV Charging and Biofuels Surge

(Mobility Plaza) Austria ended 2024 with 2,724 publicly accessible fuel stations, according to data from the country’s energy and fuel industry association (FVEK). While the overall number of sites fell slightly, the range of services and alternative fuels expanded significantly. The network

January 07, 2026 Read Full Article

Corteva and bp Launch Biofuel feedstock Joint Venture Etlas™

(bp) Partnership will leverage Corteva technology and bp integrated downstream capabilities to produce and deliver biofuel feedstocks to global markets; Ignacio Conti to be CEO, Gaurav Sonar to be Chair of the Board of Directors Corteva Inc. (NYSE: CTVA) and bp (NYSE: BP,

January 07, 2026 Read Full Article

Scientists Explore Turning Tobacco into Sustainable Biofuel

by Daniela Castillo Monagas (World Bio Market Insights) Researchers at Henan Agricultural University are exploring a new use for tobacco plants, aiming to produce bioethanol instead of cigarettes. The study, led by scientists at the National Tobacco Cultivation, Physiology and Biochemistry

January 07, 2026 Read Full Article

29th Annual Distillers Technology Symposium --- April 13-15, 2026 --- Indianapolis, IN

The symposium will provide the latest information on trade policy changes, economic outlook, research initiatives, proper mycotoxin determination, lab proficiency testing updates, corn genetics, composition & quality, distillers co-products animal feeding updates, issues on distillers grains marketing/merchandising, animal nutrition, processing

January 07, 2026 Read Full Article

Life Cycle Assessment Finds Significant Emissions Savings Potential across the Onboard Carbon Capture Value Chain

(Global Center for Marine Decarbonisation) Study finds that GHG emissions savings potential rises substantially when logistics and operational inefficiencies in Project CAPTURED are addressed; CO2 utilisation can outperform permanent storage in GHG emissions savings when avoided emissions from displaced carbon are taken into

January 07, 2026 Read Full Article

Shake-up in EU Fertilizer Pricing to Hit Farmer Costs

by Claudia Jackson (Argus Media) European farmers are expecting higher input costs for crops planted later this year as the EU's carbon border adjustment mechanism (CBAM) begins for imported fertilizers arriving from January 2026. Fertilizers could start to take a larger share

January 07, 2026 Read Full Article

South Dakota E15 Tax Refund Applications Now Available

(South Dakota Governor's Office of Economic Development) The South Dakota Governor’s Office of Economic Development (GOED) has opened the application period for the E15 Fuel Tax Refund Program. Applications will be accepted Jan. 1–30, 2026. The program provides a refund of up

January 07, 2026 Read Full Article

MASH Makes’ CNSL-Based Biofuel Clears Final Lab Test

(MASH Makers) MASH Makes’ Upgraded CNSL fuel has passed acritical lab engine test that confirms its readiness for marine use without the reliability issues traditionally associated with CNSL-based fuels. In recent years, CNSL, a fuel made from cashew nut shell liquid (CNSL),

January 07, 2026 Read Full Article

Small Refinery Abandons Challenge to EPA Renewable Fuel Orders

by Shayna Greene (Bloomberg Law) Calumet Shreveport Refining LLC dropped its lawsuit challenging the Environmental Protection Agency’s denial of its request seeking small refinery exemptions to renewable fuel standards. The Fifth Circuit on Monday granted the refiner’s request to dismiss its case

January 07, 2026 Read Full Article

USDA Updates Research and Development Priorities for 2026

by Erin Krueger (Ethanol Producer Magazine) The USDA on Dec. 30 announced new research and development priorities for 2026. One of the five new priorities focuses on market expansion and creating new uses for U.S. agricultural products, including for use

January 07, 2026 Read Full Article

Lawmakers Push EPA on Renewable Fuel Exemptions

by Marc Heller (E&E Daily) A spending deal would press the agency to make the renewable fuel standard more responsive to small refiners' production costs. -- Lawmakers are giving EPA a fresh nudge to let more small petroleum refineries sidestep biofuel blending

January 07, 2026 Read Full Article

Ag, Biofuel Groups Continue Call for Year-Round Sales of Lower-Cost E15

(Renewable Fuels Association) In a letter sent today to congressional leadership, a coalition of more than 70 biofuel and agricultural organizations called for the immediate passage of legislation to allow year-round nationwide sales of the American-made E15 fuel blend, containing 15 percent ethanol.

January 07, 2026 Read Full Article

CALL FOR SPEAKERS Trellis Impact 26: Where Innovation Powers Sustainable Business --- June 23-25, 2026 --- San Francisco, CA DEADLINE January 23, 2025

About Trellis Impact 26 -- Trellis Impact convenes 4,000+ leaders from across industries, technologies, and the capital stack — from Fortune 500 decision-makers to climate-tech innovators and investors. Connect with the people who turn emerging ideas into scaled solutions and who see

January 07, 2026 Read Full Article

Easy-Peasy EPC: How EPC Companies Shape Renewable Fuel Projects Podcast

(Topsoe) Behind every successful renewable fuel plant is an EPC company navigating complex engineering, procurement and construction challenges. Carron Marie Freeney from Topsoe joins the podcast to unpack the project lifecycle, contract strategies and why early EPC involvement is critical to

January 07, 2026 Read Full Article

Topsoe Series of Podcasts on Sustainable Aviation Fuel (SAF)

(Topsoe) SAF Special #1 of 3: SAF in 2025: Are we still sitting on the runway? Season 7 In the first of our three-part SAF Specials, The Fuel for Thought Podcast Season 7 opens with Patrick Edmond, Chief Marketing Officer at Future Energy

January 07, 2026 Read Full Article

Will 2026 Be a Renewable Fuel Turning Point? 7 Areas to Watch out for….

by Mikala Grubb, Sandra Winter-Madsen, Milica Folić and Sylvain Verdier (Topsoe/Biofuels Digest) The renewable fuels industry has reached a critical juncture. After years of incremental progress, false starts and regulatory uncertainty, the sector is entering a phase that experts describe with

January 07, 2026 Read Full Article

Moeve Signs Agreement with Pretium Renovables to Build up to 6 Spanish Biomethane Projects

