by Jane Nakano (Center for Strategic & International Studies) As clean energy technology becomes the latest frontier for geoeconomic rivalry, the security of supply chains for rare earths and critical minerals—essential materials for clean energy—has become a global strategic issue.

The fragility of global supply chains revealed by Covid-19 and rising competition from China have only heightened the importance of supply chain security for critical minerals.

This report compares strategies and actions taken by the United States, European Union, and Japan, illuminating key economic, security, and geopolitical factors behind these evolving approaches to enhance the security of critical minerals supply chains. READ MORE

BREAK THE CHAIN: (Politico's Morning Energy)

DOE Announces $30 Million for Research to Secure Domestic Supply Chain of Critical Elements and Minerals (US Department of Energy)

Exclusive: U.S. looks to Canada for minerals to build electric vehicles - documents (Reuters)

Schlumberger New Energy developing Nevada lithium plant to meet battery storage demand (Power Engineering)

Schlumberger New Energy Is Launching A Lithium Extraction Pilot Plant In Nevada (Clean Technica)

Energy security fears rise anew in shift to clean energy (Houston Chronicle)

Electric Vehicles Drive up Metals Demand (Transportation Energy Strategies)

Electric Vehicles Can Drive More Responsible Mining (China Dialogue/Transportation Energy Strategies)

CME Seeks to Tap Electric-Car Demand With Lithium Futures -- Contracts tied to the battery metal could make pricing more transparent (Wall Street Journal; includes VIDEO)

Lithium shortage threatens EV growth — report (E&E News)

The U.S. is facing a lithium-ion battery shortage as electric vehicle production ramps up (CNBC)

Lithium Prices Could Triple As EV Production Soars (OilPrice.com)

A transition to renewables and electric vehicles will prompt a spike in demand of critical minerals (Politico's Morning Energy)

IEA Says Governments Should Consider Stockpiling Battery Metals (Bloomberg)

Biden's conundrum: Expand EVs without harming the Earth (E&E News)

INVESTIGATION -- ‘This Is the Wild West Out Here’ How Washington is bending over backward for mining companies in Nevada at the expense of environmental rules. (Politico Magazine)

The US has to mine more minerals to meet EV, clean energy demands (electrek)

World Energy Outlook Special Report: The Role of Critical Minerals in Clean Energy Transitions (International Energy Agency)

Tesla signs deal with world’s largest nickel miner to secure resource for battery production (electrek)

Webinar: Critical Supply - Addressing US Reliance on Foreign Sources of Critical Minerals (ConservAmerica)

Biden’s Electric-Car Ambitions Face Real-World Roadblocks: Auto makers want congressional moves on charging stations and tax incentives; consumer support also is needed (Wall Street Journal)

Senators spent the night in a vote-a-rama on Democrats' budget resolution (Politico's Morning Energy)

Taliban grabs mineral riches coveted by energy developers (E&E News)

The Role of Critical Minerals in Clean Energy Transitions: Part of World Energy Outlook (International Energy Agency)

No to Seabed Mining From World Conservation Congress (Our Daily Planet)

In Argentina's north, a 'white gold' rush for EV metal lithium gathers pace (Reuters)

Biden's fork in the Alaskan road -- WHERE DOES THIS ROAD GO: (Politico's Morning Energy)

AND WE’LL NEVER HAVE ROYALTIES: (Politico's Morning Energy)

The race for lithium – a new method makes water-derived lithium possible (Bio Market Insights)

There’s a Fortune to Be Made in the Obscure Metals Behind Clean Power (Bloomberg)

The Not-So-Rare Earth Elements: A Question of Supply and Demand (Kleinman Center for Energy Policy)

Congo's $6 billion China mining deal 'unconscionable', says draft report (Yahoo!/Reuters)

The Real Winner In The War Between Fossil Fuels And Renewables (Oilprice.com/Yahoo!)

Is Lithium The Best Bet On A Overheated EV Market? (Oilprice.com)

A Power Struggle Over Cobalt Rattles the Clean Energy Revolution (New York Times)

The Role of Minerals in US Transportation Electrification Goals (Atlantic Council)

Hunt for the ‘Blood Diamond of Batteries’ Impedes Green Energy Push (New York Times) Seattle Times

Battery Pack Prices Fall to an Average of $132/kWh, But Rising Commodity Prices Start to Bite (Bloomberg NEF)

LOOKING AT AFGHANISTAN: (Politico's Morning Energy)

Excerpt from Politico's Morning Energy: BREAK THE CHAIN: The Energy Department is putting up to $30 million into research for securing the domestic supply of critical minerals — a vital component of electric vehicles and other clean energy technology. "America is in a race against economic competitors like China to own the EV market — and the supply chains for critical materials like lithium and cobalt will determine whether we win or lose," Energy Secretary Jennifer Granholm said in a statement.

