by Kim Chipman, Tarso Veloso, and Michael Hirtzer (Bloomberg) ... One of the biggest concerns is that China shippers are adding UCO to fresh palm oil. Palm, the world’s most widely used vegetable oil, is a bane to environmentalists and many countries because the industry is a key driver of deforestation in places like Indonesia as well as tied to labor abuses.

The Environmental Protection Agency has had discussions with industry stakeholders, including the National Oilseed Processors Association, about concerns over increased imports of UCO and other food wastes, according to agency spokesman Nick Conger. He said the EPA is aware of the increased imports and that will be a factor in establishing volumes for and implementing the Renewable Fuel Standard Program, a law that mandates how much biofuel must be blended into the country’s fuel supply each year.

Under RFS, producers using UCO or animal waste such as beef tallow are required to keep records that vow the ingredients meet the legal definition of “renewable biomass” as well as describe the ingredient and identify the process used to obtain it.

“We are concerned that unless EPA and other agencies get a handle on this pretty quickly, it could potentially undermine the integrity of the Renewable Fuel Standard,” Geoff Cooper, chief executive officer of Renewable Fuels Association, said in an interview.

...

Clean Fuels Alliance America, which represents renewable diesel and sustainable jet fuel producers, has been directed by its board to look into the surge in UCO from China and the possibility of fraudulent gallons coming into the US.

“Our goal is to protect our members and combat any unfair trade that we find,” said Paul Winters, director of public affairs and federal communications. “We aren’t assuming practices are unfair just because there’s more trade,” he said, but the alliance wants to make sure home-grown feedstocks aren’t facing unfair competition from imports.

The surge in UCO imports is also a top issue for NOPA, the trade group representing US seed processing industries for soybeans, canola and other crops. CEO Kailee Tkacz Buller said the group has had talks with federal lawmakers and agencies including the EPA and US Department of Agriculture.

Asia is by far the world’s biggest UCO supplier, led by China. The European Union initiated a probe into Asian imports last year at the request of European biodiesel producers, but the request was dropped. While the producers didn’t explicitly provide a reason for the change, they noted that biodiesel shipments to the EU from China’s Hainan Island — a green-fuel hot spot — immediately stopped after the start of the investigation.

“There is plenty of suspicion and lots of stories and anecdotes floating around,” said Cooper. “It appears to be one of the worst kept secrets out there that this is happening.” READ MORE

Related articles

- Suspicious China cooking oil is hurting US biofuels business (The Business Times)

- Suspicious Chinese Frying Oil Hurting US Biofuels Business (Transport Topics)

- Flood of China Used Cooking Oil Spurs Call to Hike US Levies: Soybean group says imports from China are threat to US growers; Biden to increase levies on range of China products this week (Bloomberg)

- Suspicions of Fake China Cooking Oil Alarm US Biofuel Industry (Bloomberg)

- Biden’s Plan to Hit China With More Tariffs Is Mostly Symbolic (Bloomberg)

- Biden hiking tariffs on Chinese EVs, solar cells, steel, aluminum — adding to tensions with Beijing (Associated Press)

- RFA PRAISES BIDEN ADMIN’S TARIFF INCREASE ON CHINESE EVS (Brownfield Ag News)

- Soy oil plunges as Chinese feedstocks elude US tariff hikes (Bloomberg)

- GRASSLEY CONCERNED CHINA TARIFF RETALIATION WILL INCLUDE U.S. AG (Brownfield Ag News; includes AUDIO)

- DC slammed Trump’s tariffs. Biden’s decision to keep them draws a very different reaction. The response offers yet another reminder of just how much the U.S. political consensus has shifted against free trade. (Politico Pro)

- U.S. Biofuels Maker Defends UCO From China (AgWeb)

- U.S. Imposes Sweeping Tariffs on Chinese Tech Imports: Solar Cells, Batteries, EVs, and More (Kilpatrick Townsend & Stockton)

- Sen. Chuck Grassley Pushes Back on Tariffs, GREET Model (AgWeb; includes AUDIO)

- US Biofuel Markets Are in Turmoil Over Imports From China: A surge in used cooking oil from overseas is pitting American farmers against green-fuel producers. (Bloomberg)

