by Chris Bennett (AgWeb) ... On Sept. 2, 2025, a telltale farm meeting went nuclear. Field representatives from the offices of Sen. Tom Cotton, Sen. John Boozman and Rep. Rick Crawford, along with a rep sent by Gov. Sarah Sanders, initially intended to speak with a handful of growers in Brookland, Ark.

Instead, 400-plus farmers packed the house to overflow on a Tuesday — despite the pressing demands of rice and corn harvest and a mere three days’ notice — and unleashed a chain of grievances.

Where does blame lie? Where to begin digging for a long-term solution?

Amid the fallout of the Sept. 2 meeting, three farmers sound off on markets, monopolies, moratoriums and mismanagement in U.S. agriculture. They spare no sacred cows.

Adam Chappell: “This is the Worst Economy of My Lifetime ...”

Denial ain’t just a river in Egypt, says Adam Chappell. “Year after year of sweeping all this s*** under the rug and pretending it’s not happening has got us to this point. Years of barely squeaking by, surviving with a bailout and then doing it all again. That is the definition of insanity.”

Growing 2,400 acres of soybeans, rice, and corn in east Arkansas’ Woodruff County, Chappell, 46, accuses USDA of head-in-the-sand policy: “I’m sick of USDA graphs saying agriculture income is set to rise. They’re baking cattle and coming payments into their recipe and pretending things are good. Bulls***.”

...

The entire agriculture industry — a bedrock of U.S. security — rests squarely on the shoulders of the American farmer. Ironically, that same farmer is the only player in the ag chain who cannot pass costs down the ladder.

Blame partially belongs on “Big Ag,” Chappell contends.

“Seed, chemicals or fertilizer, it’s all in the hands of a few companies that are the only game in town. You want to fix farming? Start a federal investigation on those big companies. Booming quarterly earnings and big stock dividends make no sense when farmers can’t pinch a penny.”

...

Behind closed doors, away from microphones and cameras, Chappell says federal politicians acknowledge “monopoly influence.”

...

Kenneth Graves: “At Every Level of Agriculture, There Must Be a Reckoning.”

The Sept. 2 farm meeting, held a stone’s throw outside Jonesboro at Woods Chapel Baptist, was monumental, says retired Dewitt grower Kenneth Graves, 71. “I’d say 400 people or so showed up, maybe more. We’re talking about people standing outside the building in the middle of harvest. That tells you all you need to know.”

...

Graves, chairman of the Arkansas Rice Growers Association, understands severe hardship. He farmed through the anemic ag crisis of the 1980s. However, the current unrest is a “coming disaster” unlike anything he’s witnessed across a 50-year career: “I’ve never seen this kinda look in farmers’ eyes. It’s fear. And it’s based in undeniable facts.”

In August 2025, Graves sent an open letter to media and politicians, pleading for attention to eye-popping numbers

...

Banks are forecasting farm bankruptcies at 25% to 40%, and the dirty secret is out. Everyone knows it; everyone feels it.”

How does the industry even begin to crawl out of the hole? Start with markets, Graves urges.

...

Graves advocates for immediate political intervention. “I’m urging legislators at all levels to act now,” he says. “We’re talking about our food and agriculture security, and when that tanks, the economic effect will spill over every rural region in the country.

...

“It’s past time to act. Our politicians either recognize this now or let us be some other country’s economic hostage later.”

Bailey Buffalo: “Farmers, Not the Giant Agriculture Manufacturers, Are the Ones Hurting.”

Adios to fifth- and sixth-generation farmers?

Yes, says Bailey Buffalo, 40, owner of Buffalo Grain Systems in Jonesboro, and president of Farm Protection Alliance.

“Horror stories. The pain is unreal. Worst farming situation I’ve seen in my life,” Buffalo says. “Look at Extension [University of Arkansas] numbers — corn growers losing $240 per acre; soybeans losing $144 per acre; and rice losing $380 per acre. The cotton growers may be worst of all.”

...

Storms can be weathered during agricultural tumult, Buffalo maintains — except when a thumb rests on the scale. Consolidation, he says, has turned a market rut into a debacle.

“Basic macroeconomics (CR4) tells us that if the top four competitors in any sector control more than 40% of the market, abuses become likely and that sector is approaching a monopolistic risk. That’s where I believe we’re at in farming,” he explains. “We can’t climb out of this mess partly because we’re at the mercy of agriculture monopolies.

...

Despite Buffalo’s alarm, the input market contains exceptions, he notes: “I can name small seed suppliers and fertilizer suppliers who are providing very high-quality products at fractions of what those much larger corporations are charging. The farmers just have to put the extra work into finding them and into getting their orders in early as possible. They are proving that it’s possible for small operations to sneak into corners of the market.”

