Can corn to ethanol be profitable with oil prices stabilized at about $80/barrel and agriculture exports falling because of tariff polices? Bob Kozak takes a serious look at this crossroad confronting the industry. In this three part series he'll detail the price and cost issues, offer an alternative course, and show how the alternative could be more sustainable than the current system.

by Bob Kozak* (Atlantic Biomass,LLC) Dramatic oil price fluctuations in the past decade (including negative oil prices during the Covid-19 pandemic) nearly destroyed the American shale oil production industry. In response, the banks left holding hundreds of billions of dollars of debt have enforced a new strategy that they hope will stabilize the US oil industry for years to come. This strategy consists of limiting new drilling investments while maintaining just enough production to maintain what is called “The Goldilocks Price.” This price would be not too high, or not too low, but just right for everyone. Oil production would be profitable and gasoline and other petroleum products would still be affordable for most customers.

The Goldilocks oil price is generally considered to be in the $70-$80/barrel range. It has held at that price for several years. And, despite the “drill baby drill” rhetoric of the Trump Administration, the US oil industry, by far the largest producer on the planet, is staying disciplined. This discipline is a combination of the banks wanting to eliminate their debt, a reduction in world-wide oil demand, and $3/gallon gasoline being accepted by consumers as the “New Normal.” As a sign of this acceptance, state transportation departments have noted a slight climb in the average speed of Interstate vehicles, which uses more fuel, in the last year or two.

While everyone in the worldwide petroleum industry is relatively happy and US consumers seem to care more about egg prices and mortgage interest rates, is there any industry that is seeing a major economic downturn at this price?

Yes, the American agriculture industry. In particular, corn to ethanol growers and producers.

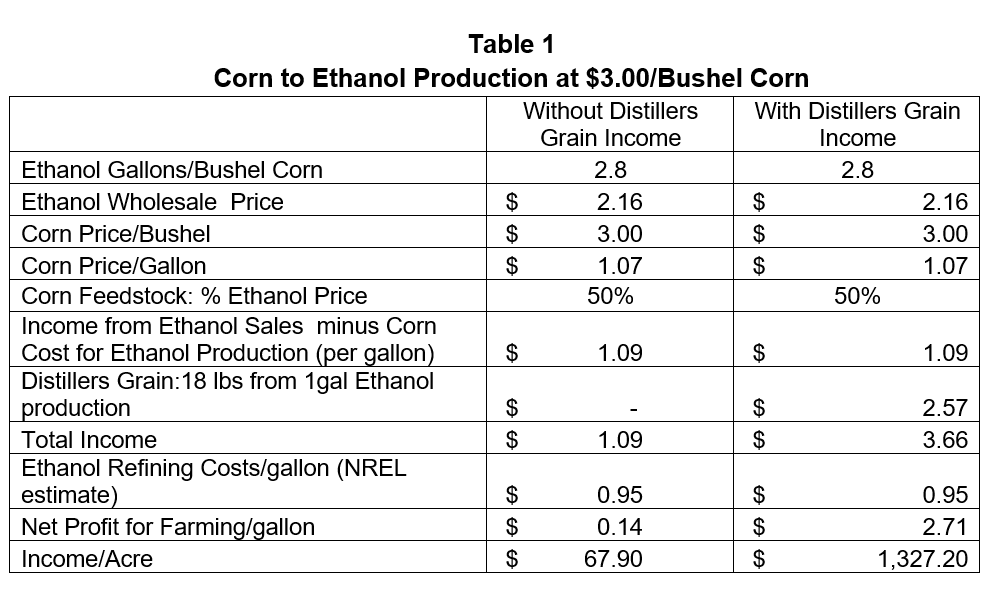

To produce a profit and compete with petroleum gasoline, corn feedstock prices cannot go much above $3.00 bushel. At this price corn feedstocks are about 50% of the wholesale price of ethanol ($2.16/gallon, January 2025). Without the addition of any value-added products from the corn, this remaining $1.09/gallon covers the cost of ethanol refining (See Table 1 for details).