- Do we need a biofuel police? (EurActiv)

- Grassley Blasts Imports of Chinese Used Cooking Oil, Undercutting US Biofuels (American Ag Network/NAFB News Servic)

- Senator Marshall Leads Letter Addressing Concerns on Used Cooking Oil Imports from China (Office of Senator Roger Marshall R-KS)

- Senators' letter

- Senators Press Federal Agencies On Concerns Over Fraudulent UCO Imports (Biomass Magazine)

- US Senators Query EPA on Possible Fake Chinese Used Cooking Oil: Bipartisan group is concerned about possible biofuel fraud; Imports could contain virgin oil fueling deforestation (Bloomberg)

- UCO (Unknown Cooking Oil): High hopes on limited and suspicious materials (Transport & Environment)

- European and US used cooking oil demand increasingly unsustainable – analysis (Biofuels Central)

- Limit Biofuel Tax Credit to US Producers, Lawmakers Tell Yellen (Bloomberg/Yahoo!)

- Exclusive: US EPA says it is auditing biofuel producers' used cooking oil supply (Reuters)

- EPA Probes Biodiesel Supply Chains as Fraud Concerns Mount: Audits seek to track source of used cooking oil in biodiesel; Some fear used oil flooding US contains illegal ingredients (Bloomberg)

- EPA Auditing Waste Oil Claimed in RFS: EPA Confirms Investigations of Biofuel Producers Using Waste Cooking Oil (DTN Progressive Farmer)

- EPA investigating used cooking oil imports for fraudulent biofuel production (KFGO)

- U.S. EPA Investigates Biodiesel Supply Chains as Concerns Grow on Feedstock Sources (Maritec)

- US imports of Chinese used cooking oil set for new record, future uncertain (Reuters)

- The Big Gorilla Is Gone And The Consequences Are Here (AgWeb)

- Gulke: A Look At How Tariffs Could Change Demand: The question becomes whether threats of tariffs include barring used cooking oil imports outright or merely tariffing the product, especially from China. (AgWeb)

- US farmers protest against climate law loophole subverting green fuel crops (SkyNews)

Excerpt from Bloomberg: A group that represents the biggest US soybean processors, including Cargill Inc., Bunge Global SA and Archer-Daniels-Midland Co., wants the levies to be higher than the current 15.5% rate, according to a notice the National Oilseed Processors Association, or NOPA, sent to its members over the weekend that was seen by Bloomberg.

NOPA Chief Executive Officer Kailee Tkacz Buller said the memo was sent in response to rumors of possible additional tariffs being applied on used cooking oil. Association members support a boost on par with other clean energy sources, such as electric vehicles and solar, to level the playing field, Buller said in an email.

Soybean crushers worry a flood of used cooking oil imports from China is weakening demand for US crop-based ingredients that can be used to make renewable diesel and sustainable aviation fuel. There’s also widespread, unconfirmed speculation the used oil from Asia may not be authentic and instead is mixed with fresh vegetable oils, such as palm, potentially distorting commodity values and undermining US biofuel laws.

China’s exports to the US of processed animal and vegetable fats and oils — a category that includes used cooking oil — reached $201 million in the first three months of this year, versus $770 million in the whole of 2023, Chinese customs figures compiled by Bloomberg show. That compares to about $47 million worth of shipments in 2022 from April onward, when the data begins.

