by Jacqui Fatka (Farm Progress) ... It is hard to predict the demand picture under the expanded E15 scenario, but lower estimates of a continued status quo indicate at least 300 million gallons of additional ethanol could be used by consumers with the year-round use of E15. “But (if you are expanding the number of E15 stations and E85 at a clip that they have this year, especially in the last few weeks when the weather allows for station development, I could see us quickly climbing from there,” White says.

White says some stations are replacing the current Unleaded 87 blend of E10 with the Unleaded 88 blend of E15 as the base unleaded gasoline offered. For those stations, they offer E15 regular, E15 midgrade and E10 premium. If more retailers move to this, it will also create increased demand for ethanol.

RFA released a new analysis that found sales of E15 blended gasoline hit a record 814 million gallons in 2021. The 2021 volume represented a 62% increase over the prior year and was nearly double pre-pandemic sales volumes in 2019. White adds that E85 sales in California are “off the charts” given the large differential cost advantage.

According to the National Corn Growers Association, if just one-third of regular E10 fuel sales were replaced with E15, it would fully replace all gasoline from previously imported Russian oil.

Expanding where E15 is offered

Growth Energy reports that E15 is available at more than 2,600 gas stations across 31 states. In tandem with the visit, USDA announced additional money through its Higher Blends Infrastructure Incentive Program. White adds the President’s announcement provides additional incentives for some retailers to make investments in higher blend infrastructure.

USDA announced funding in seven states to build infrastructure to expand the availability of higher-blend renewable fuels by approximately 59.5 million gallons per year. States included in this investment are California, Delaware, Illinois, Maryland, New Jersey, New York and South Dakota. For example, in Illinois, Power Mart Express Corp., DBA PME, is receiving a $2.9 million grant to increase ethanol sales by 17.5 million gallons per year. This project will replace 293 dispensers and 30 storage tanks at 15 fueling stations in Chicago, Maywood, Cicero, Des Plaines and Wilmington.

USDA announced $100 million in new funding for grants for biofuels infrastructure to make it easier for gas stations to sell and to significantly increase the use of higher blends of bioethanol and biodiesel at the pump. The funding will provide grants to refueling and distribution facilities for the cost of installation, retrofitting or otherwise upgrading infrastructure required at a location to ensure the environmentally safe availability of fuel containing ethanol blends of E15 and greater or fuel containing biodiesel blends B-20 and greater. USDA will also make funding available to support biofuels for railways as a means of assisting with supply chains and helping to reduce costs for consumer goods and transportation.

White says this $100 million in matching grants provided to fuel retailers is a “long-term play with no effect on this summer’s sales.” However, the first round of HBIF funds is already seeing results for increased ethanol blending.

As part of the Pandemic Assistance for Producers initiative, USDA is providing up to $700 million in funding through a new Biofuel Producer Program. The Program will support agricultural producers that rely on biofuels producers as a market for their agricultural products. By making payments to producers of biofuels, the funding will help maintain a viable and significant market for such agricultural products. Producers can expect awards before the end of April.

Permanent E15 fix needed

Efforts to permanently allow for year-round E15 sales continue to gain momentum in both the U.S. House and Senate. This emergency waiver will create 13 months of certainty, but the same issues will still be present in 2023. White says biofuel supporters continue to push on all fronts, including legislative, regulatory and state-level avenues, to achieve expanded ethanol use.

In a Brownfield report, Rep. Angie Craig, D-Minn., credits House leadership for pushing the administration toward allowing E15 sales this summer. “Speaker Pelosi, I’m going to just say, I’ve heard her say the word ‘ethanol and E15’ more in the last two weeks than I have in the last three years serving in Congress,” Craig says.

The bipartisan Home Front Energy Independence Act puts into law a ban on Russian oil and opens up the use and production of biofuel. Specifically, the legislation combines parts of several of the past bills that would make E15 available year-round, among other things. The current excess ethanol capacity domestically is nearly the same as the amount of Russian gas the U.S. had been importing: roughly 83 million barrels versus 87 million barrels.

The Home Front Energy Independence Act combines elements of several of senators’ previous bills aimed at supporting and incentivizing the use of biofuel, including the Biofuel Infrastructure and Agricultural Product Market Expansion Act of 2021, the Consumer and Fuel Retailer Choice Act, the Low Carbon Biofuel Credit Act, and the Biodiesel Tax Credit Extension Act of 2021.

