by Kim Chipman (Agri-Pulse) As farmers get a new round of bad crop market news, biofuel investment has stalled due to U.S. policy uncertainty.

America’s crop farmers got hit with a fresh wave of market woes this week, ramping up pressure on the Trump administration and Congress to move faster on biofuel policy the industry says is crucial to its future. Domestic supplies of corn and soybeans are bigger than previously estimated, with the current corn crop at a record, the the Department of Agriculture said in its closely watched monthly crop report on Monday.

Grain and soy prices fell. The full bins collide with murky demand outlook and a surge in farm production costs. Ag and biofuel groups are doubling down on calls for Washington to take action. The wish list includes passing congressional legislation to allow year-round, nationwide sales of higher blends of corn-based ethanol, known as E15, and for the Environmental Protection Agency to finalize overdue 2026 biofuel-blending regulations.

Montana Renewables CEO Bruce Fleming says the lack of policy clarity means there's not funding for new U.S. biofuel projects. READ MORE

Related articles

- USDA confirms record corn production for 2025, increased sorghum production (Ethanol Producer Magazine)

- USDA Responds to Farmer Frustration After January Report Delivers Major Surprises (AgWeb; includes VIDEO)

- What Are We Going to Do With 17 Billion Bu. of Corn: Will it Push Congress to Pass E15? (AgWeb)

- Economist says low corn prices could help shape ag policy in 2026 (Brownfield Ag News)

- Bearish report highlights need for biofuel certainty (AgriNews)

Excerpt from Ethanol Producer Magazine: Grain sorghum production was also up significantly when compared to the previous year.

According to USDA, 2025 corn yields are estimated at a record high 186.5 bushels per acre, up 7.2 bushels per acre when compared to the previous year. Record high corn yields were reported for Georgia, Indiana, Louisiana, Minnesota, Nebraska, North Dakota, South Dakota, Virgina, Washington and Wisconsin.

Corn planted area was at 98.8 million acres in 2025, up 9% when compared to the 2024 estimate. Area harvested for grain is estimated at 91.3 million acres, up 10% when compared to the 2024 estimate.

Grain sorghum production for 2025 is estimated at 437 million bushels, up 27% when compared to 2024. Total planted area for 2025 was estimated at 6.64 million acres, up 5% when compared to the previous year. Area harvested for grain reached 6.02 million acres, up 7% when compared to 2024, while grain yield was estimated at 72.6 bushels per acre, up 11.3 bushels. Record high sorghum production is expected in Colorado. READ MORE

Excerpt from AgWeb: Lance Honig, chair of the Agricultural Statistics Board and a NASS official, addressed farmer concerns in a Farm Journal interview explaining the major January data revisions that caused corn prices to sink on Monday (January 12, 2026).

The January USDA reports, considered the most influential data releases of the year, delivered unexpected increases in corn yield, harvested acreage and total production, pushing the U.S. corn crop above 17 billion bushels and sending futures sharply lower.

Ahead of the reports, average trade estimates pointed to only minor adjustments, a typical pattern for January. Instead, USDA delivered one of the more consequential end-of-season revisions in recent years, triggering frustration among farmers who struggled with disease pressure and weather challenges during the growing season.

Key takeaways from the report:

- Corn yield: 186.5 bu./acre, well above expectations

- Soybean yield: 53 bu./acre; production at 4.26 billion bushels

- Corn production: Record 17 billion bushels

- Harvested corn acres: 91.3 million

- Dec. 1 corn stocks: Over 13 billion bushels, above trade estimates

- Soybean stocks: 3.3 billion bushels

- Wheat stocks: 1.6 billion bushels

Ending stocks estimates from USDA were also higher than anticipated with corn at 2.2 billion bushels. Soybeans came in at 350 million bushels.

...

The biggest surprise came as USDA raised corn yield despite expectations for a cut, driving record production and adding pressure to an already well-supplied market.

“Acres times yield,” says Joe Vaclavik of Standard Grain. “There were too many corn acres, and the yield was larger than what the trade had expected. And that combination left us with a U.S. crop estimate for 2025, north of 17 billion bushels, more than 1 billion larger than the previous record. So, the trade was caught totally off guard by the size of the crop.”