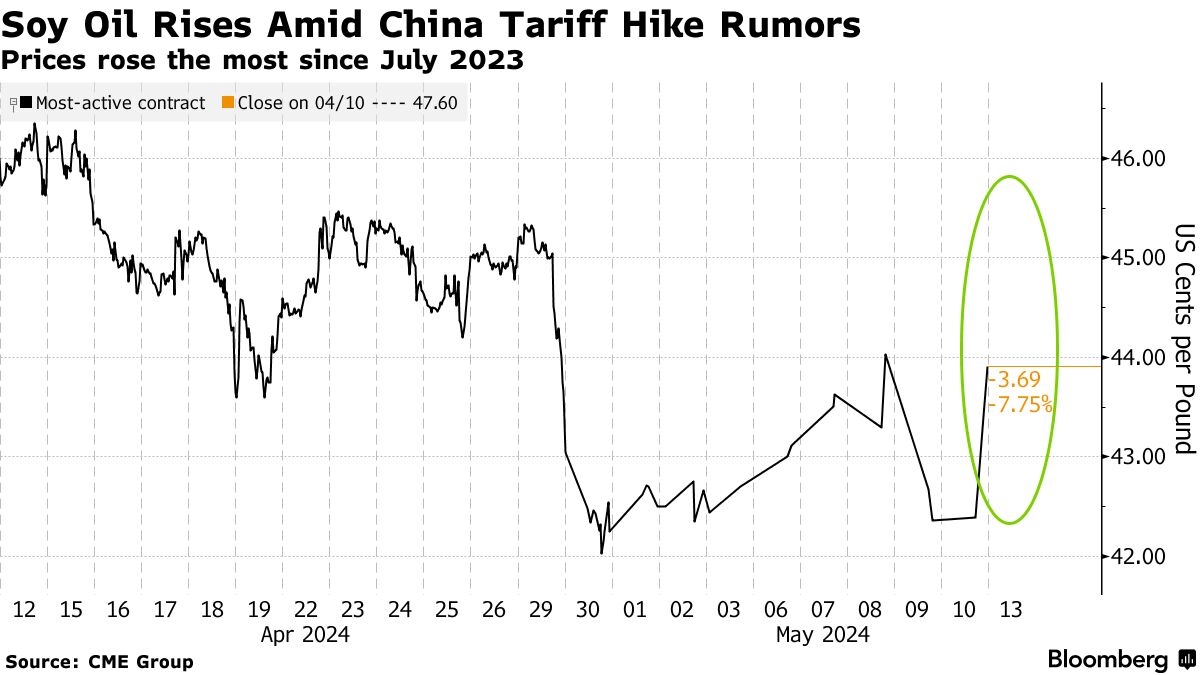

Soy oil values are down so far this year, though futures in Chicago have seen an uptick in the last couple of trading days as commodities traders await tariff news. Biden on Tuesday is expected to unveil an increase in some levies first imposed under former President Donald Trump. It’s not known if the announcement will include used cooking oil.

White House officials declined to comment..

Tariffs on used cooking oil would add to other incoming US trade measures against Chinese goods. Biden will quadruple tariffs on Chinese electric vehicles and sharply increase levies for other key industries, Bloomberg News reported this week. Semiconductors have been another key battleground.

The 2024 presidential race looms large over the moves: Biden is trying to crack down on China and differentiate himself from Trump.

...

The increased imports also jeopardize plans to ramp up US crushing capacity amid a flurry of government incentives aimed at making lower-carbon fuels to help fight climate change. READ MORE

Excerpt from Associated Press: The tensions go far beyond a trade dispute to deeper questions about who leads the world economy as a seemingly indispensable nation. China’s policies could make the world more dependent on its factories, possibly giving it greater leverage in geopolitics. At the same time, the United States says it’s seeking for countries to operate by the same standards so competition can be fair. READ MORE

Excerpt from Brownfield Ag News: Geoff Cooper, president and CEO of the Renewable Fuels Association, says the increase will also impact advanced batteries and solar cells. He tells Brownfield it’s a positive move for the US biofuels industry.

“Hopefully this signals more openness on the part of the Biden administration to look to biofuels like ethanol and other renewable fuels to help achieve the goals of reducing greenhouse gas emissions and combating climate change.”

Cooper says there are some concerns China will look to retaliate. “Obviously, China is an important and large market for many US products, including agricultural products,” Cooper said. “There again, we’ve not been able to export ethanol to China, or distillers grains for that matter, for a number of years because of protectionist barriers that that country has in place.”

The White House says the tariffs will be rolled out over the next three years. READ MORE

Excerpt from AgWeb/Pro Farmer: Darling Ingredients Inc., a major U.S. producer of renewable diesel, defended imports of used cooking oil (UCO) as a feedstock to produce biofuels. An increase in UCO shipments from China has stirred speculation that some imports may not be authentic and instead are mixed with fresh vegetable oils, potentially undermining U.S. biofuel laws.