Currently, the U.S. gets all its supply of 14 of the 35 rare-earth elements from overseas, and it imports half of its supply for 17 others, according to DOE. The investment will "fund research into the fundamental properties of rare-earth and platinum-group elements and the basic chemistry, materials sciences, and geosciences needed to discover substitutes," according to a DOE release. READ MORE

Excerpt from Reuters: On Thursday (March 18, 2021), the U.S. Department of Commerce held a closed-door virtual meeting with miners and battery manufacturers to discuss ways to boost Canadian production of EV materials, according to documents seen by Reuters.

...

Conservationists have strongly opposed several large U.S. mining projects, leading officials to look north of the border to Canada and its supply of 13 of the 35 minerals deemed critical for national defense by Washington.

Tesla Inc, Talon Metals Corp and Livent Corp were among the more-than 30 attendees at Thursday’s meeting who discussed ways Washington can help U.S. companies expand in Canada and overcome logistical challenges, according to the documents.

...

Canada’s Fortune Minerals Ltd, which is developing a cobalt mine in the Northwest Territories, has also held funding talks with the U.S. Export/Import Bank, its chief executive told Reuters.

...

Canadian firms are also able to apply for U.S. government grants under the U.S. Defense Production Act and other U.S. funding programs. There are no U.S. tariffs on Canadian EV battery metals or EV parts.

Excerpt from Politico's Morning Energy: A transition to renewables and electric vehicles will prompt a spike in demand of critical minerals, which remain vulnerable to market volatility, according to new research by the International Energy Agency — and such volatility could hinder the adoption of clean technology overall.

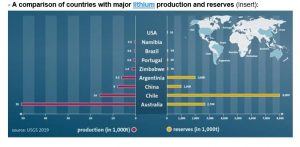

Though the situation is different for each mineral, overall demand for the minerals required for batteries and other tech could go up sixfold by 2040, depending on how quickly renewables replace fossil fuels, according to the study. Production of key minerals is concentrated in a handful of countries, and a convoluted supply chain could further risk disrupting mineral markets.

IEA recommends policymakers take steps to secure the supply chain, including outlining long-term commitments for emissions reductions, promoting technological advances and scaling up recycling to relieve pressure on primary supplies. Read the rest of the report and recommendations here. READ MORE

Excerpt from New York Times: Atop a long-dormant volcano in northern Nevada, workers are preparing to start blasting and digging out a giant pit that will serve as the first new large-scale lithium mine in the United States in more than a decade — a new domestic supply of an essential ingredient in electric car batteries and renewable energy.

The mine, constructed on leased federal lands, could help address the near total reliance by the United States on foreign sources of lithium.

But the project, known as Lithium Americas, has drawn protests from members of a Native American tribe, ranchers and environmental groups because it is expected to use billions of gallons of precious ground water, potentially contaminating some of it for 300 years, while leaving behind a giant mound of waste.

“Blowing up a mountain isn’t green, no matter how much marketing spin people put on it,” said Max Wilbert, who has been living in a tent on the proposed mine site while two lawsuits seeking to block the project wend their way through federal courts.

The fight over the Nevada mine is emblematic of a fundamental tension surfacing around the world: Electric cars and renewable energy may not be as green as they appear. Production of raw materials like lithium, cobalt and nickel that are essential to these technologies are often ruinous to land, water, wildlife and people.

That environmental toll has often been overlooked in part because there is a race underway among the United States, China, Europe and other major powers. READ MORE

Excerpt from E&E News: The United States co-founded the Energy Resource Governance Initiative with Australia, Botswana, Canada and Peru. It works with countries to create the "regulatory and governance conditions that will attract investment to their critical energy minerals sector," and reduce emissions and other environmental impacts from mining, a State Department official wrote in an email.

But can it clean up the supply chain in the short time needed?

Observers say it won't be easy.

"These things do not turn on a dime," said Morgan Bazilian, director of the Payne Institute for Public Policy at the Colorado School of Mines. "Companies have to line up; governments have to regulate ... which is not dissimilar to other parts of the economy."

He and his colleagues recently authored a study on how the rapid transition to a low-carbon economy carries the potential for severe environmental and social degradation. They're also evaluating ways to secure critical mineral supply chains that limit environmental damage and promote good governance.

One way is expanding recycling and reuse of the critical minerals used in batteries, part of the Energy Resource Governance Initiative's latest focus. Another is expanding exploration — although doing so in a way that doesn't harm the environment takes more money and attention, Bazilian said.

...

Right now, most of the critical minerals or materials used to produce those products come from China or Congo or other places with checkered human and environmental safety records.

Recent allegations that solar panels from China were made with forced labor underscored concerns about the future of U.S. solar projects (Energywire, April 15).

...

Recent analysis by the Oslo, Norway-based research firm Rystad Energy found that the mining capacity of lithium — a key ingredient in EVs and grid storage — will not keep pace with expected demand, and the shortfall could see prices for the mineral triple toward the decade's end (Energywire, April 19).

Of the 35 rare earth elements used in clean energy technologies, the United States depends entirely on imports for 14, and 17 others are at least 50% imported, according to the U.S. Geological Survey.

...

Ramping up U.S. mining isn't an easy or fast proposition, however. It can take five to seven years on average to develop and permit a mine, said Miller (Andrew Miller at Benchmark Mineral Intelligence).