(Moeve) - The companies have reached an agreement to develop between four and six biomethane plants, each with an estimated production capacity of 60 GWh per year - Andalusia is the priority region for the rollout of the projects, which will reduce

January 07, 2026 Read Full Article

ViGo Bioenergy Acquires Drive Systems, Creating Belgium’s Largest LNG Network

(ViGo) ... All stations in the combined network will provide bioLNG, offering ViGo customers expanded options on critical routes and supporting their decarbonisation ambitions. This acquisition significantly enhances ViGo’s downstream network of LNG stations across Germany, the UK, and Benelux. Customers

January 07, 2026 Read Full Article

Unless We Rapidly Ramp up CO₂ Removal, Climate Neutrality by 2045 Will Be Scarcely Achievable

(CDRterra) • LMU-coordinated research program CDRterra calls for swift action and clear political frameworks for removing CO₂ from the atmosphere. Various land-based CO₂ removal methods can help offset German residual emissions by 2045 – provided that legal and structural barriers are removed and emissions

January 07, 2026 Read Full Article

ANP Approves Petrobras' Co-processed Marine Diesel.

by Luma Poletti (eixos) Fuel co-processed with 5% vegetable oil has been marketed by the company since November. -- The board of directors of the National Agency of Petroleum, Natural Gas and Biofuels (ANP) authorized Petrobras to sell marine diesel oil with renewable

January 07, 2026 Read Full Article

Visakh Refinery Of HPCL Inaugurates Sustainable Aviation Fuel Demonstration Plant

(Tank Terminals) Hindustan Petroleum Corporation Limited (HPCL) has commissioned a demonstration plant for Sustainable Aviation Fuel (SAF) at its Visakh Refinery, marking a significant milestone in India’s clean aviation journey. The facility will manufacture SAF by co-processing used cooking oil (UCO)

January 07, 2026 Read Full Article

Argus Has Launched a New Suite of Renewable Fuel Ticket Prices for the Netherlands.

(Argus Media) Global energy and commodity price reporting agency Argus has launched a new suite of renewable fuel ticket prices for the Netherlands. The country is gearing up to implement the latest update to the EU’s Renewable Energy Directive (RED III) and

January 07, 2026 Read Full Article

Petrobras and Vale Move forward with Partnership in Fuel Supply.

(Petrobras (Google translation)) The contract also outlines business opportunities with low-carbon solutions. -- Petrobras and Vale have signed a contract for the supply of diesel to the mining company's operations in Minas Gerais . The agreement involves the supply of S10 diesel , produced by Petrobras, with the addition of the

January 07, 2026 Read Full Article

The Digest’s 2026 Multi-Slide Guide to GreenBridgeLLC

by Jim Lane (Biofuels Digest) GreenBridgeLLC focuses on bridging the gap between clean-technology innovation and commercial success, specifically targeting sectors like SAF, plastic circularity, and decarbonization. President Poornima Sharma emphasizes that the “Scale-up stage” is the toughest hurdle, where the scale-up

January 06, 2026 Read Full Article

Notes from Peanut Butter Lake: Why SAF Is Moving Slower than It Should — and What Cascadia Teaches Us about Real Take-Off

by Jim Lane (Biofuels Digest) ... Today, aviation accounts for 3% of global carbon emissions, and since hydrogen and electric aircraft remain decades from wide-scale deployment, SAF is the only drop-in solution available to decarbonize flight over the next 40 to

January 06, 2026 Read Full Article

U.S. Ethanol Blend Rate Tops 11% in October, as E15 Expansion Continues

(Renewable Fuels Association) Ethanol accounted for 11.06 percent of the nation’s gasoline in October, marking the first time in history that the monthly ethanol “blend rate” has topped 11 percent, according to newly released data from the U.S. Energy Information Administration. The

January 06, 2026 Read Full Article

Tracking Cellulosic Ethanol: Commercialization and Regional Insights

by Dina Bacovsky, Andrea Sonnleitner, Jean Felipe Leal Silva, Glaucia Mendes Souza (SCI Journals: Biofuels, Bioproducts and Biorefining) Despite early momentum, large-scale production of cellulosic ethanol has yet to achieve its expected breakthrough. The sector has faced setbacks, including project cancellations,

January 05, 2026 Read Full Article

As Risks Multiply in a World Thirsty for Energy, Diversification and Cooperation Are More Urgent than Ever

(International Energy Agency) In an increasingly complex energy security context spanning a wide range of fuels and technologies, the World Energy Outlook 2025 identifies key choices, opportunities and trade-offs for governments Countries around the world are contending with pressing energy security threats

January 05, 2026 Read Full Article

Emaar and Lootah Biofuels Introduce Sustainable Bio Yacht Fuel

by Shilpa Annie Joseph (GCC Business News) Emaar Hospitality Group, in partnership with Lootah Biofuels, has introduced a sustainable yacht fuel at Dubai Marina Yacht Club (DMYC) and Creek Marina Yacht Club (CMYC). This marks one of the first initiatives of its kind

January 05, 2026 Read Full Article

2025 Positions Biodiesel, Renewable Diesel for Success in 2026

(Clean Fuels Alliance America) The clean fuels industry strengthened its foundation in 2025 behind record policy targets, new engine capabilities and proven performance, setting expectations for continued growth in 2026. “Government agencies, fleets, manufacturers and consumers in 2025 recognized that biodiesel and

January 05, 2026 Read Full Article

UOW to Lead New $72M ARC Centre of Excellence for Renewable Fuel

by Benjamin Long (University of Wollongong) National research effort to build Australia’s sovereign clean energy future -- The University of Wollongong (UOW) will lead a new Australian Research Council (ARC) Centre of Excellence for Renewable Fuels, a landmark national collaboration that will

January 05, 2026 Read Full Article

Sabah: Sabah Uses Microalgae Biomass for Renewable Energy Generation

(The Edge Malaysia) Sabah is tapping microalgae to support the state’s green energy goals under the Sabah Energy Roadmap and Master Plan 2040, which aims to achieve over 50% renewable energy capacity by 2035 and 80% by 2050. In July, the