Chinese imports are “a legitimate source of used cooking oil,” Darling Chief Executive Officer Randall Stuewe said, noting that there are 12.6 million restaurants in China and only 700,000 in the United States. “That doesn’t mean there aren’t some bad actors out there, but at the end of the day there are legitimate suppliers,” Stuewe said at the BMO Global Farm to Market conference in New York.

Darling, a food ingredient seller, produces renewable diesel through its Diamond Green Diesel partnership with Valero Energy Corp. Stuewe noted Diamond Green’s first sustainable aviation fuel (SAF) plant under construction in Port Arthur, Texas, is close to being completed. He didn’t provide projected date for starting SAF production at the plant. READ MORE

Excerpt from Bloomberg: Now, some agriculture groups are calling for government action, including higher tariffs, to curb the wave of shipments.

But fuel makers warn of government overreach that would likely crimp already tight supplies of low-carbon feedstocks at a crucial time for the industry.

Measures such as tariffs would be “short-sighted” and amount to playing “protective politics,” said Michael McAdams, president of the Advanced Biofuels Association. It’s better to “allow the feedstocks to move around the world where they can best be used.”

...

It’s a classic faceoff between commodity producers and raw-material buyers, and adds to deep divisions over jet-fuel mandates, palm oil supply and other thorny issues debated this week at multiple industry gatherings.

Biofuel makers and feedstock providers also are awaiting details on a new production tax credit set to kick in next year. Trade groups ranging from aviation to renewable gas producers wrote this week to Treasury Secretary Janet Yellen, urging her to give guidance.

Regulatory murkiness and global competition are among reasons why US bio-based diesel is poised to face its biggest test since the industry first took shape three decades ago, according to Tore Alden of cross-commodity price reporting agency Fastmarkets.

“Secure your feedstock supply and secure it now,” Alden said at a conference held by his firm in Chicago this week. “The next three to five years are going to be different. Challenging.” READ MORE

Excerpt from EurActiv: At the Transport and Energy Council on Thursday (30 May), France, Germany and the Netherlands called the European Commission to launch controls in third countries to reinforce measures against imports of fraudulent biofuels.

The Hague, Berlin and Paris urged the bloc’s executive to intensify the ongoing investigation on Chinese biodiesel exports to the EU and take “strong corrective actions to prevent the entry of fraudulent biofuels,” a note of the three delegations seen by Euractiv states.

The three-member states proposed strengthening controls on production plants “wherever they are located in the world.” If operations do not accept the EU officials’ inspection, authorities should refuse the biofuel sustainability certification, preventing exports to the EU from that plant, the delegations proposed.

A biofuel police is an unprecedented proposal to tackle fraud in used cooked oils imports, one of the unintended consequences of the EU and global efforts to make aviation and transport more sustainable.

Used Cooking Oil (UCO) is one of the simplest raw material to produce advanced biofuels, meaning those not obtained from feed and food crops.

And it was one of the cheapest options: according to data collected from the agricultural think tank Farm Europe, in 2017 a ton costed €800, while in 2022 the price had reached €1400 per ton.

It’s the effect of a skyrocketing demand pushed by the race to produce sustainable aviation fuels. According to a recent report of the NGO Transport & Environment, European UCO consumption more than doubled in 2015-22.

Nearly 80% of those products used in EU planes, trucks and cars, is imported, and 60% of the imports are from China.

High demand has already triggered frauds, on which the EU and national authorities are investigating. Labelling normal vegetable oil (such as palm oil) as used oil, is the easiest way to take advantage of strong demand and inflated price.

This has a double impact: biofuel from crops replace those made from waste, neutralising the intended benefits for climate and environment, and third countries companies compete unfairly with the EU ones.

“[We] hope that the European Commission will follow up”, Farm Europe stated in an email supporting the initiative of Germany, France and the Netherlands.

Among other recommendations, the agricultural think tank calls for “suspending imports from third countries suspected of fraud,” in “particular China” and strengthening the EU certification mechanism. READ MORE

Excerpt from Office of Senator Roger Marshall (R-KS): U.S. Senator Roger Marshall, M.D. led a letter to the Environmental Protection Agency (EPA), the United States Department of Agriculture (USDA), U.S. Customs and Border Protection (CBP), and the United States Trade Representative (USTR) concerned with the recent and dramatic increase in used cooking oil imports from China.