Yet, exceptions do not move the overall dial.

...

Bailout cash is a “gross Band-Aid,” according to Buffalo.

“The subsidies send farmers back to the pit, over and over. The money trickles to lenders, loans, suppliers, banks or somewhere else in chain. Bailouts are the same as kicking the can down the road,” he adds.

...

In his opinion, the following four changes are in order:

1. Start with monopolies. “State constitutions have anti-trust legislation. Create smoke at the state level and force USDA and the feds to follow.”

2. Put an indefinite moratorium on all mergers and acquisitions in the food and ag sectors. “End consolidation and demand long-lasting change.”

3. Get a handle on D.C. lobbyists. According to a 2024 report, Cultivating Control: Lobbying by the agribusiness sector has steadily increased: In just the last five years, the agribusiness sector’s annual lobbying expenditures have risen 22%, from $145 million in 2019 to $177 million in 2023. And each year, agribusiness spends more on federal lobbying than the oil and gas industry and the defense sector.

A five-year “cooling off” lobbying period should be set in stone for any government official exiting office, Buffalo says: “Defense, SEC going to Wall Street, any of them, including agriculture. You should never, never be allowed to retire from an ag committee in Congress and then run over to a board at Tyson, Cargill, ADM, John Deere or any other company.”

4. The grain industry must diversify. “I think diversification must be part of any solution. I’m talking about an effort to grow all our food in this country. Our grain goes to feed and ethanol, but we need a structure to grow our own edible food as well, and protect our national security like never before.”

...

“Right now, if I was to walk into Congress and ask all the senators and reps, ‘Who thinks the agriculture industry is hurting to the point of collapse?’ all the hands would go up. Instead, the question should be, ‘Who thinks farmers are hurting to the point of collapse?’”

“There’s a giant difference between the two questions, and that difference is indicative of the separation between local Ag and Big Ag,” Buffalo concludes. “Farmers, not the giant agriculture manufacturers, are the ones hurting to the point of going belly up. There’s no solving any of this until that difference is recognized.” READ MORE

Related articles

- Making a Profit on Biofuels at Goldilocks Oil Prices (Parts 1, 2 and 3) (Atlantic Biomass)

- Farmers' loyalty to Trump is about to be tested -- The agriculture industry has stuck by the president even as his trade wars have hit their bottom lines. This fall harvest may see the limits of the their patience. (Politico)

- American farmers warn this year feels especially dire. What happens next? Farmers say lower prices for crops like corn and soybeans and rising operating costs are squeezing profits. (USA Today)

- Majority of Corn Farmers See Economic Crisis Brewing (Agri-Pulse/Successful Farming)

- Farmers Alarmed: U.S. Nearing Agricultural Economic Crisis — Steps to Reverse Course (AgWeb)

- A once-in-a-generation economic crisis in rural America means this year could be the last one for many farmers as Trump-Xi call offers no relief (Fortune)

- Enough whiplash: Farmers deserve stable, growing markets, including SAF | Opinion (American Carbon Alliance/Des Moines Register)

- SAF supplies an America-first energy future for Iowa's farmers | Opinion (Iowa Corn Growers Association District 9/Des Moines Register)

- This harvest could break records, but it's unlikely to be profitable for corn and soybean farmers (Iowa Public Radio)

- Kansas Soybean Association concerned about farm bankruptcies (KSN TV; includes VIDEO)

- Ag Lender Warns Farm Finances Under Greatest Stress Since the 1980s: With most input prices still record or near-record high, farmers in parts of the country have seen eroding balance sheets for four straight years. Now the concern is more farmers will be forced out of farming this year, unless they see some type of market or government intervention. (AgWeb)

- The 4-alarm fire in farm country (Prairie Farmer)

- Ag groups press officials to use critical minerals list to cut fertilizer prices (Agri-Pulse)

- Survey High: 91% of Ag Economists Say Crop Sector in Recession, Losses Likely Through 2026 (AgWeb)

- How Will The Ag Economy Climb Out of Its Bottom? There’s light at the end of the tunnel, but we might not see it completely turn around for two to three years,” says Grant Gardner, University of Kentucky ag economist. (AgWeb)

- First-Generation Farmers Set for Day of Reckoning as Agriculture Crisis Deepens? Wisconsin farmer says “wolf is at the door” of young corn and soybean growers. (AgWeb)

- America’s Struggling Farmers Face Even More Uncertainty (Newsweek)

- Big harvest no comfort to Iowa farmers, who worry about another Farm Crisis (Des Moines Register)

- Farmers becoming less optimistic about future of the ag economy (Brownfield Ag News)