January 05, 2026 Read Full Article

Korea’s First Hydrogen Fuel Cell Vessel Gets Launched

(Safety4Sea) VINSSEN has launched HYDRO ZENITH, Korea’s first hydrogen fuel cell–powered ship developed in compliance with the Ministry of Oceans and Fisheries’ Interim Standards. -- As explained, the launch ceremony took place on 18 December at VINSSEN’s land-based test facility in

January 05, 2026 Read Full Article

Ottawa’s Biofuels Subsidies Come into Force as CountryTries to Stay Competitive with U.S.

by Kate Helmore (Globe and Mail) The first part of Ottawa’s strategy to boost biofuels and shore up domestic demand for canola came into force on Jan 1. The $370-million Biofuel Production Incentive will be given to biofuel producers over the

January 05, 2026 Read Full Article

Gold Isn’t Just for Jewelry — It Just Made Ethanol a Fossil-Fuel Replacement

by Krishna Pathak (Regtechtimes/MSN) Gold is helping scientists turn plant-based ethanol into valuable industrial chemicals by keeping a delicate reaction under control. When ethanol reacts too strongly with oxygen, it burns into carbon dioxide and wastes energy; however, with precise control,

January 05, 2026 Read Full Article

Ethanol Successfully Tested at ‘All Load Points’ on Methanol Dual Fuel Engine

by John Snyder (Riviera) South Korean engine builder, HHI-EMD tests ethanol on methanol dual-fuel engine platform, offering increased fuel flexibility -- With ethanol gaining interest among shipowners as potential alternative fuel, HD Hyundai Engine & Machinery (HHI-EMD) reported it has successfully tested

January 05, 2026 Read Full Article

Consumer Group Sues Oil Companies for Gas Price Hike Linked to California Regulation

by Alex Nieves (Politico Pro) The class-action lawsuit argues that five gasoline producers preemptively raised prices before changes to the low-carbon fuel standard kicked in. -- California consumer attorneys have filed a class-action lawsuit against five major oil companies, claiming that they

January 05, 2026 Read Full Article

Iowa Gas Stations Must Now Offer E15 Gasoline

(RBN Energy) Now that the calendar has turned to 2026, most gas stations in Iowa are required to advertise and sell E15 gasoline. The requirement was included the state’s E15 Access Standard, which was adopted by the state legislature in 2022. Gas

January 05, 2026 Read Full Article

Viewpoint: RIN Market Awaits US Policy Clarity

by By Matthew Cope and Cole Martin (Argus Media) US renewable fuel credits have traded in a narrow range for months but are likely to break out soon, when President Donald Trump's administration provides more clarity on incentives in the new year. Under

January 05, 2026 Read Full Article

Alabama Farmers Turn to Canola as Winter Crop Alternative, Boosting Biodiesel Fuel Production

by Nick Balenger (WAFF) Alabama farmers are increasingly choosing canola over winter wheat as a new crop option spreads across the state. Stuart Sanderson planted 600 acres of canola at Henderson Farms this year, joining many Alabama farmers who are trading some of

January 03, 2026 Read Full Article

SABR Turns Two; and Like All Two-Year-Olds, Has Been Very Busy

by Joe Jobe (Sustainable Advanced Biofuel Refiners Coalition (SABR)/Biodiesel Magazine) ... SABR incorporated as a 501(c)(6) biodiesel trade association in September 2023 with about 20 organizational members, and now we have more than 70, including some of the most seasoned veterans

January 03, 2026 Read Full Article

Considerations for Switching to SAF

by Luis Hoffman (Sulzer/Biodiesel Magazine) ... First-generation biodiesel (fatty acid methyl ester or FAME) producers who have the feedstock, capability and resources to switch to SAF production may hold the fate of air travel in their hands. A Growing Market for SAF Although

January 03, 2026 Read Full Article

Complying with California’s New Specified Source Feedstock Attestation Requirement

BY Danielle Anderson (Christianson CPAs and Consultants /Biodiesel Magazine) As of July 2025, California’s Low Carbon Fuel Standard requires renewable fuel producers using specified source feedstocks to secure attestation letters reaching back to the point of origin. This marks a significant

January 03, 2026 Read Full Article

Angola Debates Proposed Biofuels Law.

(Goverment of Angola) The Ministry of Mineral Resources, Petroleum and Gas (MIREMPET) launched a public consultation on Monday, December 15th, on the proposed Biofuels Law, a strategic document aimed at laying the foundations for a more diversified, sustainable, and socially just

January 02, 2026 Read Full Article

Six National Elements Agree to Accelerate Energy Transition and Food Security, IPB University Takes Key Role

(IBP University) Food security and energy transition are often seen as two major agendas that are at odds with each other. However, cross institutional collaboration shows that both can be accelerated simultaneously through integrated research, innovation, and policies. This commitment was confirmed

January 02, 2026 Read Full Article

JETEX Invests in Azzera to Advance Sustainable Aviation Initiatives

(Azzera) Aviation sustainability provider Azzera Inc. announces that JETEX, a global leader in private aviation, is the latest strategic investor in the digital carbon-management platform. The new investment positions the technology platform to continue evolving functionality, grow its international footprint, and deliver

January 02, 2026 Read Full Article

Pakistan Pushes Voluntary Ethanol Blending

(ChiniMandi) Pakistan’s Deputy Prime Minister and Foreign Minister Senator Mohammad Ishaq Dar on Thursday (January 1, 2026) chaired a high-level meeting to review a proposal for blending ethanol with locally produced petrol by domestic refineries. The Chairman, Oil and Gas Regulatory Authority

January 02, 2026 Read Full Article

Sustainable Aviation Fuel Take-up in UK Unlikely to Hit 2025 Target, Data Suggests

by Gwyn Topham (The Guardian) Provisional figures in government mandate’s first year show 20% shortfall in levels of SAF supplied for UK flights -- Production data published by the Department for Transport (DfT) covering most of 2025 shows that sustainable fuels (SAF) only accounted for

January 02, 2026 Read Full Article

FuelEU Maritime Will Not Enter into Force in Norway on 1 January 2026

(Norwegian Maritime Authority) It has now been decided that the FuelEU Regulation will not enter into force in Norway from 1 January 2026. -- As previously communicated, efforts were made to allow for the Regulation to apply in Norway from 1 January 2026. FuelEU

