by Matt Roberts (Terrain) Many worry that electrified vehicles, fuel economy standards, and improving battery technology will make the internal combustion engine (ICE) obsolete, illegal, or both, with wildly varying estimates of the timeline. Many of these forecasts overlook the growing age of America’s light duty vehicle fleet and the implications for future liquid fuel demand.

Finding

The transition to electrification will be slower than anticipated, and as electrification includes plug-in electric hybrid vehicles (PHEVs), gasoline demand will still exist for an electrified market.

Impact

Ethanol continues to consume 35% of US corn production, and ethanol consumption depends on gasoline demand. Domestic ethanol demand will eventually decline, absent other changes in policy or automaker behavior, but will stretch much longer than is often anticipated, avoiding devastating destruction to corn prices or farmland prices.

...

The driving force for governments toward vehicular electrification is the desire to curb global carbon emissions and atmospheric concentrations. Once fleets are electrified, governments and markets can alter the ultimate sources of transportation energy without having to modify the vehicle fleet again. Areas that are solar-rich could more intensely utilize solar electricity without requiring any differences in the fleet from an area that is rich in hydro or nuclear power. Even fossil fuels, such as natural gas, coal or petroleum could be used.

...

There are other alternatives to electrification for the post-liquid fuels era. Hydrogen fuel cell vehicles have been sold by multiple manufacturers. However, while hydrogen is the most abundant element in the universe, it requires significant energy to manufacture in its pure form and likewise requires a large infrastructure investment of production, storage, transportation and fueling facilities to make it useful as a fuel.

Battery-electric vehicles (BEVs) likewise require the construction of charging infrastructure for mass adoption to occur, but the backbone of electrical generation and transmission exists and is well understood. Wide-scale adoption of BEVs require upgrades to existing infrastructure instead of construction of an entirely new infrastructure.

