by Scott Irwin and Todd Hubbs (FarmDocDaily) ... One implication of the virus-related restrictions is that people are driving much less than before, which means that gasoline and ethanol use are declining. The impact on the price of ethanol has been swift and severe, as shown in Figure 1. The price of ethanol at the Iowa plant level has declined $0.32 per gallon, or 26 percent, since late February. There is naturally great interest in the magnitude of ethanol demand destruction and the implications for corn ethanol use going forward. The purpose of this article is to investigate the potential level of ethanol demand destruction over the next few months and the associated impact on corn ethanol use.

...

The approach we take here is based on the level of restrictions currently in place in every state in the U.S., making an assumption about the impact of the restrictions on miles driven and gasoline use, and then weighting the impact by the proportion of gasoline use represented by each state.

...

Even when the reductions are assumed to be limited to March through May, the impact on annual gasoline consumption is substantial.

...

The reductions in gasoline, ethanol, and corn use discussed above are based on the assumption that virus-related restrictions in place in late March stay in place through the entire month of April and then lessen in May. There is obviously considerable uncertainty whether this will turn out to be the case. To provides some perspective on a possible worst-case scenario, we re-do the analysis assuming that 80 percent of gasoline demand is represented by the shelter-in-place category and 20 percent is represented by the social distancing category. All other assumptions remain the same. In this alternative scenario, the total decline in gasoline use for the three months is 9.9 billion gallons, the decline for ethanol use is 999 million gallons, and the decline in corn use for ethanol is 345 million bushels. We could also consider scenarios that lengthen and shorten the amount of time that the restrictions are in place, which would correspondingly increase and decrease the projections of demand destruction.

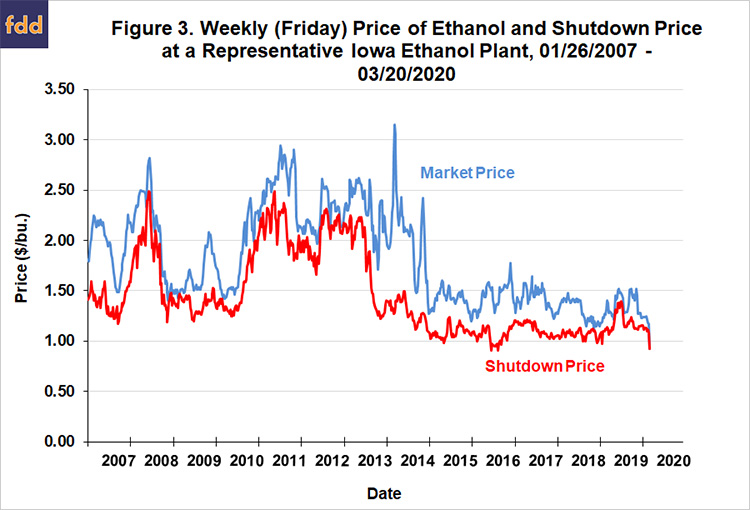

As a final step in the analysis, we examine the signal that the market is providing to ethanol producers to shut down production. READ MORE

3bn gallons of fuel ethanol idled, some plants switch to industrial production - RFA (Independent Commodity Intelligence Service)

Valero Halts Some Ethanol Production -- Gasoline Demand Hits From COVID-19 Affect Iowa, Nebraska Ethanol Plants (DTN Progressive Farmer)

Low Demand Leads The Andersons to Idle Ethanol Plants (Powder & Bulk Solids)

Rex idles NuGen plant, explores carbon sequestration project (Ethanol Producer Magazine)

U.S. Ethanol Demand And The COVID-19 Pandemic (Seeking Alpha)

U.S. refiners sell biofuel credits to raise cash as valuations tank (Reuters)

Ethanol Industry Facing A Perfect Storm (KXLG)

Cuts to ethanol production weigh heavily on corn market (Real Agriculture)

Gasoline demand expected to fall by 50 percent in wake of coronavirus: analysis (The Hill)

Siouxland Ethanol to suspend production in April, citing plummeting fuel demand (Sioux City Journal)

Siouxland Ethanol will be suspending ethanol production in April 2020. (Siouxland Ethanol)

Green Fuel Plants Are Shutting Down and Some May Never Come Back (Bloomberg)

HUGE LOSSES FOR ETHANOL INDUSTRY (KDHL)

Ethanol Plants Could Soon Start Producing for DDGs, Not Ethanol (Farm Journal AgWeb)

U.S. crude dips below $20 as lockdowns hit demand (Reuters)

Ethanol may be the loser amid cheap gas and an oil glut (Green Car Reports)

GRAINS-Corn slumps as ethanol makers feel coronavirus constraints (Reuters)

Energy bust threatens farmer earnings (Argus Media)

Pacific Ethanol's Restructuring Comes At A Terrible Time (Seeking Alpha)

Marquis: Ethanol plant will endure and boost community -- Low oil prices, COVID-19, tariffs won't stop Hennepin plant (News Tribune)

Marquis Energy continues operations during COVID-19 pandemic (Ethanol Producer Magazine)

COVID-19 reduces demand for fuel, ethanol plants cut production (Ethanol Producer Magazine)

The Oil Glut Is Getting Critical (Wall Street Journal)

A Pandemic, a Price War, and the Future of America's Oil Industry (OurEnergyPolicy)

Shocking drop in wholesale gas prices signals more refinery cutbacks and gasoline under $1 (CNBC)

S.D. ethanol industry and corn growers facing economic ‘bloodbath’ due to COVID-19 (Redfield Press)

Side effects: Fuel demand crash shuts US ethanol plants, meatpackers lack refrigerant (The Poultry Site)

Corn Futures Slip on Record-Low Ethanol Production (Market Screener)

Ethanol and Corn Producers Struggle While Country Stays Home (Atlantic News Telegraph)

Farmers face uncertain future amid global pandemic (1011 Now; includes VIDEO)

GRAINS-Corn futures slump as ethanol production hits decade low (Reuters)

State’s ethanol industry, corn growers facing economic free-fall (Brookings Register)

Excerpt from Independent Commodity Intelligence Service: The Renewable Fuels Association (RFA) predicts that 3bn gal of ethanol capacity has been idled or will idle in the next several days as the coronavirus (Covid-19) continues to dampen gasoline and fuel ethanol demand.

