by Clifford Krauss (New York Times) A surge of oil production is coming, whether the world needs it or not. The flood of crude will arrive even as concerns about climate change are growing and worldwide oil demand is slowing. And it is not coming from the usual producers, but from Brazil, Canada, Norway and Guyana — countries that are either not known for oil or whose production has been lackluster in recent years.

This looming new supply may be a key reason Saudi Arabia’s giant oil producer, Aramco, pushed ahead on Sunday with plans for what could be the world’s largest initial stock offering ever.

Together, the four countries stand to add nearly a million barrels a day to the market in 2020 and nearly a million more in 2021, on top of the current world crude output of 80 million barrels a day. That boost in production, along with global efforts to lower emissions, will almost certainly push oil prices down.

...

Then came the rise of hydraulic fracturing and drilling through tight shale fields, which converted the United States from a needy importer into a powerful exporter. The increase in American production, along with a choppy global economy, shaved oil prices from well over $100 a barrel before the 2007-9 recession to about $56 on Friday for the American benchmark crude.

Those low prices have forced OPEC and Russia to lower production in recent years, and this year many financially struggling American oil companies have slashed their exploration and production investments to pay down their debts and protect their dividends.

...

Like the shale boom, the coming supply surge is a sudden change in dynamics. Guyana currently produces no oil at all. Norwegian and Brazilian production has long been in decline. And in Canada, concerns about climate change, resistance to new pipelines and high production costs have curtailed investments in oil-sands fields for five consecutive years.

...

But exploration decisions, made years ago, have a momentum that can be hard to stop.

...

In Brazil, after years of scandal and delays, new offshore production platforms are coming online. Production has climbed over the last year by 300,000 barrels a day, and the country is expected to add as much as 460,000 more barrels a day by the end of 2021. In the coming days, Brazil is scheduled to hold a major auction in which some of the largest oil companies will bid for drilling rights in offshore areas with as much as 15 billion barrels of reserves.

In Canada, the 1,000-mile Line 3 pipeline that will take oil from the Alberta fields to Wisconsin, is near completion and awaiting final permitting. Energy experts say that could increase Canadian production by a half million barrels a day, or about 10 percent.

And the most striking change will be in Guyana, a tiny South American country where Exxon Mobil has made a string of major discoveries over the last four years. Production will reach 120,000 barrels a day early next year, rising to at least 750,000 barrels by 2025, and more is expected after that.

Guyana potentially has the most complicated future of the four countries. Its ethnically divided politics are sometimes turbulent, and Venezuela claims a large portion of its territory. But with the oil fields miles offshore, drilling is largely protected. In addition, Venezuela is mired in a political and economic crisis and unlikely to challenge a Chinese state company which has an oil investment in Guyana, along with Exxon Mobil and Hess.

...

“If I was in the business I would be scared to death,” said Philip K. Verleger, an energy economist who has served in both Democratic and Republican administrations. “The industry is going to face capital starvation.”

American oil executives express concern that drilling will fade in North Dakota, Oklahoma, Louisiana and Colorado as oil prices drop to as low as $50 a barrel in the next few years. Small companies are expected to merge, while others go bankrupt. READ MORE

Big Oil Earnings Provide an Opening for Aramco (Bloomberg)

Energy Markets Have ‘Ready Supply’ of Oil as U.S. Boosts Exports (Bloomberg)

Biofuel forecast may prop up prices (Western Producer)

Flat oil prices likely: good for fuel bills, bad for biodiesel (Western Producer)

More Cheap Oil Heading to Market Will Complicate Efforts To Curb Global Warming (Our Daily Planet)

OPEC Sees Its Market Share Shrinking for Years as Shale Triumphs (Bloomberg)

NOW ENTERING THE ERA OF MODERATION: (Politico's Morning Energy)

Epitome of America’s Shale Gas Boom Now Warns It May Go Bust (Bloomberg)

CA Governor Halts Fracking Permits, NY Governor In Standoff Over Natural Gas (Our Daily Planet)