The Consumer and Fuel Retailer Choice Act would extend the Reid vapor pressure (RVP) volatility waiver to ethanol blends above 10%. It would increase market access and continue to allow retailers across the country to sell E15 and other higher-ethanol fuel blends year-round, eliminating confusion at the pump. READ MORE

Joe Biden commits $US800 million to boosting biofuels in the United States (The Land)

Biden-Harris Administration, Department of Agriculture Announce Efforts to Enable Energy Independence by Boosting Homegrown Biofuels (U.S. Department of Agriculture)

It's Time to Check the Facts on E15 (Renewable Fuels Association)

Opinion: Biden gives in to the ethanol con (Washington Post)

Newsmakers: April 15, 2022: Rep. Randy Feenstra, R-Iowa, on E15 news and WOTUS discussions (Agri-Pulse)

Biden ethanol waiver a boost for area farmers, ethanol plants (Mankato Free Press)

Summertime E15 (AgInfo)

Fuel Industry Continues to Push Administration Over Year-Round E15 Sales (Convenience Store News)

VERIFY: Will Biden's summer ethanol waiver drop gas prices in south Texas? (KENS5; includes VIDEO)

Ethanol Report on E15 Waiver (Energy.AgWired.com; includes AUDIO)

President Biden commits to year-round E15 ethanol and pledges $4.3 billion in support of sustainable aviation fuels. (Biofuels Digest)

Amid record inflation, Biden waiving ethanol rule to counteract rising gasolene prices (The Jamaica Gleaner)

E15 Summer Waiver: Key Questions About the Market (Biofuels Digest)

E15 fuel does not pose a danger to the vast majority of vehicles on U.S. roads (PolitiFact)

Local ethanol producer reacts to year-round E-15 sale decision (Siouxland Proud)

Chairman David Scott Welcomes Announcement on Expansion of E15 Sales (U.S. House Agriculture Committee)

How Biden’s ethanol order is sparking worries about pollution (The Hill)

Gas prices show Biden too swift with energy transition, experts say (Washington Examiner)

Ethanol, Inflation and Biden’s Energy Policy -- Does it make sense to divert corn stocks to use more E15 gasoline? (Wall Street Journal)

Are President Biden’s efforts to bring down gas prices working? (WFLA)

Harris: Is expansion of ethanol in fuel wise or even ethical? (St. Louis Post Dispatch)

Ethanol gets a boost (News Press Now)

SUMMERTIME E15 SALES HAVE SOME LIMITATIONS (Brownfield Ag News)

USDA Awards $1.6 Million Biofuel Infrastructure Grant to Royal Farms to Expand Access to Higher-Blend Renewable Fuels for People in Rural Delaware and Maryland (U.S. Department of Agriculture)

MILLER-MEEKS: It's about time ethanol sales expanded (Oskaloosa Herald)

Opinion Guest Essay: Biden Has Already Done More for Rural America Than Trump Ever Did (New York Times)

Barnstorming for Summertime E15 (Ethanol Producer Magazine)

Oil, biofuels groups in talks with Fischer on E15 bill (Agri-Pulse)

Excerpt from Renewable Fuels Association: Unfortunately, many reporters and editorial boards covering the news swallowed the oil industry’s talking points—hook, line, and sinker—without bothering to check the facts or talk to third-party experts who could give an unbiased perspective. This was especially true when it came to the reporting on E15 and air quality. Numerous media outlets falsely reported that EPA had previously “banned” E15 sales in the summertime due to “smog concerns.”

A little bit of homework would have quickly led reporters to understand that E15 has lower volatility than today’s regular gasoline and reduces emissions of the pollutants that can lead to smog. Here are some other common facts that were routinely overlooked in media coverage of last week’s announcement:

- E15 was sold year-round in 2019, 2020 and 2021. Thus, allowing year-round sales of E15 in 2022 (as President Biden has pledged to do) is really nothing new. It will not place new or unexpected demands on the marketplace. Rather, the action will simply keep an existing market for ethanol (and corn) open, while also ensuring that consumers who have enjoyed three years of uninterrupted access to E15 will continue to have the choice to purchase E15 all year long in 2022.

