(U.S. House of Representatives Committee on Agriculture Democrats) Caleb Ragland, president, American Soybean Association: “Farmers are frustrated. Tariffs are not something to take lightly and ‘have fun’ with. Not only do they hit our family businesses squarely in the wallet, but they rock a core tenet on which our trading relationships are built, and that is reliability. Being able to reliably supply a quality product to them consistently.”

Josh Gackle, chairman, American Soybean Association: “We do everything we can to create domestic demand, whether it’s through biofuels or feeding our product to livestock. But you can’t eliminate the export market and expect there’s going to be a price that farmers can run their farms on.”

Lori Stevermer, president, National Pork Producers Council: “Mexico is our number one market for exports, so any type of disruptions are of concern, especially the retaliatory tariffs that might come back to us. It’s also important to note that we, as an industry, get young, weaned pigs from Canada that would be affected by those tariffs also, which would add cost to our producers. Those pigs are raised in states like Minnesota and Iowa.”

Dave Puglia, CEO, Western Growers Association: “In the last month, the looming threat of these tariffs was enough to prompt some major Canadian grocery chains to either cancel orders from American growers as they pivoted to other countries capable of supplying them or to require American growers to secure a foreign product supply to supplant their U.S.-grown crops. There is no question that with the move to impose these tariffs, our members will confront sweeping retaliatory actions that effectively block our American-grown fresh produce from those markets. The risk is not just an immediate one. Years after the China tariffs and the predictable Chinese tariffs imposed in retaliation on many of our members’ U.S.-grown products, our ability to sell into the Chinese market remains handicapped in no small part because other countries took advantage of the disruption and captured much of that market. This lingering economic harm is quite likely to be replicated this time on a broader scale as Canada and Mexico represent the top two export markets for fresh produce grown in the United States.”

Kenneth Hartman, president, National Corn Growers Association: “Farmers are facing a troubling economic landscape due to rising input costs and declining corn prices. We ask President Trump to quickly negotiate agreements with Mexico, Canada and China that will benefit American farmers while addressing issues important to the United States. We call on our trading partners to work with the president to resolve these issues so that that we can restore vital market access.”

Krysta Harden, CEO, U.S. Dairy Export Council: “Exports are fundamental to the health of the U.S. dairy industry. One day’s worth of milk production out of every six is destined for international consumers, and U.S. dairy sales to Mexico, Canada, and China account for 51% of our total global exports. That’s a lot at stake.”

Farmers for Free Trade: “There will be significant national economic implications with all these tariffs in effect. Based on 2024 data, the new rates will result in an estimated $300 billion more in tariffs, or over $824 million in extra taxes on U.S. importers per day.”

Rob Larew, president, National Farmers Union: “The tariffs announced today, along with retaliatory measures from China and Canada, will have serious consequences for American agriculture. Our farmers are the backbone of this country, and they need strong, fair trade policies that ensure they can compete on a level playing field—not be caught in the middle of international disputes. We are already facing significant economic uncertainty, and these actions only add to the strain. […] Promises alone won’t pay the bills or keep farms afloat. Without a clear plan, family farmers will once again be left to bear the burden of decisions beyond their control, and eventually, so will consumers. We urge the administration to work with our trading partners to prevent further harm to rural communities.”

Zippy Duvall, president, American Farm Bureau Federation: “Farmers and ranchers are concerned with the decision to impose increased tariffs on imports from Canada, Mexico and China – our top trading partners. Last year, the U.S. exported more than $83 billion in agricultural products to the three countries. Approximately 85% of our total potash supply – a key ingredient in fertilizer – is imported from Canada. For the third straight year, farmers are losing money on almost every major crop planted. Adding even more costs and reducing markets for American agricultural goods could create an economic burden some farmers may not be able to bear.”

Gary Wertish, president, Minnesota Farmers Union: “[F]armers, this is their livelihood. It's not a game. We're dealing with low, low prices and high input costs. So, the margin's not there. And you know this, this is definitely going to hurt farmers and consumers.”

Justin Sherlock, president, North Dakota Soybean Growers Association: “You know, we haven't really recovered from the first trade war with China. And right now, producers have very little to fall back on. This is the time of year when most family farm operations are working to renew their operating loans with their lending institutions, with their banks. So, you know, are the banks going to continue to provide lending services to us if we can't guarantee that we can pay back our operating loans? […] This could potentially really hurt a lot of family farms, and you know, whether they're able to stay in business in 2025.”

Brian Duncan, president, Illinois Farm Bureau: “We remain deeply concerned with the use of tariffs and their potential to spark retaliation on America’s farmers. Illinois farmers’ products — from grains and feed, corn, soybeans, ethanol, beef, pork, and more — rely on access to foreign markets and will undoubtedly be impacted by these new tariffs either through increased prices or decreased market access. This uncertainty coupled with an already struggling farm economy has farmers worried as we head into planting season.”

Nick Levendofsky, president, Kansas Farmers Union: “This isn’t a game. It’s not a reality TV show. It’s reality. There’s nothing fun or funny about this, when you’ve got markets that have been built up for years and decades, frankly, that are now being put into question and people are wondering if they’re going to be able to raise the crop, make it work, pay for things that they need to pay for, make a living, all of those things. […] It’s a global market, but when you’re upsetting your neighbours, your biggest trading partners that are easy-access markets, then you’re cutting your nose off to spite your face, is what you’re doing, and then you get the retaliatory tariffs, which then causes us to pay more for all these products.”