January 02, 2026 Read Full Article

The Digest’s 2026 Multi-Slide Guide to U.S. Energy Policy

by Jim Lane (Biofuels Digest) LEC Partners in this presentation navigates the “America First” energy transition, focusing on the One Big Beautiful Bill Act (OBBBA) and Executive Order 14154. They specialize in de-risking investments, recently identifying $2.8M in necessary upgrades during

January 02, 2026 Read Full Article

Selling the Oomph, Not the Oil: Aemetis, XCF, and the Invisible Value Shift That Will Define Renewables in 2026

by Jim Lane (Biofuels Digest) ... The gallons of green liquid? Not the star anymore. The real value lies in the attributes — the verified, tradeable, financeable proof of carbon benefit. Like: • Energy Attribute Certificates (RECs, Guarantees of Origin) • Zero-Emission Credits

January 02, 2026 Read Full Article

Leveling The Playing Field

by Katie Schroeder (Biodiesel Magazine) In the pursuit of supporting biofuels, both sides of the U.S.-Canada border have implemented incentive structures to encourage the production or use of renewable fuels over fossil fuels. However, the U.S. 45Z Clean Fuel Production Credit

January 01, 2026 Read Full Article

Green Diesel: Innovation at Unicamp

by Igor Savenhago (Agro Estadão) ... At the State University of Campinas ( Unicamp ), the Ethanoil+ project seeks to transform the production of biodiesel and renewable diesel – known as green diesel – using compact equipment. The initiative, led by

January 01, 2026 Read Full Article

Egypt Rejects Claims of Ceding Sokhna Land to Qatari Firm; Clarifies Details of $200 Million Investment

(Egypt Independent) The Egyptian Cabinet’s Media Center has issued a formal statement to debunk widespread allegations regarding the purported “concession” of land in Sokhna to the Qatari company, Al-Mana Group, without financial or investment returns for the state. The General Authority for

January 01, 2026 Read Full Article

Tibbi’s Bitter Harvest -- Farmers in Hanumangarh Fight Asia’s Largest Ethanol Plant, Fearing It Will Drain Their Groundwater and Poison Their Fields

by Vedaant Lakhera (The Hindu) ... For the past 15 months, residents have steadily mobilised against a proposed ethanol plant. Spanning nearly 40 acres, this facility—owned by Chandigarh-based Dune Ethanol Pvt. Ltd.—is billed as Asia’s largest ethanol plant. The residents have been protesting

January 01, 2026 Read Full Article

President Museveni Commissions the Largest Ethanol Plant in East Africa

David Rupiny (Uganda Investment Authority) President Yoweri Museveni has commissioned PRO Industries, reputed as the biggest ethanol plant in East Africa. The President, accompanied by the First Lady Janet Museveni, said the factory, located in Luwero District in central Uganda, would boost value

January 01, 2026 Read Full Article

Mureloil Orders Hybrid Chemical Tanker for Bunkering from Murueta Shipyards

(Manifold Times) Newbuilding will be deployed for the supply and transportation of liquid marine fuels, specifically biofuels and methanol, in Portuguese waters. Spanish shipowner Mureloil on Tuesday (30 December) said the company signed a contract with Astilleros de Murueta (Murueta Shipyards) to

January 01, 2026 Read Full Article

The Digest’s 2026 Multi-Slide Guide to Topsoe and NXT Clean Fuels

by Jim Lane (Biofuels Digest) Topsoe leads the HEFA market with 22 operating licensed units and 45 more in engineering. Their collaboration with NXT Clean Fuels aims for a world-scale complex in Oregon, targeting an ultra-low CI of 10.1 g C/MJ2.

January 01, 2026 Read Full Article

The Sustainable Marine Fuels 2026 Outlook: What’s Hot, What’s Not

by Jim Kendrick (Biofuels Digest) What’s Hot: The Must Haves Making a Splash in 2026 LNG — The Tailored Transitional Look If marine fuels had a little black dress, LNG would be it. Globally recognizable, easy to style, and adaptable to many settings, LNG remains

January 01, 2026 Read Full Article

USDA Releases Per-Acre Rates for Farmer Bridge Assistance Program

by Kerry Halladay (AgWeb) Rice at $132.89 and cotton at $117.35 will receive the highest per-acre rates, but some have called payments a bandage in the midst of current farm economic crisis. -- The long-awaited Farmer Bridge Assistance rates are out! Rice

December 31, 2025 Read Full Article

Charting the Course

by Caitlin Scheresky (Biodiesel Magazine) In mid-October, the International Maritime Organization’s Marine Environment Protection Committee convened for its second extraordinary session to discuss the potential adoption of the IMO Net-Zero Framework. With more than 80% of global trade and 40% of U.S.

December 31, 2025 Read Full Article

The State of Soy

by Susanne Retka Schill (Biodiesel Magazine) The soybean supply chain looks to proposed biofuel polices for hope in the midst of what’s been described as one of the most challenging years ever. For biofuel producers, the uncertainty around final rules and

December 31, 2025 Read Full Article

Yokohama to Remove Port Fees for Methanol and Biofuelled Vessels

by Gautamee Hazarika (Engine) The Yokohama Port and Harbour Bureau has said it will establish a carbon-neutral port to support Japan’s goal of achieving a decarbonised society by 2050. -- From 1 January, the port of Yokohama will launch an incentive programme offering

December 31, 2025 Read Full Article

Looming Risk of Manitoba Ethanol Plant Closure

by Robert Parsons (Free Press) In the past weeks, I was contacted by Matthew Frank, reporter with Free Press sister publication the Carillon. Frank astutely uncovered something unexpected and disturbing for Manitoba, but also with broader policy implications (U.S. ethanol imports force out

December 31, 2025 Read Full Article

Brazil Sets New Emission Reduction Targets for Fuels under RenovaBio

by Prakash Jha (BioEnergy Times) Brazil’s National Council for Energy Policy (CNPE) on Tuesday (December 30, 2025) published a resolution fixing annual mandatory targets to cut greenhouse gas emissions from fuel sales for the period between 2026 and 2035. The move

December 31, 2025 Read Full Article

RGFI Awarded Key EU Biomethane Project as European and Irish Stakeholders Convene in Dublin