Vaclavik says not only did those changes surprise the market, but it also sparked debate.

...

“There’s a lot of debate,” Vaclavik says. “Was the yield number accurate? Were the acres accurate? The acres ever been accurate? A lot of debate about that, but that was the big surprise.”

Accuracy of USDA’s Latest Reports in Question

The accuracy of the reports, and how USDA came up with such a large jump in acres, is what’s aiding the farmer frustration. USDA Deputy Secretary Vaden was asked about that while speaking to farmers during the Kentucky Bowling Green this week.

“Why does USDA continue to find corn acres and similar data that destroy markets as soon as they get too high,” was the question from one farmer.

“We may not like the report, but it is not necessarily inaccurate,” Vaden responded. “USDA market moving data will be more closely scrutinized going forward, and will begin to be held accountable for large revisions if it is a fault of the agency. We plan to have NASS staff available at the Ag Outlook Forum this year to answer questions as well. We will find out in September of 2026 if their current estimates were off based on revisions made at that time. If we notice a trend in errors we will review the way the statistics are calculated.”

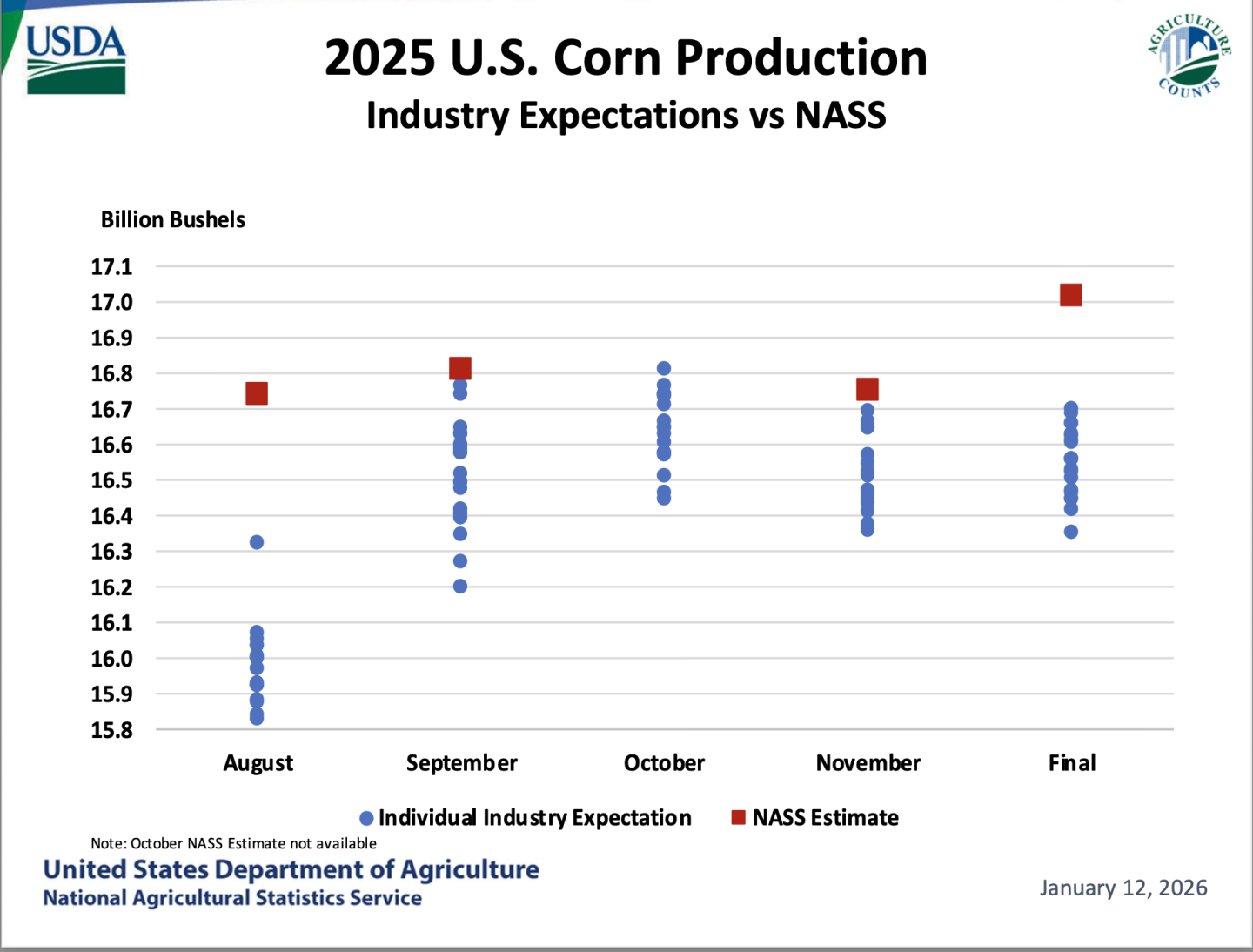

Industry expectations compared to what NASS published. (USDA NASS )

Small National Increase in Corn Yield, Big Regional Differences

Lance Honig, chair of the Agricultural Statistics Board and a senior official with USDA’s National Agricultural Statistics Service (NASS), also addressed those concerns in a one-on-one interview with Farm Journal this week, offering detailed explanations on how and why the January data changed so significantly.

...

The Bigger Driver Came in Harvested Acreage Jump

While yield caught headlines, Honig says the most significant factor behind the production increase was harvested acreage.

...

He says earlier in the year, USDA assumed the ratio of planted acres harvested for grain would remain consistent with what farmers reported in June, and consistent with how much of the crop went to grain versus went to silage or was abandoned, would be similar to past years.

“When we went back and surveyed 73,000 farmers after harvest and collected actual results, what we found was a much higher proportion of those larger planted acres went to grain than we had previously anticipated,” Honig says.

Final Planted Acreage Still a Surprise With Big Changes from June to January

USDA estimates farmers planted 98.8 million acres of corn, about 3.6 million more acres than expected back in March and June. Honig says that number was surprising not only based on what farmers told USDA and NASS earlier in the year, but also based on what most people watching the situation thought back in June, as well.