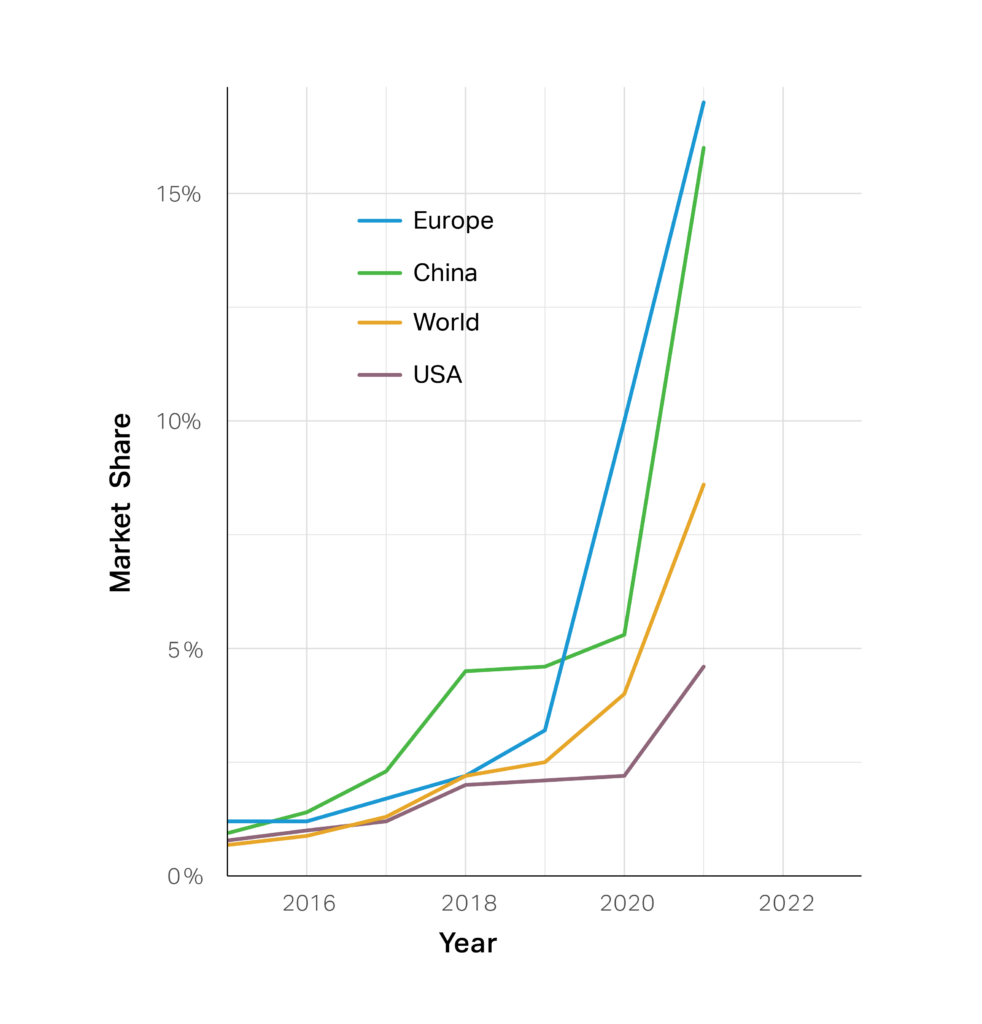

The Realities of Electrical Vehicle Market Share

Over the past few years, many governments and automakers have announced their movement away from internal combustion engine (ICE) vehicles.

- Mercedes-Benz announced that all of their light duty vehicles would be electric by 2030.

- Audi announced that they would phase out ICEs by 2033.

- General Motors announced an end to all light duty ICEs by 2035.

More recently, the California Air Resources Board (CARB), in its Advanced Clean Car II rule, mandated that by 2035, all light duty vehicles—passenger cars and light trucks—sold in California must be Zero Emission Vehicles (ZEV). Thirteen other states and the District of Columbia follow CARB standards. In total, these rules will apply to states that sell 40% of passenger cars.

In all of these cases, the headline announcement reads much worse for renewable fuels than the fine print.

In the case of Mercedes-Benz for example, they caveat their claim with “where market conditions permit.” When announcing a move to electrification, Mazda considers plug-in hybrid electric vehicles (PHEVs) to be ‘electrified.’ In California’s Advanced Clean Car II rule, up to 20% of major manufacturers’ ZEVs can be PHEVs1. For smaller manufacturers, all of their sales can be made up of ZEV-compliant PHEVs.

These details might seem quibbles, but they are important in understanding the true impact of vehicular electrification on liquid fuels demand. Nearly all of the announcements that portend the death of gasoline in fact continue to permit gasoline consumption.