Recent news coverage has suggested that large amounts of these imports could potentially be virgin vegetable oils fraudulently labeled as used cooking oil and sent here to exploit tax incentives and other renewable biofuels incentives. This dramatic shift in imports is a contributing factor driving down prices for oilseeds in America’s heartland. Senator Marshall was joined by Senator Brown (D-OH), Pete Ricketts (R-NE), Deb Fischer (R-NE), Chuck Grassley (R-IA), and Joni Ernst (R-IA) in sending the letter.

“Since 2020, in response to demand for renewable fuels, the U.S. has gone from importing less than 200 million pounds of UCO per year to importing over 3 billion pounds in 2023, with more than 50 percent of these imports coming from China,” the Senators stated in the letter. “As evidenced in recent news coverage, there is concern by some in the renewable fuels industry that large amounts of imported UCO may be a blend of UCO with virgin vegetable oils such as palm oil, which is directly linked to deforestation in Southeast Asia. This would constitute fraudulent value distortion of the commodity designed to take advantage of U.S. tax incentives in addition to Renewable Identification Number (RIN) fraud under the RFS. If true, this would have an especially punitive effect on U.S. agriculture, as imported UCO bears a lower carbon intensity score than domestically produced agricultural feedstocks, which incur punitive and unnecessary indirect land use change penalties in state and federal programs, as well as onerous verification and reporting requirements required of farmers to validate carbon-friendly practices.”

The Senators further said, “Given the fact that USDA and EPA have a role in developing renewable fuels policy, including through the agencies’ roles in helping the IRS and U.S. Treasury Department to create the guidance for tax credits for renewable fuels, you have a clear responsibility to advise the Administration on these matters and help maintain the integrity of the entire clean fuels programs by ensuring American tax dollars are not subsidizing the import of counterfeit feedstocks. USTR and CBP also have a clear role in policing imports to ensure that foreign entities are not mislabeling their products when bringing them into the country.”

You may click HERE or scroll below to read the Senators full letter.

The Honorable Michael S. Regan

Administrator

The Honorable Tom Vilsack

Secretary

United States Department of Agriculture

The Honorable Katherine Tai

United States Trade Representative

The Honorable Troy A. Miller

Office of the Commissioner

Dear Administrator Regan, Ambassador Tai, Secretary Vilsack, and Mr. Miller;

We write to inquire about actions the Biden administration is taking to address concerns regarding the increased imports of used cooking oil (UCO) into the U.S. and the potential to exploit tax incentives by foreign actors. The U.S. Department of Agriculture (USDA), Environmental Protection Agency (EPA), U.S. Trade Representative (USTR) and Customs and Border Protection (CBP) all have a role to play in ensuring the legitimacy of goods brought into the U.S., particularly goods being brought in explicitly to address the sustainability goals of this administration which are funded by taxpayer dollars.

The biofuels industry in the United States has long bolstered rural economies, diversified our liquid fuels, strengthened our national security, and reduced carbon emissions from our transportation sector. We recognize there are multiple issues that are artificially depressing values for oilseeds in America’s heartland which need to be addressed, including a growing reliance on imported foreign finished biofuels, which is a long-held drawback of the soon-to-be-retired Biodiesel Blenders Tax Credit, and the need to bolster Renewable Fuel Standard (RFS) volumes for biomass-based diesel and advanced biofuels. However, we have been made aware of another issue negatively impacting domestic biofuel feedstock producers.

Since 2020, in response to demand for renewable fuels, the U.S. has gone from importing less than 200 million pounds of UCO per year to importing over 3 billion pounds in 2023, with more than 50 percent of these imports coming from China. As evidenced in recent news coverage, there is concern by some in the renewable fuels industry that large amounts of imported UCO may be a blend of UCO with virgin vegetable oils such as palm oil, which is directly linked to deforestation in Southeast Asia. This would constitute fraudulent value distortion of the commodity designed to take advantage of U.S. tax incentives in addition to Renewable Identification Number (RIN) fraud under the RFS. If true, this would have an especially punitive effect on U.S. agriculture, as imported UCO bears a lower carbon intensity score than domestically produced agricultural feedstocks, which incur punitive and unnecessary indirect land use change penalties in state and federal programs, as well as onerous verification and reporting requirements required of farmers to validate carbon-friendly practices.