- The real reason E15 sales were restricted in the summer (prior to 2019) is because the fuel was held to a far more restrictive vapor pressure standard than regular gasoline, the result of an antiquated regulation.

- As an oxygenate, ethanol has a long history of reducing smog and improving urban air quality.

- E15 offers a lower cost per mile traveled, even when its slightly lower energy density is considered.

- E15 reduces GHG emissions compared to regular gasoline.

- E15 is legally approved for use in more than 96 percent of all cars, pickups, SUVs, and vans on the road today.

- Not a single confirmed case of “engine damage” or inferior performance has been reported since E15’s introduction a decade ago.

- E15 is not being required or mandated in any way.

- Summertime E15 sales in 2022 will have little discernable impact on corn prices and no impact on food prices. READ MORE

Excerpt from Convenience Store News: NATSO, which represents truck stops, travel plazas and off-highway fuel retailers, and SIGMA: America's Leading Fuel Marketers, were among those commending the Biden Administration for permitting year-round sales of gasoline containing 15 percent ethanol (E15). The industry cautioned, however, that ongoing impediments related to infrastructure compatibility could limit market penetration of higher blends of ethanol being sold in the United States.

"We support removing unnecessary regulatory barriers to the sale of higher ethanol blends. E15 offers retailers an opportunity to diversify fuel options and improve gasoline's emissions characteristics while lowering costs for consumers and enhancing America's energy security," said David Fialkov, executive vice president of government affairs for NATSO, speaking on behalf of NATSO and SIGMA.

"Fuel retailers will continue to face obstacles to investing in E15, primarily in the form of infrastructure compatibility concerns and associated liability exposure. While [the] announcement is positive, until these obstacles are removed, they will impede the sale of higher ethanol blends."

Specifically, fuel retailers must grapple with a state-by-state patchwork of expensive infrastructure compatibility requirements, NATSO and SIGMA stated. Fuel retailers also face liability concerns if consumers misfuel their vehicles, potentially voiding their manufacturer's vehicle warranty, the trade groups added.

"The industry looks forward to working with the [Biden] Administration, lawmakers and all industry stakeholders to address these outstanding concerns," NATSO and SIGMA concluded.

The fuel retail industry has advocated for year-round E15 sales to help lower fuel prices for consumers while enhancing the industry's fuel options and improving the carbon intensity of those fuels. READ MORE

Excerpt from Biofuels Digest: Why can we not sell E15 in the summer?

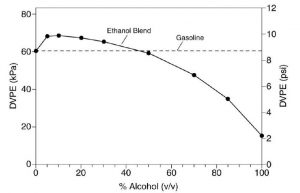

The answer to this goes back 22 years to the Clean Air Act Amendments of 1990. During the development of that legislation, Congress recognized the potential value of ethanol as a renewable fuel product that could displace some hydrocarbon fuels, reduce emissions, boost octane and potentially reduce costs. However, ethanol’s chemical properties increase the evaporative potential of gasoline when blended at lower concentrations. (The evaporative potential is measured in terms of Reid vapor pressure, or RVP, and reported as pressure in pounds per square inch, or PSI.)

We care about the RVP of gasoline because warmer temperatures increase evaporative emissions and contribute to more air pollution. Therefore, the Environmental Protection Agency requires gasoline during the summer months to be manufactured with a lower RVP to reduce emissions and benefit air quality. When Congress considered the future market for ethanol back in 1990, ethanol was typically blended at a volume of 10%. This concentration results in an increase of RVP equal to approximately one pound. Congress therefore included a provision in the Clean Air Act authorizing gasoline blended with 9% – 10% ethanol to exceed the regulatory RVP limit by 1 PSI. (There are exclusions to this, but in general this provision applies to two-thirds of the nation.)

Fast-forward to 2011 and the ethanol industry was successful in getting a partial authorization to blend gasoline with up to 15% ethanol. However, the Clean Air Act does not recognize E15 for purposes of the RVP waiver because it did not exist in 1990. Therefore, E15 is effectively prohibited from being sold during the summer months unless the gasoline into which it is blended is produced with a lower RVP to accommodate the RVP increase. This lower RVP gasoline is not required for the nearly ubiquitous E10, and with currently low volume demand for E15, refiners have had no incentive to produce a gasoline to meet this requirement.