The Role of Older Vehicles

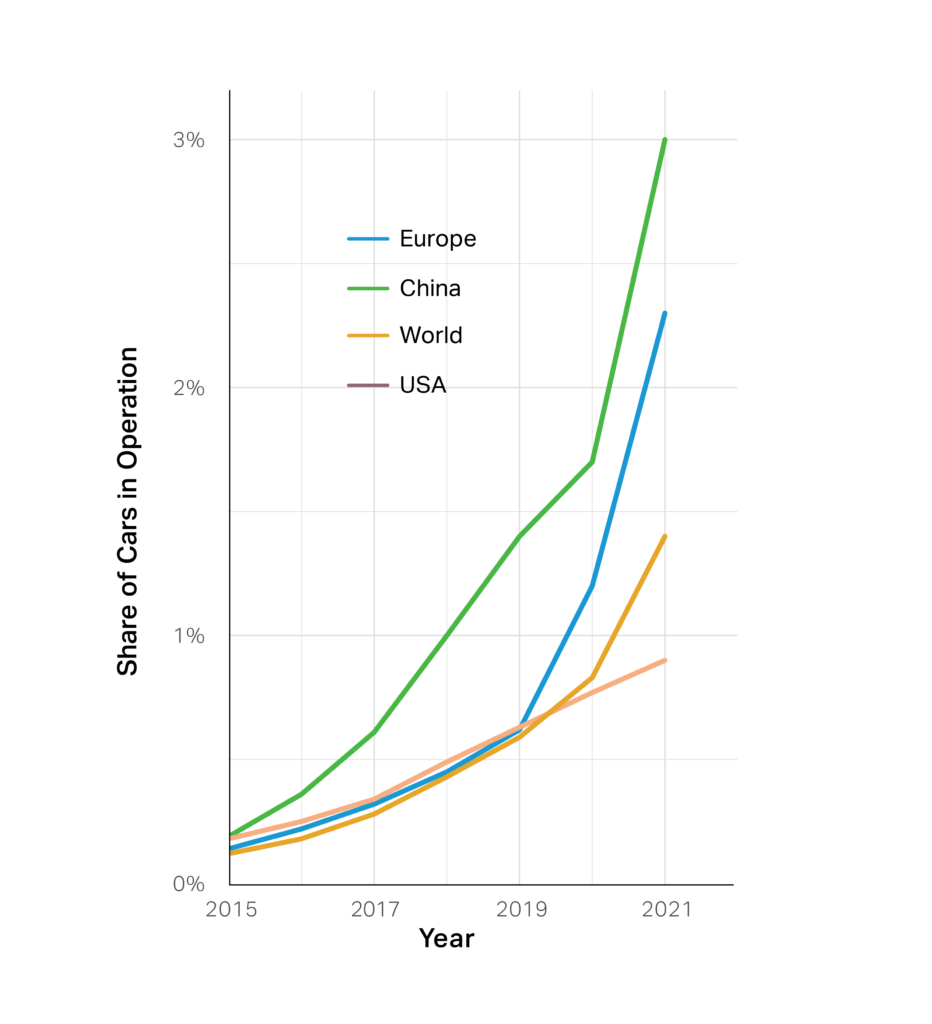

The most important consideration in liquid fuel demand isn’t even related to the headlines or state rules; it is the speed with which newer vehicles, electric vehicles especially, displace older vehicles in the marketplace.

In 2002, the average age of light duty vehicles2 registered in the U.S. was 9.6 years. It has steadily increased to reach 12.2 years in 2022. For passenger cars, the current age is even higher: 13.1 years. Based on S&P Global Mobility estimates, the aging of the fleet is not leveling off. The age continues to increase, and it appears to be increasing at an increasing rate. Hill, et al (2019)3 point out the importance of considering the turnover of the existing fleet. Even if BEVs make up a large proportion of new car sales, their penetration of the existing fleet is much slower.

Between 2015 and 2019, approximately 4.7% of light duty vehicles in the U.S. were scrapped each year, and new car sales were 5.6% of the total number of LDVs. Even if the oldest cars were scrapped first, this would require a 20-year period to turn the vehicle fleet over. In reality, many newer cars are also scrapped each year for reasons such as accidents and natural disasters. So the time period for a complete fleet turnover is considerably longer.

A further complicating factor in estimating fleet transition from ICE to EVs is the difference in cost and capabilities for EVs at present. While most of this discussion is centered on ‘range anxiety,’ the pace at which BEVs can recharge, and their effect on the classical American road trip, more important limitations emerge in cost and performance when considering light-duty trucks used for commercial purposes.

In recent testing, Motortrend4 found that a Ford F-150 Lightning, with the extended range battery pack, struggled to tow a 7,000-pound trailer more than 100 miles per charge, compared to the observed 250+ miles in normal driving without a trailer. The culprit was as much aerodynamic as weight, as the ranges decreased much more slowly than trailer weight increased.

Further, the size of batteries needed to propel a light pickup mean both significantly higher cost (a minimum of $81,000 for a 2023 model with the extended range battery compared to $39,000 for similarly equipped gasoline-powered F-150) and battery charging time. Even at a DC fast charging station, recharging the battery from 10% to 80% requires approximately 40 minutes. A home recharge using a typical 240-volt outlet may require up to 20 hours, or 8 hours with an advanced high-current circuit and a specially installed charger.

None of this is to single out Ford. Similar results in other outlets have been obtained with the Rivian R1T and Hummer pickups.

The Role of PHEVs

Most EV mandates and announcements include wiggle room for plug-in hybrid electric vehicles (PHEVs). For liquid fuel demand, this is an important factor. PHEVs are capable of using either liquid fuels or grid power for transportation. Their fully-electric range is typically 30 to 50 miles, and this range should satisfy a large number of trips for typical American drivers. In practical usage, a recent German5 study found that the electric driving share for PHEVs is 45% to 49% for private vehicles and only 11% to 15% for company-owned vehicles. Though the study doesn’t explain the causes, lack of off-street parking for charging at home, lack of charging facilities at work, and the lack of financial incentive to charge for fleet vehicles as the employer likely pays for gas, are often seen as barriers to PHEV and EV charging.