Texas oil explorers say predictions of growth contradict dire reality (Houston Chronicle/Bloomberg)

Oil Soars as U.S. Killing of Iran General Stirs Fear of Conflict (Bloomberg)

Peak Permian oil output is closer than you think, investor says (Houston Chronicle)

America’s Radioactive Secret (Rolling Stone)

The Most Exciting Oil Plays Of 2020 (OilPrice.com)

Shale pioneer John Hess says key U.S. fields starting to plateau (Reuters)

Coronavirus and Oil-Price Plunge Buries Shale and Occidental’s Big Bet (Wall Street Journal)

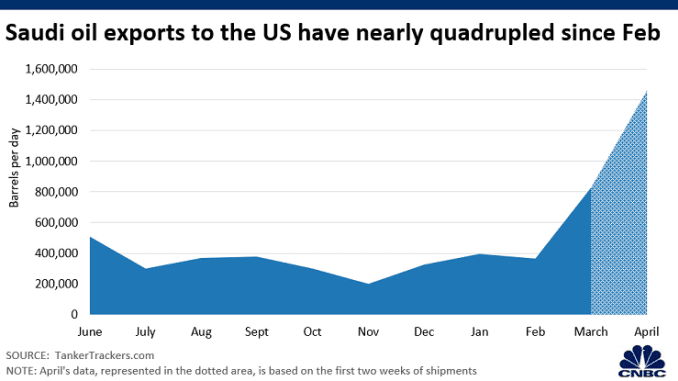

Saudi Arabia’s oil exports to the US skyrocketed in the last month - March 2020 (CNBC)

Oil & gas industry sheds more than 6,000 jobs in a single day (Houston Chronicle)

OIL ASKS: WHOSE SIDE IS TRUMP ON? (Politico's Morning Energy)

Energy-concentrated US banks may face credit issues as prices fall (S&P Global Platts)

Excerpt from Politico's Morning Energy: NOW ENTERING THE ERA OF MODERATION: Shale production is moving toward a "major slowdown," according to a new IHS Markit U.S. oil production outlook. The analysis expects total U.S. production growth to be 440,000 barrels per day in 2020 before flattening in 2021. It expects moderate growth to resume after that in 2022, but still marks a significant departure from previous years. "Going from nearly 2 million barrels per day annual growth in 2018, an all-time global record, to essentially no growth by 2021 makes it pretty clear that this is a new era of moderation for shale producers," said Raoul LeBlanc, vice president for North American unconventionals at IHS Markit, in a statement. READ MORE

Excerpt from Houston Chronicle/Bloomberg: Texas wildcatters, after years eye-rolling at shale skeptics, are now saying global analysts are underestimating just how severe the industry’s slowdown is.

What’s ticking folks off these days is how the International Energy Agency in Paris and the Energy Information Administration in Washington still predict robust U.S. production growth next year, despite the dire reality on the ground. The IEA expects an increase of 900,000 barrels a day, while the EIA forecasts 1 million, which would mean practically replicating this year’s expansion.

Those projections don’t jibe with the vibe in Texas, home to about half of U.S. crude output. Capital-hungry producers are being starved of funding, stocks have plunged and there’s been zero appetite for public offerings, making the downturn potentially more enduring than previous price-related busts.

...

So far, an unclear picture has kept oil futures in New York mostly stuck between $50 and $60 a barrel for almost six months.

Gloomy views from Texas could have something to do with recent developments in the Lone Star state. Just as the industry was recovering from the last downturn, more than 1,000 layoffs have been announced this year as drillers and their hired hands seek to cut costs. Investment banks have also had to trim staff locally thanks to a lack of dealmaking.

...

Of course, independent explorers aren’t the only drivers of growth. Exxon Mobil Corp. and Chevron Corp. have been beefing up their presence in the Permian. Plus, chatty CEOs with skin in the game have a clear incentive to talk up an impending slowdown that would bolster oil prices.