(Renewable Gas Forum Ireland) Ireland, represented by Renewable Gas Forum Ireland (RGFI) is one of eight European countries to be awarded the BIOMAPE project, a new European Union Horizon Programme initiative designed to support the accelerated and sustainable deployment of biomethane

December 31, 2025 Read Full Article

Evonik Wins Two Patent Disputes, Reaffirming Legal Protection for Its 3-Stage Process with SEPURAN® Green Membranes

(Evonik) Evonik has won two legal disputes, unquestionably securing EU and US patent rights for the company’s pioneering 3-stage biogas upgrading process with SEPURAN® Green membranes. European Patent Office upholds Evonik’s EP3240620 B1 patent, dismissing all requests for invalidation filed by other

December 31, 2025 Read Full Article

Amber Grid Joins the AIB Hub: Opening up International Biomethane Trading Opportunities

(Amber Grid) On December 19, the Association of Issuing Bodies (AIB) officially confirmed the connection of the gas transmission system operator Amber Grid to the AIB Hub, which enables the exchange of guarantees of origin for gases produced from renewable energy sources between member

December 31, 2025 Read Full Article

ANP Extends Suspension of Biodiesel Sales between Similar Distributors.

(Brazil Ministry of Mines and Energy National Agency of Petroleum, Natural Gas and Biofuels (Google translation)) This measure will allow the Agency to conduct a more in-depth analysis of the effects of the ban. -- The ANP Board approved today (12/29) the extension,

December 31, 2025 Read Full Article

Aemetis Receives Funds from the Sale of $17 million of Federal Clean Energy Tax Credits

(Aemetis) Aemetis, Inc. (NASDAQ: AMTX), a renewable natural gas and renewable liquid fuels company focused on lower cost and reduced emissions products, today (December 30, 2025) announced that its Aemetis Biogas LLC subsidiary received funds from the sale of $17 million

December 31, 2025 Read Full Article

The Digest’s 2026 Multi-Slide Guide to Yilkins and Swirl Carbonization

by Jim Lane (Biofuels Digest) Dutch company Yilkins leverages swirl fluidized bed technology for drying and carbonizing over 100 biomass residues. Their skid-based units scale from 0.25 to 14 tons per hour. With a 600M€ project backlog, Yilkins ensures bankability through

December 31, 2025 Read Full Article

Cut Me Some Slack: What I Learned about the Bioeconomy from Cal–Stanford and “The Play”

by Jim Lane (Biofuels Digest) ... The real world is five laterals and no time on the clock. The question isn’t how brilliant is your playbook — it’s whether you have a way to keep the ball alive. Yet the bioeconomy —

December 31, 2025 Read Full Article

Secretary Rollins Announces New Priorities for Research and Development in 2026

(U.S. Department of Agriculture) Today, U.S. Secretary of Agriculture Brooke L. Rollins, signed a Secretary’s Memorandum (PDF, 135 KB) that puts forth a focused effort to establish new priorities for future research and development activities funded by the U.S. Department of Agriculture (USDA)

December 30, 2025 Read Full Article

Pima County Wastewater Prepares for 21st Annual Grease Collection Event

(Pima County) For many people, the winter holidays end with New Year’s Day. But for the Pima County Regional Wastewater Reclamation Department (RWRD), the festivities aren’t over just yet. Every year, the department holds a winter grease collection, designed to give the public an

December 30, 2025 Read Full Article

Ricardo to Lead Study of Green Shipping Corridor between Panama and Spain

(Hydrocarbon Processing) Ricardo, a world-leading environmental, energy and engineering consultancy, announced that it has been appointed to conduct a green shipping corridor feasibility study between Panama and Algeciras, Spain, aiming to decarbonize maritime trade and modernize global connectivity. Funded by the European

December 30, 2025 Read Full Article

DHL Supply Chain Appointed by Siemens Mobility in New Multi-year Contract

(DHL Group) DHL Supply Chain today announces it has been appointed by Siemens Mobility, a leader in intelligent rail transport solutions, in a new multi-year transport contract. Through the contract, DHL will deliver vital rail components to depots across the UK,

December 30, 2025 Read Full Article

Topsoe’s Advanced Technology Selected for a Sustainable Aviation Fuel and Renewable Diesel Project in Uruguay

(Topsoe) • Topsoe has been selected by ANCAP to deliver technology and services for a sustainable aviation fuel (SAF) and renewable diesel plant at the La Teja Refinery in Montevideo. The project will use Topsoe’s HydroFlex® technology, proprietary equipment and catalysts enabling the production of 3,000

December 30, 2025 Read Full Article

Farmers, Ethanol Industry Honor Loos with Scholarships

by Tom C. Doran (AgriNews) For over three decades, David Loos was on the frontlines advocating for the development and expansion of the ethanol industry in Illinois. After he died unexpectedly on April 13, individuals and organizations teamed up to create education

December 30, 2025 Read Full Article

Treasury Issues 45Q ‘Safe Harbor’ amid EPA Plan to Scrap GHG Reporting

(Inside EPA) The Treasury Department is issuing a promised “safe harbor” for companies looking to qualify for the section 45Q carbon storage tax credit after EPA proposed to scuttle its Greenhouse Gas Reporting Program (GHGRP) requirements related to the sector, though

December 30, 2025 Read Full Article

Ethanol Report on 2025

(Ag News Wire) 2025 marked the 20th anniversary of the Renewable Fuel Standard (RFS) and showed just how far U.S. ethanol has come – and how much more it could accomplish for the world with just a little more freedom. Nationwide, year-round

December 30, 2025 Read Full Article

Ethanol Production Will Begin in Guatemala on June 30th of Next Year.