Walter Schweitzer, president, Montana Farmers Union: “The U.S. is the largest beef exporter in the world. We’re also one of the largest beef importers in the world. Tariffs hit us both ways on that. […] Most of our feeder calves go north to the border to be finished, fed out, and many of them come back to the United States to be processed. Most of our inputs for growing our feed come from Canada. So, these tariffs would have a very adverse impact on the cattle ranchers of Montana.”

Chad Franke, president, Rocky Mountain Farmers Union: “We’re really good at raising healthy, safe, and cost-effective food to the point that we produce way more than this country needs. To say that we’re just going to sell it domestically is like saying you should put 20 gallons of gas in your 15-gallon gas tank. Farmers and ranchers already have enough uncertainty in their daily lives. They don’t need any more.”

Kip Eideberg, senior vice president, Association of Equipment Manufacturers (per The Hagstrom Report): “Tariffs are taxes. They are taxes on American companies and farmers. They will drive up the cost of making equipment in the United States. They are inflationary, which is bad news for equipment manufacturers. We are extremely concerned about the tariffs that are set to take place at midnight. […] All tariffs will drive up the cost of making equipment in the United States. We always try to source inputs close to manufacturing operations, but some cannot be sourced at scale inside the United States.”

Agricultural Retailers Association and The Fertilizer Institute: “The 25 percent tariffs on critical fertilizer imports from Canada, including potash, ammonium sulfate, nitrogen fertilizers and sulfur will drive up the cost of production for U.S. farmers. These costs ripple throughout the agriculture community, ultimately leading to higher prices at the grocery store.”

Steve Kuiper, director, Iowa Corn Growers: “Farmers are very concerned. […] In the end we want good trade agreements where it benefits us as U.S. producers. Not only does the tariff hurt us from a business standpoint, it hurts the consumers around the country.”

Greg Tyler, CEO, USA Poultry & Egg Export Council: “Tariff wars are only serving to harm those who rely on international trade to support their livelihoods.”

Barb Kalbach, soybean farmer, Dexter, IA: “He’s out there with his wrecking ball just throwing tariffs around. This is just going to take parts of our markets away.”

Danny Lundell, corn and soybean farmer, Cannon Falls, MN: “He creates a lot of chaos and uncertainty in the farming community. There's a lot of nervousness going on right now.”

Dennis Campbell, president, Crystal Creek Enterprises: “We grow corn and soybeans here in the Midwest, and soybeans are primarily an international export product force. China will not change the amount of soybeans that they buy. They’re just going to buy it from somebody else, we could potentially overload the domestic the US marketplace, which would drive down prices.”

Marc Busch, Karl F. Landegger Professor of International Business Diplomacy, Georgetown School of Foreign Service: “Agriculture took the brunt of retaliatory tariffs by China last time, and certainly agriculture is going to be the main target of today’s retaliatory strikes. The expectation among ag stakeholders is that it will only be worse this time.”

Joe Janzen, assistant professor of agricultural economics, University of Illinois: “There is no domestic market for the amount of corn, soybeans, wheat, and other agricultural products that we now export in significant quantities.”

Francis Lun, CEO, Geo Securities, Hong Kong, CN: “I don't think China will buy any more U.S. farm products. The orders will go to South America. I think all in all, it's a lose-lose situation. Nobody gains anything.”

Donald J. Trump, president, United States of America: “Have fun!” READ MORE

- Local farmers discuss President Trump's tariff impacts (FOX 31 Denver; includes VIDEO)

- Farmers speak on impact of potential new tariffs in April (WNEM TV5; includes VIDEO)

- Trump to put tariffs on agricultural imports, tells farmers to ‘have fun’ (Straight Arrow News; includes VIDEO)

- Farmers Fear More Pain From Trump's Trade War (Time/Yahoo!)

- Trump Delays Tariffs for Goods Covered Under Mexico, Canada Trade Deal (AgWeb)

- Trump changes course and delays some tariffs on Mexico and Canada (Associated Press)

- US agribusiness attacks Trump and says Brazil will win trade war (UOL (Google Translation))

- Grain Growers of Canada react to U.S. tariffs: GGC says tariffs put family-run farms, already under strain, at great risk (Farmtario)

- US soy farmers appreciate tariff reprieve, hopeful for nontariff solutions to continue market access (American Soybean Association/Biobased Diesel Daily)

- Soy group says US farmers are frustrated with tariffs, urges Trump administration to reconsider (American Soybean Association/Biobased Diesel Daily)

- Farmers strongly back Trump. A new trade war could test their loyalty (NPR/WESA)

- ‘Tariffs break trust’: How Trump’s trade policy is putting pressure on U.S. farmers (CNBC)

- Trade wars won’t make American farming great again (Bloomberg/Money Control)

- 92% of Ag Economists Say the U.S. is Already in the Middle of Another Trade War (AgWeb)

- Poll Results: More Than Half of Farmers Say They Don’t Support Trump’s Use of Tariffs (AgWeb; includes AUDIO)

- Cross-Border Tensions: Canadian Farmers Fear No One Will Win In A Trade War -- Canadian farmers are on edge as the latest trade war could impact the crops they grow as well as the inputs they need to plant a crop this spring. (AgWeb; includes VIDEO)

- The US firms backing Trump's fight over trade (BBC)

-

US ethanol producers say Trump’s proposed port fees would hurt exports (Hellenic Shipping News)

-

Farmers Who Stand Strong With Trump on Tariffs Say Long-Term Gain is Worth Short-Term Pain (AgWeb)

-

BREAKING: CNH Halts Farm Equipment Shipments From North America, Europe To Assess Tariff Situation (AgWeb)

Excerpt from AgWeb: For Canada, the amended order also excludes duties on potash, a critical fertilizer for U.S. farmers, but does not fully cover energy products, on which Trump has imposed a separate 10% levy. A White House official said that is because not all energy products imported from Canada are covered under the U.S.-Mexico-Canada Agreement on trade that Trump negotiated in his first term as president.