- 'It’s just disappointment’: Shutdown adds to farmers’ anxieties -- Producers are struggling under the weight of the loss of certain USDA services and lack of a bailout announcement. (Politico)

- Growing unease: Michigan farmers grapple with inflation, low crop prices and tariffs (Detroit News)

- In Trump-Friendly Iowa, the President’s Policies Have Hit Hard -- The state has become a stronghold for President Trump. Now, his efforts on trade, energy and immigration are squeezing farmers, disrupting labor and threatening industries (New York Times)

- Corn, debt and doubt: A record harvest rattles Trump’s farm economy -- In an industry battered by debt and sagging prices, this year’s bounty is more bad news. (Reuters)

- Economic woes threaten push for climate-smart farming -- Trade disputes, high operating costs and low crop prices may force farmers to cut back on practices that help the environment. (Political Pro Greenwire)

- ‘The System Is Failing Us:' Why Real Change is Needed in U.S. Agriculture -- The Farm Action co-founder says it’s time for agriculture to face an uncomfortable truth. From cattle to crops, American agriculture must rebuild from the ground up or face a tough reality: U.S. agriculture no longer feeds the world. (AgWeb)

- A Silent Truth Hidden in the Farm Economy: Farmer Suicides Are on the Rise (AgWeb)

- Ethanol mandate: bad for the economy, bad for the environment (Minnesota Reformer)

Excerpt from Politico: Farmers across the country are looking at record yields during their fall harvest. They may have nowhere to sell them.

As a result of President Donald Trump’s trade war with China, crop farmers have lost a significant export market, driving down the price of top U.S. crops like soybeans and corn, even as Trump’s tariffs drive up the cost of farm equipment and fertilizer.

Now, as they approach the end of growing season, those farmers, farm groups and Republican lawmakers from agriculture-heavy states are warning of a looming crisis: crops piling up with nowhere to put them and farmers ending the year deep in the red.

They’re still not ready to blame Trump and his trade policies, however, a sign of just how much grace the agriculture community continues to grant Trump, even as his ambitious efforts to restructure the global trade economy clash directly with their economic interests.

...

That faith in the Trump administration’s long-term policy objectives hinges, in large part, on the administration’s promises to ink new trade agreements with other countries that could pave the way for more sales of U.S. agricultural goods abroad.

...

“China is the linchpin in all of this,” Alford (Rep. Mark Alford (R-Mo.)) said. “And I’m trusting that President Trump is going to strike a deal that is going to equalize our trade with China and also restore some of the imports they’ve had for our grains, our beans and our meat.”

Other farm state Republicans are toeing a similar line.

...

In Trump’s first term, the White House paid out $28 billion in financial relief for farmers hurt by his trade policies. Officials at the Agriculture Department have privately started to prepare for a similar bailout fund for this term but are unlikely to roll out any tariff relief payments this fall, according to three people with direct knowledge who were granted anonymity to discuss the private plans. READ MORE