We understand there are good actors utilizing UCO as part of a diverse array of feedstocks in their renewable fuel production, and domestic sources of UCO are held to rigorous verification and traceability requirements. However, we are concerned with the lack of transparency surrounding the United States’ efforts in the area of verifying imported UCO, specifically as it relates to 1) ensuring the integrity of the imported UCO by validating that traceability requirements have been met; and 2) evaluating the chemical composition of the imported UCO. The Biden administration has created vigorous standards to verify, not just trust, American producers, and it is imperative that the same scrutiny is applied to imported feedstocks.

Several years ago, Europe was importing large amounts of UCO from China, but it found a large number of cases of fraudulent activity to receive preferential treatment. Last year, an EU-funded Transport & Environment report found that these concerns necessitated greater scrutiny on imports to prevent the mislabeling of UCO. This increase in focus on the integrity of the imported UCO coincides with a steep decline in European imports and increased imports into the United States.

So far, the increase in demand for UCO has been driven by clean fuel policies, particularly in states like California, Oregon and Washington, and this demand will only be amplified when clean fuel tax credits from the Inflation Reduction Act (IRA) are fully implemented. While maintaining the integrity of feedstocks and renewable fuels should be of paramount importance to states with clean fuels policies, it is even more vital that the federal government prevent counterfeit imported feedstocks from being incentivized by American tax dollars as such tax credits are implemented.

Given the fact that USDA and EPA have a role in developing renewable fuels policy, including through the agencies’ roles in helping the IRS and U.S. Treasury Department to create the guidance for tax credits for renewable fuels, you have a clear responsibility to advise the Administration on these matters and help maintain the integrity of the entire clean fuels programs by ensuring American tax dollars are not subsidizing the import of counterfeit feedstocks. USTR and CBP also have a clear role in policing imports to ensure that foreign entities are not mislabeling their products when bringing them into the country. Given these responsibilities, I ask each of these agencies to answer the following questions:

1. Considering the suspicions levied in recent news coverage, can you confirm product imported from China classified under Harmonized Tariff Schedule (HTS) subheading 1518.00.4000 is meeting the specifications for classification under that provision, or is China exporting virgin vegetable oils to the U.S. as counterfeit UCO?

2. What actions are currently taken to determine the integrity of Chinese UCO as a feedstock? Provide details on frequency and process for government audits.

3. Provide the current Customs protocols for determining the suitability of Chinese UCO for importation into the United States.

a. What is the current process for Customs to determine the legitimacy of imported UCO?

b. What percentage of shipments of UCO are verified and validated?

c. Are all verification records made readily available by the importer without specific investigation by CBP?

4. If it is found that these imported products are being mislabeled as UCO, how will you ensure they are not beneficiaries of the Clean Fuel Production Credit?

I appreciate your swift attention to this matter and look forward to receiving your response not later than thirty days from the date of this letter.

Sincerely,

Roger Marshall, M.D. Sherrod Brown

United States Senator United States Senator

Pete Ricketts Deb Fischer

United States Senator United States Senator

Chuck Grassley Joni Ernst

United States Senator United States Senator

Excerpt from Reuters: The U.S. Environmental Protection Agency has launched investigations into the supply chains of at least two renewable fuel producers amid industry concerns that some may be using fraudulent feedstocks for biodiesel to secure lucrative government subsidies.

EPA spokesperson Jeffrey Landis told Reuters that the agency has launched audits over the past year, but declined to identify the companies targeted because the investigations are ongoing.

...

But fears have been mounting that some supplies labeled as used cooking oil are actually cheaper and less sustainable virgin palm oil, a product that is associated with deforestation and other environmental damage.

...