“This was definitely a larger change between June and January than we would typically see,” he says. “There’s really two components. You really have to break the acreage down though, because you’ve got your planted area and then, of that total, how many of the acres were harvested for grain. Obviously big changes from June to January in both cases, but from a planted perspective, we picked this almost all up back in August and September.”

...

How the Data Was Collected

It’s also important to note how the data was collected for the January report. Honig emphasizes January estimates are built on actual, end-of-season results rather than projections.

“For the end of the season, it’s really largely driven by a large survey we do of producers, about 73,000. We do that in the month of December, which means it’s after harvest,” he says. “So we’re actually asking a large number of producers after everything’s in the bin.”

Those surveys are conducted after harvest and ask farmers directly:

- How many acres they planted

- How many acres they harvested

- How many bushels they harvested

- What their final yield was

USDA also incorporates final objective yield survey data, which comes from physical sample plots across key growing regions. So, it’s no longer forecast, and it’s actual data from the crop that’s harvested.

“We do also have final results from the objective yield survey work that we did as well, which means those sample plots that we lay out across the key growing area across the country,” Honig says. “And so a lot of data after the crop has already been not only grown but harvested that are really just giving us actual results.”

Survey Response Rate and Farmer Participation

The December producer survey had a response rate of about 40.2%, down from roughly 46% last year but still strong by industry standards.

“If you compare that to what most folks in the survey business are doing, that’s actually still quite good,” Honig says.

Still, he encourages farmers to participate whenever possible.

“My message to all farmers would be: The more response we get, the more data we have, and the more accurate we can be,” he says.

Acknowledging Farmer Frustration

Honig says he understands why producers are frustrated by large January revisions, particularly in a year when margins are tight.

“These are all data-driven decisions,” he says. “We have one purpose at NASS, and that’s to estimate everything as accurately as we can.”

He notes that earlier use of FSA data helped reduce the size of the January adjustment and says USDA will continue evaluating ways to improve the process.

“We’re going to dig in between now and June and see if there’s anything we can do to make the process even better,” Honig says.

The Part Not Many Are Saying Out Loud

Vaclavik says the changes were surprising, and whether you think they’re accurate or not, Vaclavik points out the USDA reports have produced unprecedented changes all year. He thinks there’s an underlying issue impacting the data from USDA and NASS.