...

The exemptions will expire on April 2, when Trump has threatened to impose a global regime of reciprocal tariffs on all U.S. trading partners.

...

U.S. stock markets resumed their recent sell-off on Thursday, with investors citing the rapid-fire, back-and-forth developments on tariffs as a concern due to the uncertainty they are fanning. Economists have warned that the levies may rekindle inflation that has already proven difficult to bring fully to heel, and slow demand and growth in its wake. READ MORE

Excerpt from Associated Press: Roughly 62% of imports from Canada would likely still face the new tariffs because they’re not USMCA-compliant, according to a White House official who insisted on anonymity to preview the orders on a call with reporters. Half of imports from Mexico that are not USCMA-compliant would also be taxed under the orders being signed by Trump, the official said.

...

Trump’s actions also thawed relations with Canada somewhat, after its initial retaliatory tariffs of $30 billion Canadian (US$21 billion) on U.S. goods. The government said it had suspended its second wave of retaliatory tariffs on additional U.S. goods worth $125 billion (US$87 billion).

Trump’s on-again, off-again tariff threats have roiled financial markets, lowered consumer confidence, and enveloped many businesses in an uncertain atmosphere that could delay hiring and investment.

Major U.S. stock markets briefly bounced off lows after Commerce Secretary Howard Lutnick previewed the monthlong pauses on CNBC on Thursday. Significant declines already seen this week resumed within an hour. The S&P 500 stock index has fallen below where it was before Trump was elected. READ MORE

Excerpt from UOL: U.S. soybean producers are criticizing President Donald Trump and warning that, in the face of a trade war with China and other partners, Brazil will be the winner of the White House's protectionist policies. The pressure on Washington comes at a time when the Brazilian government is also launching its first effort to negotiate a diplomatic solution and avoid being targeted by Trump's tariffs.

Today, Vice President Geraldo Alckmin will have a virtual meeting with US Secretary of Commerce Howard Lutnick.

The meeting comes after Trump named Brazil in his speech to Congress as an example of a country that imposes "unfair" tariffs on US products.

...

The inclusion of Brazil sounded the alarm in the government about the possibility that, in April, tariffs would be imposed on goods exported by the country.

Brazil hopes to open a channel of dialogue and seek a solution before the case turns into a trade war. One of the arguments of the Lula government is that the Americans have accumulated a trade surplus of US$200 billion in the last ten years in the flow of trade with Brazil. The government will also insist on the fact that, on average, it applies a tariff of 2.7% to American goods and that, among the main items on the agenda, several products sold by the US enter the national market tariff-free.

But Washington is likely to use the fact that Brazil charges an 18% tariff on ethanol to justify a protectionist gesture. READ MORE

Excerpt from Farmtario: Canadian grain farmers are bracing for significant economic hardship following the United States’ decision to impose a 25 per cent tariff on Canadian grain and grain products.

The Grain Growers of Canada is now urging the Canadian government to take immediate action to eliminate the tariffs, highlighting the potential for widespread market instability, increased financial burdens on Canadian crop producers and increased food costs for American consumers.

The newly implemented tariffs threaten a vital trade relationship, with Canada exporting more than $17 billion worth of grain and grain products to the U.S. annually.

...

“Uncertainty with our largest trading partner for grain and grain products, on top of ongoing instability with our second-largest trading partner, China, could push many family farms to the brink.”

GGC argues that the tariffs will negatively impact American consumers.

“A 25 per cent tariff on Canadian grain and grain products is in effect a 25 per cent tax on American consumers who purchase groceries every day,” said Larkin.

He predicted price increases for a range of everyday products, including bread, pasta, beer, oatmeal and canola oil, which will exacerbate the current affordability crisis. READ MORE

Excerpt from NPR/WESA: Travis Zook grows corn, raises cattle and owns a seed dealership and farm service business in northeast Indiana. He exemplifies some of the mixed emotions that many farmers have when it comes to President Trump.

Like more than 75% of voters in rural, farm-dependent counties, the 44-year-old farmer says he cast his ballot for Trump in November. He stands by that decision. "I still think some of the stuff is maybe the right move for our country," Zook says, "but maybe not the way he's doing it."

But Zook also recalls the pain experienced in Trump's 2018 trade war, which hit farmers particularly hard. "The markets definitely went down last time," he acknowledges.

In fact, it ended up costing farmers an estimated $27 billion in lost agricultural exports. Although Zook says he appreciates the financial relief that farmers received from Trump in his first term — billions of dollars in subsidies aimed at offsetting those trade-war losses — he isn't entirely comfortable with government handouts to farmers.

What's more, now isn't the time for corn growers like himself to get hit again by tariffs. "There's a lot of things stacked against us right now," he says. "You know, bird flu is a scare right now. If we all of a sudden kill billions of chickens, there's a big consumer of corn that's not going to be there."

Trump's latest trade war targets the United States' top three trading partners: Mexico, Canada and China. China is once again imposing countertariffs on U.S. soybeans and corn, two major agricultural exports. Canada, which supplies 85% of U.S. potash (a key fertilizer ingredient), might be considering halting shipments across the border. Meanwhile, Trump's deportation push could reduce the flow of migrant workers from Mexico, many of whom have long been the backbone of American agriculture.

Adding to the pressure on U.S. farmers, Elon Musk's government efficiency team has put a stop to payments for essential agricultural programs tied to the Biden-era Inflation Reduction Act and severely cut funding to the U.S. Agency for International Development, which used to buy around $2 billion worth of American farm products annually.

...