(Publi News) Despite the environmental and economic benefits, the mandatory 10% ethanol blend with gasoline faces logistical and legal challenges for its final implementation in the country. -- Ethanol , a biofuel derived from sugarcane or corn, will begin to be used

December 30, 2025 Read Full Article

Indian Federation of Green Energy Signs MoU with Global Ethanol Association to Advance Ethanol as Sustainable Marine Fuel

by Prakash Jha (ChiniMandi) The Indian Federation of Green Energy (IFGE) has signed a Memorandum of Understanding (MoU) with the Global Ethanol Association (GEA) to promote the adoption of ethanol as a sustainable green fuel, with a primary focus on the

December 30, 2025 Read Full Article

Indonesia Plans to Fine Palm Oil Growers, Miners $8.5 Billion for Forest Encroachment

by Gayatri Suroyo (Reuters/MSN) Indonesia has identified potential fines amounting to $8.5 billion that the government could collect in 2026 from palm oil companies and miners operating illegally in forest areas, the country's attorney general said on Wednesday (December 24, 2025). President

December 30, 2025 Read Full Article

Salvador Bahia Airport Becomes Brazil's First to Supply Commercial Flights with SAF

(VINCI Concessions) Salvador Bahia Airport, part of VINCI Airports’ network since 2018, is pioneering Brazil’s aviation decarbonization by becoming the country’s first airport to supply Sustainable Aviation Fuel (SAF) for commercial operations. Regular use of SAF begins this November. This marks

December 30, 2025 Read Full Article

Repsol Reaches 1,500 Service Stations with 100% Renewable Nexa Diesel in Spain and Portugal

(Repsol) • The multi-energy company consolidates its leadership in renewable fuels with 1,500 stations offering Nexa Diesel of 100% renewable origin and meets the objective set in the update of the 2024-2027 strategic plan. It positions itself as the most relevant network

December 30, 2025 Read Full Article

Biodiesel: JBS's Biopower Announces a R$ 140 Million Investment in Its 3 Plants.

(Noticias Daily Life) Biopower, a JBS New Businesses company that produces biodiesel, has just announced an investment of R$ 140 million in modernization and technological innovation at its three plants, located in Lins (SP), Campo Verde (MT), and Mafra (SC). This

December 30, 2025 Read Full Article

The Digest’s 2026 Multi-Slide Guide to Hexas and XanoFiber

by Jim Lane (Biofuels Digest) Hexas accelerates biomass aggregation using XanoGrass, yielding 200 tons of XanoFiber™ from just 8 acres. This land-use efficiency is vital, as 2023 median farm income was –900 while 2025 corn losses are projected at 160 per acre.

December 30, 2025 Read Full Article

Clean Fuels Applauds CARB’s Decision to Sunset Outdated Biodiesel Restrictions

(Clean Fuels Alliance America) Clean Fuels Alliance America welcomes a ruling by the California Air Resources Board (CARB) to sunset the oxides of nitrogen (NOx) mitigation requirement for biodiesel blends up to B20 (20% biodiesel) in the Alternative Diesel Fuel (ADF)

December 30, 2025 Read Full Article

Biofuels Mandates Around the World 2026

by Jim Lane (Biofuels Digest) Daily Digest today released its annual review of biofuels mandates and targets around the world, looking at the state of biofuels mandates in 65 countries. Get the latest up to the minute new information on the

December 30, 2025 Read Full Article

World Hydrogen & Carbon Americas --- March 10-12, 2025 --- Houston, TX

Join over 800 senior professionals from across the hydrogen, carbon, feedstock, and fuels industries at World Hydrogen & Carbon Americas. This event brings together leaders from across the value chain to exchange practical insights, share project updates, and build partnerships that move

December 29, 2025 Read Full Article

Pioneers of the Next Era in Global Shipping

(DNV) Explore the next generation of maritime excellence. Throughout 2025, #DNVesselOfTheMonth has featured DNV-classed vessels that demonstrate cutting-edge design, advanced compliance, and sustainable performance, pushing the boundaries of smarter and greener shipping. READ MORE

December 29, 2025 Read Full Article

DHL Expands Partnership with Air France KLM Martinair Cargo, Signs New Framework Agreement for Emission Reduction Rights

(DHL Group) Building on their milestone partnership, established in 2022, this agreement introduces a clear focus on emission reduction claims, emphasizing the development of market-ready book-and-claim models to advance sustainable air freight solutions across the sector. New agreement strengthens long-term collaboration to

December 29, 2025 Read Full Article

BSR to Introduce E10RON95 Biofuel on June 1

(Viet Nam News) Dung Quất Oil Refinery Director Cao Tuấn Sĩ shared the information during an interview with reporters on Tuesday (December 23, 2025). -- The Bình Sơn Refining and Petrochemical Joint Stock Company (BSR), a member of the Vietnam National Industry

December 29, 2025 Read Full Article

Toyota Seeking to Wring out Biofuel from Sorghum in Fukushima

by Go Takahashi (Asahi Shimbun) In a 5,000-square-meter farmland in one corner of the town, which co-hosts the disaster-stricken Fukushima No. 1 nuclear power plant, some 30,000 sorghum plants are blowing in the wind. But the staple crop isn't being grown for food

December 29, 2025 Read Full Article

Business News | Ethanol Industry Faces Surplus as Demand Stalls, Exports Uncompetitive: GEMA President

(LatestLy) Exports are unlikely to provide a viable outlet for surplus ethanol, says CK Jain, President Grain Ethanol Manufacturers Association (GEMA). -- New Delhi [India], December 26 (ANI): Exports are unlikely to provide a solution for surplus ethanol in India, according to

December 29, 2025 Read Full Article

Ethanol Industry Celebrates Strong Markets, Record Output

by Mark Dorenkamp (Brownfield Ag News) Renewable Fuels Association president Geoff Cooper says a record amount of ethanol has been produced this year. “It has been quite a year for the ethanol industry, and I think I’d start by saying just what

December 29, 2025 Read Full Article

Volatile Biofuels Demand Is Reshaping the Price Relationship between Soybean and Palm Oils

by Yu-Chi Wang and Joe Janzen (farmdoc/Successful Farming) ... Soybean oil and palm oil are the two most widely available vegetable oils in the world and are substitutes in many products, including as feedstocks in the production of biofuels. For many years,

December 29, 2025 Read Full Article

Understanding the Trade Impacts of Sustainability Certification: Insights from the STAR4BBS White Paper

(Renewable Carbon News) The White Paper is based on a systematic review of 563 publications, of which 21 quantitative studies met the criteria for detailed assessment -- Sustainability requirements have become a decisive factor in shaping global trade, influencing competitiveness, transparency and