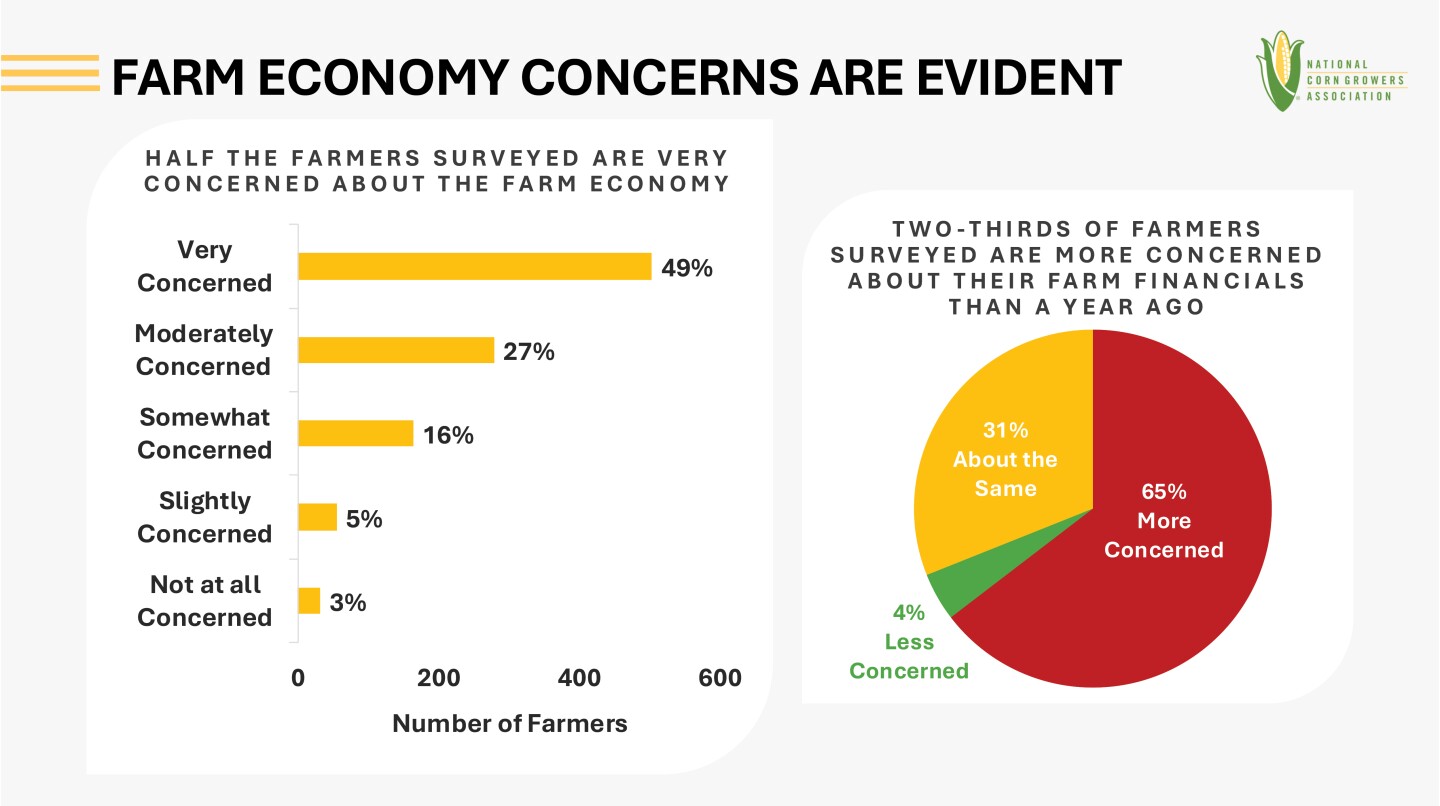

Excerpt from Agri-Pulse/Successful Farming: New polling shows that the majority of U.S. corn producers see an economic crisis on the horizon — or at least the possibility of one.

In a survey published Wednesday commissioned by the National Corn Growers Association, the Farm Journal polled more than 1,000 farmers on whether they think the U.S. is on the brink of a farm crisis.

Almost half the farmers surveyed in late August and early September said the U.S. is on the brink of a crisis. A further third said the farm economy might be heading that way, while just 15% said they don’t think a crisis is coming. The farmers included in the survey have corn as their primary crop.

Accordingly, 76% of respondents said they were “very” or “moderately” concerned about the state of the farm economy. This concern has grown for most farmers in the last year, respondents say, with 65% reporting heightened concern.

...