The issue came into focus following a surge in used cooking oil exports from Asia in recent years that analysts have said involves unrealistically high volumes relative to the amount of cooking oil used and recovered in the region. The European Union is also investigating feedstocks over the fraud concerns.

The EPA audits began after the agency updated domestic supply-chain accounting requirements in July 2023 for renewable fuel producers seeking to earn credits under the RFS, he said.

"EPA has conducted audits of renewable fuel producers since July 2023 which includes, among other things, an evaluation of the locations that used cooking oil used in renewable fuel production was collected," he said. "These investigations, however, are ongoing and we are not able to discuss ongoing enforcement investigations."

U.S. senators from farm states have called for more oversight of biofuel feedstocks, saying federal agencies should be as rigorous in verifying imports as they are auditing domestic supply chains.

...

Another letter from 15 senators to the Treasury Department on July 30 urged the administration to exclude imported feedstocks like UCO from an additional clean fuel tax credit program passed in the Inflation Reduction Act. READ MORE

Excerpt from DTN Progressive Farmer: "For a little context, used cooking oil falls into the 'yellow grease' category in the Energy Department's monthly report of biofuel feedstocks used," (DTN Lead Analyst Todd) Hultman said.

"In the first five months of 2024 (the most recent data), yellow grease used to make biofuels averaged 610 million pounds a month, up 17% from the same period a year ago. By comparison, soybean oil used to make biofuels averaged 1.004 billion pounds in the first five months of 2024, up 3% from the same period a year earlier."

Used cooking oil and tallow have seen significant gains as feedstocks used to make biofuels during the past 18 months.

Sustainable aviation fuel guidelines released in late April make used cooking oil an especially popular feedstock, Hultman said, as it has one of the lowest carbon scores of eligible feedstocks.

"Because it is considered a waste product, it does not have the same burdensome production requirements found with corn ethanol and soybean oil," he said.

"There is also a temptation for used cooking oil providers to find inexpensive ways to turn soybean oil into used cooking oil."

Last month, several agriculture interest groups asked U.S. Treasury Secretary Janet Yellen to include a domestic-feedstock requirement in upcoming guidance on the 45Z Clean Fuel Production tax credit.

The letter, signed by the American Farm Bureau Federation, National Corn Growers Association, National Farmers Union and the American Soybean Association, said that without such a requirement, the benefits of the policy "are at risk of being diverted" from American farmers. READ MORE

Excerpt from Maritec: The U.S. Environmental Protection Agency (EPA) has launched investigations into the supply chains of at least two renewable fuel producers amid industry concerns that some may be using fraudulent feedstocks for biodiesel to secure lucrative government subsidies. The action by the EPA comes as farm groups and a growing number of lawmakers press the government to address worries that Used Cooking Oil (UCO), a valuable ingredient for making renewable fuels, could be fraudulent.

The Investigation:

The investigations primarily focus on auditing UCO supply chains of domestic renewable fuel / biofuel producers to verify whether the feedstock qualifies under the Renewable Fuel Standard (RFS).

The audits seek to track the source of the UCO following the suspicions that the UCO supply entering from Asia may not be authentic and is instead being mixed with fresh vegetable oils, such as palm oil, which is potentially distorting commodity values and undermining US biofuel laws.

Palm Oil, one of the world’s most widely used vegetable oils, is a significant pain point to environmentalists and many countries because the industry is tied to labor abuses and is a key driver of deforestation and environmental damage.

The production of biodiesel from sustainable ingredients can earn refiners a string of state and federal environmental and climate subsidies, including tradable credits under the RFS programme. But the mounting fears that the supplies/renewable fuel sources are tainted with much less sustainable virgin palm oil would sit in violation of the RFS programme.

In similar news reported, governments in France, Germany and the Netherlands also recently called on the European Union (EU) to adopt stricter checks on overseas suppliers of biofuel as the EU investigates allegations of fraud in imports from Asia. This too arose from concerns on whether the fuel can be truly deemed certifiably sustainable, given the adverse environmental damage caused through their actual harvesting practices.