...

As for recycling, it's hard to say when that approach will be broadly available. Technological hurdles stand in the way of making it economically feasible to recycle the materials used in batteries and put them back into the market at a price that is competitive with what can be mined out of the ground, Miller said. READ MORE

From Energy Matters vol 7.10

Excerpt from The New Yorker: Southern Congo sits atop an estimated 3.4 million metric tons of cobalt, almost half the world’s known supply. In recent decades, hundreds of thousands of Congolese have moved to the formerly remote area. Kolwezi now has more than half a million residents. Many Congolese have taken jobs at industrial mines in the region; others have become “artisanal diggers,” or creuseurs. Some creuseurs secure permits to work freelance at officially licensed pits, but many more sneak onto the sites at night or dig their own holes and tunnels, risking cave-ins and other dangers in pursuit of buried treasure. READ MORE

Excerpt from International Energy Agency: This World Energy Outlook special report on The Role of Critical

Minerals in Clean Energy Transitions identifies risks to key minerals and metals that – left unaddressed – could make global progress towards a clean energy future slower or more costly, and therefore hamper international efforts to tackle climate change. The IEA is determined to play a leading role in enabling governments around the world to anticipate and navigate possible disruptions and avoid damaging outcomes for our economies and our planet.

This special report is the most comprehensive global study of this subject to date, underscoring the IEA’s commitment to ensuring energy systems remain as resilient, secure and sustainable as possible. Building on the IEA’s detailed, technology-rich energy modelling tools, we have established a unique and extensive database that underpins our projections of the world’s future mineral requirements under different climate and technology scenarios.

This is what energy security looks like in the 21st century. We must pay close attention to all potential vulnerabilities, as the IEA did in our recent series on electricity security for power systems, which covered challenges such as growing shares of variable renewables, climate resilience and cyber security.

Today’s supply and investment plans for many critical minerals fall well short of what is needed to support an accelerated deployment of solar panels, wind turbines and electric vehicles. Many minerals come from a small number of producers. For example, in the cases of lithium, cobalt and rare earth elements, the world’s top three

producers control well over three-quarters of global output. This high geographical concentration, the long lead times to bring new mineral production on stream, the declining resource quality in some areas, and various environmental and social impacts all raise concerns around reliable and sustainable supplies of minerals to support the energy transition.

These hazards are real, but they are surmountable. The response from policy makers and companies will determine whether critical minerals remain a vital enabler for clean energy transitions or become a bottleneck in the process.

Based on this special report, we identify the IEA’s six key recommendations to ensure mineral security. An essential step is for policy makers to provide clear signals about their climate ambitions and how their targets will be turned into action. Long-term visibility is essential to provide the confidence investors need to commit to new projects. Efforts to scale up investment should go hand-in-hand with a broad strategy that encompasses technology innovation, recycling,

supply chain resilience and sustainability standards.

There is no shortage of resources worldwide, and there are sizeable opportunities for those who can produce minerals in a sustainable and responsible manner. Because no single country will be able to solve these issues alone, strengthened international cooperation is essential. Leveraging the IEA’s long-standing leadership in safeguarding energy security, we remain committed to helping governments, producers and consumers tackle these critical

challenges. READ MORE

Excerpt from Politico's Morning Energy: Senators spent the night in a vote-a-rama on Democrats' budget resolution ... Among the other non-binding amendments ... adopted by voice vote an amendment from Sen. Ron Wyden to prohibit federal funds from going to the purchase of materials, technology and critical minerals produced, manufactured or mined with forced labor. READ MORE

Excerpt from Politico's Morning Energy: AND WE’LL NEVER HAVE ROYALTIES: Miners are pushing back against proposals on the Hill to impose royalties on mining on federal lands, Reuters reports . The House Natural Resources Committee advanced a measure to set royalties on new and existing mines, subjecting the industry to similar schemes as federal-land oil and gas extraction. The proposal went forward as part of the committee’s reconciliation legislation.

But miners say the royalties would impede domestic critical mineral extraction when the country needs it most. "The race for electric vehicles and electrification of the economy requires metals and mining, and that needs to be incentivized, not stalled," Rich Nolan, head of the National Mining Association, told Reuters. READ MORE

Excerpt from Politico's Morning Energy: LOOKING AT AFGHANISTAN: Afghanistan’s rich lithium and copper deposits are attracting renewed attention from China, The Financial Times reports. Chinese officials have been in contact with the Taliban since the summer, and a cohort from China’s mining industry visited Afghanistan recently to discuss access to copper deposits in Mes Aynak, southeast of Kabul, according to FT. Afghanistan is believed to have some of the richest deposits of lithium and other crucial resources on Earth, and demand for the resources is only expected to grow with higher reliance on batteries for electricity storage and electric vehicles.

Republicans have used foreign-sourced resources as a cudgel against Democrats’ clean energy plans, particularly following the Taliban takeover of Afghanistan. Read more from FT. READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- El Salvador

- Equatorial Guinea

- Eqypt

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.