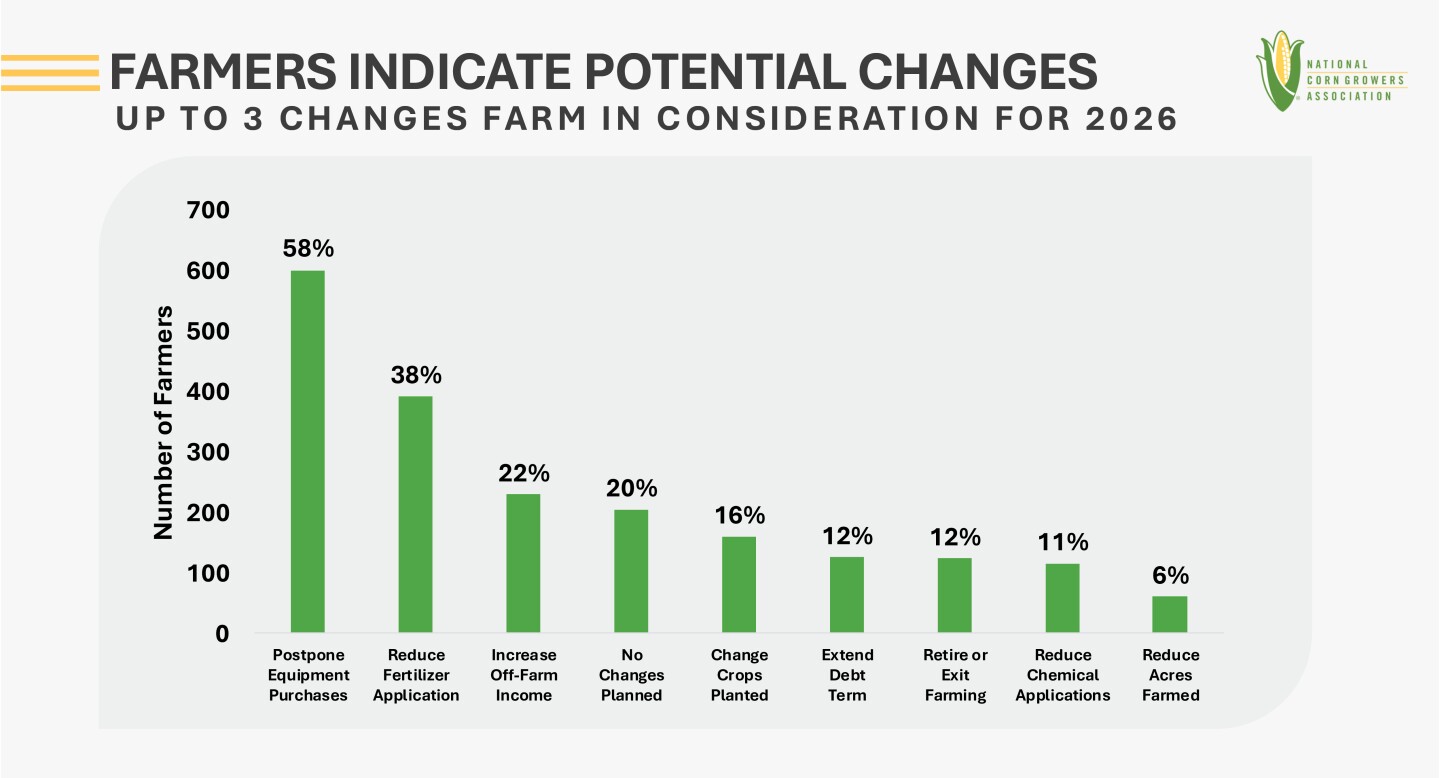

Almost 60% of respondents said that concerns over the farm economy would likely cause them to postpone equipment purchases in the coming year. Some 38% said they would pare back fertilizer application.

...

Only 20% of respondents said they would not make any operational adjustments in 2026, and 12% said they would retire or leave farming altogether.

...

The poll landed the same day as a new Rabobank report projecting higher operating costs and tighter margins.

...

The corn growers are calling on Congress to take steps to avert an economic crisis and support faltering growers, beginning with authorizing year-round sale of fuel with 15% ethanol blends – or E15. READ MORE

Excerpt from AgWeb: The economic conditions for many sectors in agriculture have been deteriorating for some time. John Newton, executive leader at Terrain, says this is the third or fourth year for many row crop producers to be facing profitability at break-even or below break-even margins.

(National Corn Growers Association 2025 Survey)

He points to three trade-related examples driving challenges in ag sector profitability:

- China is out of the soybean market

- Canada hasn’t bought any U.S. wine

- The tree nut industry is facing pressures

“The whole farm economy is facing challenges maybe outside of the livestock markets,” he says. “We need an above-all approach to improve the farm economy.”

Newton says cash receipts for crop farms (adjusted for inflation) have declined by $71 billion in the last three years, which is the largest amount of all time.

(National Corn Growers Association 2025 Survey)

What Can Change The Trajectory?

The news of the federal reserve lowering interest rates one-quarter of a percent is a welcome update.

...

As NCGA reports corn margins are at a loss of $161 per acre for new crop in 2025, many farmers will be looking to take short-term debt and roll into long debt to help navigate the tough economic environment.

...

As a longer-term domestic demand builder, Newton eyes year-round E15 as a potential boost to the corn farmer’s bottom line. NCGA reports for each 1% increase in the blend rate, the range of corn used is 200 to 400 million bu. of corn.

“While it may not do anything to eat into the 2 billion bu. we’ll have in ending stocks for the new crop, in five to six years, you’ll have the infrastructure for the corn we’ll continue to supply,” Newton says.

As for recent actions by Congress, and USDA Secretary Brooke Rollins saying financial aid may come as early as this fall to farmers, Newton says those are signs of how lawmakers and the administration are evaluating what they can do and what tools are in the toolbox.

However, he’s quick to point to the limitations they have. READ MORE

Excerpt from American Carbon Alliance/Des Moines Register: It’s time to grow the demand side of the equation, and that means investing in low-carbon fuels, expanding SAF, supporting carbon capture and sequestration innovation.

A USDA report has once again sent shockwaves through the corn market. Their prediction, a record-setting 188.8 bushels per acre, puts even more pressure on farmers already facing financial hardship and declining incomes. After all the hard work, all the input costs, and all the uncertainty, farmers are now staring down yet another hit to their bottom line.