Conclusion:

While the EPA investigations are ongoing and yet to be concluded, this latest probe by the U.S. EPA is reflective of the prevalent global shift towards driving robust sustainable practices across borders and industries. To achieve justifiable sustainability, upholding sustainability standards in every aspect of the supply chain is central to the core principles of programmes such as the RFS. READ MORE

Excerpt from Reuters: U.S. demand for UCO driven by biofuel incentives; EU tariffs on Chinese biodiesel boost U.S. imports; uture U.S. policy changes create uncertainty for Chinese UCO exporters

U.S. imports of used cooking oil (UCO) from China are set to hit a record in the months ahead, even as regulatory uncertainty casts doubts over longer-term prospects of a trade that boomed last year, according to market participants.

U.S. demand for UCO, a feedstock for biofuels like renewable diesel, has surged as federal and state governments launched incentives to support the industry as they aim to decarbonize transportation. That sparked such a frenzied rush to build new renewable diesel plants that U.S. capacity more than doubled from 2021 to 282,000 barrels per day in 2023, according to government data.

The rapid surge flipped the U.S. from a net exporter of UCO until 2021, to a net importer since 2022. U.S. imports surpassed 1.36 million metric tons (mt) last year, up from about 400,000 mt in 2022, the data showed.

"Demand for UCO from U.S. renewable diesel producers has grown much faster than domestic supply," said Duane Dunlap, owner of renewables consultancy DNS Enterprises.

...

The supply gap has been readily filled by Chinese exporters, who needed a new outlet as demand from their top buyers in Europe shrank from mid-2023 amid complaints of artificially low prices that led to a European Union investigation. The EU began imposing tariffs on Chinese biodiesel imports this month.

Imports from China made up half of all the UCO purchased by U.S. refiners last year, compared to a 0.1% share in 2022, customs data showed. This year through June, China accounted for roughly 60% of the roughly 1 million mt of UCO imported by the U.S., the data showed.

EU tariffs will likely lift UCO shipments from China to the U.S. even further in the months ahead, two senior biofuel traders in Singapore said.

MIXED DEMAND SIGNALS

The U.S. biofuels market is set to undergo major changes next year as the government prepares to transition from a program that rewards producers based on output volumes to a qualitative system that will award tax credits based on the fuel's carbon intensity.

...

Since UCO is otherwise a waste product, its carbon footprint is lower than alternative biodiesel feedstocks, such as soybean oil and canola oil. That makes UCO more attractive for producers.

However, lobbyists representing U.S. farm-states have called for an extension of the existing tax credits as prices for their commodities have slumped under the weight of lower-cost UCO imports. A bipartisan bill, opens new tab to extend the volume-based system through next year was introduced in the U.S. House of Representatives last month.

Similar efforts have resulted in multiple extensions of the current system over the past decade. The credits were set to expire at the end of 2022, before the Inflation Reduction Act extended them through the end of this year.

Farmers' groups and lawmakers have also raised concerns over allegations that some Chinese UCO supply could be tainted with virgin palm oil, a product linked to deforestation.

The U.S. Environmental Protection Agency confirmed earlier this month that it has been auditing supply chains of at least two U.S. renewable fuel producers amid concerns of fraudulent feedstock usage.

U.S. trade policy could also shift dramatically following the November presidential election in the country, which is creating uncertainty for Chinese UCO exporters, one of the Singapore-based traders said.

Aside from the recent boom in UCO trade, other relations between the world's two biggest economies have been increasingly strained in recent years. Both sides have lobbed tit-for-tat tariffs on each other's imports since 2017.

Republican nominee Donald Trump's vice presidential running mate J.D. Vance last month called China the "biggest threat" facing the United States.

Another major upheaval for the global UCO trade will come from Beijing's widely anticipated announcement of Sustainable Aviation Fuel (SAF) production targets. Since SAF also uses UCO as a feedstock, China's push into that market could dry up its UCO export capacity in about five years, one of the traders in Singapore said.

"There is a lot of uncertainty right now surrounding future policymaking, but as long as the U.S. does not ban it — which we see as unlikely in the short-term - UCO imports will grow," said Zander Capozzola, vice president of renewable fuels at AEGIS Hedging.

"It's just a question of where these imports will come from." READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Canary Islands

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia/Slovak Republic

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea (Republic of Korea)

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler/Ship

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.