However, it does not leave any income for growing the corn. By including the sale of Distillers Grain, on average, about $2.57 from the corn grain used to produce 1 gallon/ethanol, all ethanol refining costs are covered and the average income available per acre of corn production is about $1,300.

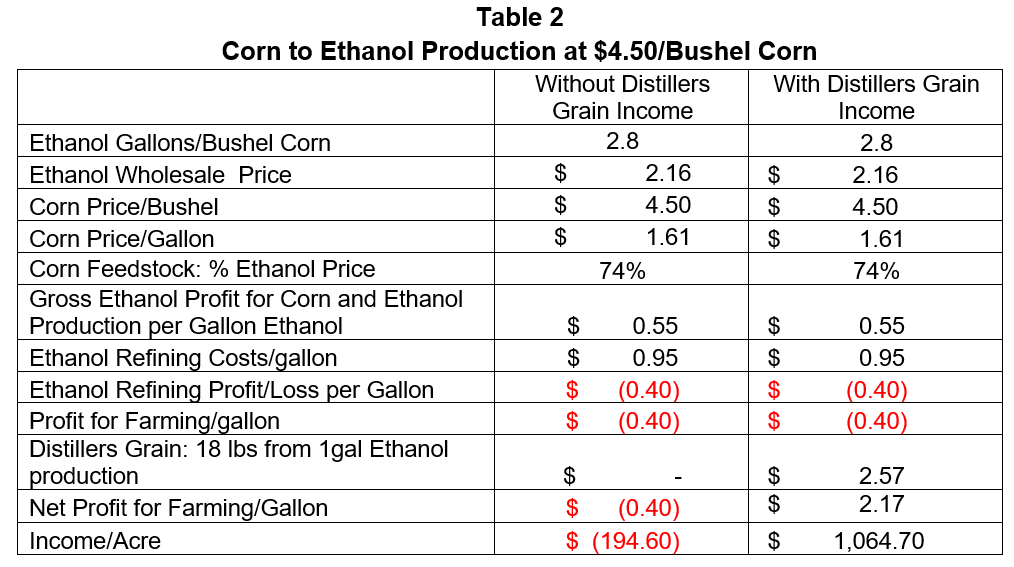

While this price balance was adequate for growers, let’s look at what $80/barrel oil prices have done to corn kernel to ethanol production.

Two immediate effects of this Goldilocks oil price have been:

1) ethanol prices have not increased, while

2) corn prices have increased to try to cover production cost increases for growers.

The combination has put ethanol sale prices below the cost of ethanol refining. This requires Distiller Grain sales by the ethanol producers to balance the production cost budget and pay corn growers.

With Distillers Grain sales there is still about $1,000/acre available for growing corn. However, there are questions if this adequately covers the effects of the following cost increases and market decreases.

Fertilizer Costs: The production and income estimates in the above tables are based on yields of about 175 bushels of corn/acre (2022 yields were 173.4 and 2024 yields were 179.3 bushels/acre (USDA 10 January 2025 data). On most US lands, to continually achieve these yields takes a fair amount of nutrient inputs. Here’s where petroleum price increases kick-in. Most commercial ammonium nitrate fertilizers are based on natural gas feedstocks. Long term natural gas prices tend to move in concert with oil. Current US natural gases are around $4.00/million BTUs. While this price is affordable for Europeans importing US LPG (liquefied petroleum gas) to replace Russian supplies, it is about $1/million BTUs (33%) above the $3.00/million BTU price that most US farmers had thought would hold for the rest of the decade. Effects of this natural gas price increase included the average price per ton of ammonium nitrate going from $355/ton in December 2023 to $510/ton in March 2024 (a 43.7% increase). Continuing to use the same quantities of fertilizer needed to maintain optimum corn yields means a significantly lower growing margin which is probably not completely covered by current corn prices in the $4.50-4.70 range.