Nick Levendofsky, the executive director of the Kansas Farmers Union, urges caution. He reminds farmers that they have been down this road before — during Trump's first term. "We need to be cautious. We need to be wary of this," Levendofsky advises.

Even temporary tariffs can lead to permanent losses in markets and disruptions in agricultural supply chains, Levendofsky warns.

...

This comes at a time when commodity prices and input costs, including fertilizer, chemicals, fuel, equipment and land, are at historical highs, making it even more difficult for farmers.

...

A study from last year, commissioned by the National Corn Growers Association and the American Soybean Association, found that in the event of a new trade war, U.S. soybean exports to China could drop by 51.8%, and U.S. corn exports to China could plummet by 84.3%. Meanwhile, Brazil and Argentina would likely increase their exports, gaining valuable market share.

...

Last month, AFBF President Zippy Duvall cautioned that mass deportation of farmworkers could lead to a political backlash, with disruptions to the food supply and price hikes. READ MORE

Excerpt from CNBC: • American farmers could ultimately feel even more pain as a result of President Donald Trump’s tariffs on Canada, Mexico and China.

- The latest Purdue University/CME Group Ag Economy Barometer reading showed that almost half of farmers think a trade war leading to a significant decrease in U.S. agricultural exports is “likely” or “very likely.”

- The February sentiment data comes amid worries among experts that farmers won’t be as profitable in 2025.

...

Tariffs on China were not included in these exemptions. China retaliated with levies of its own, which mainly target U.S. agricultural goods. Specifically, U.S. soybeans are now subject to an additional 10% tariff, while corn gets hit with an extra 15% charge.

“We’re already at the point that we’re unprofitable,” Ragland (Caleb Ragland, a soybean farmer in Magnolia, Ky. and president of the American Soybean Association) said. “Why on earth are we trying to add insult to injury for the ag sector by basically adding a tax?”

Ragland pointed out that he “appreciates the president’s ability to negotiate” and wants Trump to be successful for the sake of the country. However, he emphasized that those in the industry, especially soybean producers, don’t have any “elasticity in our ability to weather a trade war that takes away from our bottom line.”

“Folks are upset,” Ragland said about sentiment from other farmers, stressing that they all need relief through deals that reduce barriers to trade and a new five-year comprehensive farm bill – legislation that provides producers with key commodity support programs, among others. “You’re talking about people’s livelihoods,” he remarked.

...

Even in the runup to the implementation of Trump’s tariffs, American farmers were sounding the alarm. Despite the latest Purdue University/CME Group Ag Economy Barometer reading showing that farmer sentiment overall improved in February, 44% of survey respondents disclosed that month that trade policy will be most important to their farms in the next five years.

...

The February survey also showed that almost 50% of farmers said that they think a trade war leading to a significant decrease in U.S. agricultural exports is “likely” or “very likely.

...

Kristen Owen, an analyst at Oppenheimer, predicts that the duties will likely solidify Brazil becoming the primary global producer for both corn and soy, whereas the U.S. will become a sort of incremental supplier to the world. READ MORE

Excerpt from Bloomberg/Money Control: This year, the US will record its third consecutive annual deficit in food trading, with imports set to exceed exports by nearly $50 billion, according to a US Department of Agriculture forecast. It’s a shocking occurrence that reverses almost 70 years of history: America hasn’t seen three straight years of agricultural deficits since Dwight Eisenhower was in the White House.

With Trump’s second term, those agricultural deficits are likely to become permanent. Trade wars are bad for the US agricultural sector. And the White House should know it; or probably knows, but it doesn’t care. Every time the government has embarked on one, the US has lost market share in global agricultural markets.

The US lost its crown as the world’s largest exporter of wheat and soybeans, two of the world’s staples, during the last 10 years to Russia and Brazil, respectively. It remains the king of corn exports, but only for now. Argentina is a major threat to American corn farmers, and the policies of President Javier Milei could unleash monster crops that will erode US dominance.

...

The decline of the American farming sector is part of a long economic trend. President George W. Bush tried to reverse it, introducing mandates to boost the use of corn to produce biofuel. Bush assembled a rare alliance of national security hawks determined to reduce America’s dependence on foreign oil, environmentalists keen to boost green energy and farming lobbyists always happy to use federal money for their benefit. It was the last effective effort to revive American farming.

Thereafter, the White House has done little to help rural America.

...

The previous trade war cost American farmers about $27 billion, according to a USDA study. The number will be larger this time, with Beijing already targeting food for retaliation. The American Farm Bureau Federation, the most powerful institution representing the country’s rural areas, has broken with its traditional support for Republican presidents, warning Trump he’s making a mistake. “For the third straight year, farmers are losing money on almost every major crop planted,” it said earlier this month. “Adding even more costs and reducing markets for American agricultural goods could create an economic burden some farmers may not be able to bear.”

...

Argentina is the must-watch nation. It’s never previously threatened the US because local politics, via large export taxes on grains and oilseeds, curbed the full development of its agricultural sector. Ironically, Milei, a free-market-supporting politician who’s close to Trump, could be poised to unleash Argentina’s potential.

American farmers face many enemies — foreign and domestic. But, ultimately, the US rural electorate is getting what it voted for. READ MORE

Excerpt from AgWeb: The majority of respondents in the March Ag Economists’ Monthly Monitor agree the U.S. is currently in a trade war, but who wins? Ag economists say it’s not the U.S., Canada or Mexico but rather Brazil that could come out on top.

...