This kind of volatility isn’t new, and the American Carbon Alliance has been shouting from the rooftops for a few years. But this trend is absolutely unacceptable. Year after year, American farmers do their part. They grow more with less, adopt new practices, and feed and fuel the world. But without strong, reliable demand, they’re left chasing markets that won’t sustain them.

We cannot afford to keep going through this cycle. If we continue doing the same thing over and over again, America will lose family farms, and rural economies will suffer. What we need are new markets and ideas that reward innovation and provide lasting stability. That’s why expanding the use of low-carbon fuels, like ethanol and sustainable aviation fuel (SAF), is more important than ever.

We all know that higher blends of low-carbon ethanol in our cars are a win for everyone, the consumer, the farmer, and our energy security. As with anything, you don’t put all your eggs in one basket. That’s why sustainable aviation fuel and other utilization of low carbon ethanol produced right here on our nation’s farms present such a critical opportunity.

This market is just getting started, and it needs policy certainty from Washington to ensure the United States owns this space, not China, Brazil, or some other global competitor. We can do both: higher ethanol blends in our cars and sustainable aviation fuels in our planes. The result? The U.S. and the American farmer in control of our energy future.

SAF is already being produced here in the U.S., and it’s one of the most promising ways to grow long-term demand for corn. By pairing ethanol with carbon capture technologies, we can produce a drop-in jet fuel that meets strict sustainability standards and creates real opportunity for rural America. This opens new markets for farmers’ crops, expands production opportunities for ethanol facilities, and lifts rural economies.

And we need to acknowledge what’s changed. The old way of hoping Mother Nature balances supply and demand doesn’t hold sway anymore. Today’s corn hybrids withstand drought, disease, and pests better every year. And the old model of simply exporting more raw commodities is no longer a guarantee. Countries like Brazil and Argentina are catching up in scale, acreage, and output. That’s why a new path forward, one that builds domestic demand, is essential.

Congress has taken steps in the right direction with the 45Z tax credit. But now’s the time to protect that policy, build the infrastructure, and give producers the confidence that these markets are here to stay. No more whiplash. No more wondering what the next report will bring. It’s time to grow the demand side of the equation, and that means investing in low-carbon fuels, expanding SAF, supporting carbon capture and sequestration innovation, and making sure the future of agriculture isn’t left up to chance. READ MORE

Excerpt from Prairie Farmer: So, what do you do? Increase demand, for one.

On the corn side, Congress needs to pass the Nationwide Consumer and Fuel Retailer Choice Act of 2025, which would remove an outdated provision in the Clean Air Act that restricts summertime fuel sales with 15% ethanol blends, or E15. That would help.

Lesly Weber McNitt, NCGA vice president of public policy, is tired of messing around.

“Farmers are tired of excuses, tired of procedural hurdles, and they’re tired of political finger-pointing,” she says. “If legislators want to help farmers in a real, durable way, they’ll find out how to get the E15 bill done, and they’ll figure out how to implement some of these solutions.” READ MORE

Excerpt from AgWeb: According the latest Ag Economist’s Monthly Monitor, all respondents say the U.S. ag economy is in worse shape than one year ago (27% much worse off, 73% somewhat worse off). As this year (2025) marks the third year or economic hardships for many row crop producers, economists believe we might have found the bottom of this ag cycle.

“We’ve got to bridge the gap to next year, where things look better from the policy perspective,” says Grant Gardner, University of Kentucky ag economist. “From that point on, it’s about what farmers can weather, and if we can get a bump to push beans to $11 cash price and see cash $5 corn. That’s what’s needed with input prices today,”

...

Ag economists point to one action that would inject positivity in the outlook for row crop profitability — a trade deal with China. Based on the September survey, 77% say current U.S.-China trade policies hurt farmers, but uncertainty still looms as 54% think China will buy U.S. soybeans in 2025.

“It’s fair to say a trade deal with China is the silver bullet,” says Michael Langmeier at Purdue University. “Trade uncertainty hurts farmers short-term and long-term. We’ve already hurt our export prospects for ’25. We are so far behind. Long term I worry about losing market share for China.”

...

Langemeier says Brazil has been expanding soybean production since 2018 and could become China’s sole supplier of soybean imports.

Gardner echoes the importance of China for soybeans.

...

He says while none of these examples individually equal China’s tons, they help consume the abundant supply of U.S. crops: increased support for domestic biofuels use, more research and development around products using soybean by-products and lowering restrictions and red tape on other international countries.

“The best hope we have — a trade deal with China,” Gardner says.

While Brown agrees there’s no 1-for-1 substitute for China when it comes to trade, he’s optimistic for expanding efforts to additional export countries and building domestic demand.

...

From the September (2025) monthly monitor, 62% of economists say direct government payments would provide meaningful relief, though many believe challenges are too severe for short-term fixes.