The role of PHEVs is also important as the recently enacted Inflation Reduction Act contains large changes in EV tax credits. From January 2023 onwards, an increasing amount of the ‘critical minerals’ used in the battery must come from the U.S. or U.S. Free Trade partners. Half of the total $7,500 credit will hinge upon whether 40% (in 2023) to 80% (beyond 2027) of these minerals are sourced in the U.S. or a partner nation. The other half depends on the location of battery assembly.

Mineral production will likely remain constrained. Therefore, I believe that manufacturers will maximize the tax credits (often marketed as vehicle discounts) through using the available minerals to produce a greater number of smaller batteries for PHEVs rather than a smaller number of larger batteries for BEVs.

For comparison, PHEVs have 9 to 18 kilowatt-hour batteries, whereas car and crossover BEVs have 54-90 kilowatt-hour batteries. That means that for a given amount of battery capacity, 3 to 9 PHEVs can receive tax credits for each BEV that receives a tax credit. This scenario of manufacturers pushing toward more PHEVs than BEVs is even more likely given that the tax credit legislation now includes price caps on the vehicles that qualify.

The Role of Ethanol

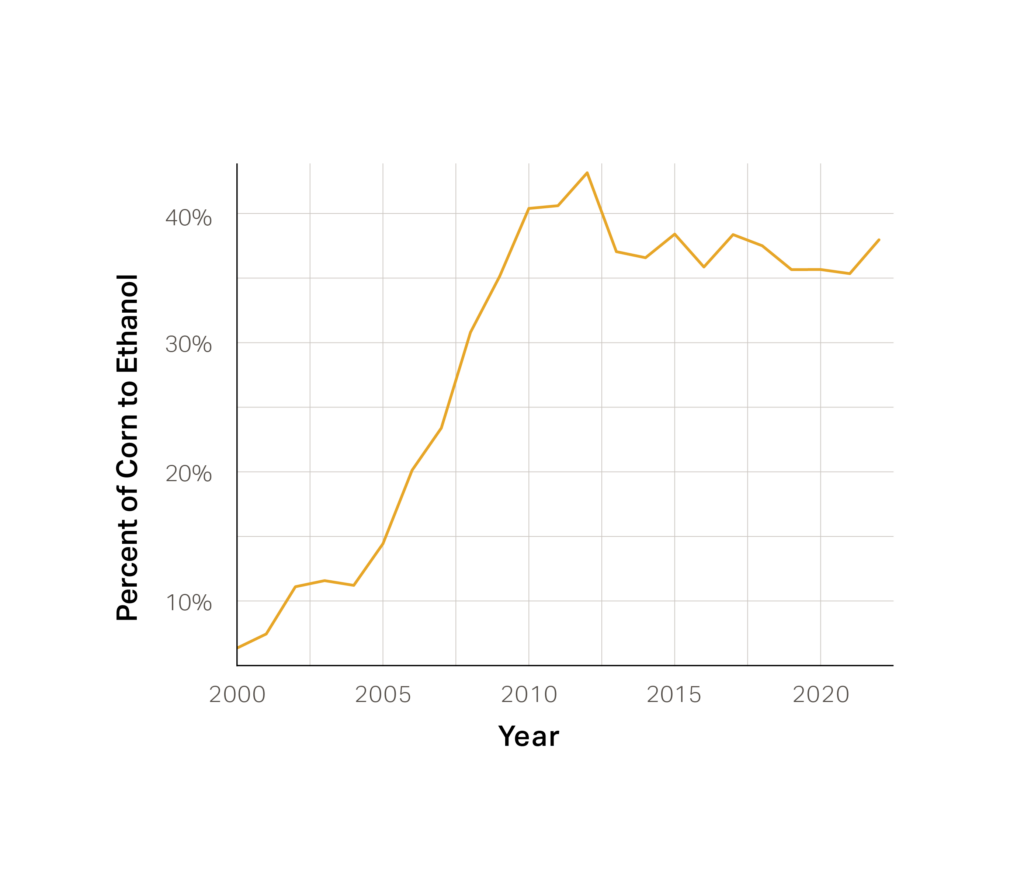

Ethanol has long played a role as transport fuel, dating to the birth of the automobile. Its popularity grew dramatically in the late 1970s in response to the oil crisis, and again in the early 2000s in response to high oil prices and increasing environmental concerns about petroleum fuels and additives.