December 29, 2025 Read Full Article

Scientists Uncover How Microbial Consortia Break Down Lignin

by Zhang Nannan (Chinese Academy of Sciences/Phys.Org) Researchers from the Institute of Applied Ecology of the Chinese Academy of Sciences have developed a "top-down" synthetic microbiome strategy to enrich microbial consortia capable of efficient lignin degradation from straw compost and straw-returning

December 29, 2025 Read Full Article

Indonesia Keeps 2026 Biodiesel Quota Flat, Raising Doubts over B50 Target

by Aditya Kondalamahanty and Ck Quick (S&P Global) 2026 biodiesel quota at 15.646 million kiloliters; Non-PSO allocations raised, PSO requirement reduced -- Indonesia has set its biodiesel production quota for 2026 at 15.646 million kiloliters, Ernest Gunawan, secretary general of the Indonesian Biofuel

December 29, 2025 Read Full Article

UNDP Conducts Stakeholder Consultations for New Biogas Project in Solomon Islands

(Solomon Islands Government) Technical officers from the United Nations Development Programme (UNDP) contracted for the Sustainable Energy from Biogas for Solomon Islands (SENBIOSIS) project are currently in the country to consult with project stakeholders. Funded by the Ministry of Environment and Energy

December 29, 2025 Read Full Article

Iowa Challenge to Summit Carbon Pipeline Permit Placed on Hold

by Cami Koons (Iowa Capital Dispatch/Des Moines Register) The Iowa Utilities Commission will have to decide whether Summit Carbon Solutions can change the destination of its carbon sequestration pipeline before a challenge to the company’s permit to build it in the state

December 29, 2025 Read Full Article

Princeton’s Satish Myneni Wins Schmidt Grant to Accelerate Hydrogen Generation

by Arun Kumar (The American Bazaar) Satish Myneni, an Indian American professor of geosciences at Princeton University is getting funding through the Eric and Wendy Schmidt Transformative Technology Fund for a research project to speed up natural hydrogen generation for clean

December 29, 2025 Read Full Article

Gujarat Green Hydrogen Policy 2025 Unveiled

(DeshGujarat) Gandhinagar: The Gujarat government has rolled out its Green Hydrogen Policy, aiming to position the State as a leading hub for green hydrogen production and accelerate the transition toward clean energy-driven industrial growth. Under the policy, the State government targets investments

December 29, 2025 Read Full Article

Eni: Products and Technologies Supporting the Sustainability of Milano Cortina 2026

(Eni) Eni is a Premium Partner of the Milano Cortina 2026 Olympic and Paralympic Winter Games with the aim of supporting this major Italian event also through sustainability-related initiatives aimed at reducing greenhouse gas (GHG) emissions. Eni aims to achieve carbon neutrality

December 29, 2025 Read Full Article

The Digest’s 2025 Multi-Slide Guide to GranBio’s Cellulosic SAF

by Jim Lane (Biofuels Digest) GranBio utilizes its patented AVAP™ technology to produce Sustainable Aviation Fuel (SAF) from various biomass residues, establishing a Net-Zero solution without immediate carbon capture. GranBio targets 1 billion gallons per year (GPY) capacity by 2040 by repurposing ten shuttered

December 29, 2025 Read Full Article

In the Pits: Time to Refuel in the Race to Net Zero

by Jim Lane (Biofuels Digest) ... A new study out of the University of Sherbrooke has answered with brutal clarity: If the goal is maximum CO₂ avoided now, put the can in the truck — not the plane. Why would the

December 26, 2025 Read Full Article

The Digest’s 2025 Multi-Slide Guide to Mango Materials and PHA Technology

by Jim Lane (Biofuels Digest) Mango Materials is addressing plastic pollution by producing Polyhydroxyalkanoate (PHA), a biodegradable and often carbon negative material, under the brand YOPP™. This material is produced via a microbial process utilizing methane emissions, such as biogas captured from

December 25, 2025 Read Full Article

UNEP Global Methane Status Report 2025: Methane Cuts Achievable with Rapid Investment

(World Biogas Association) The United Nations Environment Programme’s Global Methane Status Report 2025 provides insights into the potential to meet the Global Methane Pledge (GMP) target of a 30% reduction below 2020 levels by 2030. The World Biogas Association (WBA) was honoured to

December 24, 2025 Read Full Article

Growth Energy: Amendments to ESA Rules Would Strengthen the RFS

(Growth Energy) Growth Energy, the nation’s largest biofuel trade association, expressed its support today for regulatory amendments proposed by the U.S. Fish and Wildlife Service (FWS) and the National Marine Fisheries Service (NMFS) that streamline the regulatory process, addressing unnecessary barriers that have the potential

December 24, 2025 Read Full Article

Statkraft and Fortescue Renegotiate Power Agreement for Holmaneset Green Hydrogen and Green Ammonia Project in Norway

(Statkraft) Statkraft and Fortescue have agreed to amend and extend the conditional power agreement currently in place for the Holmaneset project. -- Currently in the feasibility phase of the green hydrogen and green ammonia project, Fortescue is continuing to progress studies

December 24, 2025 Read Full Article

The Digest’s 2025 Multi-Slide Guide to Low Carbon Fuels Market Trends

by Jim Lane (Biofuels Digest) ICF forecasts environmental commodity pricing will likely rise, driven by domestic feedstock shortages versus aggressive Renewable Volume Obligations (RVOs). This tension is compounded by the California Low Carbon Fuel Standard (LCFS) limiting full credit for virgin

December 24, 2025 Read Full Article

Optimizing Microalgae for Wastewater and Biofuels

(Bioengineer.org) ... Microalgae hold considerable potential for wastewater treatment while simultaneously serving as a biofuel feedstock, thereby facilitating an intriguing intersection of environmental science and bioenergy research. A recent study conducted by Jalalah et al. delves into this dual-functionality of microalgae,

December 24, 2025 Read Full Article

Winter Oilseeds as a Response to Biofuels Feedstock Demand

by Jacob Lionberger and Joe Janzen (farmdoc daily) U.S. biodiesel and renewable diesel output has increased significantly in recent years and the outlook for future policy and production is strong (Hubbs and Irwin, 2025). Growth in biomass-based diesel (BBD) fuel output