Equipment Purchases: New GPS guided/autonomous tractors and harvesters as well as drones for pesticide application and crop monitoring offer farmers the opportunity to really drive down personnel and other operational costs. However, these systems are expensive and their prices keep rising due to supply-chain and loan interest costs that are both being pushed up by the inflationary effects of $80/barrel oil. As a result, growers, who are being squeezed by lower crop margins, are beginning to hold off on new purchases. For example, lower sales have caused layoffs at John Deere. In 2024 over 2,100 people there lost their jobs and about 200 more employees have already been released in 2025. This means negative effects on rural families and communities.

Lack of Export Markets to Balance US Market Conditions: We can’t blame everything on oil prices, Goldilocks or otherwise. Since the end of World War II, there has generally been enough global stability to ensure decent agriculture export markets for US farmers. In many cases these exports greatly helped US farmers to improve their bottom lines even while the US markets weren’t very profitable. However, the continuing hostilities between the US and China, including newly enacted US tariffs on agricultural products and equipment, as well as the growth of BRICS agricultural powers such as Brazil have driven down US agricultural exports. According to the latest USDA figures, in 2023 US agriculture exports fell $17 billion (8.7%) as compared to 2022. These exports included 977 million bushels of soybeans exported to China. For comparison, Brazil exported 2.737 billion bushels of soybeans to China in 2023 (180% more than the US). As for worldwide soybean exports, USDA is estimating US 2024 exports at 1.875 billion bushels and Brazil’s total soybean exports at about 3.490 billion bushels (86% more that the US).

So, while trying not to sound too pessimistic, if current oil pricing trends hold and export markets either stay flat or continue to decrease, corn based ethanol may soon be facing a reckoning.

Is There a Solution for Growers and Processors?

The goal is very simple.

Lower feedstock costs while increasing farmers’ and producers’ NET INCOME.

But making it happen is much harder. There are significant technical roadblocks that need to be overcome. Is progress being made?

Yes. Unfortunately it is not as fast as just about everyone would wish. In the next installment of this story, we will cover some very promising developments.

Source of Data: Agriculture yield, export, and related data is from USDA reports. Petroleum and ammonium nitrate prices come from petroleum pricing on-line reports. This data is subject to daily changes.

*Bob Kozak is the founder and President of Atlantic Biomass, LLC, and a co-founder and board member of Advanced Biofuels USA. After working in the transportation, energy, environmental, and government relations industries, he is now focusing on the development of integrated end-to-end biomass-to-fuel systems that do not require pretreatment. He can be reached at atlanticbiomass @ aol.com

Related articles

- RFA Releases 2024 Ethanol and Distillers Grains Export Reports (Renewable Fuels Association)

- With multiple tariffs looming, farmers who support Trump grow nervous: They fear losing foreign customers for American crops (Washington Post)

- One in four bankers say that their local economy is in a recession, according to the Rural Mainstreet Index (RFD TV; includes VIDEO)

- Goss: Rural Mainstreet Economy Falls Again (Husker Radio)

- Rural Economic Index Continues Downtrend -- Rural Mainstreet Index Sinks Again (Pro Farmer)

- Where Is the Technical Solution for Overcoming the “Goldilocks Pricing” Problem for the Biofuel Industry? (Part 2) (Atlantic Biomass)

- Making a Profit on Biofuels at Goldilocks Oil Prices (Part 3) (Atlantic Biomass)

Excerpt from Washington Post: Their costs for seed, fertilizer, labor and equipment are rising even as the prices they receive for their crops hover at multiyear lows. Farmers who borrow money to bridge the gap face punishing interest rates of nearly 8 percent, up sharply from three years ago.

After reaching a record high in 2022, net farm income, a broad measure of profitability, fell for two consecutive years, according to the U.S. Department of Agriculture. Farmers’ take is expected to rebound this year, largely because of government disaster relief payments to compensate them for damage from hurricanes and other storms.