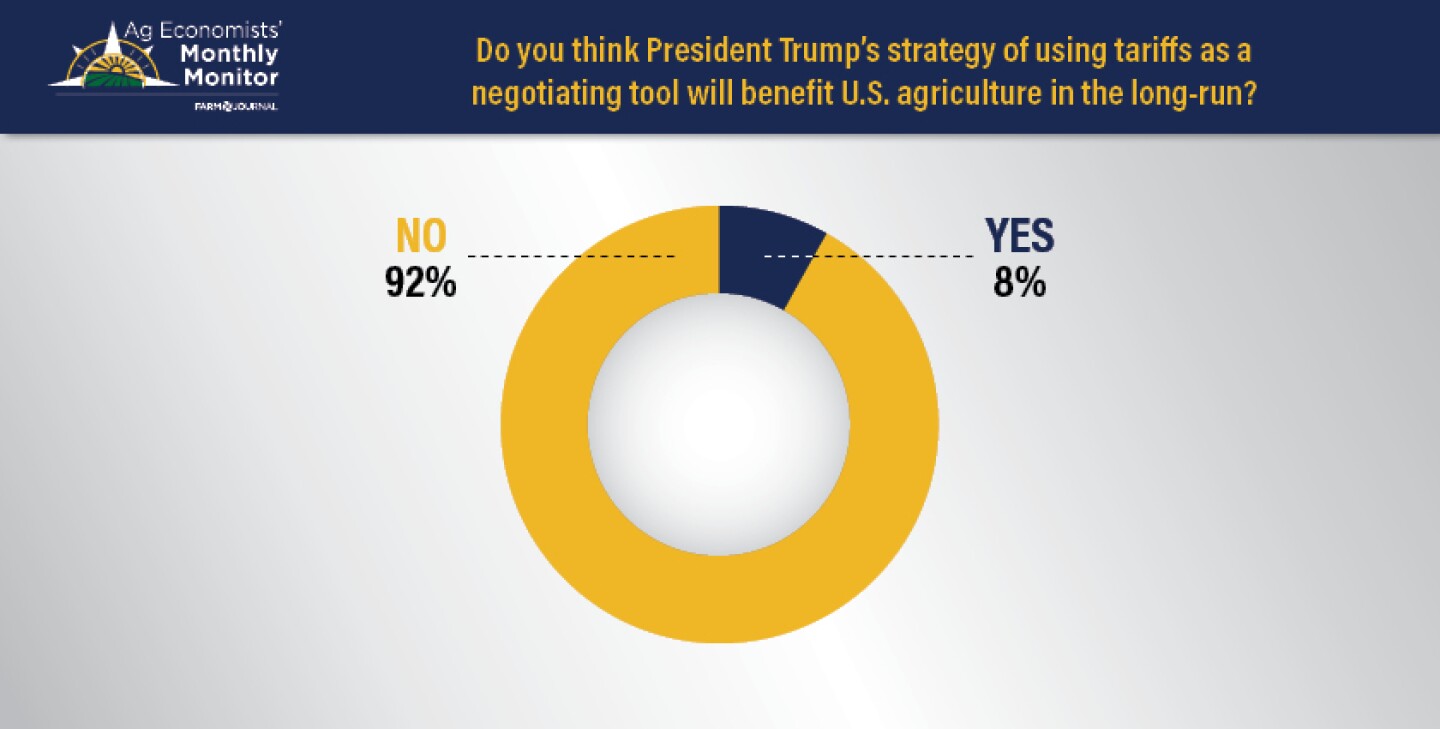

According to the Trump administration, when it comes to tariffs and the impact on the overall economy, long-term gain will be worth the short-term pain. However, when it comes to agriculture, ag economists survyed in the March Ag Economists’ Monthly Monitor don’t agree.

Ninety-two percent of economists think Trump’s strategy of using tariffs as a negotiating tool won’t benefit U.S. agriculture in the long run.

Here are some of those economists’ comments from the most recent Farm Journal Ag Economists’ Monthly Monitor survey.

...

- “Farm Journal readers should learn about the long-term consequences of Smoot-Hawley. It wasn’t just about the economic costs — it was also about the relational damage between trading partners. I have a hard time believing we will rebuild these relationships any time in the foreseeable future,” another economist said.

- “It depends on whether tariffs are used as a negotiating tool with the ultimate goal of reducing trade barriers, or whether they instead result in a world with higher barriers. The president’s emphasis on tariffs as a way to raise revenue suggests tariffs and their consequences may persist,” was another economist’s response in the Monthly Monitor.

However, one economist wasn’t as certain, saying, “For it to be beneficial depends on it being short lived and resulting in trade initiatives with market access or purchase commitments. And in the meantime, action is taken quickly related to Trump’s post to offset trade loss with increased domestic use such as removing dated rules that limit ethanol blends, renewing or creating biofuels production incentives, and adding SAF as a mandated fuel.”

Trade War or No Trade War?

What an overwhelming number of agricultural economists do agree on is that the U.S. is in the midst of another trade war. Ninety-two percent of economists say a trade war is already here, while only 8% responded no.

...

“If we think about U.S. and Canada, we both lose,” Mostafa says. “The way our markets are integrated, both from the input side as well as the product side, any tariff really increases cost of production for our farmers all the way to food on the table. What then happens, essentially, some of our products are going to be less competitive in major markets than where we compete. Who then benefits? Perhaps Brazil, Russia or other countries.”

Other agricultural economists agree: If you’re looking at the trade war between the U.S. and Canada or the U.S. and China, it’s not the U.S. who wins, it’s ultimately one of the United States’ biggest competitors: Brazil.

The Ag Economists’ Monthly Monitor asked, “In the next 10 years, which country ultimately benefits the most from the current trade turbulence?” Seventy-three percent of economists think it’s Brazil, and 18% said China.