The early 2000s popularity culminated in the passage of the Energy Policy Act of 2005 and the Energy Independence and Security Act of 2007, which created the Renewable Fuels Standard (RFS). The RFS mandated increasingly larger levels of renewable fuels of various forms in the nation’s liquid fuel supply.

As a policy to stimulate a new market for consumption of domestic agricultural production, the RFS has been a success.

Prior to the passage of the Energy Policy Act in 2005, ethanol production consumed 12% of U.S. corn production, primarily as an oxygenate and additive to conventional gasoline. In 2011 and 2012, over 40% of U.S. corn production went to ethanol production, as rising RFS mandates stimulated a sharp rise in the number and capacity of plants.

Since that time, mandated ethanol consumption has been flat, but corn production has continued to rise, due to yield increases. In 2021, only 36% of corn production became ethanol.

The mechanism that the RFS uses to mandate ethanol inclusion is complex but can be summarized by that the EPA divides the number of gallons of ethanol mandated to be blended by the total number of gallons of motor fuel used. This percentage of mandated blending is then required for all gasoline blenders.

Blenders who blend and sell more than this percentage can sell the overage to blenders who do not meet this level through a system of trading blending credits. In recent years, this mandated blending level has hovered at 11% to 12%. While all vehicles are compatible with 10% blends, the additional demand must be absorbed through sales of higher blends, such as E15 or E85.

If BEV vehicles were to comprise a majority share of the vehicles in use in the U.S., gasoline demand would decline. This would mean that if RFS mandated levels remain unchanged, an increasing portion of ethanol would need to be sold as part of higher blends.

While vehicles newer than 2001 are compatible with E15, higher blends require a Flex Fuel compatible vehicle. Flex Fuel vehicles account for only about 7.5% of the vehicles in operation in 2022. Therefore rapid BEV adoption would have very real, adverse consequences on the demand for ethanol, and therefore, the demand for corn in the U.S.

The Future of Ethanol Demand in the U.S.

In the Annual Energy Outlook, the Energy Information Agency includes long-term projections for energy production, demand and prices, including for the transportation sector. Multiple cases are constructed using different assumptions and the results for each case are reported.

The 2022 AEO explores various oil price scenarios, each with somewhat different impacts on biofuel usage through 2050. But by and large, each story’s conclusion is no different: ethanol usage remains similar.

...

A primary opportunity is to expand flex fuel compatibility of a greater number of modern engines. As emissions and fuel economy standards have tightened, automakers have wrung increasing efficiencies out of ICEs through technologies such as high compression ratios, forced induction and direct injection. To effectively utilize these means to increase fuel efficiency, higher octane fuel is required to maximize combustion efficiency. In 2020, 51% of all models tested by the EPA required premium gas, compared to 41% requiring only regular gasoline. In 2010, those proportions were 37% and 53%, and in 2000, they were 28% and 69%.

Increasing numbers of vehicles requiring premium unleaded fuel could be important for ethanol consumption. Blends of 40% or more ethanol provide higher octane levels than premium gasoline. And more importantly, high-ethanol blends price well against premium gasoline. According to a recent AAA survey of gasoline prices, E85 sold at a 32% discount to premium, whereas it only sold at a 17% discount to regular gasoline.6

One of the challenges of E85 adoption has been its price differential to regular gasoline. Drivers can expect 23% lower fuel economy on E85 than regular unleaded7, which means that E85 needs to be priced 23% lower than gasoline to provide the same cost per mile of fuel.

But E85’s 32% discount to premium more than offsets the blend’s 23% lower fuel economy compared to premium gasoline. If more premium fuel vehicles are offered with flex fuel compatibility, it opens the door for E85 to become much more price competitive over much larger swaths of the U.S.

...

Estimates indicate liquid fuel demand would drop by 25% or more from 2022 levels.

There nonetheless remains opportunities even now for ethanol to increase market share in the U.S. E85 could be a mechanically and economically superior substitute for premium gasoline, and a demand driver for ethanol through this transition. READ MORE

Proposed Advanced Clean Cars II Regulations: All New Passenger Vehicles Sold in California to be Zero Emissions by 2035 (California Air Resources Board)

Electric vehicles are less reliable because of newer technologies, Consumer Reports finds (CNBC)

EVs, full-size pickup trucks least reliable - Consumer Reports survey (Reuters)

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Canary Islands

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia/Slovak Republic

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea (Republic of Korea)

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler/Ship

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.