Should we be able to sell E15 in the summer?

This is a very different question. The regulations developed at the direction of Congress in the Clean Air Act are clear – but they are also outdated and inconsistent with science. E15 in fact increases the RVP of gasoline less than E10 – as the volume of ethanol increases, its impact on evaporation goes down. But the law only provides the RVP waiver to E10 – again, this is because in 1990 no one anticipated the existence of E15.

...

The key takeaway from this ruling is that Congress must take action to revise the Clean Air Act. Doing this is a significant challenge since it opens the door to other efforts to change the Act from those who think it is not aggressive enough as well as those who think it is overly burdensome. Given the current political divide, the prospects for Congressional action appear to be relatively dim.

...

Can E15 lower pump prices?

The short answer is yes. When the Chicago Board of Trade closed on April 13, 2022, ethanol was trading for $2.137 per gallon. At the same time, gasoline (reported as RBOB) was trading for $3.29. At these prices, the wholesale price of E15 would be 5.7 cents per gallon lower than E10. Here is how the economics play out in terms of the wholesale price of fuel:

But this is only part of the story. Because ethanol satisfies the obligations of the federal Renewable Fuel Standard (RFS), each gallon is assigned a renewable identification number (RIN) and when blended with gasoline generates a credit. These credits can be sold to refiners to satisfy their obligation. The blender, quite often the retail company, can then use the value of these RINs to either reduce prices at the pump or supplement its profitability or a combination of each. RIN values can be quite volatile, ranging from $0.65 to $1.65 in 2021. Assuming RINs are valued at $1.10 (just for illustration purposes) and assuming the retailer applies the RIN credit to the retail price (which is not guaranteed or an easy thing to do), the price differential between the price advantage of E15 could expand to about 11.2 cents per gallon.

Will the waiver result in more E15 sold this summer?

The lack of the RVP allowance for E15 is a significant barrier to the market expansion of E15. However, from anecdotal information provided by several retailers it has not really affected volumetric sales from stations that offer the product. EPA has used it discretion to not actively enforce the RVP restriction on E15 and many retailers have continued to sell it during the summer months. While some have applied stickers to their dispensers saying that E15 in those months is only for flex fuel vehicles, others have chosen to not make that distinction.

That said, the issuance of an official waiver provides greater security to fuel retailers that they will not be subject to any enforcement action. It also protects them from a private lawsuit.

...

The waiver announced this week is being issued largely in response to increased prices as the pump, and ethanol can have a positive influence on this situation as demonstrated above. But ethanol also represents an opportunity to lower the carbon emissions associated with transportation.

Policy makers and industry leaders have determined that decarbonizing the transportation sector should be a priority, but how we address emissions from the existing fleet and future internal combustion engine vehicles (ICEV) is a daunting task. The most viable option right now is to reduce the carbon in the fuel these vehicles consume.

...

Unfortunately, regulations limit ethanol blend ratios primarily to 10% and, thereby, limit the carbon benefits that might be available. Increasing the sale of E15 from more retail facilities and opening the door to additional ethanol blend levels can increase the carbon mitigation contribution from ethanol.

This is not as easy as it sounds, however. Doing so will require a variety of regulatory changes as well as investments in fuel distribution infrastructure to accommodate higher blends. In addition, not all vehicles were designed to operate on these higher blends, so additional effort would be required to ensure the right fuel is used in the right vehicles. But if reducing carbon is a priority, then steps should be made to provide a lower carbon fuel, whether it be ethanol-based or not.

The bottom line is that ICEVs represent 99% of the vehicles in the United States and will continue to be a significant part of the transportation sector for decades. With 73% of ICEV greenhouse gas emissions generated during the combustion of fuel, the best way to reduce carbon emissions is by reducing the carbon intensity of the fuel.

The Fuels Institute is researching various paths that can lead to lower carbon emissions from the transportation sector. It is critical that the right solutions be applied to the right vehicle applications to expedite emissions reductions and benefit the end user. Ethanol has an important role in this effort – the outstanding question is how we can best leverage the opportunities is represents. READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Canary Islands

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia/Slovak Republic

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea (Republic of Korea)

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler/Ship

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.