"We believe between 30-40 plants are fully idle and another 40-50 have reduced output," said Geoff Cooper, CEO and president of RFA.

...

While some plants cut production, others have the ability to shift to industrial ethanol as the need for sanitzers increases.

Making industrial alcohol from ethanol requires a further step in distillation, so not all fuel ethanol plants are able to accomplish this.

It also requires permits from the US Food and Drug Administration and the federal Alcohol and Tobacco Tax and Trade Bureau. READ MORE

Excerpt from Seeking Alpha: The ethanol sector is backed by the U.S. revised Renewable Fuel Standard [RFS2], which requires that specific volumes of different biofuels be blended with refined fuels every year. This has provided the sector with an important demand backstop during past periods of low gasoline prices.

This demand backstop is not functioning properly at the moment due to a quirk in the rulemaking procedure that the U.S. Environmental Protection Agency [EPA], which administers the blending mandate, utilizes. Specifically, when the EPA finalizes in Q4 the blending volumes for the subsequent year, it does so by taking the absolute statutory volumes and dividing them by expected refined fuels demand to calculate average percentage standards. Given that the COVID-19 outbreak didn't even begin until after the EPA had finalized its rulemaking for 2020, the denominator that it used was much higher than what is currently being used. Ethanol demand under the RFS2 has therefore recently declined in line with gasoline demand.

This does not, however, mean that mandated ethanol demand is completely tied to gasoline demand. The timing of the EPA's rulemaking is critical to understanding how ethanol demand will be affected by the COVID-19 pandemic moving forward. Specifically, the EPA's rulemaking for 2021 will be based on the U.S. Energy Information Administration's October 2020 projection of 2021 refined fuels demand. If the largest peak in COVID-19 cases does not occur until late 2020/early 2021, as researchers at the Imperial College London have forecast, then the EPA's denominator, expected refined fuels demand in 2021, will shrink relative to the statutory blending volume for that same year. This will mean that ethanol demand in 2021 will rebound to a level that is more similar to that of 2019 than 2020. This will also likely cause the mandated ethanol blending volume to exceed what the infrastructure is able to handle, perhaps by a large margin. The EPA's proposed 2021 rulemaking, which is to be released in Q2 2020, will be the first indication of such a development.

The RFS2 also contains a separate mechanism that may also cause ethanol demand to be partially separated from gasoline demand. The blending of biofuels with refined fuels under the mandate generates tradable compliance commodities known as Renewable Identification Numbers [RIN]. Obligated blenders such as refiners are allowed to bank RINs for use in the following year. RINs are only generated via blending operations (1 gallon of ethanol equivalent generates 1 RIN), so demand for ethanol can be effectively shifted forward one year via the RIN banking mechanism. It may become rational for refiners selling into those states that are capable of handling >10 vol% ethanol blends to blend (and generate RINs) as much as possible now in preparation for the possibility of much higher RIN prices in 2021 should widespread social distancing measures either remain in force or be re-implemented in Q4.

There is some evidence that such demand shifting is already occurring. The price of the D6 RIN category that corn ethanol generates has increased from $0.17 on March 18 to $0.31 on March 25 (see figure). This has been accompanied by a sharp increase in the price of ethanol relative to gasoline, absolute declines to both prices notwithstanding (see second figure). Ethanol prices are low, in other words, but they would be lower still without the mandate.

...

It has been calculated that the White House's SRE expansion ultimately reduced total RIN demand by almost 2.5 billion through the end of 2019. The court's ruling effectively reallocates approximately 0.8 billion of these waived RINs to 2020. READ MORE

Excerpt from Reuters: Refiners that sold off credits last week include Monroe Energy, which co-owns a refinery with Delta Airlines in Trainer, Pennsylvania, and Delek US Holdings, which owns refineries in Texas, Louisiana and Arkansas, according to market participants.

...

U.S. renewable fuel credits fell for three sessions straight last week to as low as 12.75 cents each, traders said. They have since rebounded, to trade at 23 cents each this week.

One other factor pushing RIN prices higher this week was the U.S. Environmental Protection Agency’s decision to not appeal a court ruling that is expected to dramatically change refiners’ obligations to blend biofuels into the fuel pool.

Delek US Holdings shares have fallen 56% since the beginning of 2020. In the same period, PBF Energy is down 73%, Par Pacific is down 64%, and Marathon Petroleum is down 48%.

Goldman Sachs noted that given the extent of the demand destruction so far in 2020 and a lower crack spread environment this year than in 2009, Delek’s leverage is elevated.

Delta’s Trainer refinery, which is optimized to produce jet fuel, cut capacity by 40,000 barrels per day earlier this week as the airline announced it was reducing overall flights by 40% due to the coronavirus pandemic. READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Canary Islands

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia/Slovak Republic

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea (Republic of Korea)

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler/Ship

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.