...

On top of their newfound financial discipline, a number of producers have run into disappointing results from wells that were placed too close together.

...

Then there’s the rapid decline of shale-well production. In the top five shale basins, wells that came on in 2018 are declining at their fastest rates yet, according to David Ramsden-Wood, the former chief operating officer of Permian producer Franklin Mountain Energy.

“These factors have to be playing a bigger role than analysts think,” he said. “Productivity isn’t increasing.” READ MORE

Excerpt from OilPrice.com: For the US shale industry, the future hangs in the balance. It’s now official: after a phenomenal decade-long run that has propelled the United States to the top of the oil producers’ league, America’s second shale boom is running out of gas.

According to the US Energy Information Administration, drilling in the Permian--easily the most prolific of the shale basins--declined 11% in the nine months to August. Output growth over the next year is expected to clock in at just 370,000 barrels a day--the slowest clip in four years. With oil prices remaining stubbornly low and no respite in sight, drillers in the shale patch are struggling and rig count has seen a steady decline.

However, there are other regions that are pretty well endowed. Not only are they ready and willing to seize the moment, but they’re positioned to be the next major shale boom venues.

#1 Argentina's Vaca Muerta ...

#2 Kavango Basin, Namibia ...

#3 Karoo, South Africa ...

Bonus: Big Oil Diving Into Uncharted Waters READ MORE

Excerpt from CNBC:

Excerpt from Politico's Morning Energy: OIL ASKS: WHOSE SIDE IS TRUMP ON? The collapse of energy prices looks likely to be destructive for shale producers, POLITICO's Ben Lefebvre reports . Analysts at Raymond James Inc. estimated that the crash could knock out about half of all shale producers if prices remain at between $20 and $30 per barrel. Worse, some industry executives say, Trump seems to either not recognize the threat or is unwilling or unable to address it.

In interviews with POLITICO, a half-dozen industry officials who have talked with White House officials in recent days described Trump as slow to comprehend the dual threats that the global pandemic and a price war between Saudi Arabia and Russia pose to an industry he has long supported. "People that have spoken to the White House — myself included — are concerned that the administration doesn't realize that the U.S. oil industry will eventually cease to exist at sub-$30 oil," said Dan Eberhart, CEO of Canary LLC and a major Republican donor.

While the energy sector has so far not seen direct assistance through federal legislation, most industry executives said they would be happy if the administration puts diplomatic pressure on Russia and Saudi Arabia to rein in production. Trump's first shot at convincing Saudi Arabia that a flood of oil could seriously hurt the U.S. economy came in a telephone call with Crown Prince Mohammed bin Salman on March 9, Ben reports.

Two people with knowledge of the call said Trump told the Saudi leader that he was fine with the kingdom's plans to produce more oil to try to squeeze Russia out of certain markets, but he requested that prices not fall far enough to hurt U.S. producers. "Keep [prices] low, but keep it viable" for U.S. drillers to remain in business, was Trump's message, according to a former senior administration official who was briefed on the call. But the size of the resultant wave of oil, which caused prices to drop by more than 25 percent in the two weeks since the phone call, caught the administration off guard, the official said. "No one thought it would go quite this low," the person said. "It was whoa, we didn't think it would get to this."

TRUMP TO TAP SAUDI ENERGY OFFICAL: The president is planning to appoint Victoria Coates as special energy representative to Saudi Arabia, Reuters reports. Coates joined the Energy Department in February from the National Security Council as a senior adviser to Secretary Dan Brouillette. She "will be based in Saudi Arabia to ensure the Department of Energy has an added presence in the region," an Energy Department official told Reuters, adding that her assignment "has been in the works for a while." Her appointment comes amid the ongoing oil market meltdown caused by declining demand and the price war between Saudi Arabia and Russia. The president last week told reporters he would get involved in the price war "at the appropriate time." READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- El Salvador

- Equatorial Guinea

- Eqypt

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.