...

“When you look at the ARC and PLC programs, the One Big Beautiful Bill upped some of the payments. But payments won’t come until October 2026. Farmers need the payments now. There’s an urgency. Net income in 2024, 2025 and 2026 is ugly. This isn’t like 2014 to 2019, when only one year was bad — 2015. This is just as bad, but we’ve got three years in a row,” Langemeier says.

Brown and Gardner agree there’s a lot at stake with the current conditions and farmers could go out of business.

“My sense is there are farms that will go out of business regardless of if there are payments or not,” Brown says.

Gardner says the current financial support being discussed for farmers won’t equal profitability for farmers, but rather just survivability.

“If you look at where the payments were recently, it may cover some loss, and it may cover enough loss to keep a farmer producing into the next calendar year, but it won’t make them whole. There’s still going to be a loss,” Gardner says. READ MORE

Excerpt from Newsweek: However, the department said payments to farmers would cease and federal farm loans would be delayed.

...

John Boyd, the founder of the National Black Farmers Association, told Newsweek: “Farmers are blowing up our phones. They are asking: How can they receive program payments? Does the NBFA have resources … to help them get through harvest? How will they pay annual farm loan payments? Will interest be adjusted? October and November are generally when farmers make annual payments to USDA. We don’t have any resources to help our members. Our government funding has been cut, and foundations have turned a cold shoulder to our organization and farmers.”

“The shutdown means no federal programs at USDA—federal crop insurance, loans, program payments, nothing,” said John Boyd, a farmer and the founder of the National Black Farmers Association (NBFA).

“The shutdown will add to the chaos that farmers are already experiencing,” he told Newsweek. READ MORE

Excerpt from Politico: The government shutdown is creating financial heartburn for farmers across the country, stalling the delivery of farm loans, the release of critical market reports and the Trump administration’s plans for cash bailouts.

Producers of row crops like corn, wheat and soybeans have for months been weathering tariff uncertainty and high input costs for things like fertilizer and machinery, while hoping that President Donald Trump will open new markets for their products or send them financial assistance, as he did during his first-term trade war with China.

...

“Every day that the government isn’t open, there’s slightly more anxiety in farm country, especially as growers are harvesting and having to pay bills and having to pay off their bank,” Russell Williams, a Texas-based corn and wheat farmer, said in an interview. “There’s serious risks of farm bankruptcies this year.”

Andy Jobman, a Nebraska corn and soybean farmer, said the pause in USDA’s monthly agricultural data on harvests and supply is hindering his ability to make business decisions or anticipate market fluctuations. And Iowa Corn Growers Association President Stu Swanson said farmers in his state are seeing delays in payments they had been counting on for this growing season because of the closure of USDA Farm Service Agency offices. FSA administers disaster and conservation programs and provides farm loans, which totaled more than $5 billion in fiscal year 2024.

Swanson said he is unable to access his USDA payment for land he put in a conservation program or his loan on grain until the government reopens, which means he needs to borrow money at higher rates from banks in the interim.

...

Trump administration officials, from Agriculture Secretary Brooke Rollins to Treasury Secretary Scott Bessent, have prepared money from an internal USDA fund to send to producers and suggested tapping tariff revenue. But the shutdown has delayed the announcement and rollout of those funds, which Rollins confirmed in a Cabinet meeting Thursday (October 9, 2025).

...

“There’s a great deal of stress out there,” said Sen. Chuck Grassley (R-Iowa) previously told POLITICO, pointing to low grain prices and high input costs. “I’ve heard some rumors ... that some banks have advised some farmers that they ought to sell some of their land.” READ MORE

Excerpt from Reuters: Measuring ears of corn by hand may seem a relic in an age of satellites and artificial intelligence. Yet the annual survey by the Pro Farmer Crop Tour felt like a rural quest for signs that Washington was now wrong – that disease or something unseen would result in a lower forecast.

As Trump fired government statisticians, farmers and traders have questioned whether the quality of U.S. Department of Agriculture data, long a market backbone, would hold up, heightening interest in the crop tour. More than 15,000 USDA employees, or about 15% of its workforce, have taken financial incentives to leave the agency under Trump’s downsizing mandate.

USDA temporarily removed some climate data from its websites, delayed a key trade report and deleted language tying Trump’s tariffs to a widening trade deficit. Agency staff shuttered research, and were obliged to correct export sales notices. It was a portent of more to come, with the federal government shutdown freezing the majority of USDA data or forcing it offline.

...

(Kyle) Wendland’s own farm was crowded with corn worth less than it cost him to grow.

...