December 24, 2025 Read Full Article

The 7-Billion-Gallon Gift: Affordable, Cost-Competitive Biofuels Are in Our Biostockings

by Jim Lane (Biofuels Digest) Today, the American bioeconomy finds itself in a curious reversal. We are surrounded by abundance — residues in our fields, forests, and cities — yet capital hesitates. Not because demand is unclear. Not because policy signals

December 24, 2025 Read Full Article

China Is Investing Billions in Latin America, Potentially Sidelining US Farmers for Decades to Come

(News from the States) ... COSCO Shipping, a state-owned Chinese company, is investing at least $3.5 billion to construct 15 berths, logistics facilities, and a 1.1-mile tunnel, enabling cargo to be channelled directly from the port to nearby highways. Once fully operational,

December 24, 2025 Read Full Article

Canadians Called Slow to Embrace Biofuel Policy

by Greg Price (Atberta Farmer) Agricultural producers encouraged to embrace stronger government biofuel policies for for their commodities -- Canadians farmers have had a hard time embracing biofuel policy the same way that producers south of the border have, says Shaun Haney,

December 24, 2025 Read Full Article

Iowa Court Directs State Regulators to Review CO2 Pipeline

by Nina H. Farah (Politico Pro Energywire) Summit Carbon Solutions' interstate carbon dioxide project faces headwinds from a South Dakota law. -- An Iowa judge has ordered state regulators to take another look at the permit requirements for an interstate carbon dioxide

December 24, 2025 Read Full Article

Viewpoint: Policy Delays Refocus US SAF Industry

by Matthew Cope (Argus Media) ... SAF output rose to an all-time high of 196mn USG through November of this year compared to 39mn USG in all of 2024, according to US Environmental Protection Agency (EPA) data. But growth next year

December 24, 2025 Read Full Article

India Moves to Tackle Sugar Surplus with Price Hike and Ethanol Push

(Zoombangla) The Indian government is planning new steps to manage a looming sugar surplus. A formal policy announcement is expected in January 2025. The measures aim to prevent a domestic sugar glut. They also seek to ensure timely payments to sugarcane

December 24, 2025 Read Full Article

MDV Allowed to Recover RM109mil Loan from Ex-Biodiesel Producer, 4 Others

by V Anbalagan (Free Malaysia Today) The High Court, however, dismisses the company's second suit against eight parties for fraud and conspiracy. -- The High Court here has allowed government-linked Malaysia Debt Ventures Bhd (MDV) to recover about RM109 million from a former biodiesel

December 24, 2025 Read Full Article

From Powerhouse to Global Leadership: Why India Needs a National Biogas Mission

(World Biogas Association) India stands at a pivotal moment in its clean energy transition. As the country races to secure energy independence, decarbonise hard-to-abate industrial sectors, and manage mounting organic waste, the biogas sector offers a rare convergence of solutions. This

December 23, 2025 Read Full Article

Leveraging Tobacco for a Low-Carbon Biorefinery

by Quanyu Yin, Quanyu Yin, Zhengkang Zhu, Zhengkang Zhu, Yujia ChenYujia Chen Mengquan Yang (Frontiers in Plant Science) Tobacco has historically served as a high-value cash crop within the cigarette industry. However, increasing public health concerns and climate change mitigation objectives are

December 23, 2025 Read Full Article

Vanguard Renewables Opens River Falls Facility for Sustainable Food Waste Disposal

(Vanguard Renewables) Vanguard Renewables, a national leader in organics recycling and renewable energy production, has opened a new anaerobic digestion and advanced depackaging facility in River Falls, Wisconsin. The site provides food and beverage manufacturers, retailers, and processors across the Minneapolis-St.

December 23, 2025 Read Full Article

Canada Issues New Regulations to Reduce Methane Emissions

by Erin Krueger (Biomass Magazine) The Canadian government on Dec. 16 released final regulations to reduce methane emissions from the country’s oil and gas sector and landfills. The government is also investing $16 million in methane measurement, reporting and mitigation research.

December 23, 2025 Read Full Article

Global Hydrogen Market: Uniper and thyssenkrupp Uhde Sign Framework Agreement on the Use of Ammonia Cracking Technology

(Uniper) Strategic partnership further expanded; License packages for up to six commercial plants with a total capacity of 7,200 mtpd of ammonia; Joint goal: Establishment of a scalable hydrogen import infrastructure -- Uniper and thyssenkrupp Uhde have signed a framework agreement that lays the

December 23, 2025 Read Full Article

A New Approach to Carbon Capture Could Slash Costs

(MIT News) Chemical engineers have found a simple way to make capturing carbon emissions from industrial plants more energy-efficient. -- Capturing carbon dioxide from industrial plants is an important strategy in the efforts to reduce the impact of global climate change. It’s

December 23, 2025 Read Full Article

Gevo’s Carbon Dioxide Removal Credits from Its North Dakota Facility Expected to Improve in Value with a Higher Grade from an Independent Rating Agency with a Global Reputation

(Gevo) Gevo North Dakota Awarded “A” Rating from BeZero Carbon, Affirming its High-Quality Carbon Removal Credits -- Gevo, Inc. (NASDAQ: GEVO) is pleased to announce that BeZero Carbon Ltd., a preeminent global carbon rating agency, has upgraded its rating for the Gevo

December 23, 2025 Read Full Article

UPM Unlocks New Bio-Based Markets as Leuna Biorefinery Produces Its First Commercial Product

(UPM) UPM, a global leader in sustainable material solutions, has achieved an important milestone in the startup of production of commercial, wood-based chemicals in its Leuna biorefinery in Germany. The refinery, which is the largest industrial-scale investment in biochemicals in Europe,

December 23, 2025 Read Full Article

DHL and CMA CGM Accelerate Decarbonization of Ocean Freight with Joint Biofuel Initiative

(DHL Group) The two companies have agreed to jointly use 8,990 metric tons of UCOME second-generation biofuel, enabling an estimated 25,000 metric tons of CO2e well-to-wake emission reduction for ocean freight transported under DHL's GoGreen Plus service. Purchase of 8,990 metric tons

December 23, 2025 Read Full Article

The Digest’s 2025 Multi-Slide Guide to Aemetis, Inc.