“My personal opinion is that it’s not an opinion. USDA is understaffed,” says Vaclavik. “Understaffed to what degree, I don’t know. That is the simplest answer to the reason that the data has been, the word I’ve been using for acres is ‘janky.’ It’s kind of all over the place. You saw these big moves during the growing season that you wouldn’t typically see. And I know the survey response rates are never great. That was again, the case this year, but I think that the easiest and simplest and most obvious answer. Is that USDA has staffing problems. They’re doing relocations. They, I think, pay people to quit, basically. I think that’s where the problem is.”

What Comes Next

Beyond corn, Honig says winter wheat seedings came in roughly in line with last year, slightly higher than some expected, and emphasized that the March report will provide another opportunity to refine those estimates. READ MORE; includes VIDEO

Excerpt from Ag Web: he political climate might finally be right to pass year-round E15 legislation. Analysis from NCGA indicates E15 legislation would be one of the quickest ways to increase demand and work through the record pile of corn.

USDA’s projection of a record 17-billion-bushel corn crop is turning up the heat on lawmakers to get nationwide, year-round E15 legislation passed in Congress.

Analysis from the National Corn Growers Association (NCGA) indicates that would boost corn use by approximately 2.4 billion bushels annually and be one of the quickest ways to increase demand and chew through the record pile of corn in the U.S.

Is the Time Finally Right?

The political climate might finally be right to pass year-round E15 legislation. Biofuels leaders, including Geoff Cooper, president and CEO of the Renewable Fuels Association, are optimistic about attaching a bill to the mini-omnibus appropriations bill or the Continuing Resolution (CR) at the end of January.

“We know there’s going to be another CR bill at the end of January to hopefully avoid another shutdown, but the bottom line is we have to get it done,” Cooper says. “I don’t want to say it’s now or never, but the period between now and early 2026 is really our best shot at getting this legislation done.”

Bipartisan Support for E15

Cooper says there’s growing bipartisan support for E15 in Congress and even from the oil industry.

“We had 70 ag and biofuel groups at the state level, at the federal level, that sent a letter on that last week,” Cooper says. “It’s gotten a very good response. We’re hearing a lot more chatter on the Hill today about this being a priority. Senator Grassley’s been talking about this every chance he gets, but we also have Whip Emmer talking about E15.”

He adds that a year ago the biofuels industry was close to having that legislation done and across the goal line.

“We think we’re pretty close again this year,” Cooper says.

House Agriculture Committee Ranking Member and Minnesota Rep. Angie Craig, D-Minn., is leading efforts in the House co-sponsoring the Nationwide Consumer and Fuel Retailer Choice Act with Rep. Adrian Smith, R-Neb. She reiterated her support at the American Farm Bureau convention in Anaheim, Calif., this week.

“We need more domestic markets in this nation, and so I’m going to be looking for year-round E15, higher blends of ethanol, sustainable aviation fuel,” Craig says. “We have to be thinking about that.”

Similar legislation has been introduced in the Senate by Nebraska’s Deb Fischer, with bipartisan support including Senate Agriculture Committee Ranking Member Sen. Amy Klobuchar, D-Minn. READ MORE

Excerpt from Brownfield Ag News: An ag economist with the University of Missouri Extension says the current state of the ag economy could help shape ag policy this year.

Ben Brown says he doesn’t expect much movement for corn prices.

“Even if we look outside of 2026, I think we’re getting pretty close to an equilibrium unless we see major changes in policy,” he says. “We’ve got some more work to do on efficiency and input cost management to get to a point to where we’re making money.”

He tells Brownfield expanding ethanol demand could be an opportunity to help shape long-term market access for corn.

“E-15 has had a lot of discussion both in the U.S. and in other places around the world as they try to increase their ethanol mandates,” he says. “One of the perks of having $4.00 corn or below $4.00 corn for a period of time is it has reignited the discussion around E-15.”

Brown says farmers should take advantage of any price improvements and continue to monitor their balance sheets throughout 2026. READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Canary Islands

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia/Slovak Republic

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea (Republic of Korea)

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler/Ship

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.