This Trade War Could Be Worse Than the Last time

Of the agricultural economists surveyed, 69% say they don’t think a trade war today would have the same impact it did 2018 through 2020. Instead, most think it will be worse. READ MORE

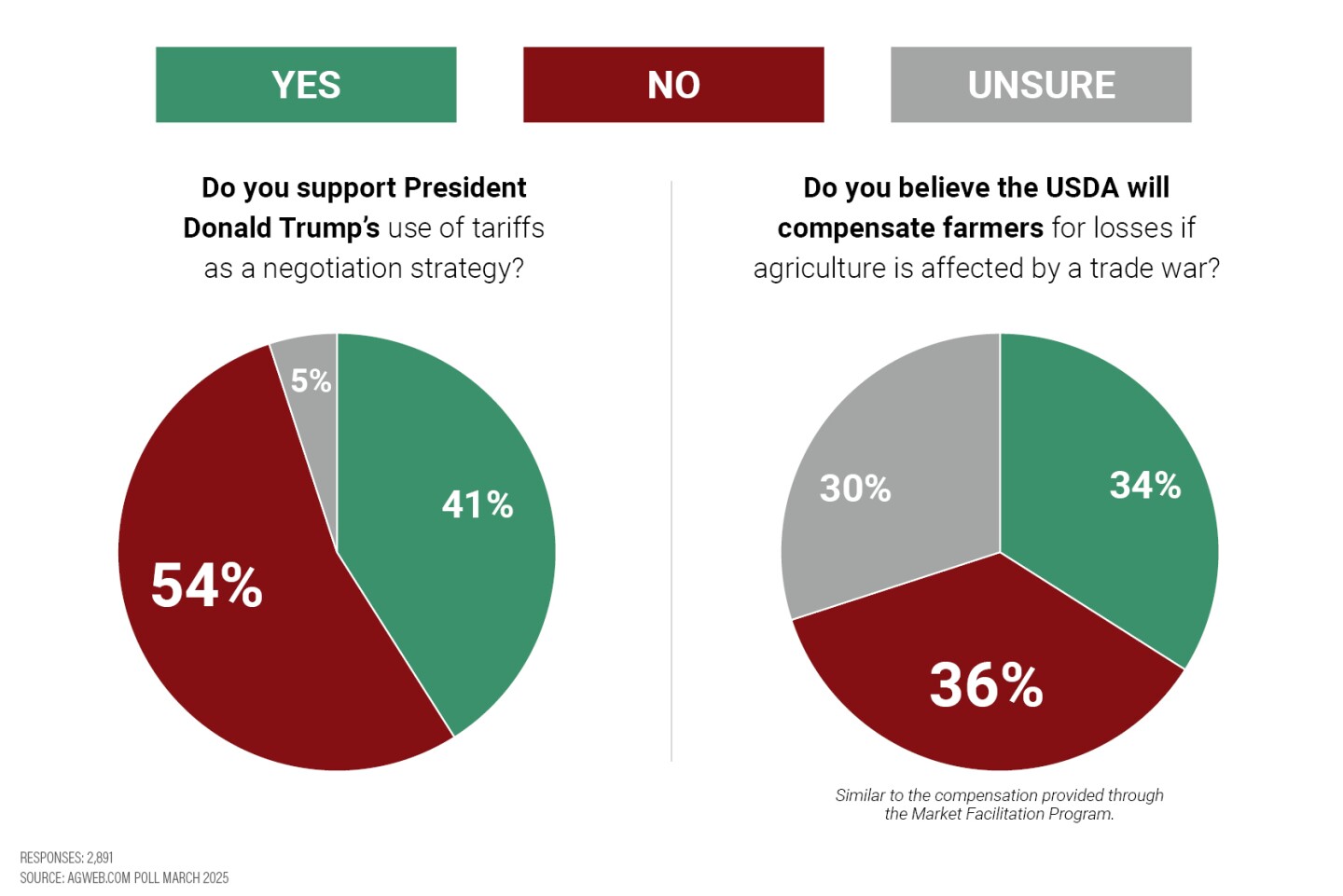

Excerpt from AgWeb: As both targeted and blanket tariffs are applied, retaliatory tariffs on U.S. agriculture are also caught in the middle of the latest trade war. How do farmers feel about this? That’s exactly what we wanted to uncover during the latest AgWeb poll.

The latest AgWeb poll asked, “Do you support President Donald Trump’s use of tariffs as a negotiation strategy?” And even though the majority of farmers say they don’t support Trump’s use of tariffs, according to the recent AgWeb poll, it wasn’t on overwhelming majority.

(AgWeb Poll)

Out of the nearly 3,000 farmers who responded,

- 54% responded “no”

- 41% responded “yes”

The poll then followed-up by asking, “Do you believe USDA will compensate farmers for losses if agriculture is affected by a trade war?”

The responses here were much more mixed.

- 36% responded “no”

- 34% said “yes”

- 30% responded they were “unsure”

What are farmers saying in the field? Michelle Jones, a fourth-generation farmer in south central Montana was asked the question about if she supports Trump’s use of tariffs on “AgriTalk” last week.

“No, definitely not,” Jones said. “I don’t think that tariffs are an effective negotiation strategy, and I also don’t think that we’re truly being surgical in how we are applying them.”

READ MORE; includes AUDIO

Excerpt from AgWeb: Currently, U.S. farmers are focused on what they can control: putting a crop in the ground. The wheels are already in motion this spring for northwest Iowa farmer Ben Riencshe.

“We’re putting on fertilizer, we’re doing a little light tillage, ammonia, phosphorus and potash and getting fields ready. It will be a few weeks before we put seed in the ground,” says Riensche, owner and operator of Blue Diamond Farming Company, which is located in Jesup, Iowa.