Farm debt is set to hit a record high this year as global grain flows shift, deepening the downturn in an industry battered by trade policies set in motion under Trump, largely maintained under Democratic president Joe Biden, and broadened in Trump’s second term.

China, usually the top buyer of U.S. soybeans, hasn’t purchased a bushel from this year’s crop. Last year, it bought 45% of U.S. soybean exports.

Anticipating trouble, many farmers planted more corn. They bet exports to Mexico and Canada, ethanol production and livestock feed would keep prices afloat.

Instead, the season stayed mild. Fields flourished. Prices drifted lower. Farmers’ age-old fix – to boost yields and grow their way out of the problem – was no fix at all when the fields were this full and their bills so big.

...

Iowa corn farmers who rent land – a common practice – need $4.58 a bushel this year to break even, according to Iowa State University Extension and Outreach. In August, the average cash price: $3.89.

...

The tour’s hand-written counts helped fill gaps in government data, too. USDA stopped collecting corn and soybean samples for its August crop production report after an agency audit during Trump’s first term. These days, the agency leans on satellites and farmer surveys, done in late July and early August. Just 14,900 farmers took part this year, nearly 27% fewer than the 20,300 producers surveyed in 2020.

On August 12, USDA predicted the largest corn crop since 1866: 16.7 billion bushels, enough corn to fill every barn, bin, and crib in America and still feed the nation’s livestock for half a year. Corn prices dropped.

...

Launched by the Illinois Farm Bureau in the 1970s to gauge crop health, the tour expanded under news and marketing firm Pro Farmer to Ohio, Indiana, Iowa, Minnesota, South Dakota and Nebraska.

In Ohio, in a hotel meeting room, former Wall Street trader Peter Meyer outlined the rules: stop every 13 miles, sample and measure 30 feet of corn, count soybean pods longer than a quarter-inch. Randomness was the point – hundreds of imperfect samples stitched into a number that was a snapshot, not a guarantee.

...

Some anger is rooted in fear. Farm debt is expected to hit nearly $600 billion this year, a record. As credit conditions deteriorate, risk-wary bankers are tightening lending practices, according to the Federal Reserve Bank of Kansas City and farm lenders.

For debt-heavy growers, that can mean higher interest rates to cover spring planting or being denied by their existing lender, according to interviews with a dozen grain farmers.

As the scouts crisscrossed the Midwest, trouble was spreading that farmers may not have seen when talking to USDA in late July. Southern rust, a plant disease, freckled corn leaves, pustules black as pitch or bright as paprika. Spores clung to shirts and ballcaps.

...

While big agribusinesses can afford pricey private analytics, many farmers in the U.S. and worldwide rely on government data to help guide planting and marketing decisions.

There are fewer people producing that information. At the USDA’s National Agricultural Statistics Service, roughly a third – 243 staff – left through the administration’s incentive programs as of May. The Economic Research Service lost 78 staff, or about 27%.

That was before the shutdown. About half of USDA’s 85,907 employees were slated for furlough when the government shuttered this month, according to the agency’s lapse-of-funding plan. At ERS, 94% of staff was furloughed; at NASS, 91%. How many USDA jobs might ultimately be eliminated remains unclear.

USDA data and research can swing commoditymarkets, raising or crushing crop values and triggering algorithmic trades.

...

That’s why alarms went off in May when the USDA delayed a quarterly trade outlook and stripped out analysis linking a widening farm trade deficit to Trump’s tariffs. When it finally appeared, the tables were there; the analysis was gone.

Then came mistakes. In July, USDA announced a 135,000-ton corn sale to China – later corrected to South Korea. In September, it said China bought 68,000 tons of soybeans from this year’s crop. The sale happened in January.

Some data sets are gone for good: USDA scrapped the Agricultural Labor Survey, used to help set H-2A guest worker wages, and the long-running Household Food Security Survey, a benchmark for hunger. Other reports halted by the Biden administration for budgetary reasons, such as the July Cattle Report, were revived.

On August 22, Pro Farmer analyzed the data and released its estimate: 16.204 billion bushels, a tour record but smaller than USDA’s lofty outlook. Online, scouts were pilloried by analysts for bowing to farmer pressure to put out a lower forecast, and chastised by farmers for estimating too much. “Our opinion about the crop has not changed,” said Pro Farmer economist Lane Akre. “The data speaks for itself.”

...

Three weeks later, USDA updated its corn prediction with crop-insurance data submitted by farmers. It showed farmers had sown the most corn acres since the Great Depression, even more than previously thought.

USDA forecast American farmers would indeed produce a record crop, and raised its 2025 U.S. corn production estimate: 16.814 billion bushels. READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Canary Islands

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia/Slovak Republic

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea (Republic of Korea)

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler/Ship

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.