With costs high and revenue pressured, profit margins are thin.

“That’s the hard part about agriculture. It takes 3 million [dollars] or 4 million worth of equipment for a small-percentage return,” said Joe Shirbroun. “So, you know, why do we do it? Well, we just love the challenge of the crop. And it is stressful some days. And when you get tariffs ... all of a sudden, your market changes.”

Many farmers are responding to the pervasive uncertainty by pausing discretionary investments. The Shirbrouns, for example, usually trade in their giant combines for a new model every two or three years. But not this year.

“We’re holding on to equipment longer. Same thing with tractors, planters, all the equipment. We’re just not going to be able to upgrade as often as we have in the past,” Suzanne Shirbroun said.

Sales of farm equipment slumped last year, long before Trump reentered the White House. John Deere, a maker of tractors, combines and other machinery, said this month that its profits fell by half for the quarter that ended Jan. 26. The company said it expects sales of large agriculture equipment in the United States to remain weak for the rest of the year. Tariffs would only add to the gloom. READ MORE

Excerpt from RFD TV: The Rural Mainstreet Index has fallen once again after a slight bump last month. Around one in four bankers surveyed say that their local economy is in a recession, or will take a sharp downward turn sometime in 2025.

Dr. Ernie Goss with Crayton University spoke with RFD-TV’s own Suzanne Alexander on what he is hearing from the ag community, the outlook for ag exports, and 2025’s ag economy. READ MORE; includes VIDEO

Excerpt from Husker Radio: For the 17th time in the past 18 months, the overall Rural Mainstreet Index (RMI) sank below the 50.0 reading in February, according to the monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy.

Overall: The region’s overall reading for February slumped to a weak 38.0 from 42.3 in January. The index ranges between 0 and 100, with a reading of 50.0 representing growth neutral.

...

Jeffrey Gerhart, Chairman of the Bank of Newman Grove and former Chairman of the Independent Community Bankers of America, said, “We’ve built up good relationships with both Mexico and Canada over the years. Working together with Mexico and Canada would be a better course of action than threatening our two longtime trading partners with tariffs.”

“The economic outlook for grain farmers remained weak for 2025. However, grain prices have recently improved, but not enough for profitability for many producers. On the other hand, regional livestock producers continue to experience solid prices with only 9.3% of bankers expecting negative cash flow for ranchers in 2025,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Other comments from bankers in February:

- Jim Eckert, CEO of Anchor State Bank in Anchor, Illinois, said, “Area farmers are somewhat optimistic going into the 2025 crop. Our area is somewhat “dry”, but the situation is not serious yet.”

- According to Jeffrey Gerhart, Chairman of the Bank of Newman Grove and former Chairman of the Independent Community Bankers of America, “The fallout from the actual tariffs remains to be played out, but I don’t believe that it will be good for the folks down on the farm.”

Farming and ranch land prices: For the 8th time in the past nine months, farmland prices sank below growth neutral. The region’s farmland price index fell to 40.0, its lowest level since October 2024, and down from 42.0 in January. “Elevated interest rates and higher input costs, along with below breakeven prices for a high share of grain farmers in the region, have put downward pressure on ag land prices,” said Goss.

This month, bank CEOs were asked to project 2025 grain and livestock net cash flow or income. On average, 70.8% of bankers expect livestock ranchers to experience positive cash flow or net income for the year. On the other hand, only 54.2% of bank CEOs forecast grain farmers to breakeven or earn a profit for 2025. READ MORE

Excerpt from Pro Farmer: For the 17th time in the past 18 months, the overall Rural Mainstreet Index (RMI) sank below the 50.0 reading in February, according to the monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy. READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Canary Islands

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia/Slovak Republic

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea (Republic of Korea)

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler/Ship

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

0 COMMENTS

Leave A Comment

Your Email Address wiil not be Published. Required Field Are marked*