Farmers’ Biggest Concern? Cash Flow

Dry conditions this winter are helping Riensche get in the field a little early. It’s a hopeful start to what could be another challenging year.

“Locally, it’s been dry, so we need to catch up with rain. But a dry spring is usually a blessing, just as long as we catch up later,” Riensche says. “I think more on the mind of farmers is finance. We’ve had a couple years of drawdown on farmers’ working capital. Prices are probably slightly below most farmers’ cash flow level of production. $4.50 corn, which we think is a gift compared to harvest time last year, still doesn’t quite reward unless you’ve got a tremendous amount of equity in your land or machinery.”

Two-Thirds of Ag Lenders Are More Worried about 2025 Compared to 2024

Creighton University releases a survey of ag bankers each month called the Rural Mainstreet Index (RMI). The latest RMI shows two-thirds of ag bankers think 2025 will be worse than 2024, and Riensche agrees.

“If we stay on the current course, I think that’s exactly true,” he told U.S. Farm Report. “I think grain farmers will have another year of drawing down working capital.”

Input costs are still a pain point for farmers like Riensche, with some inputs elevated from even last year.

...

Eroding balance sheets are a concern being echoed by ag lenders- and economists- across the U.S.

According to Farm Journal’s latest Ag Economists’ Monthly Monitor, 62% of ag economists think the row crop side of agriculture is already in a recession, and 85% of those surveyed think it will accelerate consolidation not only on farms, but also agribusinesses.

“The end of the year was rough, but looking at projected cash flows for ‘24/25, we see that looking even worse. Unrealized, of course, but definitely looks like it could be a challenge,” says Alex McCabe, agribusiness loan officer with CUSB Bank, which is located in northeast Iowa.

The Biggest Wild Card: Tariffs and Trade

...

“Last month we were in Canada, and for every single farmer I talked to, their biggest concern right now is trade. But would you say that’s not your biggest concern,” U.S. Farm Report’s Tyne Morgan asked Reinsche.

“I think we’re in a good negotiation phase. For those of us who’ve dickered on a new tractor or wrestled with an input supplier to get the fertilizer at the right price, we’re just making offers right now,” Reinsche says. “So much of this, especially with our Canadian neighbors, is about making trade equal - countervailing so that our products equal theirs.”

“So, you’re in the camp that short-term pain is long-term gain,” Morgan asked as a follow-up.

“Absolutely,” Riensche says.

Not all farmers agree, though. Farm Journal conducted a recent poll of farmers and ranchers, asking the question, “Do you support president Donald Trump’s use of tariffs as a negotiation strategy?” 54% responded “no” and 41% said “yes”.

The poll then followed-up by asking, “Do you believe USDA will compensate farmers for losses if agriculture is affected by a trade war?” Those responses were more mixed, with 36% saying “no” and 34% responding “yes”.

When ag economists were asked if they think President Trump’s strategy of using tariffs as a negotiating tool will benefit U.S. agriculture in the long run, 92% said “no.” READ MORE

Nearly 55,000 articles in our online library!

Use the categories and tags listed below to access the nearly 50,000 articles indexed on this website.

Advanced Biofuels USA Policy Statements and Handouts!

- For Kids: Carbon Cycle Puzzle Page

- Why Ethanol? Why E85?

- Just A Minute 3-5 Minute Educational Videos

- 30/30 Online Presentations

- “Disappearing” Carbon Tax for Non-Renewable Fuels

- What’s the Difference between Biodiesel and Renewable (Green) Diesel? 2020 revision

- How to De-Fossilize Your Fleet: Suggestions for Fleet Managers Working on Sustainability Programs

- New Engine Technologies Could Produce Similar Mileage for All Ethanol Fuel Mixtures

- Action Plan for a Sustainable Advanced Biofuel Economy

- The Interaction of the Clean Air Act, California’s CAA Waiver, Corporate Average Fuel Economy Standards, Renewable Fuel Standards and California’s Low Carbon Fuel Standard

- Latest Data on Fuel Mileage and GHG Benefits of E30

- What Can I Do?

Donate

DonateARCHIVES

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- June 2007

- February 2007

- January 2007

- October 2006

- April 2006

- January 2006

- April 2005

- December 2004

- November 2004

- December 1987

CATEGORIES

- About Us

- Advanced Biofuels Call to Action

- Aviation Fuel/Sustainable Aviation Fuel (SAF)

- BioChemicals/Renewable Chemicals

- BioRefineries/Renewable Fuel Production

- Business News/Analysis

- Cooking Fuel

- Education

- 30/30 Online Presentations

- Competitions, Contests

- Earth Day 2021

- Earth Day 2022

- Earth Day 2023

- Earth Day 2024

- Earth Day 2025

- Executive Training

- Featured Study Programs

- Instagram TikTok Short Videos

- Internships

- Just a Minute

- K-12 Activities

- Mechanics training

- Online Courses

- Podcasts

- Scholarships/Fellowships

- Teacher Resources

- Technical Training

- Technician Training

- University/College Programs

- Events

- Coming Events

- Completed Events

- More Coming Events

- Requests for Speakers, Presentations, Posters

- Requests for Speakers, Presentations, Posters Completed

- Webinars/Online

- Webinars/Online Completed; often available on-demand

- Federal Agency/Executive Branch

- Agency for International Development (USAID)

- Agriculture (USDA)

- Commerce Department

- Commodity Futures Trading Commission

- Congressional Budget Office

- Defense (DOD)

- Air Force

- Army

- DARPA (Defense Advance Research Projects Agency)

- Defense Logistics Agency

- Marines

- Navy

- Education Department

- Energy (DOE)

- Environmental Protection Agency

- Federal Energy Regulatory Commission (FERC)

- Federal Reserve System

- Federal Trade Commission

- Food and Drug Administration

- General Services Administration

- Government Accountability Office (GAO)

- Health and Human Services (HHS)

- Homeland Security

- Housing and Urban Development (HUD)

- Interior Department

- International Trade Commission

- Joint Office of Energy and Transportation

- Justice (DOJ)

- Labor Department

- National Academies of Sciences Engineering Medicine

- National Aeronautics and Space Administration

- National Oceanic and Atmospheric Administration

- National Research Council

- National Science Foundation

- National Transportation Safety Board (NTSB)

- Occupational Safety and Health Administration

- Overseas Private Investment Corporation

- Patent and Trademark Office

- Securities and Exchange Commission

- State Department

- Surface Transportation Board

- Transportation (DOT)

- Federal Aviation Administration

- National Highway Traffic Safety Administration (NHTSA)

- Pipeline and Hazardous Materials Safety Admin (PHMSA)

- Treasury Department

- U.S. Trade Representative (USTR)

- White House

- Federal Legislation

- Federal Litigation

- Federal Regulation

- Feedstocks

- Agriculture/Food Processing Residues nonfield crop

- Alcohol/Ethanol/Isobutanol

- Algae/Other Aquatic Organisms/Seaweed

- Atmosphere

- Carbon Dioxide (CO2)

- Field/Orchard/Plantation Crops/Residues

- Forestry/Wood/Residues/Waste

- hydrogen

- Manure

- Methane/Biogas

- methanol/bio-/renewable methanol

- Not Agriculture

- RFNBO (Renewable Fuels of Non-Biological Origin)

- Seawater

- Sugars

- water

- Funding/Financing/Investing

- grants

- Green Jobs

- Green Racing

- Health Concerns/Benefits

- Heating Oil/Fuel

- History of Advanced Biofuels

- Infrastructure

- Aggregation

- Biofuels Engine Design

- Biorefinery/Fuel Production Infrastructure

- Carbon Capture/Storage/Use

- certification

- Deliver Dispense

- Farming/Growing

- Precursors/Biointermediates

- Preprocessing

- Pretreatment

- Terminals Transport Pipelines

- International

- Abu Dhabi

- Afghanistan

- Africa

- Albania

- Algeria

- Angola

- Antarctica

- Arctic

- Argentina

- Armenia

- Aruba

- Asia

- Asia Pacific

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia and Herzegovina

- Botswana

- Brazil

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Canary Islands

- Caribbean

- Central African Republic

- Central America

- Chad

- Chile

- China

- Colombia

- Congo

- Congo, Democratic Republic of

- Costa Rica

- Croatia

- Cuba

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Dubai

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Estonia

- Eswatini/Swaziland

- Ethiopia

- European Union (EU)

- Fiji

- Finland

- France

- French Guiana

- Gabon

- Georgia

- Germany

- Ghana

- Global South

- Greece

- Greenland

- Grenada

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Kuwait

- Laos

- Latin America

- Latvia

- Lebanon

- Liberia

- Lithuania

- Luxembourg

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Mauritania

- Mauritius

- Mexico

- Middle East

- Moldova

- Monaco

- Mongolia

- Morocco

- Mozambique

- Myanmar/Burma

- Namibia

- Nepal

- Netherlands

- New Guinea

- New Zealand

- Nicaragua

- Niger

- Nigeria

- North Africa

- North America

- North Korea

- Northern Ireland

- Norway

- Oman

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Republic of

- Romania

- Russia

- Rwanda

- Saudi Arabia

- Scotland

- Senegal

- Serbia

- Sierra Leone

- Singapore

- Slovakia/Slovak Republic

- Slovenia

- Solomon Islands

- South Africa

- South America

- South Korea (Republic of Korea)

- South Sudan

- Southeast Asia

- Spain

- Sri Lanka

- Sudan

- Suriname

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Uganda

- UK (United Kingdom)

- Ukraine

- United Arab Emirates UAE

- Uruguay

- Uzbekistan

- Vatican

- Venezuela

- Vietnam

- Wales

- Zambia

- Zanzibar

- Zimbabwe

- Marine/Boat Bio and Renewable Fuel/MGO/MDO/SMF

- Marketing/Market Forces and Sales

- Opinions

- Organizations

- Original Writing, Opinions Advanced Biofuels USA

- Policy

- Presentations

- Biofuels Digest Conferences

- DOE Conferences

- Bioeconomy 2017

- Bioenergy2015

- Biomass2008

- Biomass2009

- Biomass2010

- Biomass2011

- Biomass2012

- Biomass2013

- Biomass2014

- DOE Project Peer Review

- Other Conferences/Events

- R & D Focus

- Carbon Capture/Storage/Use

- Co-Products

- Feedstock

- Logistics

- Performance

- Process

- Vehicle/Engine/Motor/Aircraft/Boiler/Ship

- Yeast

- Railroad/Train/Locomotive Fuel

- Resources

- Books Web Sites etc

- Business

- Definition of Advanced Biofuels

- Find Stuff

- Government Resources

- Scientific Resources

- Technical Resources

- Tools/Decision-Making

- Rocket/Missile Fuel

- Sponsors

- States

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawai'i

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Midwest

- Minnesota

- Mississippi

- Missouri

- Montana

- Native American tribal nation lands

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Coast

- West Virginia

- Wisconsin

- Wyoming

- Sustainability

- Uncategorized

- What You Can Do

tags

© 2008-2023 Copyright Advanced BioFuels USA. All Rights reserved.

.jpg)

Comments are closed.